The Pocket Option "Vortex" strategy is a clever combination of two indicators that help you identify the emergence of a new trend.

The strategy for the trading platform of the Pocket Option broker "Bollinger Bands and RSI" contains independent indicators that together can generate more accurate signals.

Strategy for the trading platform of the Pocket Option broker "Three Canadians" where a Moving Average and a simple Price Action pattern are used to enter the market in the direction of the price impulse.

Strategy for the trading platform of the Pocket Option broker "Wells MACD" based on two indicators: MACD and Parabolic SAR. How to use it profitably for trend trading?

The strategy for the trading platform of the Pocket Option broker "MACD Profitunity" uses the MACD and Awesome Oscillator indicators, which allows you to receive accurate signals on any timeframe.

The strategy for the trading platform of the Pocket Option broker "Aroon EMA" uses a new and not yet very popular indicator that allows you to determine market reversals.

The strategy for the Pocket Option trading platform allows you to trade binary options without using indicators, having studied just one effective pattern.

The strategy for the Pocket Option trading platform using the “Candlestick Absorption” pattern is an effective candlestick formation that even a beginner can recognize.

A strategy for the Pocket Option trading platform using several effective candlestick patterns that work on any time frame.

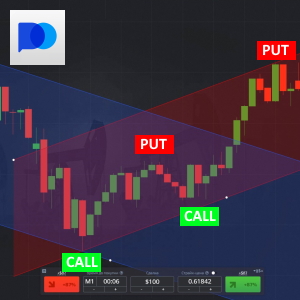

A strategy for the Pocket Option trading platform based on parallel channels and breakouts allows you to open trades in the direction of the trend without using indicators.

A strategy for the Pocket Option trading platform based on three effective indicators allows you to open medium-term trades, which eliminates mistakes associated with “market noise”.

The strategy for the Pocket Option trading platform using Moving Averages allows beginners in binary options trading to start trading using just one indicator and a couple of simple rules.

Strategy for the Pocket Option trading platform using the Bollinger Bands indicator and three consecutive unidirectional candles.

Strategies for the Pocket Option trading platform from Larry Williams are short-term and long-term ways to make profits based on the psychology of traders.

The strategy for the Pocket Option trading platform, based on parabolic, helps to open profitable trades using the Parabolic SAR and ADX indicator on any time frame, including the smallest.

The strategy for the Pocket Option trading platform using technical lines allows you to see the direction of the trend and make accurate trades at the moment of a market reversal.

A strategy for the Pocket Option trading platform, which works using a trend technical indicator, which allows you to make transactions at the moment of a trend reversal.

The "Ladder" strategy for the Pocket Option trading platform allows you to make trades by adhering to just a few simple rules related to the trend and formation of candles.

A strategy for the Pocket Option trading platform using the well-known and simplest indicator - SMA (Moving Average).

A strategy for the Pocket Option trading platform based on two Stochastics, which is highly efficient and gives 80-85% of positive trades.

Trading using Fibonacci lines on the Pocket Option trading platform is easy for novice traders, as it does not require indicators and has simple trading rules.

This scalping strategy for the trading platform of the Pocket Option broker allows you to make a lot of fast and short trades using only the Stochastic Oscillator indicator and channels.

This strategy for the trading platform of the Pocket Option broker does not require indicators and allows you to trade options using only the “Horizontal Line” tool.

Trading turbo options with the Pocket Option broker can generate income in a very short period of time thanks to just three indicators that are already built into the broker's trading platform.

This strategy for the Pocket Option trading platform uses a tool built into the platform - parallel channels, which allows you to get a unique strategy for options trading.

In this beginner's guide, we will share our practical experience mastering binary options trading on the Pocket Option platform. As your trading coach, we will look at the trading tools in this famous broker's user-friendly interface and analyze the most popular strategies for beginners. Get ready for an interesting five-minute read about extracting profits from price prediction.

Table of contents:

Introduction to Pocket Options

Key Features of Pocket Option

Understanding the Basics of Trading

- Key Terminology in Pocket Options

- Types of Assets Available for Trading

- Market Hours and Their Importance

Getting Started with Pocket Options

Fundamental Analysis for Beginners

Popular Pocket Option Strategies

- Simple Moving Average Strategy

- Support and Resistance Strategy

- Relative Strength Index Strategy

- Moving Average Convergence Divergence Strategy

- Bollinger Bands Strategy

- Candlestick Patterns Strategy

- Trend Following Strategy

- Range Trading Strategy

- News Trading Strategy

- Reversal Trading Strategy

- Setting Stop-Loss and Take-Profit Levels

- Determining Position Size

- The Importance of Diversification

The Role of Emotional Discipline in Trading

Resources for Continuous Learning

Introduction to Pocket Options

Pocket Option is a modern digital trading platform for binary options trading. It helps traders make price predictions on specific timeframes. The essence of trading on this platform is the ability to predict whether the asset price of a financial instrument will increase or decrease within a particular time - from 30 seconds to several hours. The platform stands out from its competitors due to its user-friendly interface, low entry barriers, and many educational resources and assets for trading.

What are Pocket Options?

Pocket Option is a digital trading platform that helps investors deal with binary options. This platform has low entry barriers, a user-friendly interface, and many educational resources. Additional advantages of this platform are the variety of trading instruments. In it, traders can trade binary options on forex pairs, commodities, cryptocurrencies, and stocks. All users can practice trading strategies with Pocket Option on demo accounts without risking real funds.

How Pocket Options Work

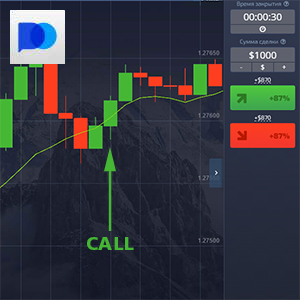

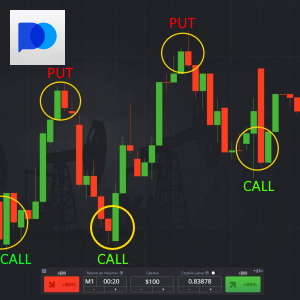

The Pocket Option uses simplicity, user-friendliness, and transaction processing speed. The trader starts with asset selection and expiration period setting to predict the direction of price changes at a particular time frame. If the trader expects an increase, he prepares to buy a Call option; if it decreases, he will buy a Put option. The platform has social trading tools that allow novice investors to copy the strategies of experienced traders. In addition, all users of this platform can receive bonuses and participate in tournaments using customizable tools. The pocket option offers assets with high payout percentages. Each trader can choose a suitable financial instrument according to their risk tolerance.

Key Features of Pocket Option

The main advantages of this platform include:

- A demo account.

- A wide range of technical analysis tools, including such indicators as Moving Averages, RSI, and MACD.

- Social trading system for copying the best pocket option strategies of experienced traders.

Thanks to a well-developed knowledge base and tooltips, the platform simplifies the learning process for its clients. These tools help traders make informed decisions.

Understanding the Basics of Trading

Before we delve into the nuances of pocket option strategies, let's understand the key trading principles. In the following sections, we will look at the terminology basics, consider which assets are available for trading, and analyze the most suitable market hours for operations.

Key Terminology in Pocket Options

For successful work, anyone who is going to get into binary trading needs to know the following key concepts:

- Strike price - the price of the asset against which the trader determines the profitability of the option at the expiration time.

- Expiration time is a predetermined moment the trader sets when the transaction's result is determined.

- Payout: is the amount the trader receives due to a profitable transaction.

- Out-of-the-money: At the moment of expiration, the underlying asset's price is outside the strike price, and the option is not profitable.

- In-the-money: At expiration, the underlying asset's price is inside the strike price, and the option is not profitable.

The handy tooltips and knowledge base will help you learn more about these terms. Understanding these concepts is the basis for making informed decisions.

Types of Assets Available for Trading

At Pocket Option Broker, you can trade four asset classes: Forex pairs (EUR/USD, GBP/USD, and others), commodities (gold, oil), cryptocurrencies (Bitcoin), and stocks (like Apple, Tesla, and others). Each underlay asset has its features. Traders must diversify investments to make a stable profit regardless of market conditions. This approach allows you to mitigate risks and increase the reliability of your trading strategies.

Market Hours and Their Importance

Different asset classes have their active trading hours. This schedule is due to the functioning of international financial centers and global market operations in various countries. For this reason, some instruments have 24-hour availability, and some are only available during exchange hours. Therefore, you should learn the market schedule feature to use all these tools effectively. The easiest way to do this is to use the market calendar you will find on the broker's platform. This approach will allow you to trade on pocket option trading strategies at the right time.

Getting Started with Pocket Options

The trader must perform several actions at the beginning with the pocket option. First, he needs to go through the account creation procedure. Second, he should master platform navigation and set up a convenient trading environment. In this section, we will look at all the steps to getting started with the platform in detail.

Creating Your Account

Sign up for the Pocket Option. It is a simple and intuitive process that requires an email address and social media profiles. Following regulatory requirements, the broker will demand that you undergo a verification procedure. This measure is necessary for anti-money laundering and "know-your-customer" rules. We strongly recommend all new traders start familiarizing themselves with the platform with a demo account. You can move to a live account only after you get stable results on your trading strategies.

Navigating the Platform

The trading platform's intuitive interface is characterized by its main dashboard, which contains real-time market data, asset lists, trading charts, and technical analysis tools. Even an absolute beginner in trading can understand the straightforward interface of the trading terminal. The platform has many customizable settings that allow you to modify its appearance to the needs of a particular trader. You can use tutorials and on-screen guides to familiarize yourself with the terminal.

Setting Up Your Trading Environment

A comfortable trading environment and distraction-free space are key to successful market analysis. The broker's application works on desktop and mobile devices. Such various terminals provide traders with a flexible approach to different trading strategies. We recommend you customize your trades and keep an eye on economic calendars. This method will help improve the quality of your decision-making.

Fundamental Analysis for Beginners

Fundamental analysis is the primary tool for studying the behavior of financial markets. This section will examine the leading economic indicators and principles for assessing the news impact on assets. Understanding these fundamental principles will help you comprehend the nature of price movements.

Understanding Economic Indicators

Economic indicators such as GDP growth, unemployment, and inflation rates significantly impact asset prices and create market trends. As a rule, the markets have strong price instabilities after the economic data release. Therefore, traders should follow the publication of vital indicators in the trading platform's built-in economic calendar. This way, they will always be ready for unexpected price movements.

Evaluating News Impact on Markets

Many news events, such as central bank announcements and geopolitical developments, influence market volatility. For example, publishing an interest rate decision leads to a sharp change in currency rates on the Forex market. Therefore, traders need to get information from reliable news sources and real-time updates to assess their impact on assets. Only a complete understanding of the current market situation will help you make the right trading decisions.

Technical Analysis Essentials

Technical analysis is a practical method of forecasting future price dynamics. This technique is based on chart reading and studying historical data with indicators. Unlike fundamental analysis, it considers price patterns as a trading signal for a profitable trading strategy. In this section, we will look at the basic principles of modern technical analysis, which has long been the primary tool in every trader's arsenal.

Introduction to Chart Reading

Charts are a trader's primary tool. With their help, it is easy to visualize price movements in time. In the broker's trading platform, you will find several charts: line charts, bar charts, and candlestick charts. Each of them has its peculiarities and scope of application. We recommend you start studying technical analysis with candlestick charts. With its help, you can easily find price trends on different timeframes. Choosing a suitable charting interface will allow you to highlight significant price levels easily. This approach will make it more comfortable to determine market sentiment.

Utilizing Technical Indicators

With the help of popular technical indicators, Moving Averages, Relative Strength Index (RSI), Bollinger Bands, and MACD, traders determine trends and overbought/oversold conditions. Also, with the assistance of indicators, it is possible to decide on reversals in trends and make data-driven decisions. You will find an extensive indicators library in the Pocket Option trading platform. Most customization options allow you to configure them to work with a specific asset and timeframe.

Recognizing Price Patterns

Popular price patterns such as heads-and-shoulders, double tops/bottoms, and triangles often appear on charts before powerful market movements. These patterns warn the trader and give him a competitive edge. The broker's trading platform's convenient charting tools facilitate pattern recognition and analysis of these trading models.

Popular Pocket Option Strategies

Below, we will look at a few of the most popular trading strategies, such as trend following, range trading, news trading, and reversal trading, which are designed explicitly for this broker's platform. Take the trading system from this section as a foundation and adapt it based on your preferences and market analysis methods. Once you understand these basic strategies, you can add technical indicators such as SMA, RSI, MACD, and Bollinger Bands to filter trading signals. We recommend using support and resistance levels with candlestick patterns to increase the percentage of profitable trades.

Simple Moving Average Strategy

The Simple Moving Average strategy is a simple yet effective trading methodology for beginners. It consists of three main components:

- Customizing the candlestick chart with two SMAs: a fast SMA indicator (usually 5 or 20 periods) and a slow one (50 or 200 periods).

- Entry points: determined by crossover points of moving averages.

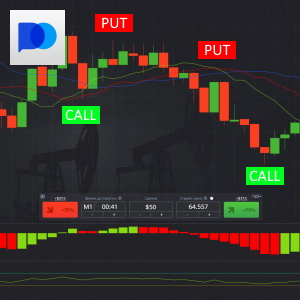

- The choice of trading direction: when the short-term SMA crosses the long-term SMA from bottom to top - upward trend (buy Call option); when the short-term SMA crosses the long-term SMA from top to bottom - downward trend (buy Put option).

This simple strategy allows you to determine the trend and open trades in its direction effectively.

Support and Resistance Strategy

The strategy of trading on support and resistance levels uses the prices at which, historically, price reversal occurs in the opposite direction. Trading with this plan consists of three stages:

- The investor defines critical historical levels on the chart.

- When the price breaks out of resistance level, we buy a Call, and when it comes with support, a Put.

- Confirmation indicators such as RSI and MACD confirm entry points and increase the percentage of profitable trades.

If you trade in the Forex market, you can use these levels as exit points.

Relative Strength Index Strategy

This methodology uses the momentum oscillator Relative Strength Index. With its help, a trader can estimate the speed and amplitude of price fluctuations. This indicator determines reversal points. A trading system based on it consists of the following steps:

- The trader sets the RSI indicator with a period 14 on the candlestick chart.

- Overbought conditions occur when the oscillator rises above 70, and oversold conditions occur when the indicator values fall below 30.

- When the oscillator values leave the overbought zone (below 70), we buy a Put. When the indicator leaves the oversold zone (above 30), we buy a Call.

We recommend using this strategy in sideways markets without a clear trend.

Moving Average Convergence Divergence Strategy

The MACD is a complex trend-following momentum indicator. Its primary purpose is to show the relationship between two moving averages and the underlying asset's price. To use this approach, follow the steps below:

- Customize the indicator by setting the parameters for calculating the MACD line, signal line, and histogram.

- If the MACD line signal crosses from bottom to top, buy Call; if it crosses in the opposite direction, buy Put.

- Another trading signal is the divergence between MACD and price, which warns the trader about a possible market reversal.

This strategy helps investors identify changes in the strength and direction of the trend. It is suitable for both trending and flat markets. Pay attention to the indicator crossover points.

Bollinger Bands Strategy

This system utilizes the volatility indicator Bollinger Bands. It consists of the center line - a simple moving average and two upper boundaries located at a distance of several standard deviations from it. It is very easy to use this strategy:

- Let's set up the Bollinger Bands indicator on our asset chart. They usually consist of a 20-period SMA and two bands separated by two standard deviations.

- When the price touches the upper boundary, overbought conditions occur. When the price touches the lower boundary, oversold conditions arise.

- If the price bounces down after touching the upper band, we buy a Put; if it bounces up after touching the lower band, we buy a Call.

This system will help you to identify probable reversal points and estimate the level of volatility.

Candlestick Patterns Strategy

Exploiting candlestick patterns helps traders find potential market reversals and trend continuations on the charts, which they use for more accurate trade entry. To apply this approach, do the following:

- Find key formations on your asset's graph, such as a Doji, Hammer, or Engulfing patterns.

- To increase the trade's reliability, confirm the patterns found with signals from technical indicators such as RSI or MACD.

- Open a trade on the confirmed pattern. For example, buy a Call option when the Hammer appears on the chart near the support level with the confirmation of the RSI signal. The same is true for Put options when a pattern occurs with the confirmation of technical indicators.

These formations work because they reflect the psychology of market participants. You can use this method as a signal filter for your trading strategies.

Trend Following Strategy

This methodology involves searching for trend direction and dealing in its direction. As we know, an uptrend is a sequence of rising highs and lows. In this case, it is advisable to buy Call options. Meanwhile, a downtrend consists of declining highs and lows. If you find such a tendency, buy Put options. The most popular way of determining the trend is moving averages, trendlines, or indicators like Moving Average Convergence Divergence (MACD). A trader must have patience and discipline to use this strategy successfully. Enter the market only when there are clear signals. Avoid trading on mature trends to reduce the risk of false breakdowns.

Range Trading Strategy

Traders use price range trading in a market without a clearly expressed trend. For this purpose, the trader finds horizontal support and resistance levels, which act as the boundaries of the trading range. When the underlying asset's price reaches support levels (the lower boundary of the range), the investor buys a Call. When the price reaches resistance levels (the upper boundary), the investor buys put options, expecting a subsequent price reversal and decline.

The technical indicator Relative Strength Index (RSI) confirms the signals. When they indicate overbought conditions with a value above 70 and the price rises to the resistance levels, in this case, we recommend buying Put options. If the RSI value is below 30 when the price drops to the support levels, it indicates oversold conditions. In this case, we recommend buying Call options. The main advantage of this system is the simplicity and reliability of its signals in sideways markets. However, monitoring price action is a necessary process that will allow you to avoid missing a breakout of an established range. A trend has already started, and it does not make sense to trade using this method.

News Trading Strategy

It is one of the strategies for the pocket option based on the analysis of economic news and various geopolitical news, which you can use to predict market movements. With the help of this trading technique, traders capitalize on market reactions that occur immediately after the publication of important news. For example, with an increase in the central bank interest rate, the national currency strengthens because assets denominated in this currency become more attractive to investors. This event dashingly increases its demand, leading to a sharp jump in its value.

To trade with this strategy, you must constantly monitor economic calendars and reputable financial news sources. This will help you learn in advance about events that can significantly increase market volatility. This strategy suits forex and commodity traders, who traditionally experience substantial short-term price fluctuations.

Reversal Trading Strategy

This approach is used to predict trend price reversals. With this methodology, traders open positions after an overextended price move in one direction. The strategy uses extreme price movements, which can be detected by the investor using technical indicators such as the Relative Strength Index (RSI). Its values above 70 indicate overbought conditions, and below 30 indicate oversold conditions. Such extreme RSI values warn of a possible reversal.

Additionally, you can use candlestick patterns, such as engulfing patterns and doji candles, to confirm potential reversal points. However, remember that such trading carries a risk of false signals. Therefore, for beginners, we recommend using demo trading first to learn and practice this strategy thoroughly without risk.

Risk Management Strategies

It is impossible to talk about pocket option trading strategies for beginners without describing the most crucial concept, without which profitable trading is impossible. Risk management is the key to preserving your capital. This approach is not just another set of rules but the most critical trading principle. It will determine your long-term success in the market. Based on risk management rules, traders determine where to set a stop-loss, take-profit, and position size for their trades. Applying these rules will improve your trading and contribute to risk diversification.

Setting Stop-Loss and Take-Profit Levels

Risk management is still critical to achieving consistent results despite the absence of stop-loss orders in binary trading. We recommend that beginners set a loss limit for the day and profit targets in advance. Also, keep an eye on the risk-to-reward structure of your trade. Such a process will help you determine potential outcomes in advance.

Determining Position Size

Another element of risk management that cannot be ignored is position sizing. Experienced traders recommend a 1-2% risk percentage of the account balance per transaction. Capital preservation is necessary in case of inevitable losing streaks. You can use calculator tools to set the level of risk per transaction depending on your risk tolerance.

The Importance of Diversification

Diversifying through multiple assets reduces risk. Allocating capital among several assets can minimize the impact of a single market event. Other investments can offset losses if one market is in volatile conditions. The broker's platform offers a wide range of assets for effective portfolio management.

The Role of Emotional Discipline in Trading

Trader psychology is an integral part of successful trading. Emotions such as fear and greed distort a trader's rational thinking and lead to rash trades. Most of which will lead to a loss of capital. It is vital to maintain discipline and learn to control your emotions. Understanding your psychology will help you become a professional trader. After all, thanks to emotional discipline, you can systematically follow your strategy's trading signals and manage risks.

Understanding Trader Psychology

Emotions are a trader's worst enemies. Fear can force prematurely close positions, preventing the trader from making a full profit. On the other hand, greed pushes you to make rash trading decisions. If you increase your positions without proper justification, it will inevitably lead to significant losses. Once trapped in the trader psychology trap, an investor seeks to win back at any cost, which makes his position even worse.

Acting in this way will destroy any trading plan, even one that is very effective. We recommend you avoid risks and overtrading. Professional traders regularly conduct self-awareness and develop strict emotional discipline, avoiding excessive risk-taking. Calmness in the conditions of market volatility allows them to make objective decisions. It is essential to maintain mental resilience regardless of trading results, wins, or losses.

Techniques for Maintaining Discipline

We recommend that you follow some rules that will help you maintain trading discipline. First, decide on your trading goals and develop a trading plan. It should have clear rules for entering and exiting a trade. After that, set rules for risk management. Don't forget to take breaks in trading. These pauses will help you avoid over-trading and impulsive decisions. Learn to control your emotions. Don't try to chase losses. Revenge trading will only make your results worse. Be sure to use journaling and meditation. This approach will increase your level of mindfulness.

Developing a Trading Plan

A trading plan represents a set of sequential actions for opening a trade. In addition to technical components, it includes backtesting a trading strategy and risk and capital management. Without a trading plan, a trader's actions become a game of luck. A full-fledged trading plan is mandatory in building a profitable strategy. Without a detailed plan, you cannot expect to succeed in trading.

Components of an Effective Trading Plan

A practical blueprint contains a carefully thought-out algorithm of specific actions. Thanks to it, a trader will always know what to do and in what sequence. A good trading plan contains clear, measurable, and achievable trading goals. They will help to evaluate the trading progress over time. In addition, you need risk management and capital rules, position sizes, and stop-loss levels. Next, you should define a trading strategy with clear directions for opening trades. We recommend choosing strategies from trend following, range trading, and news trading. Then, define trading hours. A specific schedule will help you avoid impulsive overtrading. Finally, working on your emotions, such as fear and greed, will help you deal with losses caused by emotional rules. A good plan is the foundation for clarity and consistency in trading.

Backtesting Your Strategy

Backtesting checks strategy performance against historical market data. This procedure allows a trader to evaluate a strategy's potential profitability and viability. With the help of this tool, beginners can identify weaknesses and refine strategies. Demo accounts are ideal for backtesting with virtual funds. It increases the trader's confidence in the chosen plan and allows him to adjust preferences according to risk tolerance. All in all, it is an essential step on the way to informed trading.

Common Mistakes to Avoid

Beginners often make mistakes. The major ones are overtrading and ignoring market research, a standard trap for beginners. Inexperienced traders fall into it because, as a rule, they trade without a trading plan. They skip market studies and do not use technical analysis. As a result, emotion drives them. Knowing about these problems can help you avoid them and increase your chances of success.

Overtrading and Its Consequences

Overtrading is a typical problem that most beginners face. They usually trade chaotically. Fear of missing opportunities and desire to recover loss quickly lead to emotional impulses, which lead to losses and empty account balance. It is necessary to act strictly according to the trading plan, avoiding impulsive decisions and excitement. Note: It is not the frequency but the quality of trades that matters. Your discipline and consistency will bring more benefits in the long run.

Ignoring Market Research

You are making a grave mistake if you don't do market research. Relying solely on intuition and random predictions of the market conditions is foolish. In this case, you are playing roulette, not trading. You need to consider economic events and technical indicators. The broker's platform gives you the tools and resources to make educated trading decisions. Thanks to them, you can make informed trades.

Resources for Continuous Learning

It is no secret that the market is constantly changing. That is why continuous learning is essential for success. This section will introduce you to books, online courses, and trading communities. We hope it will allow beginners and experienced traders to increase their knowledge about the market. We advise you to study new strategies and techniques regularly. It is an integral part of your professional growth and becoming a trader.

Recommended Books and Online Courses

Without continuous learning, it is impossible to succeed in trading. To understand the mechanics of financial markets, we advise you to pay attention to such books as "Trading for a Living", "The New Trading for a Living", and "The Complete Guide to Technical Analysis for the Forex Market". On Udemy, Coursera, and Investopedia, you will find many online courses for traders with different experience levels. These resources will help you enhance your knowledge and sharpen your practical trading skills.

Joining Trading Communities and Forums

Trading communities, forums, and social media groups are valuable resources for exchanging ideas and finding helpful information on trading. You can discuss strategies, learn from experiences, and get support here. The Pocket Option social trading feature allows beginners to copy trades from experienced traders. Participate in webinars and grid with peers. Networking with professional traders will enrich your knowledge and open learning opportunities for your development.

Conclusion

Pocket Option offers a beginner-friendly platform for binary options trading. Everyone can use it. To do this, register and deposit an account. If you are a beginner, we recommend starting with demo accounts. You can study a profitable trading strategy and develop the emotional discipline to follow its signals. We also advise you to understand technical analysis and learn the basics of risk management. Use the economic calendar if you prefer fundamental analysis to make trading decisions. Learn from mistakes. Continuous learning in trading will help you adapt your strategies and reduce the financial risks to your deposit. Don't forget about portfolio diversification and the need to use strategic planning.

FAQ

How to successfully trade on Pocket Option?

To successfully trade on this platform, you must understand the basics of technical analysis and fundamental trading strategies. You will also need to know the rules of risk management and money management, as well as a disciplined approach to working out the trading signals of your system.

What is the most successful options trading strategy?

No "most successful" options trading strategy is suitable for all occasions. Your results will depend not only on the trading system but also on market conditions, your experience, and proper money management.

What is the best time to trade on Pocket Option?

The best time to trade varies depending on the assets you are dealing with. Generally, the best times are periods of high volatility that coincide with the main Forex trading sessions, international financial centers, or the opening of significant exchanges.

What is the 3-minute Pocket Option strategy?

As the name suggests, the three-minute strategy involves opening short-term trades with a three-minute expiration. With this system, the trader profits from market fluctuations through frequent trades based on technical analysis tools.