There are many types of analysis that can be used in binary options trading, one of which is fundamental analysis of binary options.

There are many types of analysis that can be used in binary options trading, one of which is fundamental analysis of binary options.

Fundamental analysis is the study of the main factors affecting exchange rates or individual companies. Thanks to this method, the market forecast is based on real facts, which either reinforce an existing trend or create a new one.

Also, thanks to fundamental analysis, it is possible to understand not just the technical reason for the market movement, but precisely the force pushing prices up or down. Understanding the basics of fundamental analysis of binary options will help take your trading performance to the next level.

What is fundamental analysis?

Using fundamental analysis of binary options, a trader or investor studies the economy of the country whose currency interests him. Changes in inflation, GDP, trade balance, employment or unemployment lead to changes in the value of the currency. Positive changes in economic factors, accordingly, lead to an increase in the exchange rate, and negative changes lead to a fall.

The next factor that is taken into account by fundamental analysis is the financial sector of the country. Changes in the discount rate of the National Bank or the volume of gold and foreign exchange reserves lead to an increase or decrease in the exchange rate.

The internal or external unstable political situation of the country also always leads to instability of the exchange rate, so this data should also always be taken into account.

Methods of using fundamental analysis

Fundamental analysis itself is a rather complex analysis and it is better for beginners to avoid it at the initial stage, since understanding it requires experience and consideration of many different factors (events within the state and the economy). Therefore, you can use technical analysis in conjunction with fundamental analysis, since this approach will provide a more complete understanding of the market situation, and in the event of an erroneous judgment from a macroeconomic point of view, technical analysis will correct the forecast.

The simplest example of trading using “fundamentals” is trading on news, which can be viewed in the economic calendar . But trading based on news alone will not always be correct, since many news have a short-term impact, which is very difficult to use in binary options trading. Therefore, there are different methods of applying fundamental analysis, such as:

- Data comparison method.

- Seasonal analysis.

- Correlation of indicators.

- Separation method.

- Generalization method.

Data comparison method

This approach involves comparing the same economic indicators of different countries. For example, you can compare GDP data or interest rates to make a possible forecast for currency prices. You can use not only this data, but also any other important macroeconomic indicators, since they are universal indicators.

Seasonal analysis

This method can be applied not only to currencies, but also to commodity assets, such as oil, wheat, gas, and so on. Its essence lies in the fact that in certain months the price on commodity markets can rise or fall depending on the harvest (wheat, soybeans, sugar), the increase or decrease in production (oil, gas), and if we talk about currencies, then an increase or decrease the consumption of certain goods can affect the country’s economy (holidays, vacation seasons), and thereby strengthen or weaken the state’s currency.

Correlation of indicators

This approach assumes that to form a forecast and trade binary options, not only the most important macroeconomic indicators will be used, but also rather weak ones. And when comparing all the data, it will be possible to see the correlation of some of them, which will give a possible understanding of the direction of the price.

Separation method

Using the splitting method, an investor or analyst divides currencies into certain groups and then calculates indices of these groups. But this approach requires maximum professional training and a full understanding of the calculations being made, which means that for beginners in binary options trading there is no point in using this method.

How to use fundamental analysis in trading?

There are several ways to apply fundamental analysis of binary options. Some are suitable for quick transactions, while others, on the contrary, are designed for medium- or long-term trading. But what they have in common is that they are all based on some news or events.

Short-term binary options trading based on news

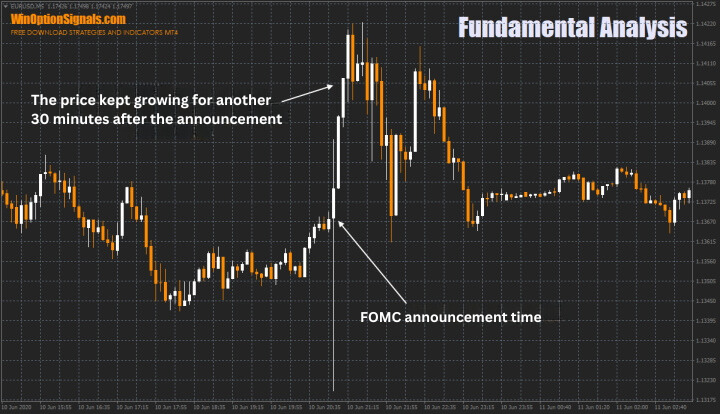

The simplest and most popular application of fundamental analysis of binary options is short-term news trading, and an example of such trading would be using the FOMC (Federal Open Market Committee) statement. Almost always, the statements of this committee, subordinate to the US Federal Reserve System, are significant for the foreign exchange market, and in particular for the EUR/USD pair:

As you can see, after the committee’s statement, the price began to rise, and the advantage of binary options is that it does not matter how many points the price moves, and a false breakout downward would not affect the transaction in any way, since the loss is always fixed.

It is worth noting that you should buy options on news with expiration from 15 to 30 minutes, depending on the news.

Also very important is a high-quality fundamental analysis of binary options, since technically (using indicators , strategies , trends or levels) some news is very difficult to predict.

Natural disasters

Although such events occur very rarely, it is always worth tracking them, as this provides an opportunity to make a profit.

One example is one of the most destructive hurricanes in US history, which caused enormous damage to the economy of this country. This event occurred at the end of August 2005:

.png)

And as you can see in the image above, at the time of the incident the dollar began to fall in value (and the euro to rise, since it is a currency pair, not a separate currency), as the country's economy suffered great damage, however, after the hurricane ended, restoration of the region, new jobs were created and the economic situation began to improve, which caused the dollar to rise after the fall.

Fundamental Analysis and Stock Prices

Fundamental analysis can also be used to assess the value of shares of any company. This is usually done using the earnings report, but there are many other factors that can affect a stock's price.

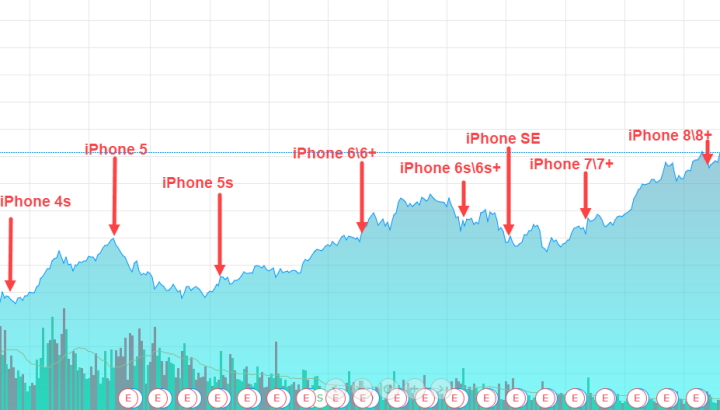

For example, Apple shares rise in 90% of cases after the start of sales of a new version of the iPhone:

In the image above, you can see that over the long term, Apple's stock price did not increase only during the sales of the iPhone 5, while in all other cases there was an increase.

Conclusion

Although fundamental analysis of binary options is quite complex compared to other types of analysis, it can still be beneficial in both short-term and long-term trading.

But you should not use fundamental analysis separately from other types of forecasting and it is better to support your forecasts with technical analysis to make sure that both methods show the same direction of price movement.

To leave a comment, you must register or log in to your account.