Today we will present to you one elementary, but quite effective candlestick model - the pin bar. Due to its unpretentiousness, this model quickly gained popularity among traders.

The thing is that it gives powerful entry signals, which are not difficult to identify on the chart. To apply the model itself, you do not need a deep market analysis, and the requirements for the trader’s level of training are extremely low.

Almost any trading platform is suitable for working with it. All they need is the ability to display price charts using Japanese candlesticks (even bars will do). In this article we will tell you how you can use this method to work with binary options .

Parameters of the "Pin Bar" strategy

- Working platform: no restrictions.

- Tradable currency pairs: no restrictions.

- Optimal timeframe: M15 and more.

- Suitable option expiration date: 3 candles.

- Time to trade: no restrictions.

- Recommended broker: Quotex , PocketOption , Alpari, Binarium .

What is a pin bar?

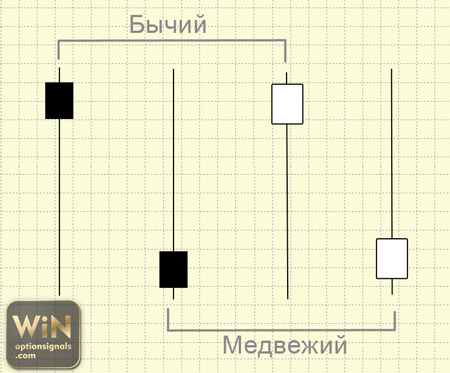

A pin bar is a candle that has a very short body (or no body at all) in relation to its own size. Moreover, one shadow of such a candle should be long, while the other should be either short or completely absent.

A pin bar is a candle that has a very short body (or no body at all) in relation to its own size. Moreover, one shadow of such a candle should be long, while the other should be either short or completely absent.

Most often, a pin bar becomes a reversal pattern, but sometimes it can indicate a continuation of the trend. The difference between the interpretation options is determined by the location of the candle body.

For example, in a bullish pin bar pattern, the closing price is close to the opening level. This suggests that at first the price decreased for some time, and then returned back, leveling the fall. Thus, after the initial sales, there was a strong demand that sellers were unable to cope with, and we expect that these purchases are likely to continue in the future.

The bearish type of pin bar is considered similarly. In his case, the price first rises and then returns to the opening level. In such a situation, sellers emerge as winners and we can expect the downward movement to continue.

Trading strategy for binary options

One of the simplest strategies based on this model is to buy an option in the direction of the smaller shadow of the pin bar (or, as they also say, in the direction of the “hammer”). In this case, the color of the candle does not matter, only the position of its body is important. Those. a signal to open a position can appear on both a black and white pin bar.

We buy a Call option when the following conditions are met:

- a BULLSH pin bar has formed on the chart;

- his body does not extend beyond the boundaries of the previous candle;

- the price updates the MAX of the pin bar.

In this case, we buy an option with an expiration period equal to 3 candles of the timeframe used.

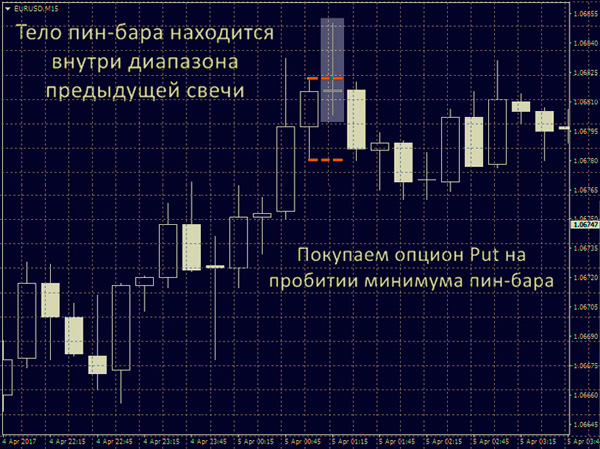

We buy a Put option under the following conditions:

- a BEARISH pin bar has formed on the chart;

- his body does not extend beyond the boundaries of the previous candle;

- the price updates the MIN of the pin bar.

We also buy Put with an expiration date equal to 3 candles of the used TF.

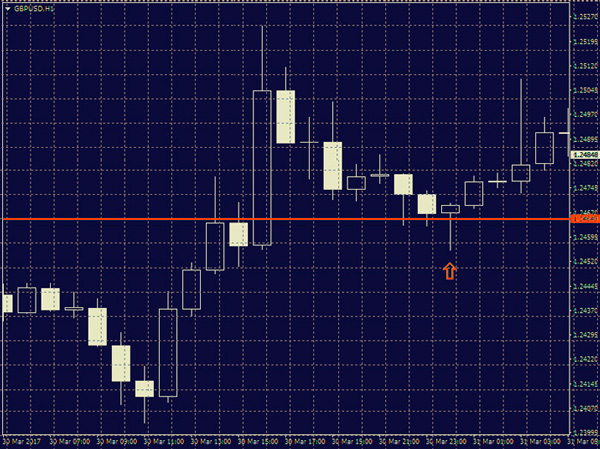

It is always better to open a position in unison with the main trend, because this allows you to avoid many unsuccessful trades. If a clear trend is not visible on the chart, then it is better to temporarily refrain from entering. The signals received on the side will be the worst.

The most suitable expiration time is 3 candles. On large timeframes this indicator may be reduced. On scales above H1, it is enough to buy options with an expiration of just one candle. But for small TFs it is no longer worth reducing this period.

You should also pay attention to the length of the pin bar. It should be close to the average size of the candles on the chart. If the distance from the high to low of the pin bar is less than the similar range of the previous candle, then it is better to skip the entry.

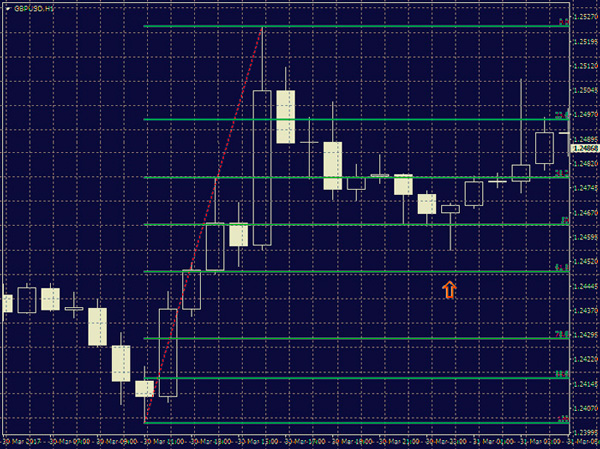

If several significant factors contribute to the appearance of a signal, then such a signal will be considered very strong. As you know, it is always easier for the price to move in the direction of less resistance. In this regard, a pin bar that has support in the form of a support or resistance level will give a much more powerful signal. It will be easier for market participants to play a rebound from such an obstacle than to overcome it.

The appearance of a pin bar at some Fibonacci retracement levels can also give a strong signal. Only natural levels of 38.2, 50 and 61.8 should be taken into account. In the case when such a pin bar also relies on a support or resistance level, the reliability of the signal will further increase.

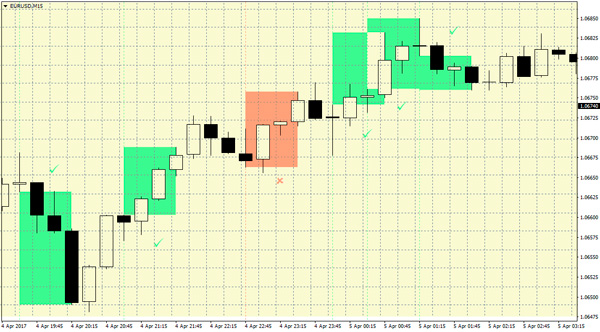

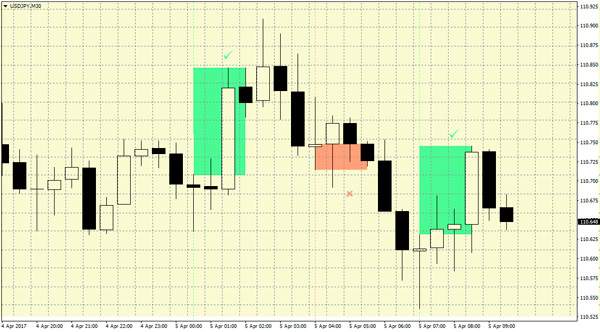

Examples of signals

As you can see, the strategy is really easy to use. Due to its unpretentiousness, it allows you to plan your working time as you wish. A price chart of an asset, represented using candles or bars, is all you need to work with.

Remember that you should not enter the market immediately after the pin bar appears. First make sure it meets all the criteria described and wait until the pin bar starts updating its limit values from the smaller shadow side.

Of course, it will not be possible to completely avoid false entries. The chart below shows an example of a failed trade. The signal received in that situation indicated an entry against the main trend, and such trading, as already mentioned, is extremely unreliable.

The strategy works best on large time frames. Meanwhile, many traders use it on small timeframes to increase the number of transactions. The most active traders can indeed choose small time frames, but in this case they should work only with the most reliable signals.

Conclusion

The incredible simplicity of the model is an important advantage. For full-fledged trading, you just need to learn how to correctly identify pin bars on the chart and follow the direction of the main trend.

Try to filter signals received on a sideways trend or pointing against the trend. And in order to increase the effectiveness of the strategy and reduce the number of unsuccessful transactions, enter only the most reliable signals and avoid situations that cause you doubts.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also:

- Online chart for binary options

- Trading training

- Forex trading session times

- Best Binary Options Brokers

To leave a comment, you must register or log in to your account.