Over the past ten years, the largest “unicorn companies” have been born (“unicorns” are startup companies whose capitalization exceeded $1,000,000,000 in five years), such as Uber and Airbnb. And although Bitcoin is not a company, the best investment of the decade belongs to it. A recent securities report from US Bank highlights that a 1 BTC investment in early 2010 is now worth over $90,000.

Over the past ten years, the largest “unicorn companies” have been born (“unicorns” are startup companies whose capitalization exceeded $1,000,000,000 in five years), such as Uber and Airbnb. And although Bitcoin is not a company, the best investment of the decade belongs to it. A recent securities report from US Bank highlights that a 1 BTC investment in early 2010 is now worth over $90,000.

Bitcoin is the best investment of the decade

At this point, a large number of people are reminiscing about the last ten years, and many realize that the emergence of Bitcoin was quite significant during this period of time. “The most valuable startup of the last decade did not raise money, had no employees, but allowed everyone to invest in it,” said popular philosopher Naval Ravikant. Apart from Ravikant's opinion, there is data that shows that Bitcoin has been the best investment over the past decade.

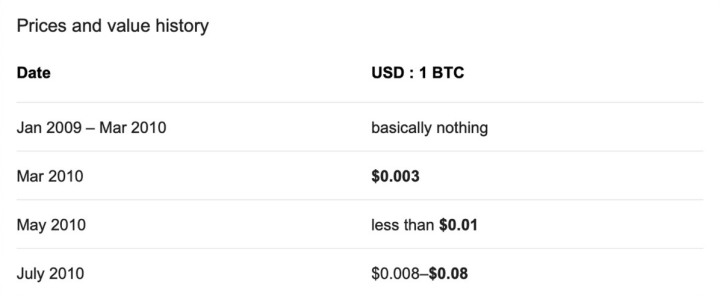

A recent Bank of America securities report said oil weakened between 2010 and 2020 and "negative interest rates were good for gold markets." But if a person had invested $1 in Bitcoin in 2010, it would be worth over $90,000 today. Thanks to Bitcoin's excellent performance, this decentralized asset has outperformed all investment vehicles over the past ten years.

Now let's just say that someone took Peter Schiff's advice on gold and invested in gold in 2010, which was trading at $1.113 per troy ounce at the 2010 open. Ten years later, gold has performed well, peaking at $1,542 an ounce, a pretty healthy 38% gain. However, in the last decade, Bitcoin has gained a whopping 8,999,900%, and even in this last year of 2019, BTC has outperformed the gold market's performance in the entire last ten years. In 2019, BTC gained 96% compared to gold's 10.8% rise.

Investment data from 2010-2020 shows that Netflix gained 4.177%, Amazon 1.787%, Apple 966%, Microsoft 556%, Disney 423% and Google 335%. And gold is only 38%. Bitcoin has grown by 8.9 million percent from January 2010 to the present.

Beyond precious metals, if Bitcoin were a company, it would also outpace investments in the most profitable "unicorn companies" created in the last decade. Profitable startups during 2010 and 2020 included Uber, Facebook, Airbnb, Snapchat, Spacex, Tesla, and Pinterest, but BTC investments outperformed all of these public stocks over the long term.

Investor and former CTO of Coinbase, Balaji Srinivasan, recently explained his thoughts on the cryptocurrency revolution over the past decade versus "unicorn" companies.

“By the end of the decade, the biggest unicorn of the 2010s wasn’t Uber, Airbnb, or Snap—it was Bitcoin,” Srinivasan wrote. “Note that all three of these companies and many others like them are excellent. But to my knowledge, nothing else founded at the same time has had a $100,000,000,000 capitalization for that long. From an investor's point of view, this is important to know."

Investing in Bitcoin

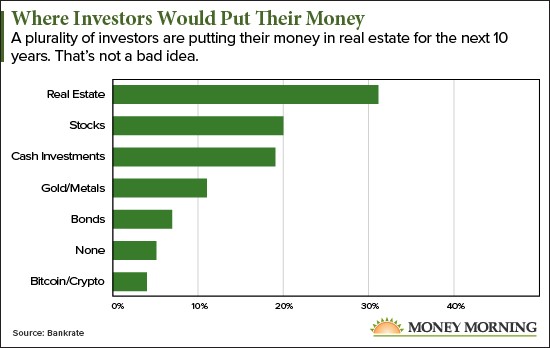

Despite being the best investments of the last decade, a Bankrate survey in September found that 31% of investors would put their money into real estate, 20% into traditional stocks, and only 4% of respondents said they would invest in Bitcoin. in the next ten years.

A number of cryptocurrency proponents agree with Srinivasan and Ravikant's statements on cryptocurrencies, and the issue is often discussed on forums and social media. Replying to Srinivasan's tweet, former Bitcoin Foundation director Bruce Fenton said: "Bitcoin did it all without a central marketing fund, without sellers representing sovereign wealth funds or family offices, without a road show, and without fundraising or pre-production."

While the digital asset has been the best investment of the decade, it has also provided significant innovation, financial disruption, and changed the way people perceive money. People can bypass corporations, financial institutions and governments like never before under censorship. It's safe to say that innovation in cryptocurrency will make the next ten years even more revolutionary.

Conclusion

As has been said more than once, Bitcoin will only gain momentum, despite the fall in its price. Its colossal growth throughout its existence speaks volumes. Therefore, do not pay attention to the manipulations that take place in any market. Sooner or later Bitcoin will rise even more.

To leave a comment, you must register or log in to your account.