Divergence is a primarily mathematical concept applied to situations in which there is a discrepancy between certain values. However, this term also applies to the financial market of binary options. Divergences also arise when conducting foreign exchange transactions. We are talking about discrepancies between market prices and the indicators shown by technical indicators. By learning to recognize divergence in a timely manner, a trader can significantly increase the amount of profit.

Definition of the concept

Divergence in the financial market, when trading binary options, is a situation in which there is a discrepancy between the current dynamics of quotes and indicator indicators. Such deviations are typical for almost all technical analysis tools. Traders who make money in binary options using divergence signals mainly use the MACD indicator to find divergences.

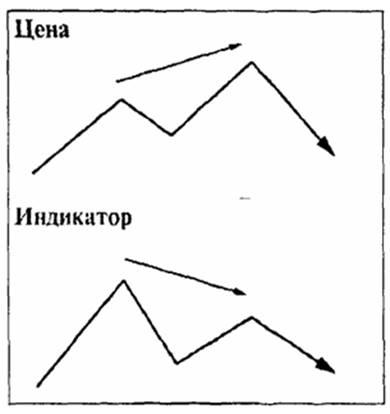

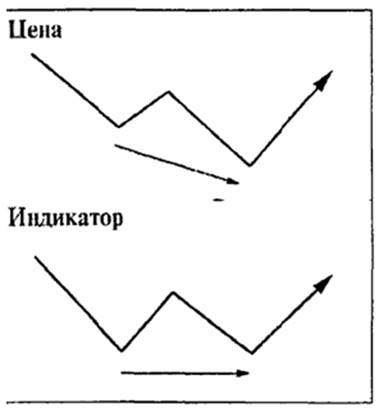

There are two types of such deviations: divergence and convergence. The first refers to the discrepancy between the indicators and the current price. The appearance of divergence indicates that a market correction will occur in the near future and the trend will go down. Such situations are reflected on the chart as two local peaks, the first of which is located below the similar peak of the MACD histogram, and the second is located above (Fig. 1).

Rice. 1. Divergence between MACD and current price. The first top of the chart is below the top of the indicator histogram.

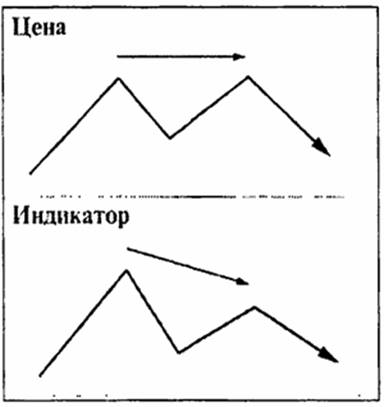

Rice. 2. Divergence between MACD and price, when two identical peaks form on the latter’s chart, and on the histogram the first peak is higher than the second.

Rice. 3. Divergence between MACD and price, in which the tops of the histogram are at the same level, and on the price chart the first top is located below the second.

Based on the charts, divergence is recorded whenever there are discrepancies between the indicator and price dynamics. It does not matter how the vertices are located. Each of the above examples signals an imminent market correction and the beginning of a decline in asset prices.

Convergence means the opposite situation: two bottoms (Low) appear on the price chart, differing in height and slope from similar indicators on the MACD histogram.

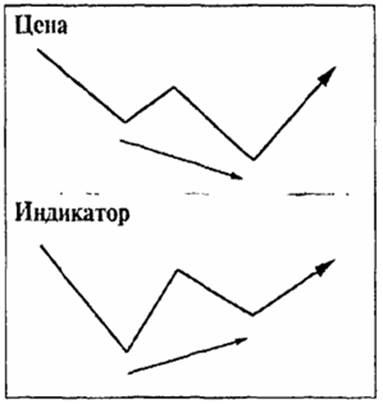

Rice. 1. Convergence between the price and the indicator, when the first base of the price chart is located above the second, and the opposite situation has formed on the MACD histogram.

Rice. 2. Convergence, characterized by the fact that on the price chart both bases are located at the same level, and on the indicator histogram - at different levels.

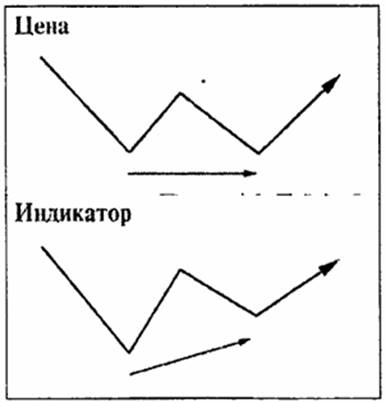

Rice. 3. Convergence, characterized by the fact that the bases on the indicator histogram are at the same level, and on the price chart - at different levels.

The appearance of convergence (or bullish divergence) indicates an imminent trend reversal and the beginning of an increase in the asset price. Signals like these are exactly what you should use when trading binary options.

According to the practice of exchange trading, the above signals are triggered in 80% of cases. This means that if a trader learns to determine the moment when divergence or convergence occurs, he will be able to close up to 80% of transactions in the black with his binary options broker.

Indicators for determining divergence

You can detect divergence on a chart either independently or with the help of specialized indicators . In the first case, it is necessary to constantly analyze the market and identify discrepancies between price dynamics and MACD. The second option is simpler, as it frees up time for trading and helps to identify all divergences.

To quickly identify divergences, traders often use the following indicators:

- divergence indicator for binary options Macd divergence;

- Divergence indicator for binary options Divergence petr.

(Archives and download links for which you will find at the end of the article)

Instructions for installing indicators in MetaTrader 4 :

The first indicator works on the same principle as the standard MACD. Macd divergence is included in the standard package of the MT4 platform and differs from the basic tool in that it can automatically detect divergences on charts.

This indicator signals the presence of discrepancies as follows:

- on the price chart, sloping lines are drawn between the maximum and minimum values;

- on the histogram of the MACD divergence indicator, sloping lines are superimposed between the extremes;

- On each of the charts, arrows are formed indicating the direction of trade (buy - up, sell - down).

As practice shows, traders who use Macd Divergence to trade binary options do not waste their time looking for discrepancies on the chart. Instead, they respond to precise indicator signals by buying or selling options on divergence and convergence, respectively.

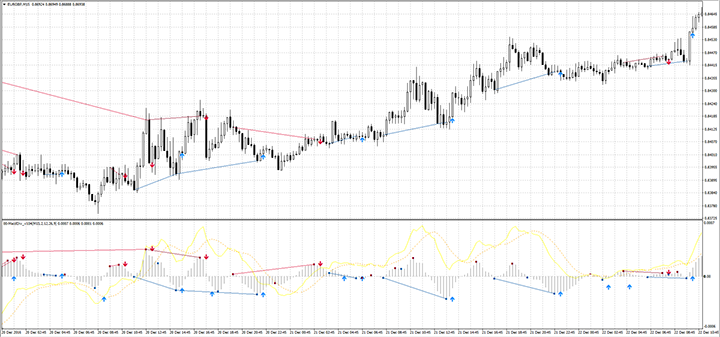

Example of a convergence signal

The Divergence indicator showed the point where the price chart and MACD histogram diverge, and also marked the direction in which the trend is changing.

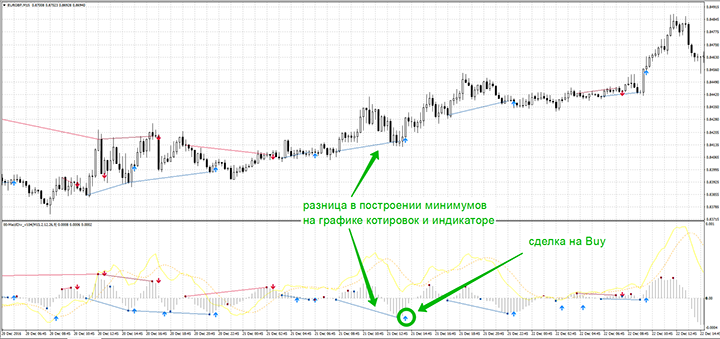

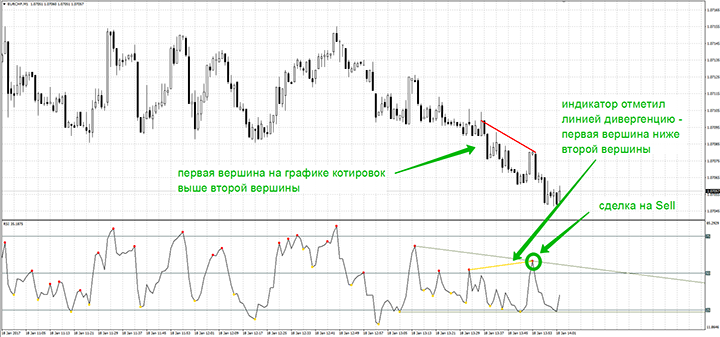

Example of a divergence signal

The Divergence indicator marked the tops on the price chart and MACD histogram, indicating with an arrow the direction of the trend change.

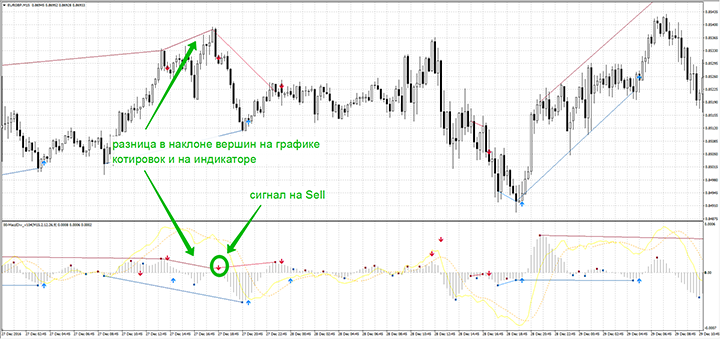

In addition to Macd Divergence, the Divergence petr indicator is used to determine divergence. This technical tool works on a similar principle. The difference is that Divergence petr determines the divergence between the price chart and the RSI indicator .

In the chart below, a situation has arisen where there is an upward price breakout: The chart below shows that the first price minimum is located below the second, when, as in the RSI histogram, the opposite situation has developed: the second minimum is below. A buy order should be placed at the moment when the second lows are formed.

An example of a divergence occurrence graph:

On the price chart, the first peak is located significantly higher than the second, when, as on the RSI, the second is higher. This indicates a downward reversal in quotes. We recommend opening a sell order when the second top is formed.

Using divergence indicators in binary options is very profitable, as practice shows that the signals received from these indicators provide the most accurate reversal signals , which allows traders to make more profitable transactions on the brokers' platform.

Watch the video lesson on divergence.

Download the MACD divergence indicator

Download Divergence petr indicator

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

With this indicator use:

How to trade divergences in binary options

To leave a comment, you must register or log in to your account.