Today, cryptocurrencies are of great interest not only to long-term investors, but also to binary options traders. Over the past few years, the value of two major digital assets – Bitcoin and Ethereum – has increased significantly, attracting the attention of binary options trading platforms . Read our review to find out how to choose the best one for trading bitcoin options.

Content:

Definition of Cryptocurrency Options

Benefits of Trading Cryptocurrency Options

Difference from Traditional Cryptocurrency Trading

Criteria for Choosing a Platform for Trading Cryptocurrency Options

- Safety and Regulation

- Available Cryptocurrencies and Options Types

- Commissions and Fees

- User Interface and Mobile Applications

- Tools for Аnalysis and Trading

- Customer Support

Top 5 Crypto Options Trading Platforms

Tips for Beginner Traders

Risks of Trading Cryptocurrency Options

Conclusion

FAQ

Definition of Cryptocurrency Options

The best binary options brokers strive to keep up with the times and regularly offer new assets to their clients. One of them is cryptocurrency options. If you don’t know what it is yet, it’s time to figure out this interesting financial instrument.

So, options on major cryptocurrencies are instruments that give the owner the right, but not the obligation, to buy or sell a certain amount of digital assets at a predetermined price (strike) at a certain point in the future ( expiration time ).

There are two types of cryptocurrency binary options:

- Call option : will bring profit to its owner if, for example, the price of Bitcoin at the time of expiration is higher than the purchase price of the digital contract.

- Put option : will bring profit to its owner if the price of cryptocurrencies at the time of expiration is lower than the purchase price of the digital contract.

Benefits of Trading Cryptocurrency Options

Cryptocurrency, due to its high volatility , allows a trader to make a significant profit in a relatively short period of time, which attracts many. However, not everyone understands the benefits of trading cryptocurrency options.

Let's figure it out. First of all, this tool allows the trader to use various trading strategies depending on his expectations and forecasts of market behavior. In addition, binary options on cryptocurrency provide the opportunity to flexibly manage risks , limiting their size to the cost of an open position (the size of your bet).

If you know how to correctly identify trends in the financial market and trade with the trend , cryptocurrency options can bring much greater profits than regular speculation in digital assets. To make a profit on binary options, it is enough for the price of the underlying asset to be just one tick higher or lower than the purchase price of the Call or Put option, depending on the direction of trading.

An active trader can make hundreds of trades, while an indecisive investor will wait for the cryptocurrency rate to rise in the long term. If you don’t yet have all the techniques of trend trading, we recommend that you read this selection of articles on this topic:

- How does a trend work in the markets?

- Identifying and using bullish and bearish trends.

- Market phase changes .

- How to identify a flat market?

However, despite the obvious advantages, cryptocurrency options also have certain disadvantages that you should be aware of. First of all, it is high volatility. The prices of cryptocurrency assets can change rapidly, which can lead to negative results. In addition, trading on a binary broker platform is more complicated than investing on the buy-and-hold principle.

Difference from Traditional Cryptocurrency Trading

It may seem that cryptocurrency options trading and regular binary options trading are the same thing. However, despite the similarity of the basic mechanisms, they have differences. First of all, this concerns the underlying assets.

In traditional trading, we usually work with popular and proven assets, such as shares of leading international companies, stock indices, currency pairs or commodities on the commodity markets. In the case of cryptocurrencies, the situation is different: they are not as regulated, predictable and safe as traditional assets.

When trading cryptocurrency options, we work with financial instruments known for their high volatility and large price fluctuations. This creates opportunities for significant profits, but without proper money management, it can result in large losses.

So, what are the differences between traditional binary options and cryptocurrency options:

- Underlying assets. As already noted, traditional binary options trades are based on stocks, currency pairs, and other classic financial instruments. While crypto-binary contracts can be traded exclusively on digital assets such as Bitcoin.

- Market volatility. Cryptocurrency assets are more volatile than the surface of the ocean, influenced by wind and tides. In such a market, a trader must pay special attention to risk and capital management.

- Regulation: Traditional underlying assets are overseen by reputable government agencies, while cryptocurrency markets remain largely unregulated, creating the risk of price manipulation by large players.

- Accessibility. Cryptocurrency options allow you to trade around the clock, 24/7. Traditional markets, on the contrary, are closed on weekends and holidays.

It is important for traders to be aware of these differences in order to adapt their trading strategies and money management approaches depending on the trading instrument they choose.

Criteria for Choosing a Platform for Trading Cryptocurrency Options

When choosing a broker for crypto options trading, focus on your experience and results with traditional binary options. This will help you choose the right platform for BTC trading, reduce risks and increase your chances of success.

Safety and Regulation

In any business, security is of the utmost importance, especially when it comes to investing and trading cryptocurrency options. Reliable brokers and exchanges take care to protect their clients by using two-factor authentication, data encryption, and cold storage of crypto assets. When choosing a platform for trading, be sure to study not only who regulates it, but also real user reviews. We recommend giving preference to platforms that pay special attention to the safety of clients' funds and offer compensation in case of their loss.

Available Cryptocurrencies and Options Types

When choosing a broker, pay attention to the cryptocurrencies available for trading. Most binary options brokers usually offer popular digital assets such as Bitcoin and Ethereum. However, if your trading strategy requires other cryptocurrencies, try to find a broker that has them available.

Typically, trading platforms provide standard types of binary options: "higher" and "lower". But this is far from a complete list of possible options. If your strategy requires certain market conditions to be met for a trading signal to occur, choose the appropriate type of binary contract.

Commissions and Fees

Commissions and fees play an important role as they directly affect the financial result of your trading operations. Therefore, always try to choose platforms with minimal commission for cryptocurrency binary options transactions. As a rule, such trading platforms do not charge fees for deposits and withdrawals. However, payment systems may charge them for transferring funds to your brokerage account, and this should be taken into account.

User Interface and Mobile Applications

Of course, the workspace of your trading application should be intuitive and convenient, regardless of whether you are a beginner or an experienced trader. Therefore, when choosing a platform, we recommend giving preference to honest brokers with a well-designed terminal equipped with advanced tools for market analysis. We also recommend paying attention to mobile applications . They are convenient and allow you to open trades literally on the go.

Tools for Аnalysis and Trading

When choosing a trading platform, pay attention to the available graphical analysis tools and the list of technical indicators that can be used in trading strategies. The wider the range of available tools, the more opportunities for generating trading signals. Therefore, before opening an account with a specific broker and starting trading cryptocurrency options, be sure to study the functionality of its trading terminal on a demo account .

Customer Support

Another element that beginners should pay attention to is customer support. As a rule, all top brokers provide 24/7 support via social networks, chats, email, and phone. Responsive customer support not only creates a favorable impression of the company, but also helps improve your trading experience and will come to the rescue in a difficult situation.

Top 5 Crypto Options Trading Platforms

As already mentioned, choosing a broker with a minimum deposit for trading cryptocurrency options is difficult to overestimate. Make sure you choose a brokerage company from our rating. It includes only proven and reliable companies with a wide range of assets, a convenient terminal and a large number of positive reviews from satisfied users.

|

Broker |

Cryptocurrency Options Payouts |

Minimum deposit |

Top up your account in cryptocurrency |

Passive income |

Open an account |

|

up to 92% |

5$ |

✔️ |

Copy trading, tournaments |

||

|

up to 93% |

10$ |

✔️ |

Affiliate program, trading room |

||

|

more than 100% |

5$ |

✔️ |

Copy trading, multipliers |

||

|

up to 90% |

5$ |

✔️ |

Bonuses, real rewards for trading on a demo account |

||

|

up to 55% |

1$ |

✔️ |

Copy trading, affiliate program |

Pocket Option

Pocket Option broker supports replenishment of the real account using a variety of cryptocurrencies, and the minimum deposit on the platform is only $5.

The following assets are available for trading on the Pocket Option platform: Avalanche OTC, Bitcoin ETF OTC, BNB OTC, Dogecoin OTC, Litecoin OTC, Solana OTC, TRON OTC, Ethereum OTC, Cardano OTC, Ripple OTC, Bitcoin OTC, Chainlink OTC, Toncoin OTC.

Quotex

Quotex broker also provides the ability to fund your account using various cryptocurrencies, with the minimum deposit being only $10.

The following assets are available for trading on the Quotex platform: Bitcoin OTC, Dogecoin OTC, Pepe OTC.

Derive

Broker Deriv provides the opportunity to open accounts not only in fiat, but also in cryptocurrency. You can choose the appropriate option when opening a trading account.

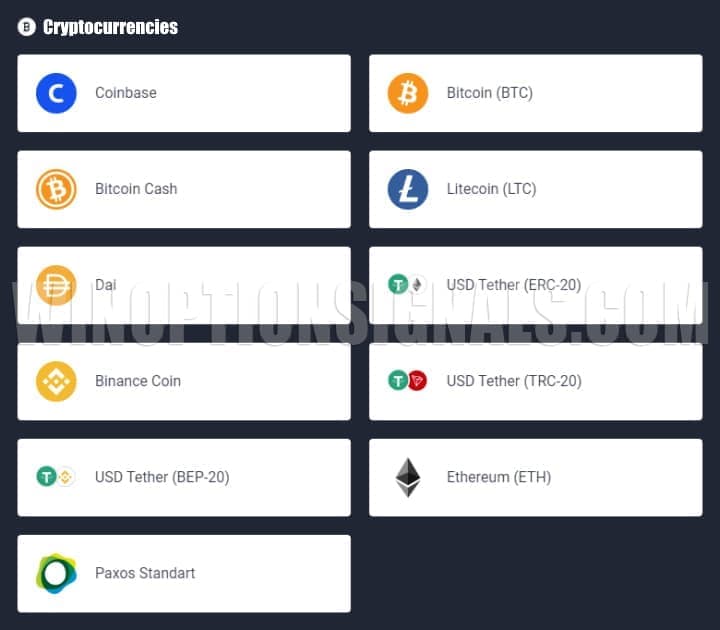

Account replenishment is available in the following cryptocurrencies.

Cryptocurrency pairs BTC/USD and ETH/USD are available for trading.

Binarium

Broker Binarium , like the previous company, provides its clients with the opportunity to open an account in digital assets:

You can trade Bitcoin, Ethereum, Litecoin and Ripple.

Alpari

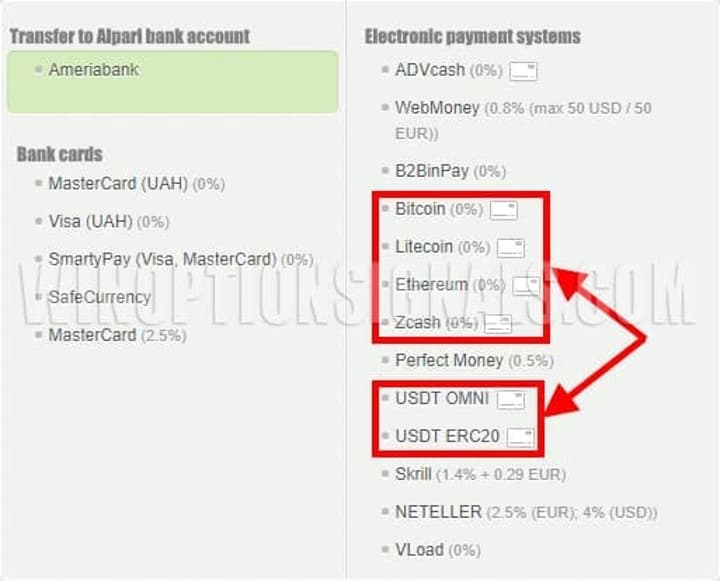

Broker Alpari allows you to open accounts only in fiat currencies. However, you can top them up for trading with coins:

Broker Alpari stands out from its competitors in that it allows trading not only cryptocurrency pairs to USD, but also to EUR, GBP, JPY. For example, such pairs as BTC/GBP and ETH/EUR are available.

Tips for Beginner Traders

Trading cryptocurrency options has certain features that every novice speculator should know about. Start your path to trading success with a demo account. This is necessary not only for learning how to trade, but also for mastering the functionality of trading platforms, which are sometimes not as simple as they seem.

Try to learn from your mistakes. To do this most effectively, keep a trader's journal . After each trading session, analyze your trades to understand the reasons for losses and find ways to avoid them in the future.

In addition, be sure to understand how to manage your own money wisely. Understanding that you should not invest all your capital in one transaction is not enough. You need a clear algorithm: increase the volume of transactions in profitable series and reduce it in unprofitable ones. Even if you adhere to the Martingale system , it is important to use it correctly. To simplify your calculations, we have created a special section on the site with a Martingale calculator . Now you can easily calculate the size of the next bet based on the amount of your deposit and the percentage of payments.

However, despite all the above conditions for profitable trading, the most important thing is to maintain discipline and composure in a series of losing trades. Do not make impulsive decisions - always follow your trading strategy.

Remember that there is no limit to perfection. Having studied one strategy or approach, continue reading books, communicating with other traders on forums and social networks, remembering that you are not competitors. Such interaction will help you improve your methodology and increase the efficiency of binary options trading.

And remember: there is no system or strategy that will allow you to make trades with 100% accuracy. Stay realistic and keep in mind that binary options trading always involves risk.

Risks of Trading Cryptocurrency Options

So, it’s time to discuss the risks that come with trading cryptocurrency binary options. In our opinion, the main ones are as follows:

High volatility: It is no secret that the cryptocurrency market is highly volatile, which is why prices can change significantly in a short period of time. This feature makes success in trading binary options on crypto assets difficult to predict.

Low payout percentage: Many binary brokers reduce the payout percentage for cryptocurrency options due to the high volatility of their prices. Constantly trading with payouts slightly above 50% can lead to losses, as in this case, extremely high signal accuracy is required to avoid draining the deposit .

Regulation: The cryptocurrency market is still in its infancy. The lack of strict regulation creates additional risks, including the possibility of manipulation by large players. At the time of writing, most binary options brokers only offered cryptocurrency trading on the over-the-counter (OTC) market.

Trading psychology: fear and greed are the main enemies of a trader, which can significantly affect trading results. It is very important to stick to the rules of the strategy, even if the results could be better.

To reduce the impact of the above factors, conduct a thorough market analysis before trading. Open a trade only when all the conditions for doing so are met. Follow current news using the economic calendar and manage the size of your trades according to pre-set rules. All this will help reduce risks and increase the profitability of cryptocurrency options trading.

Conclusion

So, we have looked at some of the most popular cryptocurrency options trading platforms. Each of them has its own advantages and disadvantages. However, there is one thing that all of these platforms have in common: to succeed in binary options trading, it is important to be disciplined and have a solid trading strategy.

As is known, cryptocurrencies have high volatility, which means that when opening option trades based on them, traders should focus on strategies with short expiration periods. In our experience, 5-30 minutes is the optimal holding period for cryptocurrency options. Start with a demo account, and after getting good results, move on to trading on a real account. We wish everyone successful trading!

FAQ

What are the Optimal Time Frames for Trading Cryptocurrency Binary Options?

Given the high volatility of cryptocurrencies, we recommend making deals with expiration from 1 minute to 1 hour. For fans of technical analysis, intervals from 5 to 30 minutes will be more suitable. It is not recommended to make deals for a longer period.

Are Аll Cryptocurrencies Аvailable for Options Trading?

No, not all cryptocurrencies are available for binary options trading. You can check the specific list of assets with your broker. Most leading platforms support Bitcoin and Ethereum trading. It is rare to find other cryptocurrencies as an underlying asset.

What Аre the Main Criteria for Choosing a Strategy for Trading Binary Options on Cryptocurrencies?

When choosing a trading platform, pay attention to its security and regulation, as well as the list of available cryptocurrencies and the types of options that can be purchased on these underlying assets. Brokerage commissions, various fees, and user interface are also important, as are mobile applications that make it easier to monitor open positions. However, advanced market analysis tools combined with responsive customer support will make your trading not only profitable but also enjoyable.

What Аre the Risks of Losing Money When Trading Binary Options on Cryptocurrencies?

When trading binary options on cryptocurrencies, there are risks of losing funds similar to those present in trading options on traditional assets. Therefore, before moving on to trading on a real account, be sure to test the strategy on a demo account.

What Аre the Ways to Trade Crypto Options Without Risking Real Money?

To try trading cryptocurrency options without risking real funds, use the most popular method - open a demo account with a broker. Thanks to it, you will be able to use virtual funds in simulated trading, as close to real as possible. This will allow you to test the operation of your own trading strategy without financial losses. Another way is deposit bonuses. They can also be used for trading without risking your funds. However, we recommend that you first familiarize yourself with the conditions for receiving them and withdrawing profits from your broker.

To leave a comment, you must register or log in to your account.