If you ask traders who trade binary options, what expiration time is the most popular, most will answer: 60 seconds. And this is not surprising: many strive for quick profits and "easy" money, and one-minute expiration provides such an opportunity. Additionally, it's psychologically much easier to see the result immediately than to wait for weeks or months in constant tension.

Contents:

- Trading strategy for minute expiration

- Popular strategies for 60-second binary options

- Rules for trading using minute binary options strategy

- Filters for reducing loss risk when trading with minute expiration

- The main filter of this trading system

- Conclusion

Trading Strategy for Minute Expiration

Recently, trading binary options with extremely short expiration times has become increasingly popular. It uses the Martingale system and impulse price movements of the underlying asset.

Anyone who has carefully studied the live price chart online knows: even during an upward trend, pullbacks are inevitable. No matter how strongly prices rise, there will always be those willing to sell, for example, to lock in their profits.

Simply put, during price increases, red candles often appear, and during decreases – green ones. This observation is extremely useful as it allows us to use it to our advantage.

Advantages of Minute Expiration Time

As mentioned above, the key advantage of 1-minute expiration is the high speed of profit generation. The small position holding time allows the trader to make multiple trades during one trading day, which provides additional income. Such trading is considered one of the best ways to quickly grow your deposit.

Furthermore, 1-minute expiration allows the use of simple candlestick chart combinations as binary options strategies. You can read more about this in the article "Japanese candlesticks for beginners and how to read them".

Additionally, when using binary options trading strategies with short expiration, fundamental analysis loses its significance. The publication of macroeconomic statistics and other fundamental events do not affect short-term asset fluctuations, which significantly simplifies market analysis.

At the same time, 1 minute is quite enough for a trader to react to any changes in price behavior and benefit from it. On such a timeframe, it's particularly beneficial to apply scalping – a strategy that allows earning on increased volatility and random price fluctuations.

Disadvantages of Minute Trading

Among the disadvantages of minute trading, it's worth noting the high level of stress that accompanies this way of working with binary options. We recommend applying scalping in options strategies only to those who can make quick decisions and react to trading signals. Otherwise, constant tension and the need for instant reaction can negatively affect the trader's psychological state, which often leads to opening ill-considered trades.

Keep in mind that high frequency of operations can bring not only increased profits but also significant losses. In high-frequency trading, the probability of encountering a series of losing trades increases significantly. Moreover, random price fluctuations often trigger false signals, which ultimately leads to losses.

On small time intervals, classical technical analysis tools work poorly, as they were developed for use on higher timeframes. For 1-minute trading, it's better to use special indicators that have been optimized for short time intervals.

Also pay attention to your broker's trading platforms. Not every company offers terminals with fast order execution, which is critically important for binary options with 60-second expiration.

Popular Strategies for 60-Second Binary Options

Now let's look at several strategies for trading binary options with one-minute expiration. There are several popular approaches, but most of them include combinations of technical indicators and candlestick patterns.

The "Marathon" Strategy

To successfully trade using the "Marathon" trading system, a trader needs to use two simple indicators: moving average and MACD. So, first, we need to find a chart with a clearly defined trend on the higher timeframe. Then we'll add the MACD indicator with standard settings, as well as a simple MA indicator with a period of 9.

Trading signals for buying Call and Put options:

|

Rules for buying Call |

Rules for buying Put |

|

|

The "ADX+MA" Strategy

Another interesting strategy is the combination of two popular indicators ADX and moving averages. In it, the crossing of averages indicates the trading direction, while ADX serves as a volatility filter, where trades are only allowed when this indicator rises above a certain threshold value.

Trading signals for buying Call and Put options:

|

Rules for buying Call |

Rules for buying Put |

|

|

Rules for Trading Using Minute Binary Options Strategy

Now let's examine the strategy of trading on a minute chart against the price movement of the underlying asset. Recommended brokers for working with this strategy are Quotex, Pocket Option, and Binarium.

The main idea is to open trades against the current movement after the appearance of a price impulse consisting of several candles of the same color.

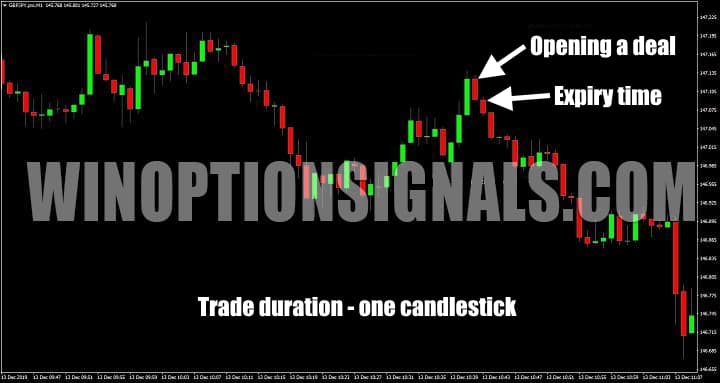

Since the strategy involves working with 60-second expiration on an M1 chart, each trade will correspond to one candle. This means that if a trade is opened at the very beginning of a new candle formation, it will end simultaneously with its closing.

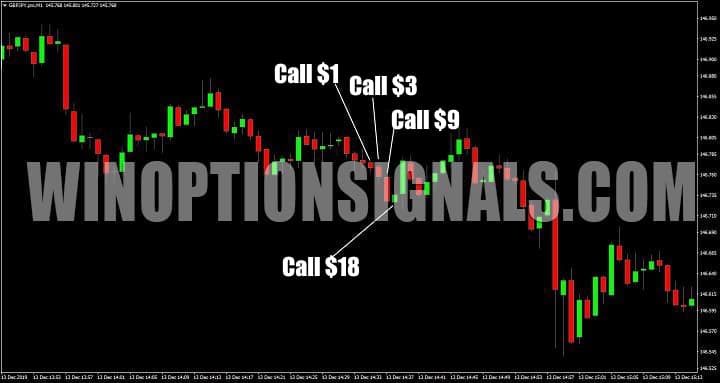

Besides visual convenience, this approach makes it easy to notice short impulse movements forming during the day. Upon detecting such movement, you can open a Call option (up) for $1 (minimum stake). If several red candles appear in a row (2-3 is enough), we open a Put option (down).

Let's return to the example with buying a Call option (up). The candle closed green, and the trader received a profit of 80% of the invested amount.

If the candle closed down (red), we'll get a loss of $1.

In case of profit, it's simple: we look for new impulse price movements to open next trades. However, losses require a special approach. After a losing trade, it's necessary to increase the stake size and open a Call option (up) for $3.

If the next candle is green, this brings profit that covers the loss from the previous trade, plus additional income. If the candle turns out to be red again, the stake size should be increased to $9.

In the illustration below, you can see that the fourth trade ended successfully, brought profit and fully compensated for the losses from all previous positions.

The maximum number of trades in one series should not exceed six: $1, $3, $9, $18, $42, $97. For convenience and accurate position calculation, we recommend using our online Martingale calculator.

Filters for Reducing Loss Risk When Trading with Minute Expiration

Let's look at filters that help avoid situations where six trades are not enough to generate profit. If this still happens, after the sixth trade, it's necessary to stop trading and analyze the causes of losses.

Why are six trades usually enough? Any price movement, even the most prolonged, is inevitably accompanied by correction. The stake sizes are calculated in such a way that one successful trade covers the losses of all previous unsuccessful positions.

To increase efficiency and increase the probability of profit with this strategy, you need to follow simple rules:

- Trade only from 10:00 to 19:00 GMT+2.

- Don't use AUD/NZD currency pairs, cryptocurrencies, euro crosses, and pairs containing JPY.

- Don't trade during important news releases.

These recommendations will help significantly improve your trading effectiveness.

The Main Filter of This Trading System

The main filter of this minute binary options trading system helps avoid situations where the market shows prolonged movement in one direction without pullbacks. Of course, it's impossible to completely eliminate errors and losses, but following all recommendations will significantly increase your chances of success.

In the illustration below, you can see how after a prolonged downward price movement, there was a pullback and more than three green candles formed in a row. According to our strategy, this is an excellent chance to buy a Put option (down). However, such movements sometimes turn out to be market reversals and the beginning of a new bullish trend. In this case, there might not be red pullback candles for some time. Trading in such a situation is not advisable, as the probability of losing funds is very high.

As an example, below is a possible scenario where no new major movement occurred, and the price moved with many candles both up and down.

Conclusion

This trading methodology really shows excellent results when following all rules. Of course, losing series are possible, but they are easily covered by a series of profitable trades, thanks to increasing position size.

Don't forget to observe risks and open positions for an amount you can afford to lose. And most importantly – test all strategies on a demo account before moving to real trading. However, keep in mind that the approach to testing minute strategies is radically different from what is usually used in binary options trading.

In this case, the most significant will be the strategy's performance results over the past week. At the same time, it's mandatory to keep track of test trades by trading sessions: Japanese, European, and American. After this, you'll be able to determine the most effective and most suitable time for the strategy within it.

Additionally, we recommend setting a limit on the number of losing trades in one day and never exceeding it. You can learn more about risk management principles and capital management from articles dedicated to these topics on our website.

We wish you successful trading!

If you have questions about how this strategy or any indicator works, write about it in the comments to this article. Also, don't forget to subscribe to our YouTube channel WinOptionCrypto, where we will definitely address all your questions in video format.

See also:

Free signals for binary options online

To leave a comment, you must register or log in to your account.