Binary options strategy Volume Trading is a strategy that suggests entering the market on “overbought” and “oversold” signals based on changes in candle volume. The indicator signals are not redrawn, and, according to the author, they allow you to determine the price reversal at the beginning of the movement.

How effective is the strategy? What results does it show in real time? How to filter out false signals? We will try to give answers to all these questions in this article.

Characteristics of the Voume Trading strategy for binary options

- Terminal: MetaTrader 4 .

- Timeframes: any, but recommended from M30 and above.

- Expiration: 1 candle.

- Types of options: Call/Put.

- Indicators: _Data Volume.ex4, _Linex.ex4.

- Trading instruments: currency pairs , cryptocurrencies , stocks, commodities.

- Trading hours: around the clock.

- Recommended brokers: Alpari , Quotex , PocketOption , Binarium .

Installing Voume Trading Strategy Indicators in MT4

Indicators are installed as standard in the MetaTrader 4 terminal.

MetaTrader 4 instructions for installing indicators:

The easiest way is to install an indicator for binary options from the Voume Trading strategy from the template located at the end of the article.

Review of Voume Trading strategy indicators for binary options

The strategy is positioned by the developers as an effective tool for predicting trend changes, where the main signals for opening a transaction are “overbought” or “oversold” of the market.

Overbought is a market situation that occurs after the price has risen too high and too quickly:

Oversold – a situation in the market when the price has fallen too low and quickly:

The logic of the strategy is incredibly simple:

- If the price rises too quickly, a decline is expected.

- If the price falls too quickly, an increase is expected.

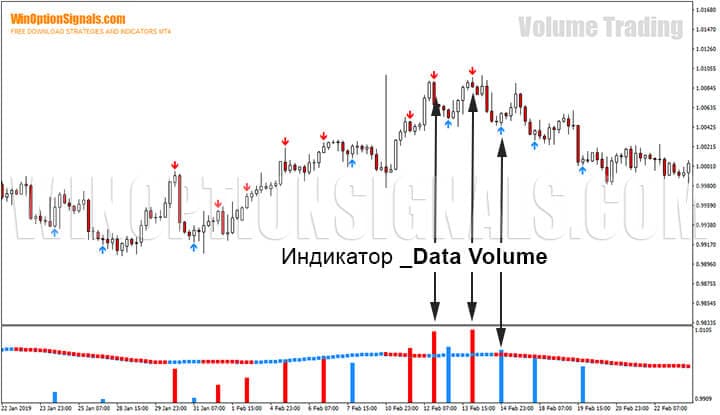

The trader is not required to conduct technical or fundamental analysis , or even monitor the market. For this purpose, the system provides a Data Volume indicator. The indicator is represented by a histogram at the bottom of the MetaTrader 4 platform and up/down arrows colored blue and red. This is the main indicator of the strategy, indicating possible changes in price movements.

Please note: indicator signals are not redrawn. Moreover, up or down signals appear even before the candle closes. Also, on our resource, you can familiarize yourself with the best indicators without redrawing .

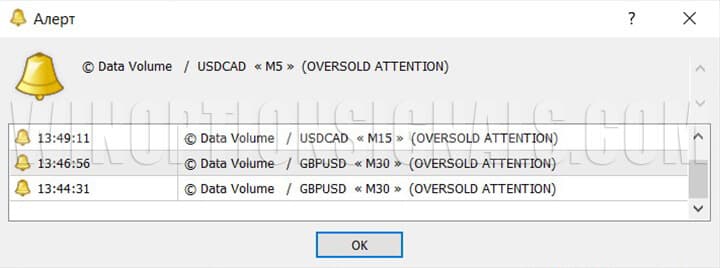

We do not recommend changing the standard settings in the indicator parameters. But please note that alerts are enabled by default: in the terminal, by email and phone number. In order to disable alerts for example for a mobile phone, just change the value of the “Alertformobile” variable to “false”.

Built-in alerts (indicator notifications) perform a warning function: “Oversold/Overbrought Atention” messages may appear in the terminal, which gives the main signal to the trader about a possible “Oversold/Overbought Market”.

This is just a warning signal and before buying options you need to wait for a confirmation signal from the second indicator.

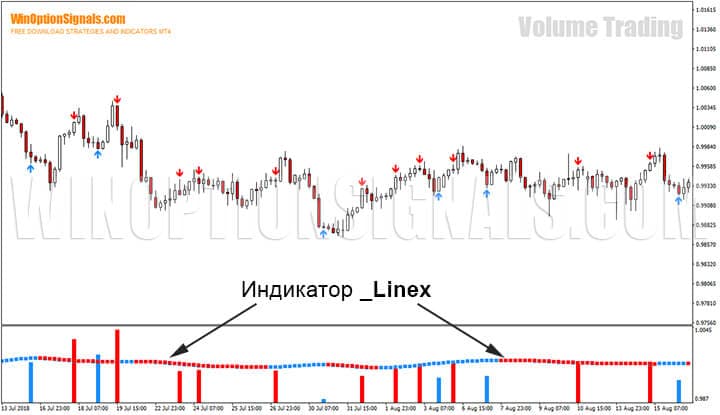

The Linex indicator is the second indicator of the strategy, which serves to confirm the signal. The indicator is also located at the bottom of the MetaTrader 4 platform and represents a horizontal line crossing the volume histogram of the Data Volume indicator. For confirmation, the color of the indicator is used: blue color – purchase of a Call option (“Higher”); red color – purchase of a Put option (“Below”).

It is also worth noting that this indicator is based on tick volume, not real volume. Despite this, even tick volumes can be used in binary options trading to make a profit.

Trading rules using the Volume Trading strategy for binary options

Buying a Call option ("Higher") :

- An up arrow (blue) appears on the chart;

- The histogram column of the Data Volume indicator is colored blue;

- The color on the Linex indicator line matches the color of the Data Volume indicator.

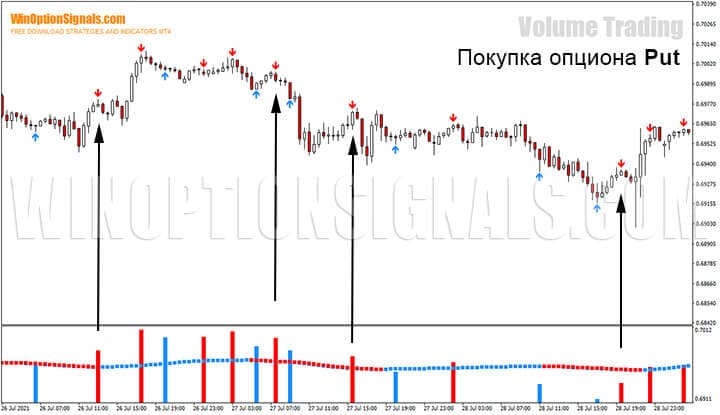

Buying a Put option ("Below") :

- A down arrow (red) has formed on the chart;

- The histogram column of the Data Volume indicator is colored red;

- The color of the Linex indicator matches the color of the Data Volume indicator.

The choice of expiration time is recommended in 1 candle:

- For M1 charts – 1 minute.

- For chart M5 – 5 minutes.

- For M15 charts – 15 minutes.

- For M30 charts – 30 minutes.

- For H1 charts – 1 hour.

Indicators and built-in alerts make buying options more convenient: an alert from the main indicator - a confirmation signal from the second - opening a deal with a short expiration of 1 minute. At first glance, this is very convenient for a trader, both from a technical and psychological point of view. But how effective is this system and what profit or loss can it bring when trading on a real account?

Signals based on the Volume Trading strategy for binary options

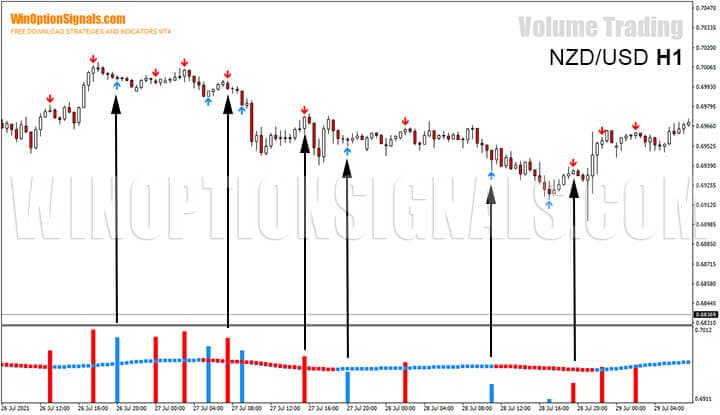

Let's look at an example of how this system works on the NZD/USD currency pair, timeframe H1:

In the chart above you can see a calm bearish trend, which changed to a bullish trend towards the right edge of the chart. According to the rules of the strategy, six entry points are clearly visible: three for buying a Put option and three for buying a Call option. At first glance, you get the feeling of a large number of “false” signals, where the ratio of profitable to unprofitable transactions will be approximately 50%, which is very low even for the Forex market .

As we have already seen above, the Volume Trading strategy, like all other publicly available strategies, does not work without additional market analysis. And if this strategy is a “reversal” one, then in this case, support and resistance levels , as well as Japanese candlesticks, will help us a lot.

The chart below (currency pair GBP/USD, timeframe M30) is a vivid example of the synthesis of several tools to determine the entry point: the Data Volume indicator signals a price reversal, the Linex indicator confirms the signal, the candle closes below the resistance level. This signal not only guaranteed an excellent deal, but also warned of a short-term change in price movement.

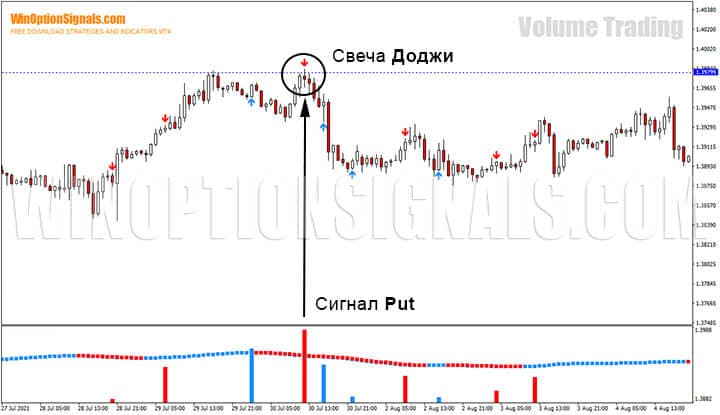

Another example (currency pair GBP/USD, time frame H1) of the intersection of signals from the Volume Trading strategy and candlestick analysis: a signal to buy Put was formed, and the candle was closed with a Doji reversal figure below the resistance level. The chart below shows an incredibly accurate entry into the market with minimal risk.

Conclusion

While familiarizing yourself with this strategy, you can conclude that it is more suitable for analyzing the market rather than searching for entry points. Too many signals from the Data Volume indicator and a frankly poor filter from the additional Linex indicator make this strategy unprofitable in the short term, and even more so in the long term. However, the results of this strategy can be improved by combining it with the basics of graphical analysis , candlestick analysis and levels, as was shown in the examples above.

However, before trading on a real account, you should try this strategy on a free demo account . Pay attention to money management and risk management to protect your deposit from being lost .

If you still want to try trading binary options using this strategy, then you should find a binary options broker that allows you to use expiration for at least a day. Such brokers include brokers Deriv and Binarium .

Download the Volume Trading strategy for free

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also:

How to adapt a Forex strategy to Binary Options?

Psychology in trading - what does a beginner need to know?

To leave a comment, you must register or log in to your account.