Not all companies providing binary options trading services are willing to pay earnings. In this regard, questions often appear on the Internet about the broker not withdrawing money, where to go for help, and so on. You can avoid such situations if you follow a number of rules.

First of all, it is worth noting the features of withdrawing money from most binary options brokers in order to dispel fears in cases where there is no basis for them. Most often, it takes several days to review the withdrawal application. But do not sound the alarm if the money does not arrive at the specified time, since according to the regulations that all brokers have, withdrawals can be made within 1-5 business days. There are also situations when funds are sent to a bank account and therefore their arrival may be delayed for a short time.

In this article we will look at situations in which difficulties arise with withdrawing funds when working with binary options, as well as ways to solve them. We are not talking about trivial delays associated with erroneous data, but about deeper problems with the withdrawal of capital.

How to avoid being scammed by a scam broker

Compliance with the following rules helps to avoid cases when the broker does not withdraw money:

- Before starting cooperation with a specific company, it is recommended to open a search engine and find reviews from real users. All traders immediately report situations when the broker does not withdraw money, what to do in such cases and other similar information.

- If the reviews do not indicate that the broker does not withdraw money from the account, it is recommended to first top up the balance with a minimum amount . This will help check the honesty of the company and the terms of cooperation.

- You can top up your balance with an amount that does not exceed your total earnings over the last six months. This is done in order to reduce the risk of losing money ( risk management ). In the event of bankruptcy or other reasons explaining why the broker does not withdraw money, traders with this approach will be able to reduce the amount of losses caused by such situations.

- Every month you need to withdraw your profit, not forgetting to leave the amount necessary for trading in your account. In particular, if during the specified period the trader “expanded” the deposit , for example, from 1 to 3 thousand dollars, then 2 thousand dollars should be withdrawn. It is recommended to set aside part of this amount to form a reserve fund.

- You should top up your balance using VISA and MasterCard bank cards. Both services support chargeback and, if necessary, return funds if the broker does not withdraw money from the account. If these methods do not suit you, then there are TOP 10 ways to top up your account with a broker .

You need to understand that if a broker does not withdraw money from the account, this does not always indicate that the company is a fraudulent broker .

What to do if the broker does not withdraw money: traders’ mistakes

Not all cases described in reviews in which users are trying to find out how to withdraw money from a “black” broker are due to fraudulent actions of the company. Traders often make mistakes themselves, which lead to their account being blocked. So, the answer to the question why the broker does not withdraw money can be the following situation:

Not all cases described in reviews in which users are trying to find out how to withdraw money from a “black” broker are due to fraudulent actions of the company. Traders often make mistakes themselves, which lead to their account being blocked. So, the answer to the question why the broker does not withdraw money can be the following situation:

- The trader fills out the form and accepts the terms of the user agreement without checking the information entered.

- The trader replenishes the deposit, makes several successful trading operations and places a request to withdraw funds. But the broker asks you to undergo verification by sending a scanned passport and other documents.

- The trader refuses to do this, as a result of which the money in the account is blocked.

It should be understood that in such cases, the answer to the question when the broker does not withdraw money, where to contact, will be a request to the technical support service. Users must first find out the reason for blocking funds in the account from company specialists. Reliable binary options brokers are ready to explain the problem in detail and indicate solutions.

Also, users often write in reviews about cases when the broker does not withdraw money, and ask where to turn in this situation, but they themselves have previously completed the so-called double registration. That is:

- The trader opened an account under a third-party pseudonym. This is done in order to get acquainted with the features of the services that the broker offers without exposing personal data.

- If the conditions meet the user’s requirements, he registers under his own name and goes through the verification procedure.

However, in such circumstances, the account is often blocked. The reason why the broker does not withdraw money under these conditions is that the trader completed both registration procedures using the same computer and IP address. In this case, blocking is introduced to protect customer deposits, as specified in the user agreement. The answer to the question when a broker does not withdraw money, where to turn, should be sought from the support service. Traders also need to submit an appropriate application in case of blocking. Technical support specialists will explain the reason for the “freezing” of the account.

We can consider six more frequently occurring reasons why a broker allegedly “deceived” and did not return the money:

- Verification of an account with a broker . Before withdrawing funds, you must verify your brokerage account. This is indeed a requirement as brokers are required to do so by regulators. Moreover, if fraudsters gain access to the verified account, they will not be able to send money to third-party details. So this clause protects, among other things, your interests. If a problem with withdrawal occurs precisely because of incomplete verification, contact your manager and find out what data you need to confirm and how to do it. Of course, it is best to go through this process in advance, before you start trading.

- Trading activity after submitting an order . The second common reason for a delay in withdrawal of funds is the continuation of trading after submitting an application. Such actions may delay the execution of the withdrawal, and therefore it is better to pause, make sure that the required amount is available in the account and wait for the withdrawal.

- Lack of funds . After submitting a withdrawal request, be sure to ensure that you have enough available funds in your account (i.e., all money outside of open positions) for the broker to process the withdrawal. A situation may arise in which you, having ordered a withdrawal, continued trading and lost part of the account, after which the amount of available funds turned out to be lower than the value specified in the application. Of course, in this case, withdrawal is not possible and you will have to submit a new application taking into account all the changes.

- Replenishment bonuses . Many brokers offer their clients various bonuses. Each of these bonuses must be worked out before withdrawing funds. Honest brokers can make withdrawals without taking into account the bonus, in fact canceling it. In this case, we mean really large brokers that have no problems with withdrawals (for example, Pocket Option , Quotex , Alpari , Deriv ). Some small firms that are not trusted may deliberately add bonuses to the client so that he cannot withdraw the profits.

- Errors in details . When filling out registration forms, indicate the actual required data in order to subsequently avoid difficulties when working with the broker. By indicating a fictitious name, it will be difficult for you to prove the fact that the account belongs to you. In case of such discrepancies, you will need to send many documents for reconciliation and confirmation, and therefore it is better to take care of the authenticity of the information provided to the broker even at the stage of opening an account. Always carefully fill out any information relating to your identification. It is better to double-check your full name and address for any accidental errors rather than fiddling with supporting documents later.

- Various payment methods . A situation may arise in which the broker has already carried out the withdrawal of funds, but you simply did not know about it. The money may not have gone to the account you planned. There is no need to panic and start a scandal with the broker. First, check where your funds were sent. It is likely that they have already been withdrawn, but they went to a bank account and not to a card.

Binary options brokers who have been on the market for many years do not deceive clients. The reason is that most users often lose money due to errors. Therefore, companies even without deception make good profits. In this regard, when reading user reviews and coming across the question of how to withdraw money from a fraudulent broker, such information needs to be further checked. It is possible that such problems arise due to mistakes by traders, and not the fault of the company.

What to do if the broker does not withdraw money: broker mistakes

Now let's move on to consider situations where it is not the trader who is to blame for the withdrawal delay, but the brokerage firm itself. First of all, it is worth noting two non-dangerous, but common options:

Now let's move on to consider situations where it is not the trader who is to blame for the withdrawal delay, but the brokerage firm itself. First of all, it is worth noting two non-dangerous, but common options:

- Technical error or failure . In this case, you should contact your manager and clarify the specifics of the problem and the time frame for its elimination. In addition, you can send a request to technical support.

- Personnel changes . It is possible that a specialist who directly serves you was fired or sent on vacation. Usually in such cases he should transfer your case to another person, however, if this does not happen, it may be difficult to reach a conclusion. To resolve this issue, contact your broker, specifying your manager's details in the request.

We advise you to also maintain correspondence with all professionals who serve you, be they managers, technical support or anyone else working on behalf of your broker. If controversial situations arise, you can always cite letters received from these people as an argument, and therefore they can really come in handy.

Finally, let's move on to the most common and unpleasant type of problems associated with broker dishonesty.

A situation often arises when a trader deposits funds into an account with a company that deliberately refuses to withdraw money. Unfortunately, such brokers do exist and in considerable numbers. These include young sites that pretend to be large binary options brokers. They usually attract clients by sending letters with tempting but unrealistic offers like “instant earnings without any risk” or “these signals will help you earn 100,000 rubles per hour.” It is better to immediately filter such letters or send them to the trash, since getting involved in such adventures is not safe for your wallet.

There are also options in which some brokers slip into the category of scammers. Among these are King Trade , Stars Binary , Opteck, DailyTrades , OptionRally, TitanTrade, Bin Trade Club and others.

If you receive a call with any offers, always ask who is calling, where they are from and for what reason. Don't believe in stupid promises of easy mountains of gold. No matter what they tell you, your income will always depend only on you and no one will magically increase it.

Approach the assessment of brokerage companies soberly. Before opening an account, spend some time researching the companies on the market. Read reviews and reviews from trusted sources. Choose to work only with the largest and most trusted brokers.

But if you do contact an unreliable company and are trying to figure out how to withdraw your hard-earned money, then you can take into account two methods:

But if you do contact an unreliable company and are trying to figure out how to withdraw your hard-earned money, then you can take into account two methods:

- "Mail attack" . Make a written request to the broker. Include in it detailed information about the completion of account verification, the date of sending the withdrawal request and comments on the situation from your managers. Don’t be lazy to add screenshots to your letter to confirm your words. Calmly, without any emotion, demonstrate your intention to go to the end. If this broker has a license, then indicate that you intend to contact the regulator in case of violation of your rights. Then send copies of this letter to any of the brokerage company addresses you have. If you do not receive a response, please resend your emails.

- "Playing with the Human Factor" . Use your manager's intentions. Open a dialogue with him in which you are interested in what benefits you will get if you supposedly earn a few thousand more dollars (individual bonuses, programs, analytics, etc.). Negotiate with your manager for several days to try to get better terms. Even if he starts demanding a higher deposit amount, you can first feign some thought and then agree. It is important for you that the manager decides that you are “hooked” and that his offer is really important to you. The amount of the deposit that you allegedly plan to make must exceed the withdrawal amount by more than 10 times. When you and the manager have already agreed, demonstrate your willingness to contribute these funds. Then say that, after thinking about the offer, you decided to first check whether this company is a scam, and therefore you want them to withdraw the amount you require before depositing. Of course, there are no guarantees that such a naive method will work, but in reality, the manager may not be one of the most far-sighted and intelligent people. In the end, you can try.

How brokers deceive clients: popular schemes

Despite the above, often messages on how to withdraw money from a fraudulent broker actually point to companies that deceive clients. Attackers mainly use the schemes shown in the table for this:

| Delays in withdrawals | The support service informs customers about a technical failure. Because of this, the money is “frozen” for several weeks. |

| Illegal accrual of bonuses | The broker unexpectedly issues a deposit bonus. But after this the company introduces restrictions on turnover. That is, the trader is forced to make transactions for a certain amount. Until this is done, the account for withdrawal is blocked. |

| Unexpected write-off of bonuses | The company offers an attractive bonus when making a deposit. But after transferring money to the account, the conditions suddenly change. |

| Withdrawing money without profit | Companies change the terms of cooperation unilaterally, refusing to pay profits. |

The first sign that the broker is not withdrawing money is ignoring requests from users or delaying response. The company may also directly state that it does not intend to pay out profits. The solution to such problems, when the broker does not withdraw money, what to do and how to get the amounts due, should be sought from the regulator.

Deceived by a broker: how to get your money back

If you are unlucky and you were deceived by a broker, then you can get your money back in several ways:

- try to negotiate with a broker;

- contact the regulator;

- use chargeback.

The first option will not work in 99% of cases, since it is unlikely that you will be able to prove anything to the company that deceived you. The other two options are more realistic. The regulator, for example, has leverage over the brokers it regulates. Chargeback, although not always, also allows you to get your money back. Next, we will consider each of these two options in more detail.

Withdrawal of money using the regulator

Many brokers, in order to confirm the reliability of the services provided, obtain a license from specialized regulators. The latter resolve disputes arising between traders and companies. Therefore, if the broker does not withdraw money from the account and does not solve the problem, it is recommended to write a letter to the regulator with a detailed explanation of the situation.

If, during an inspection, the controlling organization reveals that the company’s actions are unlawful or there are signs of fraud, the issued license will be automatically revoked. At the same time, the broker receives a large fine. In such circumstances, the regulator itself pays the trader the amount due.

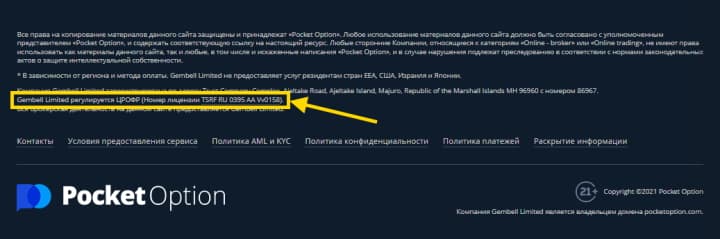

Information about which organization controls the activities of the companies is indicated on the brokers’ website:

To resolve the issue of why the broker does not withdraw money, it is recommended to go to the official resource of the regulator. Most often, binary options brokers are regulated by CySEC or CROFR . Therefore, you can always file a complaint with these organizations.

But before writing to the regulator, you need to check whether the issued license is valid. This can be done by searching for the company on the official website of the regulator. If it is not there, then the broker's license is most likely fake. Most often, brokers leave a link to the certificate on the website of the Center for Financial Markets or another regulator.

PS: evaluate the broker before you start trading, this will save not only your time, but also money.

How to get money back from unregulated brokers

Often messages on how to withdraw money from a fraudulent broker appear if the user has previously started working with an unregulated (unlicensed) company. Such organizations are divided into two types: fly-by-night or newbies. The first ones are initially created to illegally take money from people. But newcomers without a license often work to become market leaders. The support service of such companies does not ignore incoming requests and quickly processes requests related to problems with withdrawing money.

Shell companies are usually registered in offshore zones. Therefore, in such circumstances, it is impossible to resolve the issue of how to withdraw money from a fraudulent broker.

Refund using chargeback

If you cannot resolve the issue of why the broker does not withdraw money, but the deposit was previously replenished using a bank card, you can use the chargeback procedure to return the funds. The essence of this method is that the payment system (Visa or MasterCard) itself cancels the transaction. To return funds when the broker does not withdraw from the account using chargeback, you need to:

- Submit an application to the payment system.

- Describe the problem that has arisen and provide documentary evidence of your innocence.

- Wait for the problem to be resolved.

Using chargeback it is not always possible to return funds if the broker does not withdraw money. Payment systems have introduced the following restrictions on this procedure:

Using chargeback it is not always possible to return funds if the broker does not withdraw money. Payment systems have introduced the following restrictions on this procedure:

- the refund is made within 540 days after the violation is recorded;

- You can only return the amount transferred to the deposit (profits are not withdrawn);

- You cannot receive money if the broker managed to withdraw all funds from the account by the time the application was considered.

Payment systems may refuse refunds for other reasons.

Do you need to sue if you were deceived by a broker?

Quite often, when users in reviews ask to find answers to questions, how to deal with the situation if the broker does not withdraw money, what to do in such circumstances, traders recommend going to court. However, this does not always bring the desired result. The reason is this:

- When registering on the site, traders must accept the terms of the user agreement. This document, which is a public offer, contains information that brokers are not responsible for clients' losses.

- To return funds from a company registered outside of Russia, you need to apply to an international court. This is recommended if the broker cheated you out of several thousand dollars. Otherwise, legal costs will exceed the amount that the trader wants to return.

- To return funds, it is necessary to find those people who are involved in the alleged offense.

It can be difficult to recover money from scammers even when the broker’s guilt is proven and the relevant persons are held accountable. This is explained by the fact that such companies deceive thousands of people. And scammers do not always have enough funds to compensate for the losses of all clients.

Results

Before making a deposit on the website of a brokerage company, you need to find out how reliable it is. To do this, you should read reviews from real people. If the company regularly pays out profits, then cooperation should begin by replenishing the balance with a minimum amount.

If the broker refuses to pay profits, it is recommended to find out the reasons for blocking. Often money is “frozen” due to the fact that the trader did not comply with the terms of the user agreement (did not provide a scan of his passport, etc.).

Before starting cooperation, it is also recommended to find out which organization controls the company’s activities and check the validity of the license. To avoid problems, you should not open an account on the website of a broker registered in an offshore zone. This could be a shell company. In extreme cases, when it is impossible to resolve the issue of why the broker does not withdraw money, you can file a lawsuit or use the chargeback procedure.

| RATING OF THE BEST BROKERS |

To leave a comment, you must register or log in to your account.