Trading systems based on following the trend are gaining more and more popularity among traders. The Triple EMA binary options strategy is based on this idea, for which it has all the necessary tools in its arsenal: both for determining the direction of the trend and the end of the correction .

The developers of this free system took care of filtering false transactions, for which they added a special tool, which we will tell you about in detail in this review. If you like to trade binary options comfortably and hold positions in the direction of the main trend, without worrying that they will turn against you at any moment, do not miss the chance to learn an exclusive method of applying the Triple EMA strategy in practice from our review.

Content:

- Characteristics

- Installation

- Overview and settings

- Triple EMA Trading Rules

- Specifics of application

- Conclusion

- Download Triple EMA

Characteristics of the Triple EMA binary options strategy

- Terminal: MetaTrader 4

- Timeframe: M5

- Expiration: 3 candles

- Option Types: Call/Put

- Indicators: built into the platform

- Trading instruments: currency pairs , commodities, cryptocurrencies , stocks

- Trading hours: 8:00 - 21:00 Moscow time

- Recommended brokers: Quotex , Pocket Option , Alpari , Binarium

Installing the Triple EMA Binary Options Strategy Template

Triple EMA strategy templates are installed as standard in the Metatrader 4 platform. To do this, you need to add them to the root folder of the terminal by selecting “File” in MT4 and then “Open data directory”. In the opened directory, you need to go to the “templates” folder and move the template file there. You can read the installation instructions in more detail in our video:

Review and settings of binary options strategy Triple EMA

As is known, currency pairs are characterized by the presence of clearly expressed price trends. And one of the effective ways to trade on it is an attempt to capture short-term market corrections within a broader trend. This is the approach implemented in the Triple EMA binary options trading strategy. Despite its apparent simplicity, it is based on the basic principle of price behavior: markets do not move in a straight line, and a trend is always replaced by a correction.

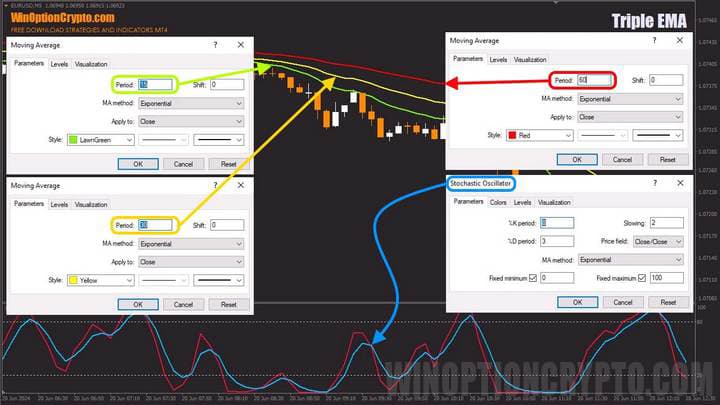

To determine the trend, three exponential moving averages with a calculation period of 15, 30 and 60 candles are used. Their position relative to each other indicates to the trader the presence or absence of a trend. Stochastic Oscillator is used as a filter for trading system signals. The calculation period of this indicator should be selected based on the results of testing on a specific asset. For example, for the EUR/USD currency pair on the M5 timeframe , the following settings have proven themselves well: %K period = 2, %D period = 3, Slowing = 3.

All four indicators are included in the standard set of technical analysis tools of the Metatrader 4 trading platform and have simple settings. At the same time, keep in mind that the specified parameters are selected for the EUR/USD currency pair, and may not be suitable for your asset. Therefore, we recommend testing and selecting these values for each instrument individually.

Triple EMA Trading Rules

In the Triple EMA binary options strategy, moving averages act as dynamic support and resistance levels, from which the price periodically bounces off. The trader's task is to recognize in time the moment when the correction against the main trend has ended, and the price begins to move in the direction of the current trend. By opening transactions in this way, the trader gains an advantage in the form of a better profitability/risk ratio if he trades on Forex, and an increased chance of closing the option in the money if he trades on the binary options market.

If you are not familiar with the concept of trading from support and resistance levels, we recommend that you study the article“How to Use Support and Resistance Levels in Binary Options ”, from which you will not only learn how to correctly apply them to the chart, but also get acquainted with the basics of building profitable trading strategies based on them. For those who are just taking their first steps in trading and are not familiar with the concept of a trend, we recommend that you study these materials on our website:

- How does a trend work in the markets?

- Identifying and using bullish and bearish trends.

- Market phase changes .

- How to identify a flat market?

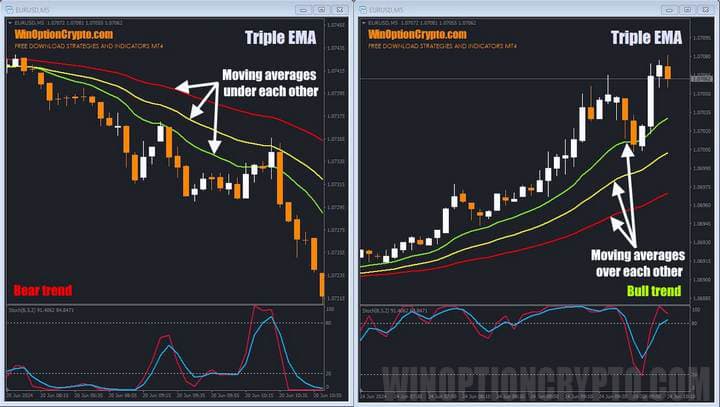

How is the trend determined by the Triple EMA strategy? By the position of the moving averages relative to each other: if EMA(15), EMA(30) and EMA(60) are located one above the other, the trend is ascending; if in the opposite order, it is descending.

A sign of trend correction in this strategy is considered to be the closing of a candle behind one of the two moving averages: EMA(15) or EMA(30). If a candle closes behind EMA(60), the current trend is called into question. It may reverse, and therefore, even if the price at some point closes behind EMA(15) again, you should not trust such a movement and you should wait for another, more unambiguous trading situation.

Once this condition is met, the trader should wait for a reversal in the direction of the main trend, which is determined by the closing of the candle behind EMA(15), to open a position.

As a filter for unprofitable trades, the Triple EMA strategy uses a standard indicator – the Stochastic Oscillator. Thanks to it, traders will be able to make sure that the price has resumed its movement along the trend and there is potential for its further development.

We will open Call options only if the fast Stochastic %K line is above the slow %D line and it has not reached the overbought zone - its value is less than 80. At the same time, to open a Put option, you need to wait for the following conditions to be met: the %K line is below the slow %D line, and it has not reached the oversold zone - its value is greater than 20.

Buying a Call Option

- We are convinced of the presence of an upward trend: EMA(15) > EMA(30) > EMA(60)

- Correction: the previous candle closed below EMA(15) or EMA(30), but above EMA(60)

- Bounce with trend: last candle closed above EMA(15)

- Filter: Stochastic %K line is above %D and has not reached 80

- At the opening of the next candle we buy Call

Buying a Put Option

- We are convinced of the presence of a downward trend: EMA(15) < EMA(30) < EMA(60)

- Correction: the previous candle closed above EMA(15) or EMA(30), but below EMA(60)

- Bounce with trend: last candle closed below EMA(15)

- Stochastic %K line is below %D and has not reached the 20 level

- At the opening of the next candle we buy Put

It is recommended to select the expiration time of 3 candles. Select the holding period of positions depending on the selected asset and the results of testing on historical data .

Specifics of using the Triple EMA binary options strategy

The best results in trading with the Triple EMA binary options strategy can be achieved by using it on trending assets: indices, stocks and major currency pairs. Also pay attention to the trading time and the publication of important economic data, which you can find out from the economic calendar on our website.

Considering that Triple EMA assumes trading along the trend, try to avoid flat , as in these areas the trading system can give false signals.

Pros of Triple EMA Strategy

One of the main advantages of trading using this strategy is the ability to make significant profits during periods of unidirectional price movement. As is known, one of the properties of currency pairs and cryptocurrencies is the tendency to move in one direction for a long time. This is the feature that trend trading systems use, which include Triple EMA.

Disadvantages of the Triple EMA Strategy

Unfortunately, the focus on the trend is not only an advantage, but also a disadvantage of the Triple EMA strategy. As soon as the market has settled into a sideways trend and prices have begun to fluctuate within a certain range, the strategy will generate false signals. To maximally protect the trader from such a development, the Stochastic oscillator has been added to the strategy, which acts as a filter for false trades. We suggest experimenting with its parameters and sharing your experience in the comments, as well as the currency pairs or cryptocurrencies for which you have managed to find the best settings.

Another obvious drawback of the system is the lack of alerts or an arrow indicator that would signal the opening of a deal based on the necessary conditions. The lack of alerts can negatively affect the efficiency of trading, since the trader will need to constantly monitor the market so as not to miss a deal.

Conclusion

The Triple EMA binary options strategy consists of standard indicators of the Metatrader4 trading platform. However, its apparent simplicity hides great potential. It is based on the basic principle of trend trading: opening a position in the direction of the trend after a correction.

To increase the reliability of the system, the Stochastic oscillator has been added, the position of the signal lines of which is the last condition in making a decision to open a deal. Before you start trading binary options using this free strategy, be sure to practice on a demo account with a reliable broker , applying the rules of risk and capital management. And only after you get the hang of it, proceed to trading on a real account. We wish everyone a favorable trend!

Download the template and TradingView script for the Triple EMA binary options strategy

See also:

How to make money on binary options

Pros and Cons of Binary Options Trading

To leave a comment, you must register or log in to your account.