Today, everyone has probably heard of the profession of a trader. Popular TV series and films have created the image of the "Wolf of Wall Street" who makes money by pressing buttons in front of a monitor. But these ideas about how a trader and financial markets work are very far from reality. The image of a "rich kid" living in luxury does not touch upon the key element of this activity - uncertainty.

In this article, we will look at the main aspects of the trader's profession: income opportunities and associated risks. We will also compare the salaries of institutional and independent traders, find out how much binary options traders earn, and discuss the specifics of cryptocurrency trading.

Content:

- Key Findings

- What Is Trading and Who Is a Trader

- Types of Traders and Trading Strategies

- Requirements for the Profession of a Trader

- How Much Does a Binary Options Trader Earn

- Long-Term Earnings Prospects

- Specifics of Cryptocurrency Trading

- Path to the Profession

- Risk Management and Typical Mistakes

- Conclusion

- Frequently Asked Questions (FAQ)

Key Findings

- It is necessary to study, because trading is not an easy profession.

- A trader's income depends on the strategy, the size of the capital and the acceptable risks.

- Anyone can start making money on the market.

- It is very important to learn how to manage risks.

- Be disciplined.

- The result of your trading will depend on your ability to follow your own rules.

What Is Trading and Who Is a Trader

When it comes to trading, most people have an image of a "white collar" Wall Street worker who watches the charts of indices, stocks, currency pairs or cryptocurrencies from morning till night, trying not to miss the moment for a successful purchase or sale of assets. And it is worth noting that this is not far from the truth.

However, trading is more than just speculation, where one trading instrument is exchanged for another, as in the case of currency pairs and cryptocurrencies, or bought cheaply in order to sell it at a higher price – a familiar strategy for any investor familiar with value investing.

Trading is a complex process that requires a deep understanding of financial markets. It resembles an oriental bazaar, where they trade not only various goods, but also money itself, securities, bonds and derivatives whose value depends on other trading assets.

And at the center of this whole process is a trader, who to some extent can be called a prophet or a predictor of the future. However, his difference from a fortune teller on Tarot cards is that he makes his decisions not on the basis of the symbolism of the cards, psychology or the emotional state of the client, but on the basis of an analysis of a huge array of market data, statistics of macroeconomic indicators, news of the economic calendar and his own intuition.

This is how a trader uses trading tools and market liquidity to predict future price changes for various assets. However, as you might guess, this is not always successful for various reasons: fear, greed, and unexpected events get in the way. To reduce the risks associated with unpredictable price fluctuations, traders often resort to hedging – a kind of insurance against unfavorable changes in the market.

Imagine that you are a large grain producer and want to insure yourself against a possible decline in wheat prices. In this case, you can enter into a contract to sell future crops at a fixed price, and if wheat prices do fall, you can sell your crop on more favorable terms specified in the contract.

Types of Traders and Trading Strategies

Now that we have a general idea of what traders do, it is time to discuss whether there are differences between them or whether they are all the same and no different from each other. There are differences – and quite significant ones.

All traders can be classified by the time they hold open trades, that is, by the period they hold positions.

Note: The period of time between opening a trade (for example, buying shares on the stock market) and closing it (selling shares) is called the holding period.

The shortest-term traders are called scalpers. Scalping involves holding positions for a few seconds to a few minutes. This style of trading is especially popular among binary options traders. They can make a huge number of trades during the day – sometimes hundreds. For ease of use, scalpers usually use specialized software called drives.

In such a drive, the extended functionality is specially designed for high-speed trading. In scalping, the main thing is the speed of sending orders to the exchange. Whoever was the first to grab a counter order at a favorable price, earned. This is how algorithmic traders work, for example.

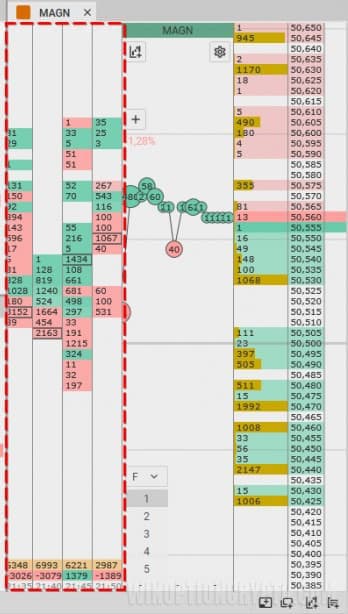

Let's give an example: if you buy 1,000 shares of Magnitogorsk Iron and Steel Works (ticker MAGN) at 50.53 rubles and sell at 50.60 rubles, you will earn 70 rubles before paying commissions. If you make 100 such transactions per day, your profit will be 7,000 rubles excluding commissions.

If you are not a fan of super-aggressive trading and prefer more calm trading, pay attention to day trading. In this strategy, transactions last longer than scalpers. Usually, day traders open a position at the beginning of the trading session and fix the profit at the end of the day. To successfully trade in this style, you need to master technical analysis and learn to practice various trading ideas.

However, keep in mind that scalping and day trading are only suitable for professional traders who trade the market as their main occupation. Beginner traders are better off with swing trading, where positions are held open for extended periods of time – from several days to weeks – in order to catch a significant price move.

Positional trading is the most conservative type of trading, which involves holding positions for many months and even years. In such trading, the trader relies on fundamental analysis, corporate reports of companies, macroeconomic indicators and industry trends. Labor costs are minimal, and earnings can be very large. This style of trading is often used by cryptocurrency traders.

Requirements for the Profession of a Trader

Making money in a fast-changing market is not an easy task. In order to earn a more or less stable income on the stock exchange, a trader must have a unique combination of skills and qualities.

An analytical mind and self-discipline come to the fore. After all, no matter how much you study Japanese candlestick combinations, Elliott waves and intricate trading rules based on Gann's astronomical cycles, the outcome of your trading will ultimately depend only on your psychological stability.

Many people know how to plot charts and analyze technical indicators, but only a few are able to keep their cool in conditions of market volatility and control their emotions, demonstrating high stress resistance.

In the end, mastering the trading terminal, technical and fundamental analysis is not difficult. Anyone who studied at a technical university will be able to understand the different types of orders, risk management and other principles of the financial market. However, the ability to make balanced decisions under the pressure of the risk of capital loss is the cornerstone that affects the trader's income.

Necessary Qualities of a Trader

To become a good trader, it is not enough to simply know technical analysis and understand trading various assets – you need to have certain character traits:

- Self-control helps to cope with emotions, overcome fear and greed, which haunt many traders, often lead to losses and reduce the trader's income.

- Psychological stability allows you to calmly wait for trading signals from indicators, rather than open trades out of boredom or fear of missing out on price movement.

- Discipline helps you stick to your trading plan even when market conditions are unfavorable for your strategy.

On the other hand, there are personal qualities that hinder success:

- Impulsiveness causes one to make hasty decisions without properly analyzing the situation.

- Fear of losses can be paralyzing, preventing you from making money: a trader either takes profits prematurely or, conversely, holds on to losing trades instead of accepting the loss and continuing to follow a trading strategy.

- Passion . How could we do without it? The desire for quick money leads to unnecessary risk and, as a rule, to a complete loss of capital.

Comparison of Trader Salaries

All traders can be divided into two types: professional institutional traders and private traders working for themselves. Each of them has its own income structure and, accordingly, level of earnings. Let's figure out how much traders earn.

First of all, it is necessary to understand that earnings in trading are extremely variable. They depend on many factors: trading strategy, experience, discipline and, last but not least, on the structure of remuneration in a particular organization.

An institutional trader works for a large financial institution, such as an investment bank or a hedge fund. Their remuneration consists of a fixed base salary and bonuses, the size of which directly depends on the profitability of transactions. The benefits of such a job are obvious: a stable income, access to managing huge capital, as well as training and technical support from the best specialists in the industry.

But, as everywhere, there are some drawbacks: strict restrictions on trading operations (often such restrictions are spelled out in legislation – for example, mutual funds cannot invest more than the percentage of their assets established by the securities law in one company or sector of the economy) and extremely high competition.

An independent trader works only for himself and is not accountable to anyone. On the one hand, it's great - you can do business at your own discretion: if you want - you can trade, if you don't want - you can go fishing with friends. But behind this freedom and flexible schedule is full responsibility for the final result. An independent trader's income depends entirely on the growth of the deposit, so his activity is possible only with consistently positive trading results. And for this, you need to constantly learn and improve.

|

Criterion |

Institutional trader |

Independent Trader |

|

Income stability |

Tall |

Low |

|

Income size |

Limited |

Potentially unlimited |

|

Freedom of action |

Limited |

Complete |

|

Risk |

Short |

High |

Work in the Company (Institutional Trader)

As we have already found out, an institutional trader is a professional who manages large capital. He can work in an investment bank, a hedge fund or an insurance company.

It is not easy to get such a profession. First, you need to get a basic economic education. Without deep knowledge of financial markets and good analytical skills, no one will trust you with managing such a large capital. Then you should pass certification, pass a qualification exam and receive a certificate from the National Commission of the Stock Market, giving the right to conduct professional activities in the securities market.

Only certified specialists who are well versed in the current legislation in the financial markets are allowed to manage the capital of mutual investment institutions, which include all kinds of funds.

Institutional traders working for financial companies can expect to earn a base salary (usually very high) and bonuses for the fund's profitability over the reporting period, compliance with risks and other metrics set by the investment committee. Both parts of the remuneration are paid out of the so-called "management fee" - a fee for managing capital that investors pay.

The returns of professional fund managers are determined not so much by the size of the profit as a percentage of capital, but by the ratio of the value of the assets under their management to the market benchmark – the index they focus on. If the fund manages to beat the market (show a return higher than the target index, for example, the S&P 500), this period is considered successful, and the managers receive a bonus on top of their basic salary.

With such a payment system, a trader working for the company is focused on long-term results. His career growth is not limited in any way. At the same time, a trader can specialize in one area, for example, derivatives trading, or participate in complex projects using financial engineering to create structured investment products.

Independent Trader

Self-trading appeals to many beginning traders. But is it right for you? Let's find out how much traders earn working for themselves.

The work of an independent trader is in many ways similar to that of an entrepreneur, with the only difference being that he makes deals not with suppliers, but with counterparties in the financial market. At the same time, he is not bound by strict obligations and a signed contract with a company, like institutional traders, and has complete freedom of action.

However, freedom does not come easy - it must be paid for with responsibility, deep knowledge and psychological stability.

As a rule, private investors work in the Forex and binary options markets. The choice of these segments is explained by the fact that they provide flexibility in decision-making and the possibility of high earnings, and do not require a large starting capital.

For example, beginners can earn 10% and even 30% per month, since they usually start trading with small deposits and strive to increase them quickly. In percentage terms, their profit will be significantly higher than that of an experienced trader who adheres to strict risk and capital management rules.

An experienced independent trader manages a large sum on a trading account and cannot afford large drawdowns. Therefore, his risk in one transaction (as a percentage of the deposit) will be significantly lower than that of beginners. Yes, in absolute figures he will earn more, but in percentage terms his profit, as a rule, is 3-5% per month.

Despite all the advantages, there are certain risks to independent trading:

- The trader is fully responsible for his trading operations.

- Financial markets are constantly changing, and a trader must continuously improve his knowledge and skills.

- Emotional stress in conditions of uncertainty can negatively affect trading results.

Factors Affecting a Trader's Income

Let's consider the factors that influence a trader's income:

- The more experience a trader has, the better he understands the market. Experienced speculators trade more consistently than beginners.

- The results of trading work directly depend on the trading strategy. Traders who regularly trade with profit earn more than their less fortunate colleagues.

- The role of a trader in a company depends on the direction of its activity. In large hedge funds, he can simply follow ready-made trading systems, and in a small financial company, he can develop trading strategies independently.

- The location of a trader directly affects his income. Those who work in large business centers have quicker access to sensitive information that helps them earn money.

- Traders' earnings are influenced by news, macroeconomic statistics and other economic factors.

- During periods of strong price fluctuations, a trader has many opportunities to make a profit. However, such market conditions lead to increased risks.

Role and Experience of a Trader

As you might guess, a trader's earnings depend on his position, length of service, and financial results. Traditionally, a trader's career path begins with the position of an analyst. This specialist collects and analyzes information about various assets, identifies patterns in the behavior of financial instruments, conducts technical analysis, and participates in the development of trading strategies.

The salary of an analyst is usually low, but this position provides an opportunity to gain experience, learn more about the profession of a trader, and is an excellent launching pad for a career.

By moving to the position of a junior trader, you will have the opportunity to independently conclude transactions under the guidance of more experienced colleagues. The salary of this specialist is higher than that of an analyst, but depends significantly on the size of the assets managed.

The senior trader is not only responsible for his work, but also manages the team, developing new trading strategies. He is the most valuable specialist. Therefore, his salary is the highest among all traders and can be several times higher than the salary of junior colleagues.

Thus, the career growth looks like this: analyst → junior trader → senior trader. The more experience, knowledge and capital under management you have, the higher the salary.

Influence of Company and Location

We have already found out that a trader's salary is a rather variable value and depends on the geographical location, the size of the company, its specialization and, of course, individual results. Let's find out how much traders earn in different parts of the world.

Traditionally, the business centers of New York, London, Hong Kong and Singapore are at the forefront of the planet – these are the cities where the world’s largest banks and investment funds are concentrated. Talented traders receive high salaries there, and the competition for this position is very intense.

Regional financial centers offer more moderate salaries, but the standard of living there can be significantly lower. For example, traders in Moscow or Frankfurt am Main may receive relatively high salaries by local standards, but their income will still be lower than that of their colleagues in New York.

Corporate culture also affects salaries. Investment banks Citi, HSBC and Goldman Sachs can offer traders higher salaries than smaller regional firms. However, it is much harder to advance in such firms.

In addition, your income level may be affected by the specific country. For example, in the US, it is common to pay traders large bonuses, the size of which depends on their performance, while in the UK, fixed salaries with smaller bonuses are more common.

Calculation of Income of a Private Trader

And yet, what can a private trader expect? The income of an independent trader is a value that is difficult to predict, since it depends on many external factors. Let's figure out what income you can expect in this profession after training.

So, to calculate profit we use a simple formula:

Profit = (Number of trades * Average win) - (Number of trades * Average loss) - (Number of trades * Trading costs per trade).

Let's assume a trader made 100 trades. The average win per trade was $100, the average loss was $50. The broker's commission per trade was $1. In this case, the private trader's income would be:

Profit = (100 * 100) - (100 * 50) - (100 * 1) = $4900

Not bad. However, in practice, everything is much more complicated. And here's why:

- Trading strategy : the final result largely depends on the trading strategy chosen by the trader. It is on this that how much the trader earns depends.

- Starting capital : the size of the deposit directly affects the potential profit. The more your capital, the more transactions you can make and, accordingly, the more you can earn.

- Trading costs : broker fees, swaps, taxes – all of these reduce your bottom line. It is especially important to consider costs in short-term trading, where the number of trades can be very large.

- Leverage : With leverage, you can significantly increase the volume of your trades. But remember that the risks will also increase. For example, a leverage of 1:100 means that a trader can make a trade for an amount 100 times greater than his own capital. In this case, his profit and risk will also increase by 100 times.

- ROI (Return on Investment) : this indicator is used to evaluate the effectiveness of investments. It shows how much profit the trader received from each dollar invested. ROI is expressed as a percentage and is calculated using the formula:

ROI = (net profit / investment amount) * 100%.

This means that if a trader invested $1,000 and made a net profit of $100, then his ROI would be 10%. The higher the ROI, the more efficient the trader is and the greater his profit.

Trading Costs and Their Impact on Profits

Now let's talk about the other side of the coin - trading costs. This is an important point, and you shouldn't neglect it. Any business, including trading, has certain expenses. They can significantly affect the final profit, so it is important to know what they consist of and be able to optimize them.

The most common costs include spreads, swaps, and brokerage fees. A spread is the difference between the purchase price and the sale price of an asset. The smaller it is, the more profitable it is to trade with such a broker. Swaps are a fee charged on the Forex market for carrying a position over to the next day. Their size depends on the difference in interest rates on the currencies that make up the currency pair.

They can be both positive (and then it is profitable for the trader to hold such a position as long as possible) and negative. Another important element that should not be forgotten is the broker's commission. This is a fee for brokerage services for administering clients' accounts and executing their transactions. Commissions can be fixed (per transaction) and percentage (from the volume of the transaction).

How Much Does a Binary Options Trader Earn

Beginner traders often choose binary options trading, and here's why. Their distinctive feature is high profitability in one transaction. Think about it: in just 30 or 60 seconds, you can get a profit of 80-90% of the invested capital, while, for example, on the Forex market, a profitability of 10% over a long period is considered excellent.

Thus, in a year of conservative trading, a trader can increase the deposit by 30-50% depending on the risks taken, strategy and his experience. At the same time, in the binary options market, the calculation of possible profit can be as follows:

With a deposit of $1000, a payout of 82% per option and a risk of 2% per trade, in case of a loss you will lose $20 (1000 × 0.02), and in case of a profit you will earn $16.40 ($20 × 0.82). Let's imagine that you made 100 trades in a month, of which only 60 were profitable, and 40 were unprofitable. Then your profit for a month of binary options trading will be: 60 × $16.4 - 40 × $20 = $184, or 18.4% of the deposit of $1000.

Long-Term Earnings Prospects

In the long term, the increase of a trader's deposit depends on the approach to capital management. Let's consider the long-term prospects for earnings:

- If a trader does not plan long-term trading and wants to quickly increase the deposit, he will use risky capital management methods, which is fraught with its complete loss.

- After two years or more, traders typically move to more conservative strategies, focusing on stable capital growth.

- After five years of trading, almost every trader reduces risks, hoping to increase profits not by increasing the volume of transactions, but by using the compound interest effect.

The key to long-term success is reinvesting profits, whereby the income received is not withdrawn from the account, but used to make new transactions. This approach allows you to increase the volume of trading operations and, accordingly, potential profit.

In practice, there are three main possible scenarios for the development of a trading account:

The aggressive scenario assumes high profitability with significant risks of capital loss. The moderate scenario is characterized by a balanced ratio of profitability and risks. The conservative scenario provides a stable, albeit small, income with minimal risks.

The choice of a specific scenario depends on the individual profile of the trader: his experience, financial goals and risk tolerance.

Specifics of Cryptocurrency Trading

Cryptocurrencies are unique digital assets that are increasingly attracting traders around the world. Many have heard of Bitcoin and Ethereum, but these are far from the only instruments for trading. The main features of cryptocurrencies are the ability to trade around the clock, decentralized nature, and the absence of a single regulatory body. This means that they do not belong to any central organization, and the influence of global financial institutions and regulators on the cryptocurrency market is limited.

This is why cryptocurrencies are highly volatile. Their value can change so rapidly that in one trading day an investor risks both significantly increasing and completely losing their capital. Unlike traditional financial markets – stock or currency – the cryptocurrency market operates around the clock and seven days a week. This allows trading operations to be carried out even during periods when the world's leading exchanges are closed for holidays.

On the one hand, this feature allows traders to increase profits and improve the overall profitability of cryptocurrency trading. On the other hand, high volatility leads to unpredictable price changes, which creates additional risks. In addition, there is a risk of price manipulation. Due to the lack of strict regulation, large players can collude, creating artificial excitement to earn money on provoked price fluctuations.

It is also recommended to avoid investing in little-known cryptocurrencies. Fraudulent projects are often found whose sole purpose is to steal funds from inexperienced investors. It is important to remember the risks of hacking cryptocurrency exchanges and other "hot" wallets. For safe storage, use special devices without Internet access. You can learn more about the rules for storing cryptocurrency from our article "Where and how to store crypto".

Path to the Profession

If you are interested in trading, you probably want to know how to get into this profession. There are several ways. The first and easiest is self-study, when you study the theory, read books, watch training videos and practice on a demo account. This path will require discipline and a lot of free time.

An alternative is to get a higher education in economics and finance. This will give you the knowledge you need for work. In addition to classical education, you can get the necessary knowledge in specialized courses that many brokerage companies conduct. As a rule, in such courses, students improve their financial literacy, study technical analysis, capital management principles, and basic trading strategies.

Risk Management and Typical Mistakes

Usually, new traders focus too much on trading rules and the earnings they could have if they followed a certain system. However, practice shows that it is much more important to learn how to follow risk management. When you start using it, losing trades will not disappear, but the drawdown of your account will significantly decrease.

Capital management is not just a set of rules, but a holistic concept that helps a trader preserve and subsequently increase his capital. It is important to remember that you should not risk more than you can afford to lose. Be sure to determine a comfortable level of risk for yourself in a transaction and in general for the day and always follow it.

The classic advice of all investors in the world — don’t put all your eggs in one basket — is relevant at all times. Distribute your capital across different assets so that profits on some of them smooth out possible losses on others. If you trade on Forex or a cryptocurrency exchange, always use a stop loss. If you prefer binary options, don’t risk more than 2–3% of your deposit in one transaction.

Remember to control your emotions and always trade according to plan. Over time, with proper capital management, you will be able to significantly increase your deposit and profit in one transaction.

But despite all the instructions, novice traders continue to make typical mistakes:

- They trade without a plan.

- They take excessive risks in their transactions.

- React emotionally to trading results.

- They do not follow the rules of their trading strategies, they open trades without a system, hoping for luck.

- They have a poor understanding of basic market concepts and are unable to analyze the market, which leads to losses.

Conclusion

The profession of a trader attracts with the possibility of high earnings. Development prospects and professional growth open doors to everyone who strives for financial independence. However, this path is thorny and goes through the jungle of one's own ambitions, fears and excitement.

A trader at the beginning of his path stands at a fork in the road, like an ancient knight at a signpost with the inscription: "If you go straight ahead, you will find success and happiness; if you go right, you will save your deposit; if you go left, you will become Warren Buffett." This is, of course, a joke. However, in the financial market, you can really get rich, but also lose everything.

Therefore, be sure to undergo training to effectively control risks. After all, trading is not a game, but serious work. Success is achieved only by those who work on themselves for a long time and painstakingly.

Frequently Asked Questions (FAQ)

Is It Possible to Make Money from Trading?

Yes, of course, it is possible, but it is not easy to do. You should treat earning money in this area not as a lottery, but rather as intellectual work that requires knowledge, experience and discipline. You need to master the art of market analysis, learn to manage risks and control your own emotions. Only then can trading become a source of relatively stable income.

Who Is the Richest Trader?

There is no clear answer to this question, as ratings and evaluations of trading results are constantly changing. However, the most famous names associated with wealth in trading are George Soros, Jim Simons and Ray Dalio. But it is important to understand that wealth is not the only criterion for success. Many traders who do not seek publicity achieve outstanding results while remaining in the shadows.

How Much Does a Trader Earn?

A trader's salary is a flexible concept. It depends on the country, experience, qualifications, company and, of course, the success of the trader's transactions. Beginner traders can count on a stable salary, which grows over time in proportion to their skills. Experienced traders often receive a percentage of the profit, which allows them to increase their income several times.

How Many Trades Does a Trader Make per Day?

The number of trades per day for a trader varies depending on the style he follows. If he is a scalper, he can make several hundred trades during the day; if he follows a long-term strategy, he can hold a position for weeks, making only a few trades per month. Everything depends on the chosen tactics, asset and market situation.

How to Become a Trader from Scratch?

This is not an easy task, but it is quite feasible. First of all, you need to undergo training, learn the basics of technical and fundamental analysis and get acquainted with the principles of risk and capital management. Then you need to develop a trading strategy and practice making deals on it on a demo account. After receiving stable results, you can move on to a real account.

To leave a comment, you must register or log in to your account.