Trading in financial markets has been gaining momentum for many years now, and for those who want to start making a profit from trading, the question may often arise - which is better, Forex or binary options ? To understand the difference between binary options and Forex and get an answer to the question posed above, it is necessary to compare both trading methods in detail.

The basic principle is the same in both cases – you should correctly predict the direction of price movement. At the same time, on Forex you can keep transactions open as long as you like, and the period on binary options is limited by expiration . At the same time, binary options are potentially more profitable, although they are also riskier, and therefore it is difficult to say which is better, since Forex also has its advantages.

Regulation of the Forex and binary options markets: what is the difference?

Forex does not have a single trading platform, since this market is decentralized. Although Forex is often confused with a futures exchange because it deals with currency trading assets, currency futures are derivative instruments and not underlying ones.

Forex brokers, in fact, do not always bring clients’ orders to the interbank foreign exchange market; they often themselves become counterparties and close transactions at the expense of counter orders from trading participants or at their own expense. The trader in this case does not feel any difference, but provided that the broker pays the profit honestly.

The Forex market is regulated by law, both in Western countries and in the Russian Federation. It is worth noting that companies operating in Russia are in no hurry to license their activities with the Central Bank. The state regulator imposes strict requirements, which make it impossible to use high leverage, as well as PAMM accounts. In addition, the number of instruments available for trading will have to be reduced.

As of 2021, only three Forex brokers in Russia have licenses from the Central Bank:

- Alfa-Forex;

- VTB Forex;

- Finam Forex.

Previously, there were four of them, but the PSB-Forex license was terminated by the regulator on December 22, 2020 based on the company’s application.

The rest of the Forex brokers operating in Russia are registered in offshore jurisdictions, where their activities are regulated, but this does not mean they are unreliable. Some companies have been operating for 15-20 years and have long developed a positive reputation due to the fact that they conscientiously transfer profits to all trading participants. In the rating of Forex brokers you can find at least 4-5 companies that are trustworthy.

Forex brokers may be licensed by the following regulators:

- KROUFR (Russia);

- TsROFR (Russia) ;

- FCA (UK);

- CySEC (Cyprus) ;

- MFSA (Malta);

- LFSA (Labuan);

- BVI (British Virgin Islands);

- VFSC (Vanuatu).

You can familiarize yourself with licenses from different regulators using the example of the Deriv broker , which provides trading in both binary options and the Forex market. The broker has many licenses, thanks to which he can operate in different countries, including Europe and Asia:

| Malta license | Labuan License | Virgin Islands License |

|

|

|

| Vanuatu License No. 1 | Vanuatu License No. 2 |

|

|

Regulation of the binary options market and differences from Forex regulators

Confidence in binary options was greatly undermined in the early 2010s, when the market was flooded with hundreds of fraudulent brokers positioning themselves as real BO brokers. Their methods and types of fraud were the reason why there was a negative and suspicious attitude towards this type of trade. This is why some still believe that binary options are a scam .

Currently, the activities of binary options in Russia and other countries of the former USSR are not regulated at the state level. BOs are not prohibited, but they exist, as it were, in a “gray” zone, and how soon this situation will change is unknown.

Of course, this does not mean that all BO brokers are deceivers, and it is impossible to make a profit on binary trading. Having studied the rating of binary options brokers , you can be sure that there is a choice and all the companies present in the rating conscientiously withdraw their earned profits to traders.

The best license for a BO broker is Maltese; this is the most stringent supervisory authority that controls the work of brokerage companies. In second place is the regulator CySEC and its licenses. Also, binary options brokers can obtain licenses from Labuan, the Virgin Islands, and Vanuatu, but the most popular regulator in Russia is the TsROFR regulator, since it is the easiest to obtain its license, and therefore most brokers prefer to work with this commercial organization.

As a result, if we consider the issue of regulation, then in binary options and Forex there are almost no differences in the licenses and regulators that issue them.

How does Forex trading differ from binary options?

Making transactions on these two types of trading is how binary options differ from Forex. The technical side of Forex trading is extremely simple. In order to get started, a trader needs to download and install the MetaTrader 4 trading terminal . Then open a new account and log in to your personal account, and then gain access to your trading account. All this will take no more than 10 minutes, after which you can open trades.

On Forex, it is possible to open positions at the current price (market orders) and future prices (pending orders, also called limit orders):

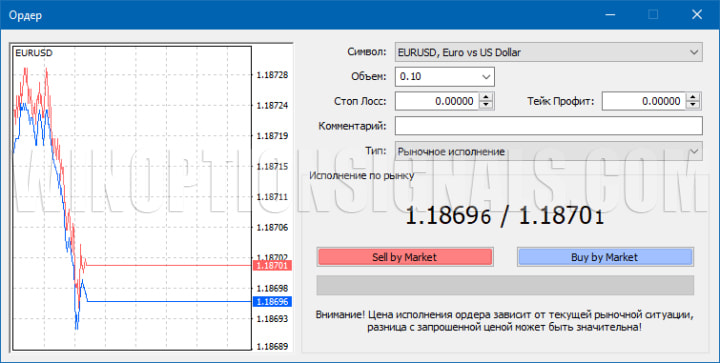

Market order – opens at the price available on the market at the time of the transaction. A buy/sell order is usually executed instantly:

When market volatility is high, slippage or requotes sometimes occur, but this does not happen often.

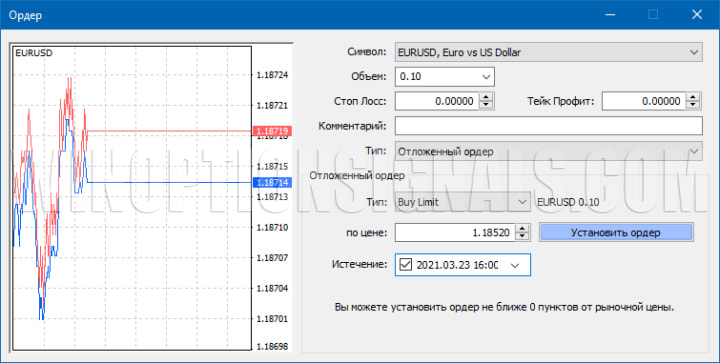

Limit order and Stop order are pending orders that are triggered when the price reaches a certain level:

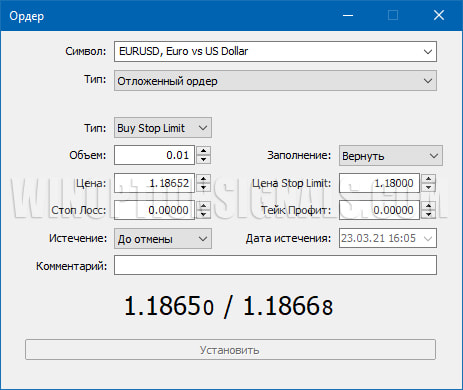

Sell stop limit and Buy stop limit are an innovation of the MT5 platform and are available only in this terminal. Such orders are needed only for exchange trading assets, and usually professional traders use them to set take profit or stop loss, since on a real exchange orders work differently than on Forex:

Also different from Forex and binary options are the following features:

- When trading on Forex, the result of the transaction is fixed at almost any moment, regardless of the distance traveled by the chart;

- A trading participant can close a position in several ways - manually or automatically (by setting a take profit, stop loss or trailing stop);

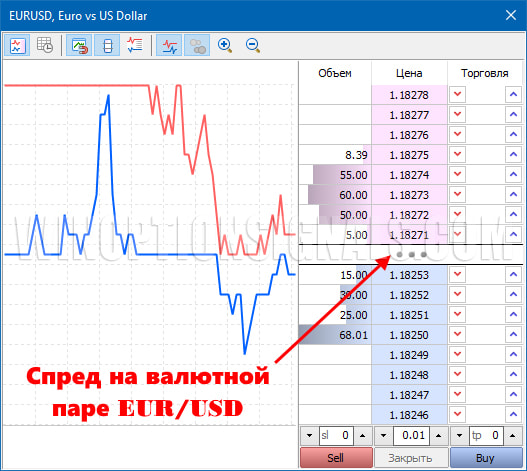

- There is a spread - the difference between the Ask purchase price and the Bid sale price, on which the broker makes money, regardless of the outcome of the transaction;

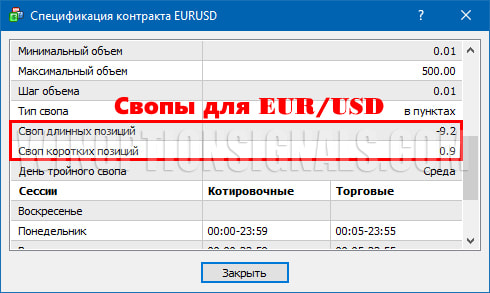

- When transferring an open position to the next day, a swap is credited or debited to the account (works only on currency pairs and also depends on the currency pair);

- The trader has control over the progress of the transaction, he can close the order partially, set or remove take profit, stop loss, and also move them above or below the previously selected level.

- In Forex, a participant has the opportunity to reduce risks by choosing certain tactics. For example, opening positions of the same volume in different directions (“locking”), and then opening the “lock” when the price returns to the desired values.

- Carry trading is available - opening positions for a long period in order to make a profit from a positive swap. This is a guaranteed small income, but the method does not work at low interest rates set by most Central Banks.

- When trading Forex, before each transaction it is always necessary to calculate the risks in order to determine where to set the stop loss, since it is not known how many points the currency pair may move in the future and in which direction.

Difference in trading between binary options and Forex

Mastering binary options is easier than trading Forex. And this is why binary options are better than Forex for some traders.

An important difference between binary options and Forex is the execution of transactions, and most likely no one will argue that binary options in a technical sense will be much easier to understand for beginners than trading on the Forex market, and this is due to the fact that in order to complete a transaction with options, just select the trading volume and expiration, and then click on the Call (“Higher”) or Put (“Lower”) button:

The amount of profit is determined only by the size of the bet (the amount of trading volume). It is important that at the time of expiration (closing the contract), the chart (price) is located above or below the initial level of entry into the transaction.

The validity period of a binary option is limited. A trader can choose an expiration time from a few seconds, minutes or ticks to several months or even years.

Pending orders for binary options are also available. At the same time, on some brokerage platforms it is possible to set not only the option purchase level, but also the desired profitability. The deal is not opened if the potential payout is lower. Currently , the binary options broker Pocket Option allows you to trade pending orders.

In addition to pending orders in binary options, there are many different types of binary options that can be used in different strategies or under certain conditions.

Another difference between binary options and Forex is that BO brokers most often provide only online platforms for trading. Although in some cases the broker may also have a desktop version of the terminal for PC.

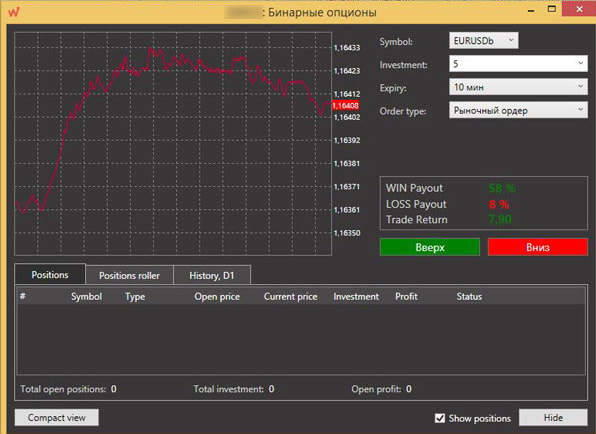

Some brokers provide the ability to use the MetaTrader 4 terminal for operations with BOs. This happens with the help of plugins, which are also provided by the broker. You can trade options via MT4 with the Grand Capital broker and the World Forex broker :

There is no spread in binary options and brokers cannot charge a fee for the difference between the bid and ask prices. The chart shows a single price as the arithmetic mean between Bid and Ask. Swaps for long-term transactions are not written off or accrued.

You can also note some differences between binary options and Forex:

- When trading binary options, locking, trailing stop and carry trading are not available;

- It is impossible to control the operation. After opening a position, the trader can only monitor price changes, which is why it will not be possible to influence the outcome of the contract and close the deal before expiration in whole or in part. True, brokers offer a number of solutions (increasing the volume and validity of the order, closing before a certain point), but this is still very different from the trading conditions and opportunities of the Forex market;

- You cannot set take profit or stop loss. Essentially, a binary option is a bet on an increase or decrease in the price of an asset. The trader either receives a profit of 80-90% of the transaction amount, or loses everything. The profit/loss percentage is biased in favor of the broker, so in order to benefit from binary options trading, a trader must have at least 60% successful trades.

How does Forex profitability differ from binary options profitability?

The main difference between binary options and Forex is the significant profitability of one successful operation. Thus, one option in 30 or 60 seconds can give a profit of 80-90% of the transaction amount:

When discussing the profitability of Forex trading, it is difficult to give exact figures. An excellent result is considered to be a return of over 10% over the long term. In a year of conservative trading, you can double your deposit, that is, get a profit of at least 100% with 2-3% risk for each transaction. If the profit is not withdrawn, but put into circulation, the amount in the account will increase exponentially thanks to compound interest.

With regard to binary options, significant profitability from one operation does not guarantee rapid growth of the deposit in the long term. For example, we can consider a situation where the trader’s deposit is $1,000, and the risk is 2% per option. When making one trade, a trader can allow a loss of $20, which is based on $1,000 x 0.02 = $20. This is the amount you should use when buying options.

Out of 100 transactions per month, for example, there can be 60 profitable ones and 40 unprofitable ones. The percentage of profitability on won positions is 82%. Thus, from one profitable trade the trader receives $16.4 ($20 x 82%). The monthly profit will be $984 ($16.4 x 60 trades). The loss from 40 unsuccessful transactions is $800 ($20 x 40 transactions). The final result of monthly trading will be +$184 ($984 – $800), which gives 18.4% of the deposit and is a very good income.

In general, if you choose which is better - Forex or binary options, then options win in terms of profitability, although the advantage is not too significant. In the case of approximately the same capital management and the number of transactions performed, Forex trading will bring less profit. But the amount in the account when trading on BO will not increase many times faster than on Forex.

Differences between trading assets in binary options and Forex

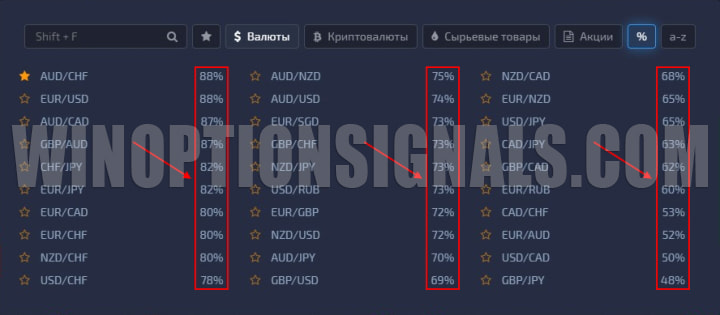

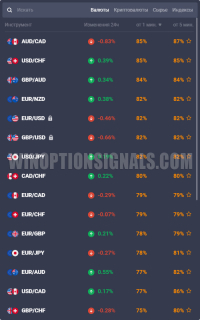

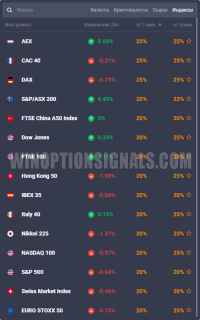

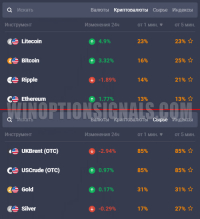

At the moment, both binary options brokers and Forex brokers provide the opportunity to trade not only currency pairs, but also a variety of other trading assets, including stocks, metals, cryptocurrencies , commodities and much more. Binary options brokers offer the following trading assets:

| Currency pairs in binary options | Indexes in binary options | Commodities and cryptocurrencies in binary options |

|

|

|

For Forex brokers, trading assets may look different, but the essence remains the same:

| Currency pairs on Forex | Indices and cryptocurrencies on Forex | Shares on Forex |

|

|

|

Therefore, in terms of the choice of trading instruments, there are almost no differences between binary options and Forex.

The only exception may be bank Forex brokers, who specialize specifically in trading currencies and metals, so they will not have other trading instruments.

Differences in commissions between binary options and Forex

In binary options, the trader does not pay any commissions or fees, and brokers make money on their clients' losing trades, and in case of a positive outcome, pay out profits.

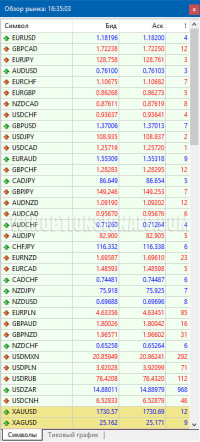

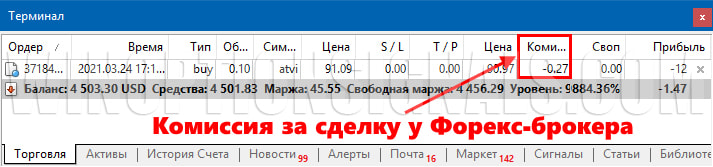

There are several types of commissions in the Forex market, which include spread or transaction commission, as well as swap.

Spread is the difference between the Ask and Bid prices, which exists regardless of the broker, since on world markets no one sells or buys an asset at the same price. But when trading through a broker, the spread is widened, and the broker takes this difference as payment for the opportunity to make transactions:

Also, instead of a spread, some assets may have a commission, which will not differ much from the spread, but in some cases it is a more convenient option in trading:

And another option for commissions is a swap, which is charged only if positions are transferred overnight, but it is worth noting that the swap can be positive and in this case the commission, instead of being written off from the trading account, will be accrued as profit from transactions. You can view the swap for any currency pair in the MT4 terminal by right-clicking on the asset and selecting “Specification”:

How do risks differ in binary options and Forex?

If we are talking about general losses from trading in financial markets, then there is no need to compare binary options and Forex, since the opportunity to “drain” a deposit is present in both, and no one except the trader himself will be able to protect the capital.

But if we compare the risks when trading binary options and Forex, then it is worth taking into account some factors, and for example, when making a transaction at the same price in the case of options, it will not matter how much the price rises or falls, since the loss and profits always have a fixed value. And if a Call option (“Higher”) was purchased, but the price began to fall sharply and ultimately decreased by 200-400 points, this will not affect the deposit in any way, whereas in a Forex transaction without a stop loss, such a situation can lead to the loss is much greater than for options (even if a small trading volume was used).

Speaking of potential profit, in the Forex market you can get much more money from your investment compared to binary options, but for this you need to correctly calculate your stop loss and take profit, which is not the easiest process. When purchasing options, all these indicators (profit and loss) are known in advance, which allows you to more competently manage risks and capital.

It is also important to always remember the rules of money management and risk management , since regardless of the type of trading, they help protect the deposit from large losses, and sometimes “explode” the trading account .

Analysis and forecasts in binary options and Forex

The analysis process is the same in both cases and involves the use of:

Technical analysis can also be divided into:

Carrying out analysis can be difficult on Forex or binary options, but in the case of options it is enough to understand the trend and where the price will go next , while with Forex currencies you need to understand how many points the asset will move, since the possible profit depends on this.

If we talk about transactions more specifically, in the case of trend movements, trading on Forex can be of great benefit, since if after analysis it becomes clear that the price, for example, will move up, but now it is in a flat, then a transaction on options may be completed before the price leaves the channel, whereas a Forex transaction does not depend on time and you can wait for a strong movement while already in the market.

And in the case of flat movements with a price range of, for example, 15 points, options will bring more benefits, since by making short transactions in a flat you can get much more profit than from transactions with currencies on Forex.

Binary options and Forex: what is the difference?

What was discussed above can be seen more clearly in the following table:

| Criteria | Binary options | Forex |

| 24/7 trading | + | + |

| Fixed income | + | – |

| Wide selection of trading assets | + | + |

| Commissions (spreads, swaps, etc.) | – | + |

| Leverage | – | + |

| Fast conclusion of transactions | + | + |

| Available minimum deposit | + | + |

| Applying Strategies | + | + |

| Application of indicators | + | + |

| Trust management with a broker | – | + |

| Copying trades | + | + |

| Manual closing of transactions | – | + |

| Automatic trading | – | + |

| Pending orders | + | + |

| Trading Tournaments | + | + |

| Bonuses and gifts | + | + |

| affiliate program | + | + |

The listed criteria do not mean that binary options or the Forex market are worse or better. You can make very good money both there and there, but you need to understand the essence of trading and be sure to practice on a demo account .

Conclusion

Both beginners and professionals can trade binary options. Before you start working, you should understand the specifics of binary options and firmly understand that high profits from one contract do not guarantee a rapid increase in the amount in the account. With proper money management, you can earn 10-30% of the deposit per month, and you should not hope for higher income at the initial level, as this will inevitably lead to the loss of the entire deposit.

Also, working with binary options brings greater profitability than trading on Forex, but everything is complicated by the fact that the trader will have to correctly predict not only the direction of price movement, but also the time during which his assumption should be realized.

See also:

- The best binary options broker! Who is he?

- How to trade on weekends. What are OTC quotes?

- Live chart for binary options online

- Binary options trading platforms

To leave a comment, you must register or log in to your account.