Binary options are a simple and accessible financial instrument for trading, which explains the rapid growth of their popularity. Despite the fact that they appeared relatively recently, there are currently many types of binary options.

The most popular types of binary options now are “Up/Down” and “Higher/Lower,” although they are far from the only ones.

The principle of operation is the same for all types of binary options, and to complete a transaction you buy a Call or Put option based on your forecast. Profitability may vary depending on the type of binary option, and in classic options the percentage varies from 55 to 95%, and in exotic options the profit can reach 500% or more.

Next, we will consider in detail all the types of binary options that exist today.

Content:

- Pros of trading binary options;

- Types of binary options;

- Types of classic binary options;

- Binary options "Higher/Lower";

- Using “Higher/Lower” options in trading;

- Binary options "Up/Down";

- Using Up/Down options in trading;

- Binary options "Touch";

- Using Touch options in trading;

- Binary Options "No Touch"

- Using binary options “No Touch” in trading;

- Binary options "Range";

- Using binary options “Range” in trading;

- Binary options "Out of range";

- Using binary options “Out of Range” in trading;

- Binary options "Turbo" or turbo options;

- Using turbo options in trading;

- Binary options "Spread";

- Using binary options "Spread" in trading;

- Binary options "Express" or express options;

- Using binary options "Express" in trading;

- Exotic types of binary options;

- Which type of binary options to choose?

Pros of trading binary options

Trading, for example, on the Forex market , a trader, when opening an order for a currency pair for 0.1 lot, expects that if the quotes change by 80 points, his profit will be $80, that is, each point has a certain value. When opening a position, a trading participant does not know how long he will have to wait for the price chart to reach the level he needs (this is affected by market volatility , the activity of other participants and other reasons). Perhaps the quotes will not cross the take profit line, but will turn around and begin to move in the opposite direction, bringing the trader not profit, but loss.

A trading instrument such as binary options is structured differently. The main difference between binary options and Forex is that in binary options you do not have to predict the number of points by which the price of the asset being traded should rise or fall. The only thing that matters is the direction of quotes after opening a position during the expiration time . Therefore, for some types of options the “life cycle” can be 1-2 minutes, for others it can be weeks or even months.

As a result, when concluding transactions with binary options, the profit of a trading participant depends only on which direction the price will go. However, some traders consider it normal to make a large number of short-term transactions in one day, while others prefer to open positions for the long term. That is why, in order to attract the maximum number of clients and traders, binary options brokers regularly introduce new types of binary options, which makes trading more flexible and suitable for all types of traders.

Types of Binary Options

Initially, all binary options are divided into types, and only then into types. And if the options “Up/Down”, “Higher/Lower” and others can be classified as types of BO, then the types of binary options include:

- European binary options;

- American binary options ;

- Bermuda binary options.

Each of the above types of binary options requires certain trading conditions. European options, for example, are the most common, and their essence is that a transaction is made with a certain expiration, and it will be closed only after this expiration. American options can be closed early at any time, but the percentage of profit will be several times lower. Bermuda options can also be closed early, but this can only be done on specific dates or times.

Each of the above types of binary options requires certain trading conditions. European options, for example, are the most common, and their essence is that a transaction is made with a certain expiration, and it will be closed only after this expiration. American options can be closed early at any time, but the percentage of profit will be several times lower. Bermuda options can also be closed early, but this can only be done on specific dates or times.

The variety and number of types and types of binary options confuses many inexperienced traders and makes it difficult to select an instrument for trading. In this case, the wrong type of option can cause large losses. Therefore, all beginners should start trading with classic binary options, and only then master their other types.

Types of classic binary options

It was with classic binary options (“Higher/Lower”) that all binary trading began. All subsequent types are guided by the basic principles of classical BO. Brokers can change the name of the contracts that they offer to their traders, but this does not change the essence and you should predict the direction of the price, choose the expiration date and make the deal. If you are correct in your prediction, you will receive from 55 to 95% (and sometimes more) profit per trade.

Most traders (about 90%) use High/Low options in their trading, as they are the most transparent and accessible, and other types of binary options were invented in order to stand out from the crowd of competitors. For example, the Quotex broker can also trade turbo options, and the Pocket Option broker also has express options and Up/Down options. Many types of binary options can also be found at the Alpari broker . If we talk about the largest number of types of binary options, then they are present at the Deriv broker .

Other types of binary options besides the classic ones are not so well known and popular, since they are often more risky for traders or difficult to understand compared to classic trading instruments. And despite this, there are quite a few of them, and further we will consider the most popular and currently used types of binary options.

Binary options "High/Low"

The most understandable and popular type of binary options is “Higher/Lower” options. This is what most traders use for daily trading.

The essence of this classic option is to correctly determine the position of quotes relative to the initial price at the contract closing point (expiration). You make a profit even if the value of the asset changes just one point above/below the price at which you bought the option:

For example, if a trader believes that the price will rise, he selects the required expiration date and buys a Call option, thereby opening a position at the current price. After the specified time, the contract is closed and the result is recorded.

If at the expiration point the value of the asset is actually higher than the initial one, then the participant receives a profit, the size of which was determined when opening the position.

If the quotes at the closing point of the contract are lower than the market entry price, the trader loses all the capital invested in the transaction.

Using Up/Low Options in Trading

It makes sense to buy this type of binary option in any market situation. Both trend price movement and fluctuations in quotes in the price corridor (flat) are suitable. Only one circumstance is of primary importance for making a profit - the price of a trading asset must rise or fall before the contract is closed by at least one point in the required direction.

If the closing price of the contract is equal to the opening price, the investment is returned to the trader’s deposit in the original amount. However, this provision does not apply to every broker, so before starting trading you need to carefully study all trading conditions.

Expiration for a transaction when trading “Higher/Lower” options can be different and vary from 30 seconds to 3 months. Long-term transactions in the case of an accurate forecast may turn out to be less risky, since the price can move far from the initial level, but at the same time their profitability is less than with a shorter expiration.

As an example, you can look at the purchase of a Down option made in the direction of the trend:

As a result, the “Higher” option will close with a profit if the price of quotes at the time of expiration is higher than at the time of purchasing the option, and the “Below” option will close with a profit if the cost of quotes at the time of expiration is lower than at the time of purchasing the option.

Binary options "Up/Down"

Let's consider a riskier, but at the same time more profitable type of binary option - “Up/Down”.

Here the trader also needs to predict the direction of price movement, but in addition to this condition there is a level above/below which the price should be at the time the contract is closed. Only if these conditions are met will the position make a profit:

To put it simply, the essence of the “Up/Down” option is also to buy an option, and for example, we buy a Call option, after which the position is opened at the market price, but at first it is unprofitable, since there is a border, upon crossing which the price will go to profit zone. This level is located higher and is designated in advance.

If at the time of expiration the price is higher than the limit set when purchasing the option, then the transaction is closed in profit and the trader’s deposit is credited with the profit, the amount of which was known when the position was opened. If the price at the expiration point is below the level set when opening the deal, the contract is closed in the negative, and the trader loses the entire amount invested in purchasing the option.

Using Up/Down Options in Trading

Buying binary options “Up/Down” only makes sense if there is a strong trend in the market. During a flat period, when the price fluctuates within a narrow price range, this type of binary options will most often bring a loss.

An excellent strategy for this type of options is news trading. After the release of current news, the price may “shoot” in one direction or another very strongly, which will allow you to close the position with a profit.

An example of a trade with a “Boost” option during the release of one of the important news:

Binary options “Up/Down”, unlike other options, have a longer expiration time and are not intended for short-term trading. It is better to use an expiration period of at least 15-30 minutes, otherwise the price may not have time to reach the desired limit.

Binary options "Touch"

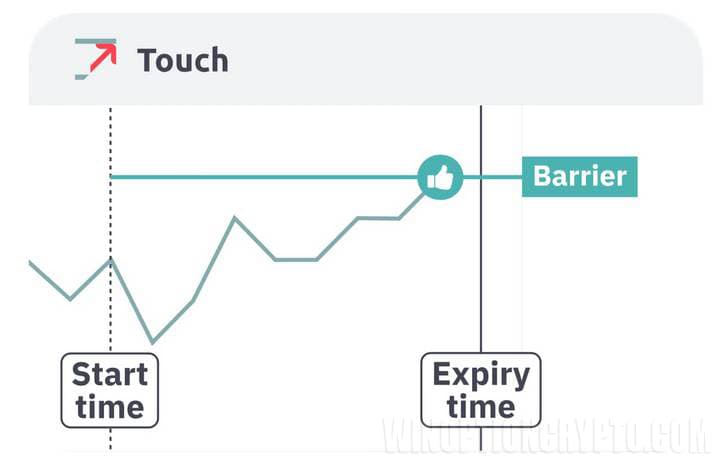

When trading binary options “Touch”, the trader receives a profit if quotes reach a certain level during the expiration period. Moreover, in order to close in profit, only a single touch of the price to this border is enough.

For example, let's assume that an investor predicted the direction of a price fall and bought a Put option. Below the current quotes, a level is set (known at the time of opening the transaction), which the price must “touch” before the expiration date expires. As soon as the price touches the desired border, the position is closed ahead of schedule, and a predetermined amount of profit goes to the investor’s deposit.

If the price has not reached the predetermined level before the expiration date, the investor loses money equal to the cost of the option.

Trading conditions for Touch options are equally interesting for both the trader and the broker, and therefore a lot of strategies have been developed for trading these types of options.

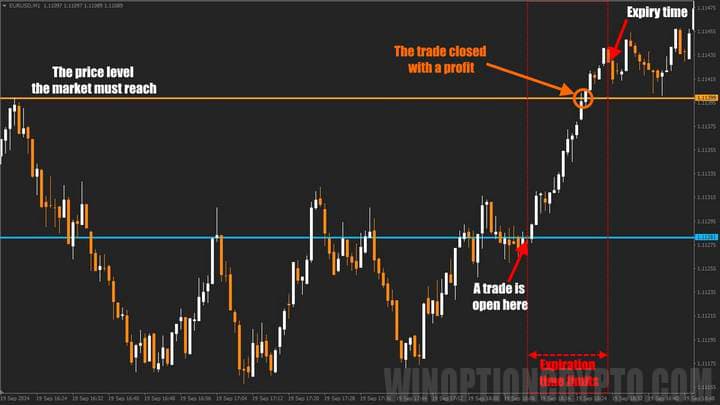

Using Touch Options in Trading

Most likely, many have already guessed that this type of binary options is best used during market impulses or sharp trend movements. Price impulses often occur around support and resistance levels , when the price breaks or bounces off them. In a flat, such options will not be effective, since the price is unlikely to reach the set level.

It is also advisable for a trader to learn how to conduct technical analysis of a chart and correctly find strong support/resistance levels, since it is likely that quotes will not be able to break through them, and then the position will close in the red.

On the chart, trading “Touch” options looks like this:

When trading these options, short-term periods are also not used. The expiration time must be at least 15 minutes. Moreover, the longer the transaction period, the higher/lower the limit that needs to be achieved is set.

Binary Options "No Touch"

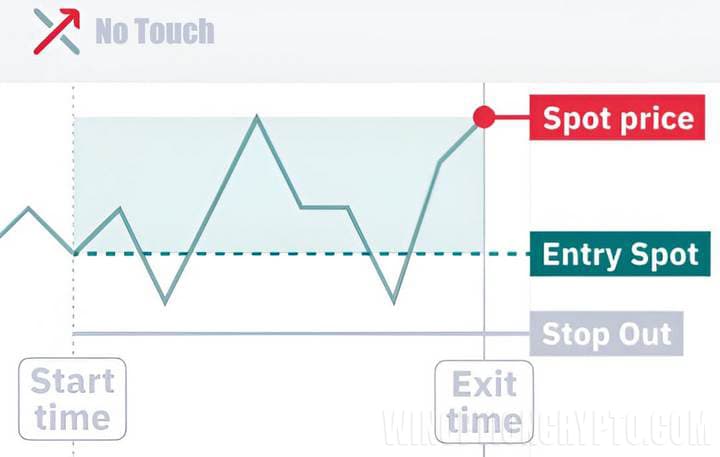

“No touch” is the next type of binary options, which is the opposite of the previous one. Its essence is to predict a situation in which quotes will not touch the established border line:

The essence of this type of binary options comes down to the fact that a trader or investor predicts a price movement such that it does not touch the border line. For example, a trader buys a Call option. Below the current price, a certain level appears (known when the order is opened), which quotes should not reach until the contract is completed. If the price touches the border line before the expiration date, the position is closed early in the negative, and the trader loses the invested amount. If the price does not touch the level during the transaction, then the option brings the trader a profit, the size of which was known in advance, that is, before opening the position.

Using Binary Options "No Touch" in Trading

Binary options “No touch” are used both during a sideways trend (flat) and during a trend movement. Its essence is to predict where the price will not go.

When using this type of option during a trend, it is necessary to catch the moment when there are no serious movements in the market and open a position in the direction of the trend so that the boundary line, which the price should not touch, is located not on the path of the trend, but in the opposite direction.

It is a little more difficult to trade in a flat, since you first need to determine the boundaries of the price corridor in which quotes are located during a sideways trend, and then select the conditions under which the line of the established level would be located outside the price range. Then the chances of touching the line will be minimal, and the chances of a profitable trade will be maximum.

On the chart, this type of binary options looks like this:

The No Touch option can be purchased with any expiration period. In this situation, time can play both against us (when the price moves closer and closer to the conditional border) and for us (if the chart goes in the opposite direction). In general, the sooner the expiration time arrives, the lower the probability of the price touching the prohibited line and the greater the chance for the trader to make a profit.

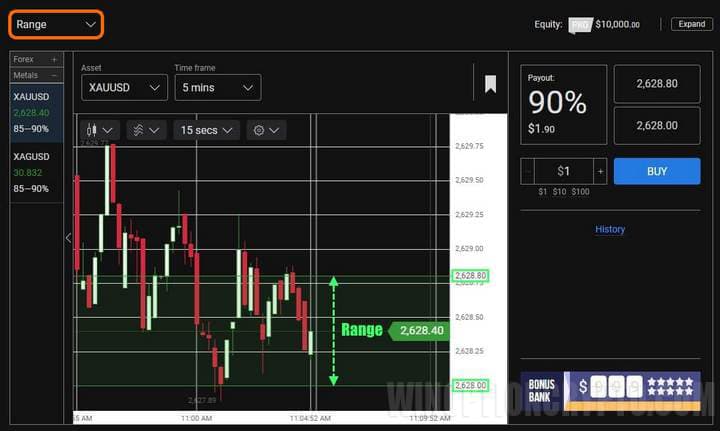

Binary options "Range"

“Range” is another type of binary options, or it can also be called “End In”. This type of options allows the trader to make a profit if the quotes at the time the order is closed are in a range limited by two lines:

Such an option should be purchased if the trader believes that the price of the asset will move in a narrow corridor (flat) for some time and no strong impulses or trend movements are expected. When buying an option, the upper and lower limits of the price range are indicated. It is worth noting that the line levels are known to the trader even before opening a position. Also, when purchasing an option, the potential profit that the trader will receive is already known if the asset price at the time the option closes is located within the boundaries of the price corridor. If quotes go outside the channel, the transaction will be unprofitable.

It should be clarified that while the position is open, the price can easily go beyond the established range. The main thing is that it returns within the boundaries at the time of expiration. This option is closed exactly at the specified time, and the profit/loss is fixed depending on the position of the quotes at the time the transaction is closed.

Using binary options "Range" in trading

Binary options “Range” are used in a calm market, that is, in a weak trend or in a flat. It makes no sense to use it when trading “on the news.”

The trader/investor is required to predict the flat and correctly find the boundaries of the price range. Then compare them with the proposed “Border” option corridor. If the conditions are suitable, you can open a position. Also, in this option, the expiration period is inversely proportional to the channel size. That is, the shorter the transaction lifetime, the wider the price corridor will be, and vice versa:

Binary Options "Out of Range"

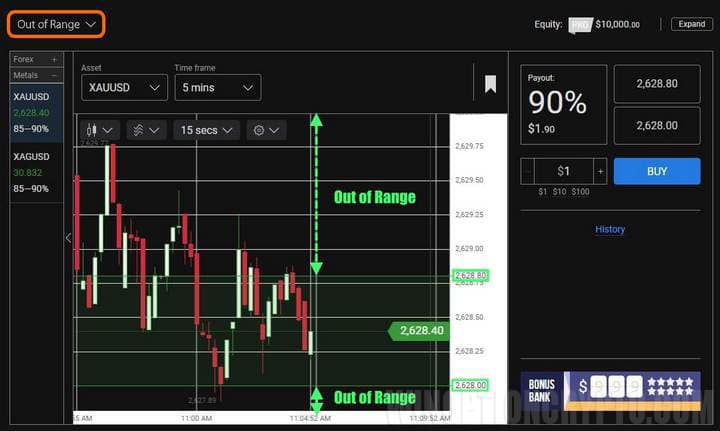

The opposite type of binary options to the previous one is called “Out of Range”, or “Ends Out”. This is a type of option that allows you to make a profit if the price at expiration goes outside the specified price channel:

This type of option should be used if the trader believes that the price of the asset will be in a trend movement and will not enter a flat or consolidation.

When creating an order, the upper and lower boundaries of the price corridor are indicated. The levels of the boundary lines are known to the trader/investor even before opening a position. If at the time of closing the contract the price is within the price corridor, then the position is closed in the negative, and the investor loses the funds invested in the purchase of the option. But if, at the time of contract expiration, the price goes beyond the boundaries of the price channel, then the position is closed in profit, and the investor fixes the profit, the size of which was determined before purchasing the option.

As with “Range” options, only the value of quotes at the time of expiration is taken into account. While the position is open, the chart may repeatedly cross the lines of the price corridor, but the main thing is that the price goes beyond the range at the time of expiration.

Using Out of Range Binary Options in Trading

Out of Range binary options are used during a strong trend or when important economic news is released. Therefore, a trader needs to predict the trending price movement or the end time of a flat with a subsequent transition to a trend. In a calm market with a short interval of price movement, the tool may not work very effectively. It is also worth considering that the longer the life of the contract, the wider the price corridor:

Binary options "Turbo" or turbo options

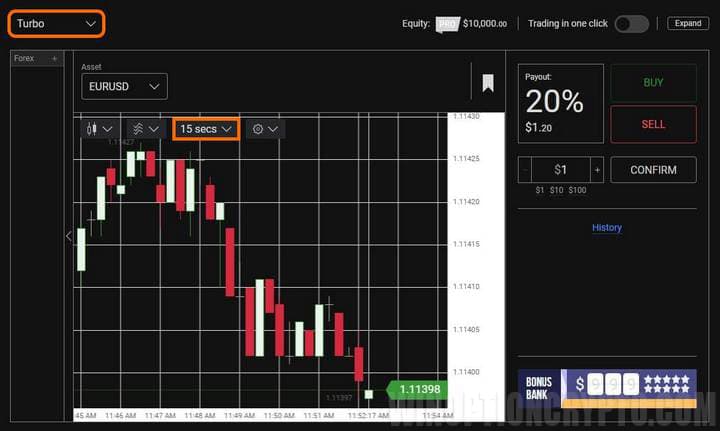

Turbo options are a type of binary options that are opened for a short period of time and can depend on both time and minor price changes (ticks):

The essence of turbo options is similar to the “Higher/Lower” options, but you can use not only fast expirations (from 30 to 60 seconds), but also the number of ticks.

For example, we can consider a situation where a trader assumes that the price will move up, and then buys a Call option. The position is opened at the market price, and if an expiration of 30 seconds was selected, then after this time the transaction will be closed, and a profit will be made if the price is higher than the opening price.

If ticks are used, the deal will be closed after the price changes by 5 ticks (1 tick on currency pairs is equal to 0.00001, if you take five digits). The trader will also make a profit if the price is higher than the opening price. The profit amount is determined before the option is opened.

If the price of the asset at the end of the contract with any of the expirations described above is lower than the initial one, then the position is closed in the negative, and the trader loses the amount invested in the purchase of the option.

Please note that turbo options are considered not only transactions that use ticks, but also transactions that use an expiration time of 30 to 60 seconds.

It is important to understand that this type of binary options is quite risky and should only be used by experienced traders.

Using turbo options in trading

Turbo options are suitable for any market and can be traded with trends, flats and impulse movements after news releases.

It is worth understanding that turbo options are much more like a game than a trade. In such a short period of time, it is very difficult for even the most experienced trader to make a real forecast of the price direction, so there is an element of luck here.

Trading turbo options with an expiration of 30 seconds looks like this:

Please note that in such a short period of time the price can change many times in different directions, and therefore turbo options are considered risky and difficult to predict.

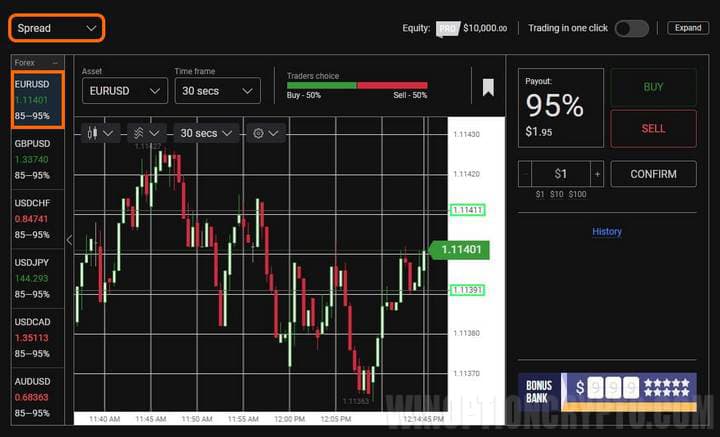

Binary options "Spread"

Binary options “Spread” are similar to a type of option such as “Up/Down”, but their essence is to correctly determine the path of price movement. In this option, you need to predict not only the direction, but also the degree of movement, namely, how many specific points the quotes at the time of completion of the transaction will be above/below the initial price:

Using binary options "Spread" in trading

The use of the “Spread” option is absolutely similar to the “Up/Down” options. Before buying an option, the trader sees the levels that the price must reach to make a profit.

On the graph it looks like this:

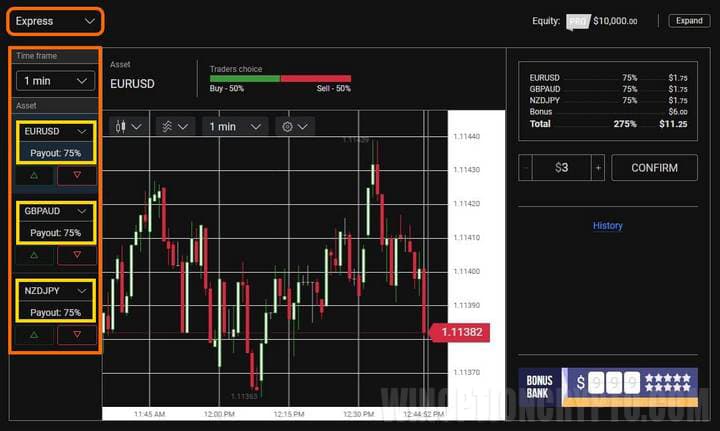

Binary options "Express" or express options

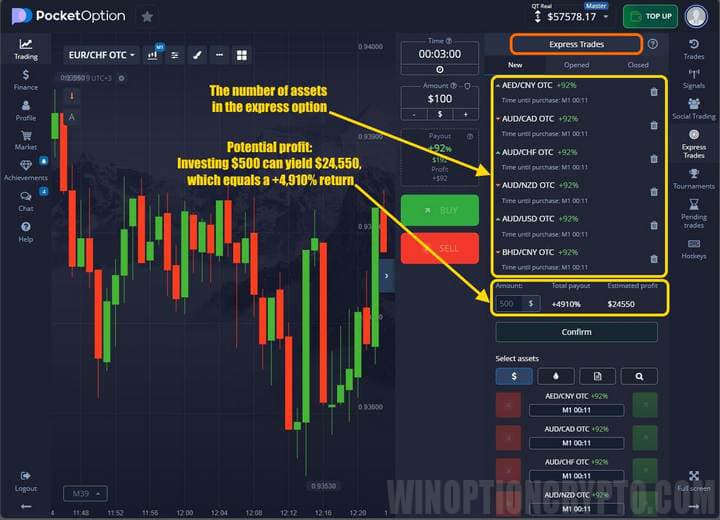

Binary options "Express" (or express options) can generate very high returns, however they are quite complex to trade. The profit on this type of binary options can be 500% or higher (with a complex express option, the profit can even reach 10,000%). But it is worth noting that with such huge potential profits, the likelihood that the express option will close in profit is very small:

The essence of express options is to make a forecast for several trading assets. Essentially, this is making 2 or more transactions in one. Moreover, the more trading assets are used in one express bet, the higher the possible profit. You can choose absolutely any trading assets, as well as expirations.

As a result, you can create an express train by buying a Call option on the EUR/USD currency pair with an expiration of 1 hour, buying a Put option on gold with an expiration of 4 hours and buying a Call option on oil with an expiration of 10 minutes. If all three options are closed in profit, the trader will receive his profit, the size of which is determined before opening the position.

If at least one transaction from the entire express is closed in the negative, then the trader loses the amount invested in the purchase of the option.

Using binary options "Express" in trading

Express options can bring high profits in just one successful transaction, since payments if the forecast comes true reach an average of 500% of the investment amount. So, when buying an option worth $10, a trader can earn $60. If the express option is complex (contains, for example, six trading assets), then with the same $10 you can already earn $450. It is clear that brokers do not want to lose money just like that, which is why this option is considered very high risk.

Typically, the conditions on an express option are not very profitable for a trader and it makes sense to use them only with long expirations (from 1 hour and above). If you use expirations of 60 seconds and try to simultaneously predict the movement of three assets, then the chances of success will be very small.

The task of a trader who decides to trade such options is to objectively assess the likely direction of the price, the strength of the movement and correctly set the option expiration. You can open express trains “on news” or with a strong impulse movement in any direction:

Exotic types of binary options

I would like to immediately note that in this article we have considered only the most popular types of binary options that are available from different brokers, but these are not all existing types of options. Less popular types of options (exotic) are:

- “Remains inside / Goes beyond”;

- “Coincidence/Difference”;

- "Even Odd";

- "More less";

- "Reset call/Reset put";

- “High/Low tick”;

- "Asian";

- “Only up/Only down”;

- “Maximum-Closing/Closing-Minimum”;

- "Maximum/Minimum".

More details about all types of options can be found in the article - “What are binary options?” and also from a review of the Deriv broker , which has more than 15 types of binary options on its platform.

Which type of binary options to choose?

Speaking about choosing the right type of binary options for yourself, there are a lot of them and each of them is interesting in its own way. Also, each of them has both advantages and disadvantages, and the spread of profitability with a correct forecast is very large. So which option is better for a trader to choose?

Binary options with high profitability (yield) almost always imply high risks, since the higher the profit, the higher the risk. Conversely, the lower the return, the lower the risk of losing invested funds. Perhaps an exception to this rule are Forex contracts, but they are much more complex than other options, so not every trader can trade them. Therefore, the choice of the type of option is always yours and depends on your preferences, experience in trading and the risks that you are willing to take.

Beginners in trading should first of all master the classic binary options (“Higher/Lower”), since they are not difficult to understand and at the same time they help to understand the essence and learn the basic principles of binary options trading. Also, when trading such options, the chance of losing your deposit is several times less.

Experienced traders can pay attention to any types of options, since such traders are already familiar with the rules of money management and risk management , and even the resulting losses in case of a wrong choice will not allow them to lose too much money.

See also:

How to choose a binary options broker

Do you make money on binary options?

To leave a comment, you must register or log in to your account.