The development of cryptocurrency technologies simplifies life not only for investors, but also for ordinary users. One of the significant technological achievements of the last decade can safely be considered the emergence of the Tether USDT coin. In just three years since its creation in 2014, USDT broke into the top five cryptocurrencies by capitalization, and in terms of daily trading volume it overtook Bitcoin. It is simply incredible how a cryptocurrency, without the status of Bitcoin and the versatility of Ethereum, was able to achieve such impressive results in such a short time.

Today, its role in the cryptocurrency industry is difficult to overestimate. In our review, we will tell you what the Tether USDT cryptocurrency is and how to use it, the meaning of USDT, where it is profitable to buy it and how best to store it , as well as how to transfer Tether with a minimum commission. And those who read to the end will learn not only how to protect their Tether wallet from hacking, but also what will happen if USDT loses its peg to the US dollar. Let's figure it out.

Content:

- What is USDT in simple words

- Why buy USDT

- How to buy USDT

- How to store USDT

- How can you use USDT

- Risks of using USDT

- Conclusion

What is USDT in simple words

In order to understand what the Tether USDT cryptocurrency is, it is necessary to understand for what purpose it was created.

What is the meaning of USDT

USDT is a cryptocurrency that is pegged to the US dollar at a 1:1 ratio. Thus, the main goal of Tether is to be as similar to the US currency as possible:

- USDT is not subject to the same fluctuations as other cryptocurrencies, which is why it is used as a safe haven during periods of market instability.

- It can be exchanged for any product or service at any time.

- It is traded on many cryptocurrency exchanges and is in the reserves of many exchangers.

- Tether can be used for fast and inexpensive transfers, as well as fiat withdrawals (conversion to regular currencies: UAH, EUR, USD).

How USDT Works

In 2014, Bitcoin investor Brock Pierce, his friend and entrepreneur Reeve Collins, and programmer Craig Sellers launched Tether, which was originally called Realcoin. The USDT issuance was backed and guaranteed by Tether Limited, a Bahamas-based company that backs Tether with real US dollars stored in its reserve “diversified bank accounts” around the world.

It is worth keeping in mind that it undergoes audits only from firms that it has hired. This casts doubt on the verdicts rendered, and such audits cannot be considered independent. The algorithm of this cryptocurrency itself is designed in such a way as to ensure that the total number of USDT in circulation corresponds to the number of reserve US dollars.

USDT Criticism

However, not all crypto experts trust such information. For example, investigative reporter Zeke Fawkes from the business publication Bloomberg in his article “ Has Anyone Seen Tether Billions? ” considers the issuer of this cryptocurrency to be an ordinary commercial bank that accepts US dollars from people who want to trade cryptocurrency and in return credits them to their digital wallets with  the corresponding amount of Tether.

the corresponding amount of Tether.

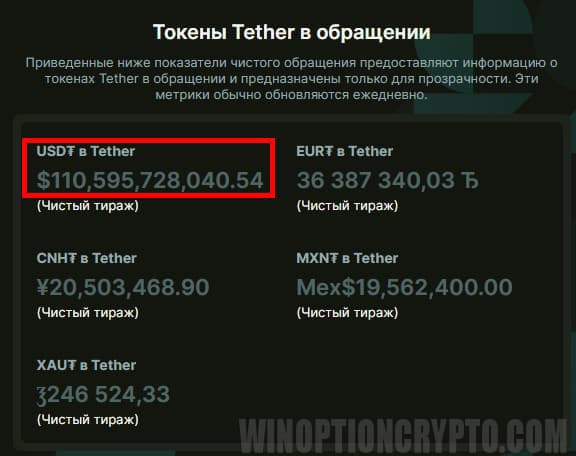

According to regulators, the size of Tether's alleged dollar assets is so large that even assuming that all of these dollars are real, it could be dangerous. For example, if a large number of traders simultaneously request a refund of their funds, Tether Limited may have to sell its own assets at a loss. This, in turn, will lead to a massive withdrawal of funds from this pseudo-bank and will have a negative impact on the entire global financial system and credit markets. To understand how great the potential threat is, it is enough to look at the current sizes of dollar collateral, which are published on the official Tether website in real time.

Impressive, right? If the critics are right and Tether is another “Ponzi scheme,” it will be bigger than Bernie Madoff’s.

How Tether is different from other cryptocurrencies

Note: A stablecoin is a cryptocurrency that aims to keep its price stable by tying it to a common currency, such as the US dollar or euro.

The main difference between this stablecoin and Bitcoin and other altcoins (all cryptocurrencies except Bitcoin) is that it does not have its own blockchain and is backed by reserves of regular currencies, such as the US dollar and the euro. That is, instead of its own blockchain, Tether uses ready-made decentralized systems of other blockchains, such as Ethereum (used most often), Tron (offers lower fees than Ethereum), EOS (high-speed blockchain), Solana (low fees and fast transactions) and Polygon (higher scalability than Ethereum and lower fees).

In general, the operation of this stablecoin is supported by various open protocols, such as Omni Layer. It is necessary for interaction with the Bitcoin blockchain, as well as for the issuance and redemption of USDT based on it.

Types of Tether

Please note: Tokens of one standard cannot be sent to addresses of another standard! Please check the addresses carefully before sending funds. For USDT on the Omni blockchain, addresses begin with 1 or 3, for ERC-20 - with 0x, and for USDT on the Tron blockchain - with the letter T.

As mentioned above, Tether operates on different blockchains. As of 2024, there are 16 distributed ledgers that support this cryptocurrency:

- Tron

- Ethereum

- Avalanche

- Solana

- Omni

- Near

- Ton

- Cosmos

- EOS

- Tezos

- Celo

- Algorand

- Polkadot

- Liquid

- Kusama

- SLP

For the average user, only the first three are of interest. Of these, the Tron network (USDT-TRC20) accounts for 52% of the total issue of these coins, and Ethereum (USDT-ERC20) 46%. The Avalanche network (USDT.e) accounts for just over 1%. It is followed by USDT on Solana with a share of 0.7%. All other networks are outsiders with a share of less than 0.2% of the total number of issued stablecoins. All information is obtained from the official Tether website .

The characteristics of the leading USDT blockchains are presented in the table.

|

Characteristic |

USDT-TRC20 |

USDT-ERC20 |

USDT.e |

|

Blockchain |

Tron |

Ethereum |

Avalanche |

|

Commissions |

Very low |

Average |

Low |

|

Transaction speed |

Tall |

Average |

Tall |

|

Suitable for |

Frequent, low cost operations |

Trading and storage |

Decentralized applications (dApps) on Avalanche |

|

Advantages |

Cheap and fast transactions |

Widespread availability and support |

Scalability and integration with dApps |

|

Flaws |

Less decentralized than other options |

High transaction fees on the Ethereum network |

A relatively new protocol |

Why buy USDT

Traders, investors, and just ordinary users buy USDT for completely different reasons. Some are attracted by its stability and its connection to the US currency rate, others like the ability to quickly transfer money with a small commission or buy goods and services in online stores. Some are captivated by its high liquidity and the ability to exchange it for regular, familiar paper money at any time. In turn, investors have fallen in love with this stablecoin for its protection from inflation and currency controls, which is especially important for countries with limited access to foreign currency.

How to buy USDT

It would be a bit strange if in a review of what the Tether USDT cryptocurrency is and how to use it, we ignored such a popular question as how to buy Tether. Therefore, let's talk about what methods of acquiring USDT are available to the average user.

There are several of them and each of them has its own pros and cons:

- Peer-to-peer (P2P) platforms. These platforms allow you to directly buy USDT from other users. This is a more anonymous way to buy Tether than through an exchange, but it is also riskier because trades are not always guaranteed.

- Cryptocurrency-enabled ATMs: Some ATMs allow you to purchase cryptocurrencies (including USDT) with cash. However, they are not as common as regular ATMs and may incur additional fees.

- Exchanges. This is the most common way to buy USDT. To do this, you will need to create an account on the exchange, pass identity verification, and make a deposit in a regular currency (such as USD, EUR, or UAH). You can then use the funds deposited into your exchange account to buy Tether USDT.

Which exchange is cheaper to buy USDT

Definitely the answer  It is quite difficult to answer this question. Since the answer to it will depend on such factors as the price of USDT at a certain point in time on a particular exchange and the level of liquidity (the volume of purchase and sale orders at a certain price). Therefore, to answer this difficult question, we recommend studying the information on the websites CoinMarketCap, CoinGecko and Cryptocom . With their help, you will be able to compare USDT rates on different exchanges in real time.

It is quite difficult to answer this question. Since the answer to it will depend on such factors as the price of USDT at a certain point in time on a particular exchange and the level of liquidity (the volume of purchase and sale orders at a certain price). Therefore, to answer this difficult question, we recommend studying the information on the websites CoinMarketCap, CoinGecko and Cryptocom . With their help, you will be able to compare USDT rates on different exchanges in real time.

In addition, we recommend paying attention to platforms for finding the best offers to buy USDT on different exchanges, such as Changelly, SimpleSwap and Totle. If you have some experience, you will probably be interested in P2P platforms LocalBitcoins, Paxful and Bisq. On them, you can profitably buy USDT directly from other users, but remember that P2P transactions are associated with greater risks than buying on an exchange. In general, in order to determine the most favorable price to buy USDT, adhere to the following rules:

- Compare rates on different exchanges

- Always consider trading fees

- Please note the minimum transaction amounts

- Be sure to read reviews of the exchanges you are going to use.

- Beware of scammers

How to buy USDT with fiat money

Note: Fiat money is money whose value is guaranteed by the state and does not depend on its backing by gold or other assets.

In a conversation about what the Tether USDT cryptocurrency is and how to use it, we will not dwell in detail on all the options for purchasing this stablecoin for fiat money, since we already wrote about this in the article “ How and where to buy and sell cryptocurrency ”.

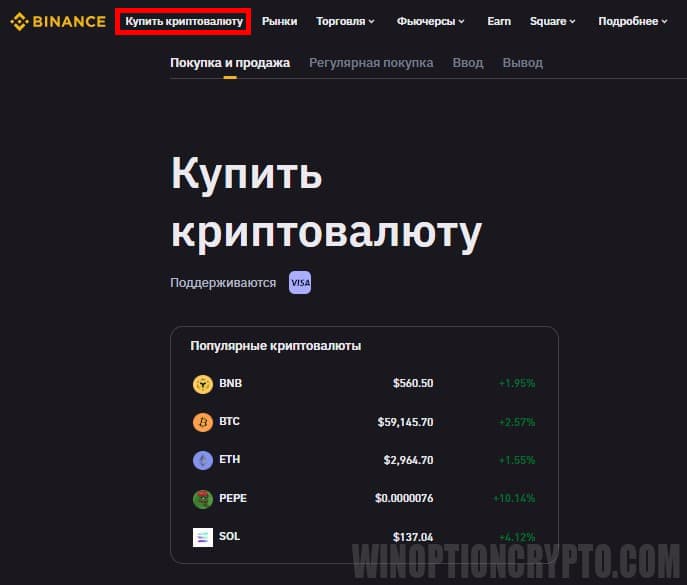

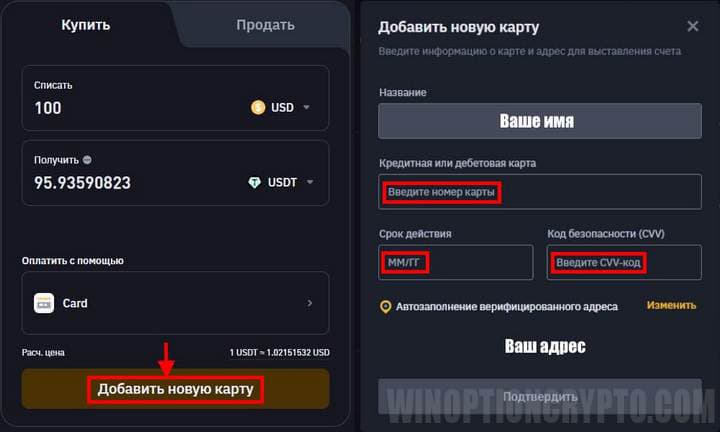

Here we will only note that the procedure itself is not complicated and even a beginner can handle it. We will show it using the Binance exchange as an example. After registering an account and passing verification, you need to go to the “Buy cryptocurrency” section.

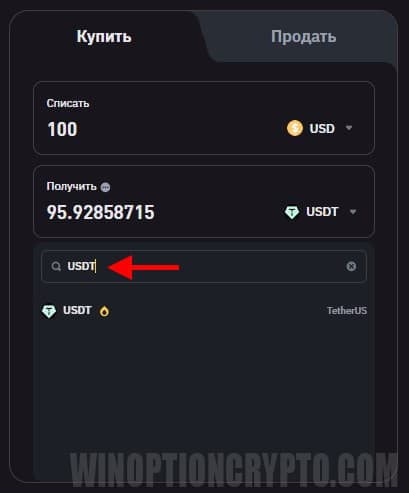

On the same page, in a special panel, we indicate the purchase amount and select the desired cryptocurrency from the drop-down list (in our case, USDT).

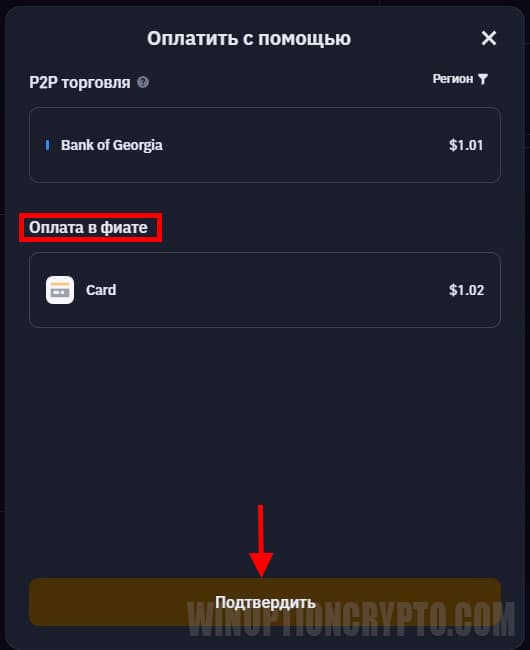

Next, we need to select the payment method “Payment in fiat” and click “Confirm”.

If you have never paid on this exchange with your debit card before, you will need to add it by entering all the necessary data and clicking "Confirm".

You will then be redirected to the payment confirmation screen, where it is important to carefully check all the details and confirm the order within the specified time. To get the latest prices, click the "Refresh" button. To place an order, click the "Confirm" button. You will then be redirected to your bank's transaction page, where you will be required to enter a one-time password. Follow the instructions to complete the payment. All coins will appear in your spot wallet after verification.

How to store USDT

There are different ways to store USDT cryptocurrency, depending on what you are using it for. However, keep in mind that the way you store stablecoins will depend on the blockchain they were created on. Typically, you will need to use the tools used for the underlying currency of that distributed ledger. For example, if Tether is implemented on the Ethereum blockchain (most commonly), you can store it in wallets of this type:

- Multicurrency – store several different cryptocurrencies in one place: Trust Wallet, Jaxx, Atomic Wallet and Exodus

- Non-custodial – you are responsible for your private keys and USDT security: MyEtherWallet and MyCrypto

- Hardware – store your cryptocurrencies on a special device: TREZOR, Ledger

- Mobile – the most popular way to store cryptocurrencies is in the form of a smartphone application: Trust Wallet, MetaMask, Coinbase Wallet, Exodus

In addition, you can register wallets with the USDT developers themselves for any token: USDT (Omni), USDT (ERC-20) and USDT (TRC-20). To do this, you will need to pass verification on the official Tether website. This procedure is paid, costs $150 and takes up to 5 weeks. If you successfully pass verification, this money will be returned to your account and this process will actually be free for you. Otherwise, you will lose it. Therefore, be very careful when submitting your documents.

In this guide on what is Tether USDT cryptocurrency and how to use it, we will focus on the two most popular ways to store it: using hardware and mobile wallets.

USDT Hardware Wallet

A USDT hardware wallet is very similar to a USB stick for cryptocurrency. It stores your digital money (or more accurately, the keys to it) in a safe place, without an internet connection. This protects your cryptocurrency from hackers and malware. There are several advantages to this method of storing digital assets:

- Your private keys are virtually impossible to hack because they are stored on a device that is not connected to the Internet.

- Hardware wallets are easy to use, even for beginners.

- Many hardware wallets support multiple cryptocurrencies at the same time, including USDT.

- Their small size allows you to take them with you anywhere, which is very convenient.

We would like to draw your attention to these models with Tether (USDT) support, which have already gained popularity among users:

Ledger Nano S – The most popular model of 2024. This compact and easy-to-use wallet supports (just think about it) more than 5,500 cryptocurrencies. At the same time, private keys are stored in a special chip that is not accessible via the Internet. A huge list of supported cryptocurrencies is periodically updated by developers. At the same time, we note that not all cryptocurrencies can be installed on your device at the same time. Choose only those that you plan to actually work with. To expand the capabilities of Nan  o S will have to update its firmware.

o S will have to update its firmware.

Trezor Model One – also popular and supports over 1600 cryptocurrencies. Like Ledger, a firmware update is required to install support for additional cryptocurrencies

KeepKey is a slightly less popular model, which nevertheless provides reliable protection for your funds. It supports more than 50 cryptocurrencies.

Mobile wallet

As the name suggests, such wallets are designed for quick access to your own funds and are not tied to any specific device. Mobile wallets are usually directly linked to a user account on a specific exchange and allow you to easily transfer funds from the wallet to the exchange and vice versa.

A striking example of such a wallet is Binance Wallet, a mobile application directly linked to the Binance exchange. After downloading and installing it on a smartphone from the App Store or Google Play, the user will be able to log into their account on the exchange. Once the connection is established, it will be integrated with their account and will have access to all the trading and service functions of this popular trading platform.

Another example of a popular mobile wallet is Trust Wallet . We wrote a full review of it with an analysis of all its advantages and disadvantages. Therefore, here we will only note that this is a good choice for a beginner, since its open source code is verified by independent experts.

To make it easier for you to understand the pros and cons of hardware and mobile wallets, we have compiled their main characteristics in a table.

|

Characteristic |

Mobile wallet |

Hardware wallet |

|

Storing private keys |

Private keys are stored on your mobile device or in the cloud |

Private keys are stored in a secure chip on the device. |

|

Safety |

Less secure than a hardware wallet as it is susceptible to hacker attacks and malware |

More secure than a mobile wallet as private keys are stored without an internet connection. |

|

Ease of use |

Easy to use and accessible from anywhere in the world |

Less convenient to use than a mobile wallet and requires connection to a computer |

|

Price |

Usually free |

Paid, price can vary from $50 to $200 |

|

Functionality |

May offer additional features such as cryptocurrency exchange, built-in browsers, etc. |

Typically has limited functionality |

How to Protect Your Tether Wallet from Hacks

Regardless of which Tether wallet you choose to store your USDT, you should remember that hackers and scammers do not stand still, and every day they come up with new methods and hacking schemes. Therefore, we advise you to adhere to certain rules that will help you protect your Tether wallet:

- Use a reliable application. Try to choose hardware wallets, as they are considered safer for storing cryptocurrency than their mobile counterparts. The main advantage is that private keys are stored offline. If you still prefer mobile wallets, choose reliable and well-established applications. Among them are Exodus, MetaMask and Trust Wallet.

- Create complex passwords. Create passwords using online password generators that are at least 12 characters long, preferably more than 20. It should include mixed case letters, numbers, and special characters, and should not be used for other accounts. Never share your password with anyone.

- Enable two-factor authentication (2FA). Using a code from another source in addition to entering your password when logging in will give your account extra security. Most Tether wallets support these 2FA methods:

- SMS authentication

- Application authentication

- Security Key Authentication

- Avoid phishing attacks. Fraudsters may try to trick you into providing your login credentials or private keys. To protect yourself from this threat, avoid clicking on links in suspicious emails or messages. Do not provide your login credentials on dubious sites, and always check the URLs of the pages where you do so before entering your data.

- Update your software. It is important to update your wallet software and operating system regularly. These updates often include security patches that can strengthen your Tether wallet against known vulnerabilities.

- Create a backup copy of your Tether wallet recovery phrase. This set of words will help you regain access to your wallet if you lose the device it is stored on or forget the password. Be sure to keep a backup copy of this phrase in a safe place, offline. It is best to have it as handwritten text on a simple piece of paper.

How can you use USDT

Considering that Tether USDT is a digital analogue of regular money, the easiest way to use it is to buy other assets on a cryptocurrency exchange. You can buy Bitcoin, Ethereum, BNB, Cardano, Solana and other cryptocurrencies for USDT. You can also pay for many goods and services with Tether. Every day, more and more online stores begin to accept payments for laptops, smartphones, TVs and other gadgets in this cryptocurrency. Among them are Newegg, Amazon, AliExpress and others.

Tether is very liquid. It can be exchanged for dollars, euros, hryvnias at any time on exchanges or at exchange offices. It is also easy to withdraw them to a bank account or card using, in addition to the methods described above, P2P exchange platforms Binance P2P, LocalBitcoins, Paxful or direct withdrawal services such as Simplex, MoonPay or Wyre. These platforms allow you to directly withdraw USDT to a bank account or card without having to register on an exchange or exchange office.

One of the main advantages of cryptocurrencies is the ability to quickly and inexpensively transfer them anywhere. USDT transfers have a low commission, which attracts users even more. In addition, if you plan to invest in promising DeFi projects, startups or ICOs, Tether will be an excellent choice. Additionally, you can receive interest on its ownership, for example, by participating in the liquidity pools of the Binance exchange: USDT / BUSD, USDT / USDC, USDT / ETH.

Risks of using USDT

Note: A scam project is a fraudulent scheme that tries to trick you into giving up your money by offering high profits or fake investments.

Market volatility and other threats

Despite the declared stability, the Tether rate is still subject to fluctuations depending on the balance of supply and demand in the cryptocurrency markets, which can be especially noticeable for large amounts. In addition, inexperienced users can encounter phishing sites that imitate popular exchanges, wallets or USDT exchange offices.

By transferring money to such a wallet or “exchanger” you can immediately say goodbye to them. In addition, dishonest businessmen can create scam projects, attracting newcomers with the help of intrusive advertising, social networks and promises of quick profits. If you lose your vigilance and transfer your USDT to their account, the scammers will immediately disappear, leaving you with nothing.

Exchange scams and hacks

In addition to “gray” schemes, hacking of cryptocurrency exchanges is also actively practiced. For example, on August 2, 2016, the Bitfinex exchange became the victim of a hacker attack. As a result, hackers managed to steal 119,755 BTC (approximately 75 million US dollars at the exchange rate at that time). The cybercriminals quickly exchanged the stolen bitcoins for USDT, which led to panic in the cryptocurrency market.

This event shocked the owners of Bitfinex so much that they published a public letter to the hacker asking him to tell about the vulnerability in their security system for a very large reward (leave him 10% of the stolen), and a promise to drop all charges against him. However, this request remained unanswered. The owners of the exchange had no choice but to start paying compensation to all victims of this hacker attack. As of May 2024, the Bitfinex exchange has fully reimbursed its clients for all losses.

What will happen if USDT loses its peg to the dollar

If this happens, the USDT price will likely simply collapse, causing losses for its holders. A crowd of investors will rush to sell their USDT in panic, further increasing the pressure on its price. The loss of the peg to the dollar will undermine confidence not only in Tether, but also in other stablecoins, which could lead to their use for payments and investments ceasing, and negatively affect the entire crypto market.

In response to USDT losing its peg to the US dollar, government officials will likely further tighten regulations on cryptocurrency, which in turn will lead to additional restrictions on its use outside of crypto markets. As apocalyptic as this scenario may seem, it is not a zero-sum scenario, as the market has seen similar things in the past.

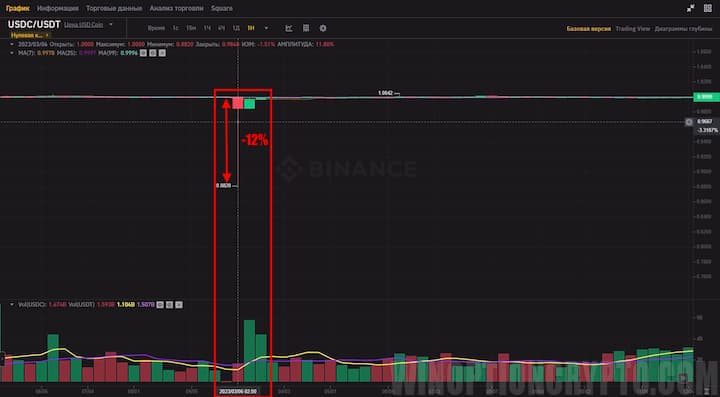

For example, in March 2023, the USDC and DAI stablecoins lost their peg due to the bankruptcy of three American banks at once: Silicon Valley Bank (SVB), Signature Bank, and Silvergate Bank. Circle, the company that issues USDC, reported that $3.3 billion of its reserves (more than 20% of all cash) used to secure the USDC stablecoin were stored in SVB. As a result, the price of the USDC token fell by more than 12% in one day.

At the same time, the DAI token was also in a very stormy situation, since more than half of its reserves were tied to USDC and related instruments. The situation was stabilized only after the intervention of the US Federal Reserve and the statement of its chairman about supporting the creditors of the above-mentioned banks. Only after that, USDC and DAI returned to their original prices. This incident forced a revision of the composition of the reserves for both stablecoins: USDC placed them in Bank of New York Mellon, and DAI increased the share of investments in physical assets.

We would like to add that the transparency of USDT reserves still raises doubts among many crypto experts, and there is a risk that it is not fully backed. Therefore, investors should definitely take these risks into account and take care to diversify their investment portfolios.

Conclusion

Tether (USDT) is one of the most popular cryptocurrencies. Due to its peg to the US dollar rate, it has the value of fiat money and the wide capabilities of digital assets. Tether attracts users with stability, convenience, liquidity, and the ability to make quick transfers without delays. In addition, USDT is widely used for issuing loans and other financial transactions.

But not everything is perfect. And so in our review of what is the Tether USDT cryptocurrency and how to use it, we examined in detail the problem of the opacity of the provision of this stablecoin and its high dependence on the issuing company - Tether Limited. We draw your attention to this and advise you to use capital management rules when creating your own investment portfolio, and not to invest all your funds in one asset.

See also:

How to buy cryptocurrency for rubles or dollars

Is cryptocurrency necessary in the modern world?

To leave a comment, you must register or log in to your account.