Most people do not understand why cryptocurrency was created, developed and exists. From the outside, digital coins are just a set of numbers that are stored on a computer, but upon closer examination of these issues, it becomes clear that cryptocurrency can change the global economy.

The essence and principles of operation of cryptocurrency

Using cryptocurrency, you can purchase goods in a store or make other purchases only in some countries and not in all stores. This limitation is due to several reasons:

- in most countries, neither the term “cryptocurrency” nor methods for regulating transactions with digital coins are enshrined in legislation;

- There is still a high level of distrust of cryptocurrencies among the masses of the population, since some of them are difficult to understand, while others are not convenient for everyday use;

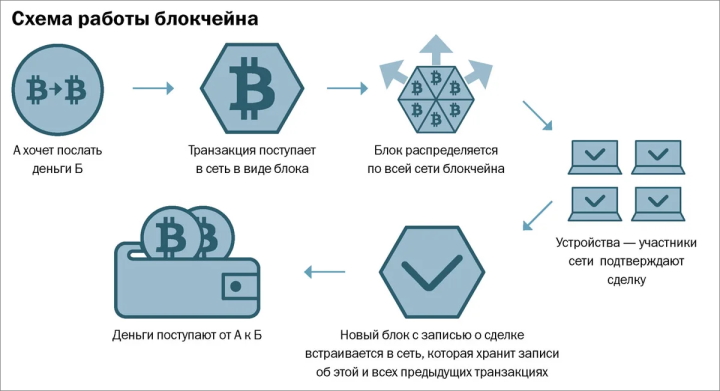

- low scalability of some cryptocurrencies, due to the peculiarities of the blockchain technology on which digital coins are based.

Speaking of scalability, when transferring cryptocurrencies to other users, network confirmation is required, and sometimes this process takes quite a long time. In particular, the Bitcoin network is so congested at some times that it takes several days to transfer funds. But it is worth noting that there are cryptocurrencies that allow you to carry out a huge number of transactions per second without any delays.

At the same time, blockchain, despite existing limitations, opens up new opportunities for the development of financial and other sectors using platforms built using this technology. Also, thanks to it, many social, economic and other problems can be solved.

The cryptocurrency itself is based on three principles introduced by the creator of Bitcoin:

- decentralization;

- scalability;

- anonymity.

And the use of cryptocurrencies, according to experts, will take macroeconomics to a completely new level, since one of the important features of digital money, due to which they have largely become popular, is the absence of a single control center. That is, blockchain technology allows people to independently manage various aspects of their life and finances.

Basic values of cryptocurrencies

Cryptocurrencies are characterized by the following features that determine the value of digital coins:

- Openness. Any user connected to the network of a specific cryptocurrency can access the code and information about mining methods. That is, every person has the opportunity to influence the development of a digital coin, and some developers allow changes to the source code.

- Anonymity. Blockchain platforms allow you to customize the level of anonymity that a business needs, and this feature of cryptocurrencies is valued by both ordinary people and companies.

- Decentralization. The absence of a single center for managing operations leads to the fact that all transactions within a separate network are carried out without the participation of third parties. That is, thanks to decentralization, system participants can reduce the amount of commission charged for transactions, as well as eliminate the dissemination of information about transactions and agreements, whereas in the traditional financial paradigm, banks or other organizations always participate in transactions.

- WITH

reducing inflation risks. In a standard economic system, money is printed on the instructions of Central Banks, while in the world of cryptocurrencies, the issue of digital coins is limited to a certain limit (for example, the maximum number of Bitcoin coins cannot exceed 21 million units).

reducing inflation risks. In a standard economic system, money is printed on the instructions of Central Banks, while in the world of cryptocurrencies, the issue of digital coins is limited to a certain limit (for example, the maximum number of Bitcoin coins cannot exceed 21 million units). - Safety. In a blockchain network, not only transactions, but also the cryptocurrencies themselves are protected from third-party interference, making it impossible for fraudsters to penetrate a user’s cryptocurrency wallet without login data. Also, cryptocurrency cannot be copied or counterfeited due to transparency, which cannot be said about real money.

Speaking of real money, cryptocurrencies have other advantages. Thus, the national currency is controlled by Central Banks, and this means that money is managed by a certain circle of privileged individuals, but in the cryptocurrency market all participants have the same rights and opportunities to manage the movement of digital coins, and access to the cryptocurrency market is open to any person.

When it comes to transferring funds, cryptocurrencies operate on the basis of blockchain technology, which ensures the transfer of information (or transactions) using relatively simple algorithms, while in the world of fiat money complex systems (for example, SWIFT) are required to carry out transactions in the digital space. the service of which costs many times more, which is why large commissions are charged, and the transfer itself takes much longer.

It is also worth noting that initially all cryptocurrencies were perceived as a type of digital money. But in 2014, the Ethereum platform was introduced, thanks to which a completely new type of smart contracts was created and the possibilities for using blockchain technology were expanded. “Smart” contracts can radically change the approach to business processes, since thanks to them, transactions between counterparties are now maximally protected due to the fact that it is impossible to make changes to the contract and this product also makes business processes more flexible.

The main disadvantages of cryptocurrencies

Cryptocurrencies have appeared relatively recently, which is why some disadvantages and shortcomings can still be observed in them, but as the blockchain improves, all of them can be eliminated. The disadvantages of digital money include the following:

- The lack of a legislative framework and, as a result, rules for regulating operations, which is why cryptocurrencies are very unpopular in some countries.

- High risks. Storing cryptocurrencies on third-party services (hot wallets or cryptocurrency exchanges ) risks the fact that they can be hacked by attackers, after which it is not possible to return such funds, while banks have guarantee funds or insurance payments.

- High volatility. The exchange rate of cryptocurrencies is constantly changing, and the price can either rise or fall quite sharply, which makes it impossible to use them as a stable means of payment, unlike the US dollar.

The disadvantages also include limited emission, due to which, as the number of coins in circulation increases, the difficulty of mining increases, as a result of which the consumption of electricity required for mining accelerates.

Expert opinions on cryptocurrencies

If we compare the opinions of experts (politicians, economists and technology developers) about cryptocurrency and blockchain technologies, they will be very different, since not everyone realizes the potential of digital money, and some, on the contrary, overestimate it.

Thus, earlier the Japanese Prime Minister said that cryptocurrencies cannot yet be considered a full-fledged means of payment and pointed out that Bitcoin is currently less reliable than real money. According to the Japanese Prime Minister, the country's leadership needs to wait a certain time to decide on the future of cryptocurrencies.

A different point of view is held by those specialists who are directly related to blockchain. Thus, Vitalik Buterin, who created the Ethereum cryptocurrency, stated that even his ecosystem has the potential for thousand-fold growth and in monetary terms this means that if this result is achieved, the capitalization of the cryptocurrency market will reach 200 trillion dollars, or 70% of all world wealth.

In general, many experts are confident that digital money is the future, but so far the prospects for the development of cryptocurrencies are not completely clear. The position of the governments of many countries, which currently do not even plan to develop a legislative framework for cryptocurrencies, also plays a significant role in this.

Do you need cryptocurrency?

Many experts are confident that digital money is the currency of the future, and blockchain can radically change the macroeconomics and social sphere of people’s lives. Therefore, in the future, with a high degree of probability, it will be introduced into many processes, including social, financial and political, as it has flexibility and other advantages.

See also:

- Cryptocurrency news

- How to buy cryptocurrency for rubles or dollars?

- What is Ripple and why do banks like this coin so much?

- Cryptocurrency rating

To leave a comment, you must register or log in to your account.