Trading options as a financial instrument with a specific expiration date and high profitability has existed on stock exchanges for decades. But binary options appeared relatively recently. The difference between options and binary options is quite large, but some traders, especially beginners, often confuse these two completely different concepts.

We are absolutely convinced, and experienced investors and traders will certainly agree with us, that without a correct understanding of special financial terms, professional growth in binary options trading is impossible. Therefore, we propose to clarify and determine the differences between options and binary options.

What are regular stock options?

A regular option is traded on an exchange and is a bilateral agreement, according to which the buyer of an underlying asset (stocks, commodities, futures, currencies , cryptocurrencies , etc.) acquires the right (but not the obligation) to sell (buy/sell) this asset in the future at an agreed price and at a certain point in time. Accordingly, the seller of an exchange-traded ordinary option will be obliged to sell or buy the asset from the buyer in accordance with the terms of the transaction.

Exchange (ordinary) options are divided into American , European and Asian. There is also a division into Call Option (to buy) and Put Option (to sell). These are the two main classifications of these financial instruments. There are many other types of division, but it makes no sense to consider them now.

Ordinary options on exchanges are used for various purposes, for example, for making speculative transactions and making a profit or hedging positions . This trading tool allows exchange players to significantly reduce risks. In this case, the possible profit is not limited in any way and depends only on the market quotes of the investment asset.

There are many options for operations with exchange options, but in order to receive income from them, a trader must have the appropriate level of training, understand the essence of exchange trading, and master fundamental analysis and technical analysis . In addition, the minimum starting capital to enter the stock market is several thousand dollars.

The main thing to understand is that binary options, which are gaining more and more popularity on the Internet, are very different from regular options. The latter are bought and sold on derivatives exchange markets, including on the Moscow Exchange, which is the largest trading platform not only in Russia, but also in Eastern Europe. For example, you can see the statistics of the derivatives market:

The structure of this exchange includes five markets on which transactions are made with different trading assets. Thus, on the commodity market, transactions are carried out with real goods (oil, grain, metals, etc.), on the stock market - with bonds and other securities. In the foreign exchange market, currencies of different countries are exchanged, and in the money market, repo contracts are concluded and loans are issued. Options and futures are traded on the derivatives market. As mentioned above, an option is the acquisition of the right to enter into a transaction with an investment asset before a certain date ( expiration ) on pre-agreed conditions. In fact, stock traders use this financial instrument for various purposes, including:

- To make a profit on the linear movement of the market - growth or decline;

- To hedge risks in investment activities;

- To generate income from non-linear trading. Options can be used to make money when quotes do not leave the corridor, on strong impulse movements, and in other cases.

To successfully operate with exchange-traded options, you must have experience working in the market with linear assets and clearly understand what kind of instrument this is. It is better to start studying options from the moment of your first investment in securities, since they allow you to insure risks (hedge positions). Let's look at this using the example of futures for shares of PJSC Gazprom. Let's say you buy this underlying asset for 22,450 rubles. You don’t know how much you can sell it for after some time. But by purchasing a Put option for a period of 3 months for 530 rubles, you buy the right to sell futures on PJSC Gazprom in 3 months at a fixed price of 22,450 rubles. That is, in this way you insure your risks in case futures quotes go down, since in this situation you can sell it for 22,450 rubles, losing only an insurance premium of 530 rubles. The movement of a futures contract often follows the movement of the stock itself, so the securities themselves can be insured with options:

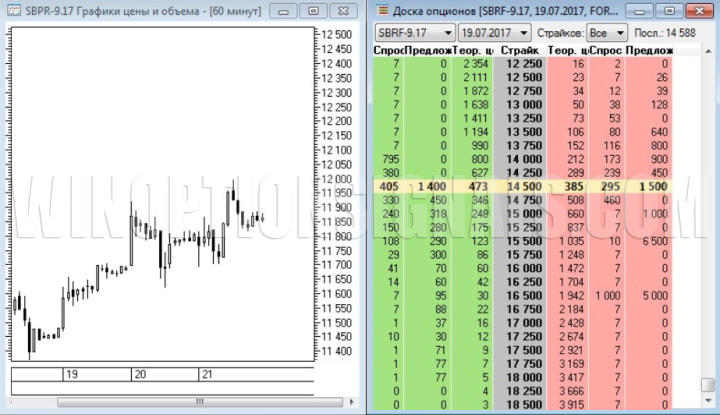

In addition to risk insurance , options allow you to make money on the linear movement of the asset price (up/down). For example, with current futures quotes of 12,250 rubles, for 240 rubles you buy the right (Call option) to purchase an asset at a price of 12,300 rubles in a month. If quotes rise to 12,900 rubles in a month, you buy the asset at the strike price of 12,300 rubles and thus earn 12,900 – 12,300 – 240 = 360 rubles. If the price falls or does not reach the strike price, you do not exercise the right of redemption and suffer a loss equal to the cost of the option - 240 rubles. Also, when buying a Put option with its cost of 220 rubles and a strike price of 11,900 rubles, to make a profit, the price must be reduced below 11,900 rubles by the cost of the option, that is, to 11,680 rubles, where a further decrease is the trader’s income:

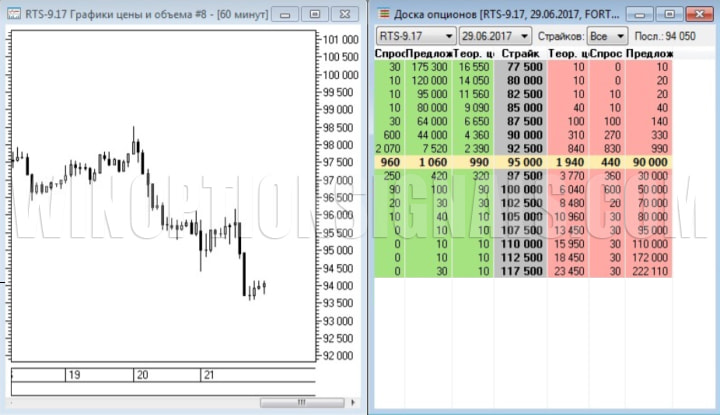

Designs that allow you to make money on non-linear price changes require an understanding of market processes and the ability to analyze the situation. Experienced stock traders recommend devoting no more than 10% of their capital to such operations ( money management ). Let’s say, with the cost of the underlying asset being 73,050 points, at a strike price of 74,000 points, you can purchase a Call option and a Put option for seven days for 760 and 1,740 points, respectively. At the same time, in order to make a profit, the quotes of the underlying asset must either rise above 74,000 - by 2,500 (760 + 1,740), or fall below the same amount. That is, in this case, it is not the direction of price movement that matters, but its power and strength:

As you can see, operations with ordinary options, in contrast to binary options, can be very diverse and help in creating an investment portfolio, increasing it and allowing you to insure risks.

Binary options and their differences from ordinary stock options

Binary options are a different financial instrument and are not directly related to market exchanges. The indirect connection is that binary options trading platforms show the actual price movement of the underlying assets from the exchanges on which they are actually traded. The terminology, as well as the procedure for opening positions in binary options, are borrowed from exchanges. This refers to Call and Put transactions, expiration dates, and so on.

The task of a participant in the binary options market is to build a correct forecast of the direction of movement of the underlying asset quotes. Brokers can also provide a large number of types of binary options to choose from. This is where the similarities with options end, and further there are differences between binary options and regular ones.

To work with binary options, the user does not need fundamental knowledge in the field of exchange trading. This financial instrument is much simpler, clearer and more accessible for investment. To correctly predict the direction of the market , it is enough to analyze using indicators for binary options , available on the online trading platform of almost every binary options broker .

- You don't need a lot of capital to start trading. Thus, the Pocket Option broker provides the opportunity to trade binary options if the trader has $5 on deposit. The same conditions apply to the binary options broker Quotex ;

- The minimum cost of opening one position with most binary options brokers is $1. Moreover, the potential profit is known in advance and reaches 90% from one successful transaction;

- For options trading, binary options brokers provide a variety of underlying financial assets, including shares of major issuers, commodities, indices, currency pairs, and cryptocurrencies. The choice of investment object always remains with the bidder;

- Binary options have short expiration periods, although there are also long-term ones. Thus, trading turbo options (scalping) can last 30-60 seconds, and sometimes less. A trader has the opportunity to open a large number of orders in one day and quickly disperse the deposit (or, conversely, drain part of the deposit ).

Based on the above, we can come to the conclusion that options differ from binary options and have many advantages, and are also much more attractive to work with, especially for beginners in online market trading. At the same time, we are not talking about easy money, since in order to achieve success and get regular profits, you will have to be patient and spend time learning and reading books on trading .

Conclusion

So, now you understand the difference between options and binary options. As you can see, exchange options are a tool for professionals who have extensive experience working with linear assets and understand the pricing mechanism and the course of exchange processes. They offer interesting opportunities for earning money, but it is better to take a closer look at them after several years of serious work with the market. Binary options provide an easy start with a small investment capital, allow beginners to quickly get used to the trading platform, and at the same time have a potentially high level of income, which attracts not only beginners, but also experienced traders.

See also:

To leave a comment, you must register or log in to your account.