Anyone investing in any field of activity strives not only to minimize losses, but also to significantly improve financial results. Binary options traders are no exception. Trading them involves increased risks. This type of income has its advantages and disadvantages. The main disadvantage is that the chance of losing the bet amount is higher than the chance of receiving income.

Anyone investing in any field of activity strives not only to minimize losses, but also to significantly improve financial results. Binary options traders are no exception. Trading them involves increased risks. This type of income has its advantages and disadvantages. The main disadvantage is that the chance of losing the bet amount is higher than the chance of receiving income.

For example, the profit from one option is set at 75%. The percentage of profitable contracts should be: 100% / (100% + 75%) = 57%. If the practical result is less, the trader gradually loses funds on the deposit. Trading will be profitable if out of every 10 options at least 7 close in positive territory. To achieve the maximum effect from trading, investors use various approaches to reduce risks. A good way of “safety net” that allows you to cover expected losses is hedging. Thanks to hedging transactions in binary options, you can significantly reduce risks, thereby protecting your deposit from being drained . Hedging can also be combined with risk reduction methods such as money management and risk management .

Risk hedging is a current way to minimize risks

Hedging is not a separate trading strategy ; rather, it complements the one used by the trader. The decision to purchase an option is made based on a signal from an effective trading system with a profitable number of transactions of at least 60%.

Let's look at a few examples of real trading situations.

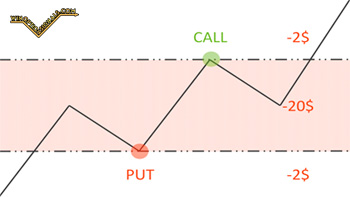

1. An option that is unprofitable if immediately closed is otherwise called Out-of-The-Money . If a Call position is open, the quotes fall below the strike level, Put – respectively, higher. An option is in deep loss (OTM) when the current price is a significant distance from the strike price.

Many investors decide to use hedging to cover the losses of a failed trade, when it would be better to admit the mistake and lose money.

Example:

The trader put $10 down, but the market turned in the other direction. A logical decision would be to open a buy deal at the next extreme, but not for options: the investor incorrectly analyzed the situation and himself created unfavorable conditions leading to the loss of both bets. Hedging didn't help.

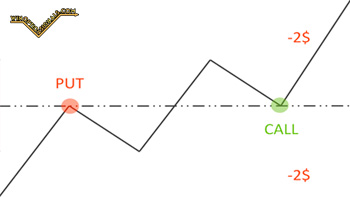

2. At-The-Money is an option that brings neither profit nor loss - the trader gets back the invested amount. This occurs when the opening price and closing price of the contract are the same.

Example:

If you purchased a Put option, and the quotes suddenly went to the resistance line and broke through it, we expect that when the new support level is confirmed, the price will touch the line on the other side. After this, we conclude a Call transaction for the same amount and with the same expiration time as the previous contract. This way we will level out the positions, reducing the overall result to zero. By hedging, the investor forms a break-even zone.

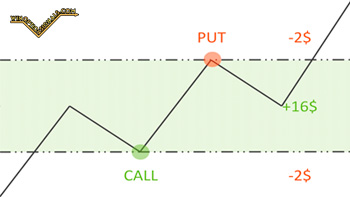

3. If the option is closed at the current level and it is profitable, it is called In-The-Money or “in the money”. A Call option gives a positive result if the quotes exceed the strike price. A put option makes a profit under opposite conditions. When the current price is a significant distance from the closing price, the contract is considered to be “in the money” (ITM).

To conclude transactions, find the maximum and minimum for a certain period, opening Put or Call positions at the bottom and top of the channel, respectively. Trading is carried out in a price corridor, this approach is especially effective with minor fluctuations. Most often, both bets turn out to be profitable.

Example:

Based on the signal from the trading strategy, we open a Call position. The trend is favorable, the price rises and reaches the upper line of the corridor. The investor must in this case open a new deal, now in the opposite direction. The bet size and expiration time are the same as for the first option. Now the trader will not lose money in any development of events: the contracts will either reach the breakeven zone or close with a profit.

Rules for opening trades

Insurance is carried out in several steps:

- receiving a signal from your trading strategy;

- opening a deal, choosing the option expiration time;

- quotes are moving in the right direction, but the strategy signals a reversal;

- we conclude a contract opposite to the first. The expiration time must be the same as the first option so that they close at the same time;

- We are waiting for the result.

Example No. 1

Let's look at part of the chart of the EURGBP currency pair, interval - H4.

Price fluctuations occur in a sideways channel; support and resistance lines are established on the chart. When the upper level was touched, a Put position was opened, then the quotes reached the channel border, which is the support line - a buy deal became relevant. When the time for options to expire came, both transactions were closed with income, the price of the asset remained in the fixed corridor.

Example No. 2.

Currency pair - EURGBP, period - M5.

When the quotes crossed the support level, the trader purchased a Put option, setting the expiration time to 4 hours. The price moved according to plan for some time, a new support level formed, then the quotes changed direction and rushed up. Having pushed off from the resistance line, it demonstrated a rollback, then began to grow again, finally breaking through the level on the second attempt. The trader studied the situation and, after waiting for the key line to touch, entered into an increase transaction; the expiration time of both contracts coincided. As a result, the first transaction was unsuccessful, and the second was closed in the money.

Finally...

Hedging as one of the ways to effectively manage capital is popular among many investors. Initially, it was used in the Forex market, but to reduce risks, this approach is no less successful on binary options, allowing, under a successful set of circumstances, to receive double income. Traders use hedging when trading different types of options - from turbo to long-term.

Before using hedging, make sure your broker offers flexible expiration timing, otherwise the tactic will not work. In addition, your strategy must ensure profit in 60% of transactions, only in this case you will achieve a tangible effect.

See also:

Where to get money to trade binary options

To leave a comment, you must register or log in to your account.