The growing popularity of the binary options market attracts fraudulent brokers , the number of which in this segment has been constantly increasing recently. Therefore, traders are gradually moving beyond the borders of their country in search of foreign brokers and American binary options, which, due to the peculiarities of local legislation, are considered more reliable. However, traders do not take into account that in a number of countries, current regulations prevent binary options trading.

The growing popularity of the binary options market attracts fraudulent brokers , the number of which in this segment has been constantly increasing recently. Therefore, traders are gradually moving beyond the borders of their country in search of foreign brokers and American binary options, which, due to the peculiarities of local legislation, are considered more reliable. However, traders do not take into account that in a number of countries, current regulations prevent binary options trading.

Thus, many investors consider American binary options brokers (binary options in the USA) as one of the most reliable partners. But in reality, even before starting cooperation with such companies, some difficulties may arise. The fact is that American legislation directly prohibits trading in American binary options, but those brokers that offer similar services here, that is, in the CIS countries and Europe (for example, brokers Pocket Option , Quotex , Binarium and others) are prohibited in the USA. Essentially, when working with these binary options brokers, the trader is not directly trading, but placing bets.

But if we do not consider the above feature, then American brokers and binary options in the USA are indeed considered one of the most reliable. This is largely due to the peculiarities of local legislation, which strictly regulates the activities of such companies.

American binary options

As noted above, the activities of simple binary options brokers are prohibited in the United States. However, this type of binary contract (American binary option) is used in trading on the American market. In the United States, there are a limited number of brokers (more precisely, exchange platforms) where transactions with such financial instruments are carried out.

At the same time, American binary options, despite the similarity with those contracts traded in Europe, Russia or the CIS countries, have an important feature. In the first and second cases, operations with digital contracts are carried out according to a standard scheme: the direction of the price for the selected asset, the expiration date and the amount of profit are determined. However, American binary options can be closed before the specified expiration time. In this case, the amount of profit that a trader receives in the event of a successful operation is reduced by several percent.

In addition to binary options in the United States, some European brokers also offer trading in foreign binary options. Such companies include brokers Pocket Option and Quotex, which offers returns of up to 92%.

Binary options in the USA

In 2008, the American Senate approved a bill according to which digital contracts (binary options) are officially recognized as one of the financial instruments. Thanks to this decision, this area began to actively develop in the United States, as a result of which competition increased, and many local brokers went beyond the local market in search of new clients.

At the same time, the number of scammers and types of fraud increased, which forced the American authorities to ban binary options trading, classifying this type of activity as gambling. That is, after just two years, unofficial brokers lost the opportunity to conduct transactions with foreign binary options. There are no exceptions to this rule, since such American companies can receive large fines, and their owners and employees are sent to prison.

At the same time, the number of scammers and types of fraud increased, which forced the American authorities to ban binary options trading, classifying this type of activity as gambling. That is, after just two years, unofficial brokers lost the opportunity to conduct transactions with foreign binary options. There are no exceptions to this rule, since such American companies can receive large fines, and their owners and employees are sent to prison.

Moreover, binary options brokers from other countries, which can freely provide their services in the CIS or Europe, do not provide their services to traders from the United States. If such companies begin to cooperate with American citizens, then the American authorities are able to impose sanctions against these brokers. In particular, companies can suffer greatly financially for such offenses.

Where to trade binary options in the USA

American binary options are in high demand among traders. In the United States today there are several companies that provide access to work with such digital contracts. These brokers include NADEX, a company that is on the list of the most popular today.

Binary options exchange in the USA – NADEX

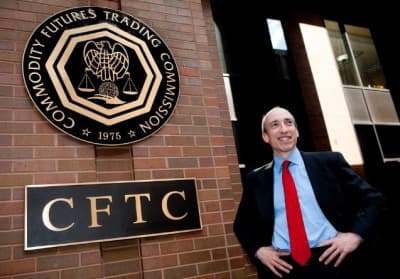

The NADEX exchange officially cooperates even with traders living outside the United States. Subject to a number of conditions, foreign citizens can register on this site. The activities of this exchange are strictly controlled by the CFTC regulator, which reports directly to the American government.

NADEX was officially registered in 2009, the company's office is located in Chicago. This exchange offers its clients to open one of four available account types. Two of them are intended for individuals from the United States and foreign countries, respectively. Beginners also have access to a demo account , and American companies have access to a business account.

To open an account with NADEX, citizens of other countries will have to provide the following information:

- place of permanent residence;

- date of birth;

- Taxpayer Identification Number or Social Security Number.

At the same time, each registering user is required to provide scanned copies of the specified documents confirming the accuracy of the entered data.

At the same time, each registering user is required to provide scanned copies of the specified documents confirming the accuracy of the entered data.

NADEX supports only two ways to replenish your deposit : using a bank card or bank transfer. The broker does not offer other options for crediting funds to the account.

At the same time, NADEX allows you to start trading binary options without going through the stage of registration and identity verification. For this purpose, a demo account has been created, which is opened upon a previously submitted application. You can use this tool without restrictions. When you start demo trading, the virtual balance contains 25 thousand dollars.

The operating principle of the NADEX platform is not much different from the platforms of other binary options brokers. In each case, traders need to guess the direction of price movement and the expiration date. If the choice is made incorrectly, the player loses the transaction amount. However, the interface of the NADEX platform is noticeably different from other similar platforms, and therefore at first you will have to get used to working with this tool.

Binary options exchange in the USA – CBOE

CBOE has been in business since 1973, but only recently began offering brokerage services for binary options trading. The peculiarity of this organization is that it works only with experienced traders. In this regard, the company allows you to open transactions only with a sufficiently large deposit and with higher transaction amounts than with conventional brokers. You should also take into account that CBOE, unlike many other binary options brokers, does not offer bonuses when replenishing an account, does not provide advice or training.

At the same time, this company cooperates with traders from Russia, CIS countries and the European Union. Like other American brokers, registration with CBOE is carried out in several stages, during which clients must provide reliable information about themselves.

Binary options exchange PHLX

The company, offering its services in the field of stock trading, was registered in 1991. Moreover, this broker first offered trading in foreign binary options back in the 80s, providing access to this financial instrument to both American and foreign traders. Trading binary options through PHLX is possible subject to a deposit of several thousand dollars. But despite this, the broker is popular among traders, since all transactions through this company are carried out on the world exchange, making each operation as transparent as possible. That is, if successful, all clients of the company receive the payments due to them in full.

Single American regulator – CFTC

This organization, officially registered in 1975, is responsible for control over operations carried out with trading assets (including foreign binary options) on exchanges. The activities of the CFTC are monitored by the American government, thereby preventing the possibility of collusion between the agency and market participants.

This organization, officially registered in 1975, is responsible for control over operations carried out with trading assets (including foreign binary options) on exchanges. The activities of the CFTC are monitored by the American government, thereby preventing the possibility of collusion between the agency and market participants.

The responsibilities of this organization include the following:

- ensuring the safety of every investor;

- monitoring compliance with business etiquette in interactions between market participants;

- ensuring openness of both markets and operations;

- monitoring the activities of brokers (more precisely, how companies comply with prescribed requirements).

The obligations that all US brokers must comply with include the following:

- Recalculate clients every day at the end of the trading session;

- warn each client about possible risks;

- conduct training for its own employees in the technical aspects of exchange trading and the ethics of communication with clients;

- promptly notify traders about account status.

The above list of rules that American brokers are required to comply with is incomplete. Thanks to such strict control by the CFTC, companies whose activities are regulated by this organization offer traders a comfortable trading environment.

Taxes from binary options in the USA

The American authorities strictly control the receipt of income of the population and corporations, so the majority of the population there regularly pays taxes on any activity, and especially financial.

Therefore, the profit that traders receive in the process of exchange trading is also subject to mandatory taxes. In this case, the amount that the investor must deposit is determined as net income without taking into account the amount of funds invested in the transaction. In the United States, strict measures are taken against traders who avoid paying taxes, including imprisonment.

Conclusion

Trading American and foreign binary options through American and European brokers is considered a more reliable way to make money than cooperation with similar companies from Russia or the CIS countries. However, due to the peculiarities of US legislation, it is more difficult to start working with this financial instrument here.

For this reason, access to American binary options brokers is closed to novice traders. This is explained by the fact that you can trade binary options in the USA only if you replenish your deposit by several thousand dollars. On the other hand, due to the strict regulation of such transactions by the government in America, the risk that a fraudster is hiding behind the guise of a broker is minimized.

See also:

Psychology in trading - what does a beginner need to know?

To leave a comment, you must register or log in to your account.