Trading binary options, despite its apparent simplicity, requires care and the ability to correctly predict price changes in the market. Traders who are not familiar with the rules of binary options trading often make mistakes that lead to losses. Even those who use their own strategies for binary options are not immune from losses. Therefore, we will further discuss trading rules that will help beginners and experienced traders achieve stable profits.

Content:

- Rule No. 1: Choose the Right Deposit for Trading;

- Rule No. 2: Keep a Trading Diary;

- Rule No. 3: Do Not Use the Martingale System at the Initial Stage;

- Rule No. 4: Аbility to Stop in Time;

- Rule No. 5: Market Аnalysis First;

- Rule No. 6: Trade Only with the Trend;

- Rule No. 7: Open No More than Two Trades at a Time;

- Rule No. 8: Аdhere to the Rules of Money Management and Risk Management;

- Conclusion.

Rule No. 1: Choose the Right Deposit for Trading

The first rule in binary options trading that new traders do not follow is to use the minimum deposit too often. This approach will not bring significant income, and with a series of unprofitable transactions it can “throw you out” of the market. To avoid such cases, it is recommended to replenish your account with an amount that allows you to withstand several losing trades in a row. This is especially true when using new strategies, indicators or any other trading methods.

It is optimal if the deposit is enough to complete at least ten unprofitable trading operations, but it is better if the amount is enough for a larger number of transactions. If you can afford less than ten trades, then you have few options for trading. In such conditions, two or three incorrect forecasts can result in about 50% of your trading account being lost. This will cause additional emotional stress and a desire to recoup, which most often entails even more losses. Therefore, proceed from the amount you invest in one trade, and if it is $10, then your deposit should be at least $100, and even better, $200 or more.

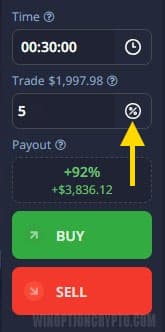

You can also calculate the minimum transaction as a percentage, which will be more convenient. Pocket Option broker and Quotex broker allow you to do this automatically. Suppose you decide that you will allocate 5% of the deposit for each transaction. In this case, you do not need to independently calculate how much it will be, for example, from $157. To use this function, at the first and second broker on the trading panel you need to switch the setting of the amount from conventional units to percentages. In Pocket Option this button looks like this:

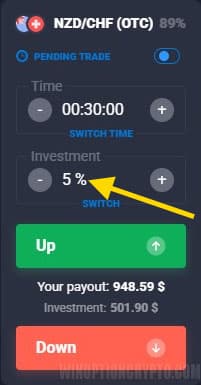

In Quotex, this function is enabled here:

Then all you have to do is set the required percentage, and the system will automatically calculate the transaction amount.

Rule No. 2: Keep a Trading Diary

A trading diary is a tool that helps you find and correct errors in binary options trading. It is recommended to record each transaction made here, indicating all its details. It can be:

- price data;

- analysis details;

- outcome of the transaction (profit or loss);

- the reason why the transaction was made;

- (required) analysis of the completed transaction, where all errors or, conversely, correct actions are written down.

After at least a few trades, you will be able to create charts and graphs showing trading account information and much more. Below you can see an example of such diagrams:

If you trade through a broker Pocket Option or Quotex, then this information can be found in your personal account in the analytics section. In addition to charts, you can find data on transactions, time, assets, amounts and much more. Thanks to the information received, you will be able to see what you are doing right and wrong, what to pay attention to in your binary options trading, or what to improve.

Rule No. 3: Do Not Use the Martingale System at the Initial Stage

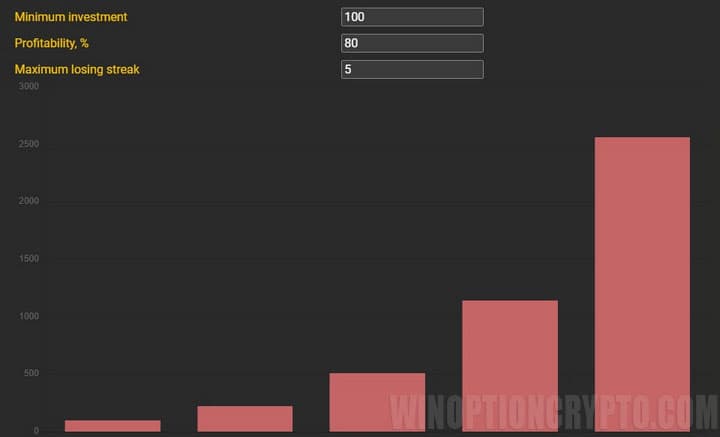

The principle of the Martingale system is as follows: when receiving a loss, the trader opens the next trade, doubling the investment amount. For greater convenience, some traders use a calculator:

It is worth understanding that with this approach, the total income can cover losses, but to make a profit you need a large deposit and the correct choice of the direction of price movement for most transactions. If you do not have enough capital or you incorrectly determine the trend , then you can “drain” your deposit quite quickly. Beginners who, due to lack of experience, do not know all the nuances of such binary options trading are especially susceptible to losses when using this method.

To avoid such consequences, it is recommended to avoid using this system at the initial stage. In some cases, it can bring profit, but if you do not stop in time, you can lose your entire deposit.

Rule No. 4: Аbility to Stop in Time

For some traders, trading binary options evokes the same emotions as gambling. Because of this, they cannot always stop in time when receiving a loss and a profit. If a trader has made two or three profitable trades, he may feel he has understood the market, and the next trade will also bring profit. However, the trader will want to win back if the next position is closed at a loss. If you receive another loss, emotions will begin to prevail over reason. Instead of waiting for a signal or the right moment, trades will be made in a row to return what was lost.

It is essential to understand that this field of activity cannot be profitable every day. Not only are individual transactions unprofitable, but also entire days when market behavior becomes difficult to predict. It applies not only to beginners but also to professional traders. Therefore, to save money, it is recommended to stop when three of your trades in a row have resulted in a loss. You must analyze your decisions and the market to understand the mistake at this stage. The optimal way out of this situation would be a temporary cessation of trade.

To become more prepared for trading psychologically, check out our article - “psychology in trading” .

Rule No. 5: Market Аnalysis First

Financial markets do not tolerate traders who act on intuition or follow their own emotions. Success directly depends on a person’s discipline. If you act relying on your intuition or emotions, then any strategy will become unprofitable. Discipline is considered one of the main tools necessary to achieve sustainable results.

The success of trading is determined by several factors. And after cold reason comes the ability to analyze and follow your forecasts. In order to increase the effectiveness of your actions, you should draw up trading plans daily before you start trading. It is also recommended to develop discipline, which will require a lot of effort, but will ultimately bring a positive effect.

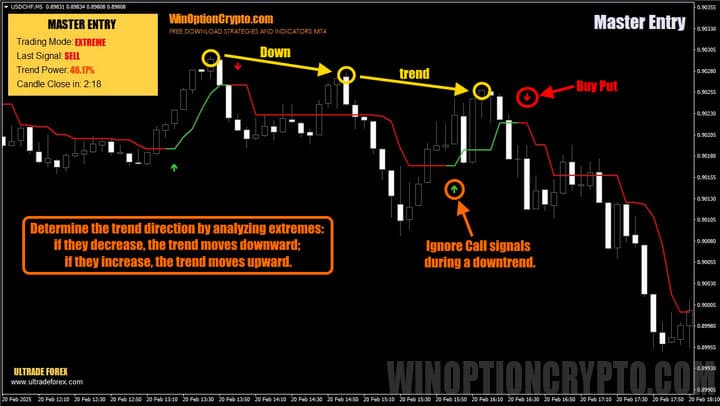

As an example, consider the Master Entry indicator and its signals. Having carried out a simple analysis, it was possible to understand that the trend at that time was downward, which means we should only use signals for Put options. And after the red arrow appears, we could buy Put. But if we had not carried out the analysis and relied only on intuition, we would most likely have opened trades using the Call signal, which would have brought a loss:

To avoid unreasonable losses, you should trade according to the rules and, after analysis, focus not on intuition, but on clear signals.

Rule No. 6: Trade Only with the Trend

You can find a sufficient number of indicators and strategies on the Internet that work in flat markets, but beginners should better pay attention to trend-based methods. We have already shown an example of making trades following the trend in the previous rule. But a trend is not based on just one direction up or down. Therefore, inexperienced traders, as well as professionals who for some reason do not know about the trend, should study the following topics:

- How does a trend work in markets ?

- Identifying and using bullish and bearish trends ;

- Market phase changes ;

- How to determine a flat in the market .

It is important to understand that 90% of trading systems can be profitable if you choose signals that correlate with the trend. Even trading using moving averages will work according to this rule:

The image above shows two simple moving averages with parameters “14” and “30”. If you use each intersection of these lines, then during a flat you can lose your entire deposit. If you use them only during a trend, then crossing in the direction of movement is more likely to bring profit. The same applies to any indicators whose signals can be used according to the trend.

Rule No. 7: Open No More than Two Trades at a Time

Analysis and decision-making provoke stress, which has a bad effect on the psychological state. And the more data you have to analyze, the higher the likelihood of making mistakes. Therefore, you should not open more than two transactions at the same time. It's even better to limit yourself to one trading asset and one trade at a time. When a beginner ignores this rule and opens, for example, three trades at the same time, this, in addition to complexity in the analysis, increases risks, since potentially each of the trades can be closed at a loss. This, in turn, will cause a desire to recoup, as we already wrote about earlier. The result is the loss of the entire deposit or a significant part of it. You should also not open more than 10 trades during the day if you are a beginner. Over time, you can increase this number and trade 20-30 transactions per day.

If it is difficult for you to adhere to this rule, then you are recommended to periodically take time off from your current activities during the working day and devote time to other activities. It could be just rest, a walk, a gym or similar activities.

Rule No. 8: Аdhere to the Rules of Money Management and Risk Management

We have already touched lightly on money management and risk management. MM and PM in binary options allow a trader to avoid unnecessary losses even with a long series of losing trades. It is precisely what the essence of trading is based on: when your total profit covers your total loss. Therefore, it is vital to "stay afloat" as long as possible. Suppose your deposit is divided into many parts, and even after ten losing trades in a row, you still have the opportunity to make trades. In that case, you can regain what you lost and maybe even become a profit. If your deposit allows you to make only a few losing trades, then the chances that you will be able to make a profit are minimal.

In more detail, money management is responsible for managing capital or working with a deposit. With it, you determine:

-

how much loss you can afford in a day;

-

what percentage of the deposit should be allocated to one transaction;

-

What percentage or dollar loss limit can you afford per week?

Risk management allows you to reduce risks using the following rules:

-

setting the number of losing trades per day;

-

setting the number of trading assets on which trading is carried out;

-

abandonment of the Martingale system;

-

refusal to trade assets that have a low rate of return;

-

refusal to transfer capital to management;

-

refusal to trade using unverified signals.

Each trader can change these rules and use only those that he considers necessary. However, it is important to adhere to them, as this will help protect your trading account from losses and help you stay in the market for a long time.

Conclusion

Binary options trading rules allow traders to improve the efficiency of their trading systems and earn more profits. Of course, these are not all the rules that help in trading binary options, but by adhering to even these basic recommendations you can reach a more professional level in trading.

See Аlso:

- Binary options trading platforms

- How to choose a binary options broker?

- What to do if the broker does not withdraw money

- Official binary options brokers in Russia

To leave a comment, you must register or log in to your account.