One of the most common and well-known technical analysis indicators is Stochastic . Unlike trend methods, they react to market changes much faster and are able to provide timely and even advanced signals. For this reason, the use of Stochastic on volatile financial instruments helps to increase the number of profitable trades with more accurate entries, and therefore higher profits. In this article we will look at the intricacies of using this indicator as part of a strategy for trading binary options .

Indicator parameters

- Working platform: MetaTrader 4

- Tradable currency pairs: highly volatile

- Optimal timeframe: no restrictions

- Suitable option expiration date: depending on the TF

- Trading time: 10.00-20.00 Moscow time

- Recommended brokers: Quotex , PocketOption , Alpari, Binarium .

How Stochastic works

The stochastic oscillator is based on the idea of measuring the strength of current price movements relative to the range of previous fluctuations within a given period. With its help, you can successfully determine overbought and oversold levels, as well as acceleration points in price movements on volatile instruments. Typically, such an indicator is displayed in a separate window under the price chart in the form of two lines fluctuating in the range from 0 to 100%.

Traditional signals for Stochastic are when its lines cross the levels 70 and 30. Depending on the market situation, instrument or other technical indicators that are used in conjunction with Stochastic, signal levels can change, for example, to 80 and 20.

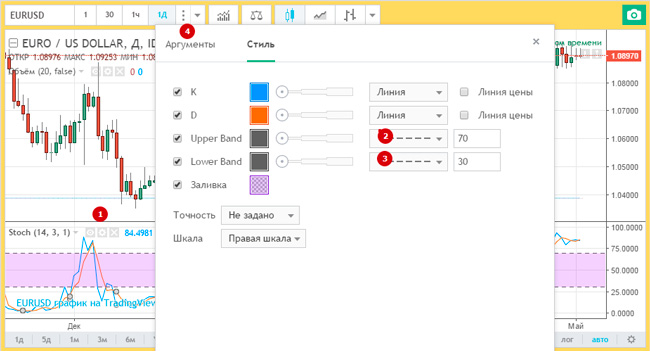

In the chart below you can see the indicator itself:

Rules for trading binary options using a stochastic oscillator

To trade Stochastic, you can use any chart timeframe . However, for binary options the M1 scale is most suitable. It is convenient to trade options with short expiration dates on such a TF. It is beneficial to use this indicator on those trading instruments that have high volatility and also have a pronounced general trend.

To start using the indicator, just install it from any “live” charting service. To begin with, you can set the oscillator settings to 14/3/1, and set the signal levels to 30 and 70.

Let's look at the rules for working with Stochastic signals.

If at the moment there is a general downward trend in the market, then:

- We monitor the behavior of the oscillator lines and wait for the moment when they enter the overbought zone above 70 as a result of a local correction.

- After the lines intersect and turn downward, we buy a Put option with a period of 2-5 minutes, expecting a decrease in the price of the asset.

If there is an upward trend in the market, stochastic oscillator signals are processed as follows:

- We wait until, as a result of a local correction, the indicator lines go below level 30, demonstrating that the asset is oversold, and then turn upward and intersect.

- We buy a Call option for a period of 2-5 minutes in anticipation of an increase in the price of the asset.

As can be seen from the described rules, using a stochastic oscillator you can receive signals about price reversals and open options at the very beginning of the movement. In the examples given, TF M1 is used, for which options with an expiration period of up to 5 minutes are best suited. To calculate the maximum risk for transactions, you should apply the standard rule of capital management - limit each entry to an amount of 5% of the capital amount.

Conclusion

The main difference of the stochastic oscillator is that it can be used separately, without additional indicators and filters. Nevertheless, trading efficiency can be significantly increased by selecting the optimal parameters for Stochastic, as well as supplementing it with other oscillators. This way you can reduce the number of false signals and increase the overall profitability of the strategy.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.