The strategy for binary options Asymmetric Deviation System, on the one hand, includes standard indicators , but on the other hand, these same indicators use a new operating algorithm, which allows you to receive high-quality signals with an expiration amounting to just one candle from the M1 time frame and three candles from all other times frames.

Characteristics of the strategy for binary options Asymmetric Deviation System

- Terminal: MetaTrader 4 .

- Time frame: M1-H1.

- Expiration: 1 candle or 3 candles (depending on the time frame).

- Types of options: Call/Put.

- Indicators: Asymmetric EMA Deviation, BB Buy Sell Zone Indicator.

- Trading instruments: all currency pairs.

- Trading hours: 9:00-17:00.

- Recommended brokers: Quotex , PocketOption , Alpari, Binarium .

Installing Asymmetric Deviation System strategy indicators in MT4

Indicators are installed as standard in the MetaTrader 4 terminal.

All indicators are installed with default settings.

To avoid setting up the chart yourself, at the end of the article you can download indicators and a template for this strategy.

Instructions for installing indicators in MetaTrader 4:

Trading rules using the Asymmetric Deviation System strategy

There are two options for opening trades in this strategy, but they are as simple as possible and work on the same principle:

- Opening a trade when the indicators are at their peak values.

- Opening a trade when the indicators cross their average.

Both options work equally effectively, and sometimes can appear sequentially.

Method No. 1

Let's look at the rules for entering a trade using the first option. To open a Call option you need to:

-

The price was in the lower zone of the BB Buy Sell Zone Indicator and touched or crossed the lower line from top to bottom at least once.

- The yellow line of the Asymmetric EMA Deviation indicator was below the “-1.0” level, after which it crossed it from the bottom up and closed above this level. The white bars of the histogram should be above the zero level.

To open a Put option you need to:

- The price was in the upper zone of the BB Buy Sell Zone Indicator and touched or crossed the upper line from bottom to top at least once.

- The yellow line of the Asymmetric EMA Deviation indicator was above the “1.0” level, after which it crossed it from top to bottom and closed below this level. The white bars of the histogram should be below the zero level.

Method No. 2

To open a Call option using the second option, you need to:

- The price crossed the middle line (yellow dotted line) of the BB Buy Sell Zone Indicator from bottom to top, and the candle closed above the line.

- The yellow line of the Asymmetric EMA Deviation indicator crossed the zero level from bottom to top.

For a Put option you need to:

- The price crossed the middle line (yellow dotted line) of the BB Buy Sell Zone Indicator from top to bottom, and the candle closed below the line.

- The yellow line of the indicator crossed the zero level from top to bottom.

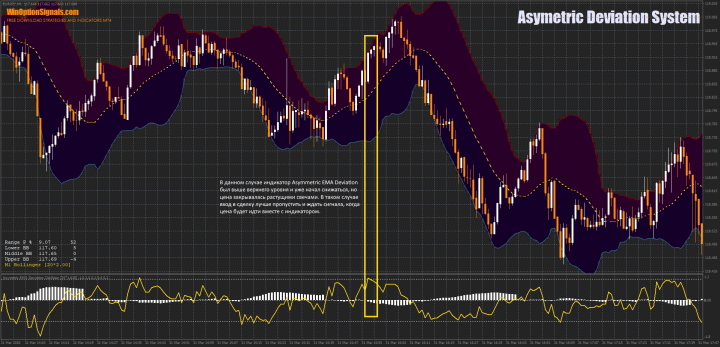

I would like to note that there are situations when all the conditions are met, but you should not enter into a deal:

You should always pay attention to the closing of the candles, and if it does not coincide with the direction of the indicator, then it is too early to enter a position.

Also, do not forget that this strategy will show the best results when working with the trend. Therefore, it will not be superfluous to know what a trend is and how to determine it .

Examples of trading using the Asymmetric Deviation System strategy

Now that the rules are known, let's look at example trades on a chart to reinforce our understanding.

For example, we will take the M1 chart with an expiration equal to three candles.

Currency pair - EUR/JPY.

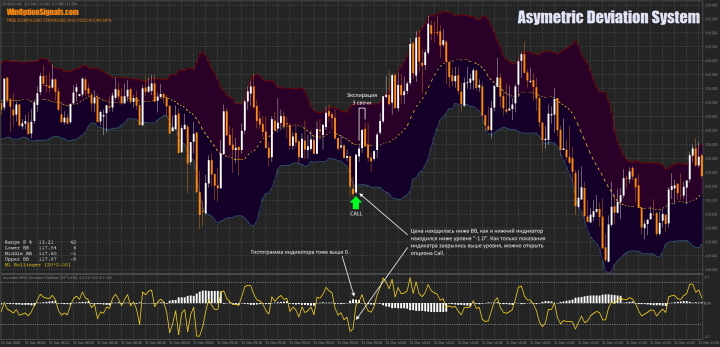

Opening a Call Option

This example shows how the conditions for opening a transaction according to the rules of the first scenario are met:

Note: Please note that an expiration equal to one candle would also bring profit.

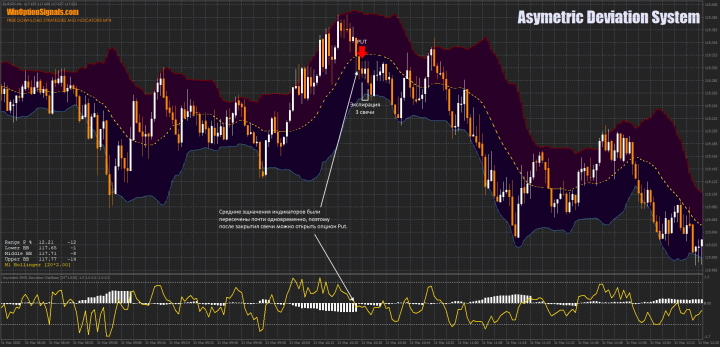

Opening a Put option

Since the first option has been considered, here is an example of a transaction according to the rules of the second option:

Note: Please note that an expiration equal to one candle would also bring profit.

Conclusion

Although this strategy for binary options includes indicators built on standard algorithms, it still allows you to make profitable trades on different time frames.

The main thing is not to forget about working with the trend and competent money management .

Also, for successful trading, it is recommended to make transactions only through a trusted broker. If you have not yet found one, then you can familiarize yourself with our rating of binary options brokers and choose the one you like.

Download indicators and template for the Asymmetric Deviation System strategy

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also:

To leave a comment, you must register or log in to your account.