The cryptocurrency market has many features, but investors often pay attention to its high volatility: within a day, asset prices can change by 5, 10, 15 or more percent. Such fluctuations are typical only for this segment of the financial world and are not typical for binary options , the Forex market, stocks, bonds and other securities.

This feature of cryptocurrencies makes the digital coin market stand out from the rest, since here traders can earn a lot of money within one day. Below is a cryptocurrency volatility index that includes Bitcoin , Ethereum , Litecoin , Dash and Monero. This parameter is determined by a formula that takes into account the market capitalization of the specified assets:

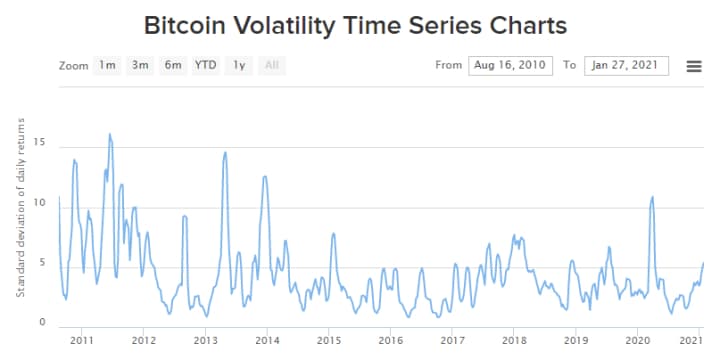

If we talk only about Bitcoin - the main cryptocurrency of the world, then although it is not the cryptocurrency with the highest volatility, in recent years (in the average range for 30 days) the coin fluctuates from 1 to 10 percent, and the average is 5%:

It is worth noting that the average daily volatility of the EUR/USD currency pair is on average 0.3-0.5%, and only during periods of crisis or some kind of global change it can reach 1%, which is still 5 times less than the average volatility of BTC.

Such high volatility of cryptocurrencies raises many questions, including the reasons for such price fluctuations. Because of this, some investors are afraid to invest money in this asset. You can answer such questions by considering the features and reasons for a significant change in the rate of cryptocurrencies.

What is cryptocurrency volatility

In the financial world, volatility refers to the degree of variability in the price of an individual asset. This feature is clearly visible on the graph of the cryptocurrency exchange rate, which shows periods of rise and fall of quotes. By determining the lower and upper limits that the price reaches over a given time period, you can find out the nature of the volatility of the asset.

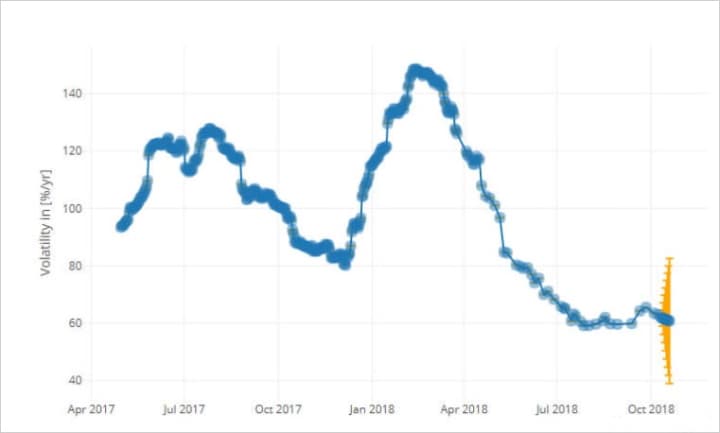

For example, from September 2 to October 12, 2018, the Bitcoin rate did not exceed $7,375. During the same period, the price of the cryptocurrency never fell below $6,179. That is, the Bitcoin volatility indicator over an interval of 40 days reached 17%. If we look at the modern period from January 8 to January 22, 2021, when the price of BTC reached $42,000, then over these 2 weeks the volatility of the cryptocurrency was already 31%:

It should be noted that this parameter is usually considered over a relatively long period, since the weekly or daily rate often reflects the current direction of the trend, rather than sharp price fluctuations.

Experienced traders analyze the volatility indicator of the cryptocurrency market on monthly charts, since the peculiarities of the functioning of digital money depend on various factors and their movement is more difficult to predict. Moreover, it is recommended to make forecasts and develop strategies based on the results obtained, using parameters that are calculated for at least the last quarter. Also, a number of traders sometimes pay attention to the historical volatility of a cryptocurrency, or the indicator of price changes over the entire period during which the digital coin is traded on the market.

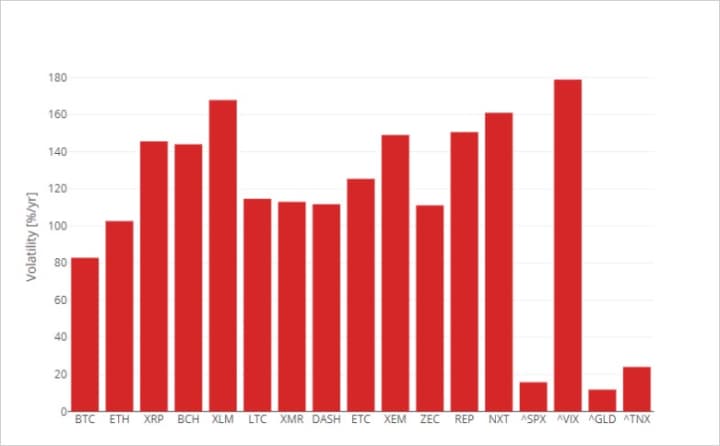

As an example, below is a graph of price fluctuations of several assets recorded over one year:

In addition, when developing trading strategies, traders take into account expected volatility, or forecasts of the price behavior of an individual crypto coin. This indicator is calculated using the following parameters:

- current coin price;

- historical volatility indicator;

- market sentiment;

- liquidity of the coin;

- capitalization and nature of changes in the popularity of the project, which is based on the selected coin;

- news reports that directly affect the movement of the coin rate.

The volatility indicator determines the value of the asset: for some traders, sharp fluctuations in the exchange rate may seem attractive for investment, while others prefer calmer coins and tokens . It all depends on the approach that the market participant uses. Thus, traders who prefer long-term investment strategies usually avoid highly volatile assets, since sharp price fluctuations raise doubts about the correctness of the choice made.

For short-term investments, such cryptocurrencies are more popular, as they allow you to earn money in a relatively short period of time. But in such cases, traders are forced to constantly monitor changes in the price chart and sell or buy coins in a timely manner. On the other hand, with short-term investing, any change in the direction of the exchange rate can generate income.

Reasons for cryptocurrency volatility

Sharp changes in the exchange rate of cryptocurrencies are in most cases due to the influence of certain factors. But due to the fact that many investors are wary of this market, and the governments and central banks of some countries periodically prohibit trading in digital coins due to the uncertain legal status of cryptocurrencies , prices for these assets often change even after the release of insignificant news.

Despite the above, traders identify several factors that directly affect the volatility of cryptocurrencies:

- News that directly concerns an individual digital coin or the entire cryptocurrency market. This factor must be analyzed in general, since some news events that seem positive from the outside can lead to a drop in the exchange rate. For example, prices for a coin rise when it is added to an exchange listing or after a message that the developers have established cooperation with a large company that does not represent the cryptocurrency market. Quotes of such assets definitely fall after the release of news about an unsuccessful hard fork or large-scale theft of funds from investors ’ cryptocurrency wallets . Each information is usually immediately reflected in the dynamics of price movement, leading to its sharp increase or decrease.

- Decentralization of cryptocurrencies. The lack of regulation of operations with digital coins by the state and central banks makes this asset highly risky. Because of this, the prices of cryptocurrencies are subject to noticeable fluctuations after the release of news, promises from developers and other factors that do not affect fiat money. The latter is largely due to the measures taken by governments to maintain their own currency.

- Dumps and pumps. Unlike the same stock exchanges, cryptocurrency exchanges often experience sharp price fluctuations due to the fact that large investors “throw away” huge amounts of digital coins. Because of this, prices for these assets rise or fall sharply, depending on the intentions of traders. The latter wait until the cryptocurrency rate reaches a certain limit and close positions to their benefit. In such cases, ordinary investors lose money due to a sharp reversal of the trend in the opposite direction. By the way, it is after pumps and dumps that some begin to think that cryptocurrency is a scam .

- Lack of real security. The price of cryptocurrencies is determined only by the mood of traders. If fiat money is backed by gold reserves, oil and other physical materials, then digital coins are backed only by the promises of developers and the expectations of investors. Therefore, any positive or negative information about cryptocurrency provokes a sharp jump in prices.

- No real value. The value of shares is determined by the performance of the issuing company, the national currency - by the economic indicators of the country. But cryptocoins do not have objective qualities on which their value may depend, and it is determined only by investors and traders who are ready or not ready to buy coins at the moment.

Why High Volatility Hinders Cryptocurrencies

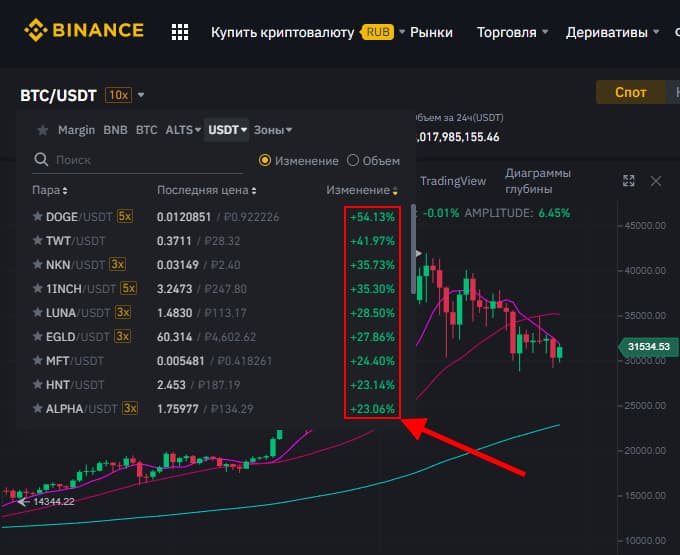

High volatility hinders the development of the cryptocurrency market. First of all, many large investors try to avoid this segment, since the risk of losing money when investing in digital coins, the price of which can change by more than 20% during the day, is too great:

The second caveat is that due to high volatility, digital coins cannot act as a means of payment. Most stores, including online platforms, do not accept cryptocurrencies due to the fact that they cannot set the exact price for the goods offered due to sharp fluctuations in the exchange rate. This is also hampered by high commissions charged for transactions with digital coins and long waiting times for payment confirmation (for example, in the Bitcoin network this process can take up to 1-2 days, although this happens very rarely).

Let's say a company sells goods for both dollars and Bitcoins. At a BTC rate of 15 thousand dollars, the product is sold for 15 dollars. But after one day the value of Bitcoin falls by 20%, and after another week it rises by 35%. In this case, the company has to constantly change its pricing policy, otherwise it will incur losses. Also, due to such high volatility, difficulties arise when calculating the tax base.

In addition, sharp fluctuations in the exchange rate are dangerous for novice investors. An illustrative example in this case is BTC, the price of which in 2017 increased from just over $700 to $20 thousand. At that moment, when the price already exceeded 15 thousand, many investors invested in the crypto coin, believing that its rate would rise. But after 2-3 months, the price of Bitcoin fell from 20 to 6 thousand dollars and continued to decline down to 3 thousand, which is why many people sold the coins and lost most of their money.

However, it is too early to say that cryptocurrencies will never become a means of payment. Back in the early 90s of the last century, many people did not understand that soon goods would begin to be sold via the Internet and it would be possible to pay for them by non-cash payment using a card, but today this is commonplace.

Cryptocurrencies with high volatility

Unfortunately, it is difficult to divide cryptocurrencies by volatility, since today one of the coins can show 1,000% growth, while another only 50%. And after some time, these same cryptocurrencies can change places. Also, the number of cryptocurrencies is very large at the moment in the world, and therefore we will consider only the most popular coins with the highest volatility at the moment for volatility.

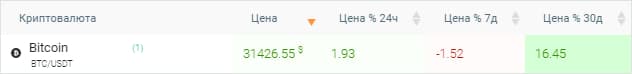

- Bitcoin is the first digital coin in the world, which can rightfully be considered a cryptocurrency with high volatility. Daily volatility averages 1.5-5%:

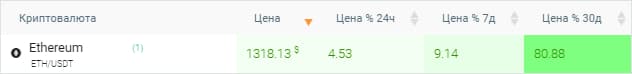

- Ethereum is the next cryptocurrency with high volatility, as it is almost always next to Bitcoin and also has high trading volumes. Daily volatility averages 2-5%:

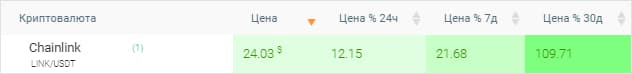

- Chainlink is a coin that has become very popular recently. Because of this, its capitalization has increased, and therefore volatility has increased, which is why it can reach from 3 to 15% per day:

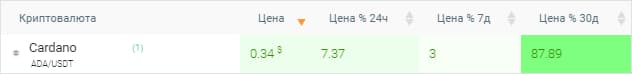

- Cardano is a coin that follows on the heels of the already mentioned cryptocurrencies with high volatility, and its daily range can also reach 15% or more:

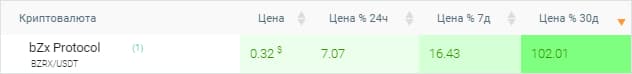

- bZx Protocol is not the most popular coin in the world, but still currently has very high volatility rates and can move in the range of 5% and above per day:

Conclusion

The nature of changes in the exchange rate of an asset, or volatility, is a specific quality of exchange products, which include cryptocurrencies. Increases and decreases in the price of a digital coin are caused by various factors. However, cryptocurrencies, unlike stocks and other similar assets, are characterized by high volatility.

This is explained by the peculiarities of digital coins, which are not backed by anything material (gold, oil and anything else), and there is no centralized regulation of them by the state and/or Central Banks. Because of this, the cryptocurrency rate is subject to sharp fluctuations that occur after news releases or due to investor expectations. In addition, a significant role in this is played by the psychology of traders and the entry of large players into the market, who “throw out” a huge amount of virtual money, thereby provoking a significant increase or decrease in price.

High volatility is considered both an advantage and a disadvantage of cryptocurrencies. The first is due to the fact that sharp fluctuations in the exchange rate make it possible to significantly increase profitability in a relatively short period of time. However, high volatility carries a high risk of loss, and therefore novice traders are not recommended to trade cryptocurrencies. In addition, this factor prevents digital coins from becoming a means of payment.

See also:

To leave a comment, you must register or log in to your account.