A little more than ten years have passed since the birth of blockchain technology and Bitcoin , which became the first cryptocurrency , after which over 200 new digital coins entered the market.

But at the initial stage of development of this segment, most people did not imagine that cryptocurrencies would become one of the most popular means of payment and speculative assets. In this regard, the attitude towards digital money has also changed, as more and more people are confident that blockchain will firmly enter various areas of life in the near future, including the global financial market.

The concept of cryptocurrency

The first thing that distinguishes cryptocurrencies from ordinary (fiat) money is the absence of a physical “carrier”. Rubles, dollars and other currencies are printed in the form of coins and banknotes, and cryptocurrency is a digital product that is better protected than fiat money. Cryptocurrencies are based on advanced cryptography methods that make this asset safe to use and store, and cryptocurrencies are based on the following technologies:

- Encryption algorithms. Today, many algorithms are used to make cryptocurrencies secure, and the most popular are SHA-256, CryptoNote, Scrypt and Ethdash.

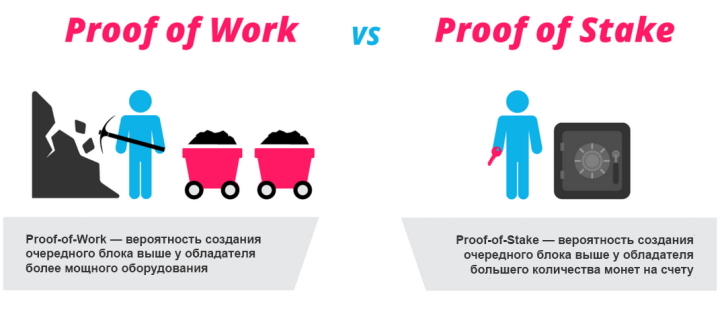

- Consensus algorithms. These technologies define the rules for reaching agreement on the order and features of transactions within a certain network (Bitcoin, Ethereum , and so on). Despite the fact that the number of consensus algorithms is constantly growing, PoW (Proof-of-Work) and PoS (Proof-of-Stake) remain the most popular.

- Anonymity protocols. All transactions carried out using cryptocurrencies are reliably protected from external influence, and it is almost impossible to track who carried out a particular operation with digital money due to the peculiarities of the protocols used. For this purpose, stealth address technologies (which are the basis of Monero and Bytecoin coins), ring signatures, CoinJoin (implemented in the Dash cryptocurrency) and others are used.

- Scalability protocols. This technology involves introducing restrictions on the size of the emission of cryptocurrencies, which prevents cryptocurrencies from creating competition with traditional banking instruments. Such technologies include the Lighting Network (implemented in Bitcoin), “sharding” (used by the Zilliga cryptocurrency and others) and Plasma (created for Ethereum).

Each cryptocurrency is inextricably linked with the above technologies, but gradually new digital coins are entering the market, which offer completely different protocols, and a number of assets do not even support consensus algorithms, which are the main ones, for example, for Bitcoin.

Properties of cryptocurrencies

Each cryptocurrency, regardless of its purpose and functions, operates on the basis of blockchain technology, which is distinguished by the following features:

- Decentralization. All transactions within one network are controlled not by one authority (for example, the Central Bank), but by all participants, or nodes, known as nodes. For their work, each member of the system receives a reward in the form of a specific digital coin, that is, network participants support its functioning through their activities. It should be noted that to date, closed blockchains have been developed that are used within a separate company and in this case the activities of the network are controlled by a specific organization.

- Irreversibility of transactions. All transactions made within a network built on blockchain technology cannot be canceled or changed (the same applies to smart contracts). The only exception to this rule is that the user to whom the money was sent can, at his own discretion, return the crypto coins. This feature is used by some companies that “burn” digital money, for which they send a certain amount to a wallet that no one has access to.

- Operations are completely transparent. Each transaction is recorded in a separate block, which is combined into a long chain with others, and any user can open a specific block and view the information that is recorded in it. For example, participants in the Bitcoin network have access to data about the time of sending funds, the amount of payment, and the wallet numbers of the sender and recipient, although there are cryptocurrencies that support anonymous transactions. In this case, users can only find out that a transfer has been made.

- High level of protection. Compared to other systems used today in the virtual world, blockchain provides the highest possible security for transactions. To date, none of the popular cryptocurrencies have been hacked, and such a high level of protection is due to the peculiarities of blockchain technology. To make changes to one block, it is necessary to do similar operations to all previous ones, however, if a person or company gains access to more than 51% of the network hashrate, then he or she will be able to change data in the chain. Bitcoin Gold and Vertcoin have already suffered from such a “hacking”.

- Complete anonymity. When registering new wallets, services do not request information about their owners.

Despite the above, some cryptocurrencies can provide complete anonymity and there are tools that allow you to reveal the identity of wallet owners.

Types of cryptocurrencies

In the cryptocurrency world, several classifications of digital coins are accepted, but to understand the features of this asset, it is worth considering the simplest gradation.

Bitcoin

Bitcoin, like blockchain technology, was officially introduced in 2008, when a document appeared online revealing the operating features of this crypto coin. Satoshi Nakamoto is considered to be the creator of virtual money, but the identity of this person has not yet been revealed.

Satoshi in this document defined three basic principles of cryptocurrencies:

- Transparency;

- Anonymity;

- Safety.

But, as noted earlier, these properties were characteristic of digital coins only in the first years of their existence, and now anonymity is provided by individual cryptocurrencies, which contain additional encryption algorithms.

But, as noted earlier, these properties were characteristic of digital coins only in the first years of their existence, and now anonymity is provided by individual cryptocurrencies, which contain additional encryption algorithms.

Despite the fact that Bitcoin is inferior to other digital assets in a number of technical parameters, this coin remains the most popular on the market and almost always the total volume of investments in Bitcoin is equal to half of the total capitalization of the cryptocurrency market.

Altcoins

Altcoins are the same cryptocurrencies, but with the exception of Bitcoin. This list includes over two thousand digital coins, and their number is constantly growing, and the first “competitor” of Bitcoin was Namecoin, which appeared in 2011. This coin is functionally an almost complete copy of BTC.

The development of altcoins at first was driven by necessity and they appeared with the goal of improving Bitcoin technology to solve the following problems:

- Low speed of operations;

- Low scalability;

- Lack of interchangeability of coins;

- Incomplete anonymity;

- The complexity of the network, due to which mining costs have increased;

- High transaction fees;

- Limited functionality.

One of the first altcoins that really brought revolutionary solutions was Ethereum, and thanks to the technology embedded in this coin, the world market gained access to so-called smart contracts.

In addition to Ethereum, today there are other digital currencies that offer solutions that can truly improve the cryptocurrency market, but among the existing virtual money there are many assets that do not provide any benefit, but are, in fact, modified analogues of BTC.

Stablecoins

Stablecoins got their name due to the fact that the rate of these cryptocurrencies is not subject to fluctuations and these coins are most often tied to fiat money and quite rarely to cryptocurrencies.

Stablecoins got their name due to the fact that the rate of these cryptocurrencies is not subject to fluctuations and these coins are most often tied to fiat money and quite rarely to cryptocurrencies.

The first stablecoin, Mastercoin, appeared in 2012, and initially this coin was tied to BTC, but this is where the functionality of this stablecoin is limited.

The first more serious product entered the market 3 years later and it turned out to be the Tether coin (tied to the US dollar), which was associated with the large cryptocurrency exchange Bitfinex, thanks to which the digital asset became in demand among traders.

All stablecoins are backed by either cryptocurrencies or fiat money, and the most popular among traders are stablecoins associated with fiat money, but such coins are centralized, since owners need to confirm the presence of foreign currency backing.

What is required to use cryptocurrencies

The tools required to use cryptocurrencies are determined by the scope of their application, and if digital coins are purchased to pay for goods or services on the Internet, then users only need to open a cryptocurrency wallet , which comes in several types. To pay for goods and services on the Internet for small amounts, it is enough to create mobile or online wallets (“hot” wallets).

To trade digital assets, you need to open an account on a cryptocurrency exchange , and if profits are withdrawn in cryptocurrency, then in this case you will also need separate wallets. But due to the fact that large sums of money are used in exchange trading, it is recommended to think about more reliable methods of protection, therefore traders are recommended to store digital coins in hardware or “cold” wallets.

To mine cryptocurrency, you need to download the entire chain (node) to your computer by installing the appropriate client, after which you will only need to configure the software through which digital coins are mined.

See also:

To leave a comment, you must register or log in to your account.