Not everyone understands the difference between a cryptocurrency and a token, since despite the similarity of these concepts, they work according to a different algorithm. Cryptocurrencies are used for trading on a cryptocurrency exchange and for making various transactions (for example, buying real goods), but the token does not have the same capabilities, and therefore cannot act as a means of payment.

Not everyone understands the difference between a cryptocurrency and a token, since despite the similarity of these concepts, they work according to a different algorithm. Cryptocurrencies are used for trading on a cryptocurrency exchange and for making various transactions (for example, buying real goods), but the token does not have the same capabilities, and therefore cannot act as a means of payment.

What is a token and cryptocurrency

A token is understood as one of the types of agreement concluded for the provision of certain services, or a debt obligation. The company that issued this asset must provide its buyer with a certain product. In some cases, tokens can be perceived as the equivalent of a share, and this asset is issued by companies during an ICO, or during their initial entry into the market (exchange). Also, tokens can be created by individuals and legal entities in order to attract money, but in this case they act as an electronic asset.

To understand the essence of a token, you can consider the example of a company entering an ICO. Developers of a certain platform (for example, cryptocurrency) issue a certain number of coins, but instead of them, at the ICO stage, the company issues tokens that investors buy. The latter thereby acquire a share in the product being developed or, if we are talking about the launch of a new cryptocurrency, a certain number of digital coins. That is, in this case we are talking about a token as an electronic equivalent of a share, but unlike the shares themselves, information about the buyers of this asset is stored in a blockchain system that has reliable cryptographic protection.

Cryptocurrency also operates on the basis of this technology, but it is one of the types of digital money presented in electronic form and, unlike tokens, it is created (mine or developed) by network participants by solving complex mathematical problems. It is also worth noting that initially cryptocurrencies were not considered as an investment instrument, but today the scope of application of digital coins is not limited to trading on the stock exchange.

What are the similarities and differences between a token and a cryptocurrency?

Tokens and cryptocurrencies are similar to each other in the following ways:

- both assets have the same protection and operate on common algorithms;

- fast operations;

- based on blockchain technology.

The difference between these tools comes down to the following:

- a token is a centralized asset (its emission is controlled by the project developer);

- tokens are created on the basis of platforms that are also controlled by developers;

- tokens are not mined, but sold as part of the ICO;

- tokens are not used as a means of payment.

A distinctive feature of the token is that its price is determined by the developer.

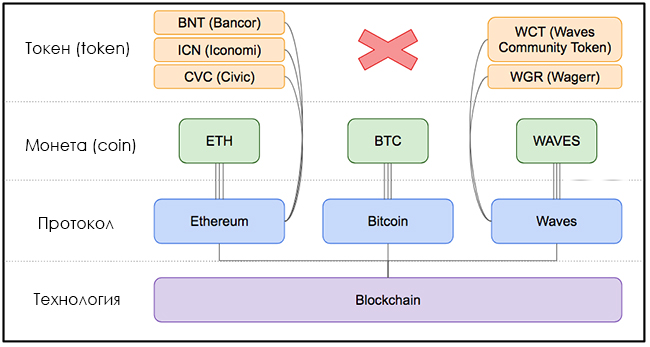

Example of tokens and coins:

Types of tokens

In the cryptocurrency world, several classifications of tokens are accepted and this asset is divided according to the principles of applied use into the following types:

- certificate proving the investor’s right to a share in the project;

- the right to distribute income from the company’s activities;

- an instrument upon presentation of which a discount is provided;

- certificate for the purchase of goods;

- internal currency on a certain site.

The scope of tokens directly depends on the marketing program of the issuing company. Often the characteristics of a given asset are determined by the characteristics of the ecosystem for which it was created.

According to the second classification, tokens are divided into the following types:

- Stock. Such tokens are issued to the exchange as part of an ICO. That is, the rate of this asset changes over time. Many companies use similar tokens when conducting ICOs.

- Credit coins. This type of token is usually issued by already existing companies and they are purchased to receive profit in the form of dividends from an operating project. Holders of such tokens undertake not to withdraw them for a certain period of time.

- App-coins. This type of token is an analogue of digital currency, which is used within only one project. App-coins make up approximately half of all issued assets of this type.

Due to the fact that tokens are assets of the issuing company, the sale of such investment instruments is carried out according to certain rules.

Where and how to buy tokens

You can buy a certain token as part of an ICO. To do this, most issuing companies offer to go to the official website of the project, register and deposit a certain amount. Investors must also indicate the number of the cryptocurrency wallet from which payment will be made.

The second option for purchasing tokens is less popular and is used mainly by companies that, at the start of the project, do not plan to spend large sums on marketing promotion, and some give out a limited number of tokens for free for performing certain actions. The options for receiving tokens are as follows:

The second option for purchasing tokens is less popular and is used mainly by companies that, at the start of the project, do not plan to spend large sums on marketing promotion, and some give out a limited number of tokens for free for performing certain actions. The options for receiving tokens are as follows:

- Bounty tokens. Tokens are paid for performing actions aimed at achieving the goals of the project.

- Airdrop. Tokens that are distributed for assistance in promoting a startup.

The last option is to purchase an asset on cryptocurrency exchanges. You can purchase tokens on the sites after the end of the ICO. The value of the asset in this case is determined not by the developer, but by supply and demand.

Possible risks when purchasing tokens

If you plan to purchase tokens, you should consider the following risks:

- token holders do not acquire the right to own a share in the issuing company;

- the price of tokens may fall over time, and the issuing company may stop paying dividends;

- in many countries the government does not regulate the ICO process at the legislative level;

- The token exchange rate strongly depends on the general conditions of the cryptocurrency market.

- Fraudsters often operate under the guise of an ICO; while showing an attractive investment project, they have not created anything in reality.

The best time to buy tokens is considered to be an ICO (or Pre-ICO, which is launched before the company enters the market). In this case, the price of the asset is at a minimum level and this option resembles the initial public offering of shares of companies (IPO) on stock exchanges.

Tokens issued by promising companies can bring significant profits to investors in the future, and in some cases, just a few hours after the ICO, the price of such assets on cryptocurrency exchanges increased tenfold.

Where to store tokens

Investors mainly store tokens in cryptocurrency wallets or use multi-currency wallets that support the ERC-20 encryption standard.

When purchasing a large number of tokens for a large amount, it is recommended to store them on “cold” wallets such as Trezor or Ledger, since these tools are convenient in that if the password is lost, it can be recovered using a seed phrase, and no one will be able to access funds due to the fact that the wallet is not connected to the network.

Conclusion

As you can see, cryptocurrencies and tokens have specific differences and are used for different purposes. Therefore, if you plan to invest a large amount in cryptocurrencies, then it is better to use coins rather than tokens, since in the future coins can be used not only for trading on the exchange, but also as a means of payment, while tokens are not suitable for these purposes.

See also:

To leave a comment, you must register or log in to your account.