Discover a hybrid exchange where you can trade directly from Telegram, Trust Wallet and MetaMask. New project of Binance top managers.

WhiteBIT crypto exchange is one of the largest cryptocurrency exchanges in Europe and allows residents of Russia and the CIS countries to trade cryptocurrencies without restrictions.

The Binance exchange allows you to trade various tokens, including those that are not presented on other services or operations on them are limited. There is an official website in Russian with an intuitive interface that facilitates the process of earning money.

Broker eToro has been allowing its clients to use innovative services to generate income for many years, but can every trader profit from it?

The Crypto.com project is one of the most developed services, which allows you not only to get a VISA crypto card, but also to start receiving passive income from your investments in cryptocurrency.

The emergence of cryptocurrencies went unnoticed by most users of the global Internet. But over time, as the value of digital money has increased significantly, attention to virtual money has also increased. Moreover, not only this circumstance has spurred interest in cryptocurrencies. Virtual money, unlike stocks and other securities, has opened up access to exchange trading for a huge number of people. And the main reason is that to engage in cryptocurrency trading you only need basic knowledge and a small amount of money.

A number of experts are skeptical about the new market, believing that virtual money is nothing more than another “soap bubble” that will soon burst. However, this opinion is not entirely correct. Traders with certain experience and skills are able to successfully make money in the cryptocurrency market. Moreover, the level of income in this segment can be colossal. Cases have been recorded on cryptocurrency exchanges more than once when the value of one coin increased to 100% within 24 hours. And prices often reached 1000% within a few months. Therefore, with the right approach, cryptocurrency exchanges can bring a lot of income.

Definition of the concept

A cryptocurrency exchange is a digital platform on which operations are carried out to exchange one digital money for another, as well as for dollars, euros, rubles and other real currencies. The types of assets that can be traded depend on the resource chosen. Cryptocurrency exchanges, along with exchangers, act as another way to receive virtual money. Before the advent of such platforms, it was possible to purchase digital coins only through mining.

A cryptocurrency exchange is a digital platform on which operations are carried out to exchange one digital money for another, as well as for dollars, euros, rubles and other real currencies. The types of assets that can be traded depend on the resource chosen. Cryptocurrency exchanges, along with exchangers, act as another way to receive virtual money. Before the advent of such platforms, it was possible to purchase digital coins only through mining.

Cryptocurrency exchanges act as an analogue of the securities market. On such sites, each registered user, having invested a certain amount of money, can exchange and sell digital coins, as well as analyze the behavior of other traders and perform other operations supported by a specific resource.

There is a fairly wide range of cryptocurrency exchanges on the Internet. Almost every platform offers liberal trading conditions: low minimum deposit and commissions.

What are cryptocurrency exchanges used for?

Crypto exchanges are used primarily for two purposes: exchanging some digital coins for others or for real currencies or trading (for making money). It is on such sites that you can, for example, buy bitcoins for dollars at the current optimal rate. Network exchangers do not offer such conditions. A number of users use cryptocurrency exchanges as a wallet on which digital money is stored. But experts do not recommend doing this. The fact is that some exchanges close over time for one reason or another. And all the users’ money usually disappears along with the site.

From an investor's point of view, cryptocurrency exchanges are the optimal place to generate income. Moreover, unlike other similar platforms, you do not need to have much experience or knowledge to work on this one. The main thing for trading on a cryptocurrency exchange is to correctly guess the direction of price movement. Such speculation can bring enormous profits. This is explained by the fact that the cryptocurrency market is subject to significant fluctuations (high volatility). The rates of digital coins change rapidly and almost every day, including on weekends.

From an investor's point of view, cryptocurrency exchanges are the optimal place to generate income. Moreover, unlike other similar platforms, you do not need to have much experience or knowledge to work on this one. The main thing for trading on a cryptocurrency exchange is to correctly guess the direction of price movement. Such speculation can bring enormous profits. This is explained by the fact that the cryptocurrency market is subject to significant fluctuations (high volatility). The rates of digital coins change rapidly and almost every day, including on weekends.

It is thanks to high volatility that the cryptocurrency market remains attractive to many traders. However, trading in such markets does not cause any particular difficulties. And the commissions charged by exchanges are quite low. Thus, the price of shares rarely grows by more than 30% per year. But more than once in the history of the existence of this cryptocurrency, the cost of Bitcoin has increased by 5000% in a similar or even shorter time period.

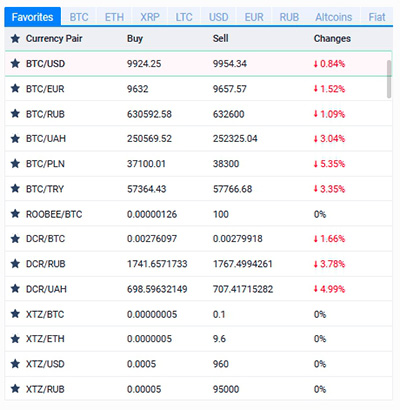

Another noteworthy nuance is that increased volatility attracts new traders, who provoke sharper price changes. And trading on cryptocurrency exchanges is similar to exchange operations. That is, traders indicate the price at which they would like to buy or sell a particular cryptocurrency. And as soon as the market reaches this value, the transaction is automatically completed.

Types of cryptocurrency exchanges

Despite the wide variety of cryptocurrency exchanges, there are two types of such platforms:

Despite the wide variety of cryptocurrency exchanges, there are two types of such platforms:

- to exchange cryptocurrencies for real money;

- for buying and selling one cryptocurrency for another.

The emergence of a large number of cryptocurrency exchanges is partly due to the fact that Bitcoin and a number of other digital coins have split over time. That is, new virtual money (forks) have entered the market, which differ from the basic ones not only in name, but also in the meaning of mathematical calculations. And cryptocurrency exchanges became a place where their developers could place new digital coins.

The level of popularity of such sites does not depend on their type. However, if you look at the ratings, those exchanges that support the exchange of virtual money for real money are in great demand. This is explained by the fact that traders, if necessary, can receive dollars, euros or rubles within 24 hours and transfer them to a bank account or electronic wallet.

But the abundance of digital assets makes trading on such exchanges difficult. Experienced traders recommend basing the price on the cryptocurrency that will be used in the future. For example, when trading the ETH/Waves pair, the success of the trades is determined by whether the amount of ether is growing or not.

Rules for choosing cryptocurrency platforms

When choosing a cryptocurrency exchange for trading and earning money, you need to pay attention to the following parameters:

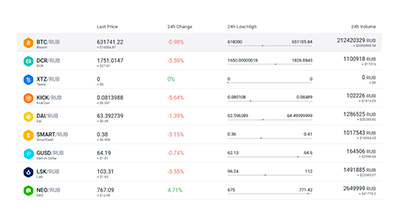

- Daily trading volume. This parameter is considered one of the main ones, as it shows the activity of traders registered on a specific exchange. Also, daily trading volume is used to analyze the prospects of a particular cryptocurrency.

- Methods and conditions for replenishing the balance and withdrawing money. In particular, before starting trading, it is recommended that you familiarize yourself with the supported methods of transferring money both to and from the exchange. You should also pay attention to the amount of commission charged for such transactions.

- Number of supported cryptocurrencies. A number of exchanges only work with a limited set of digital money. Other platforms regularly add to the list of cryptocurrencies that can be traded. A wide range of virtual money creates more conditions for making a profit.

- Availability of additional programs. Large cryptocurrency exchanges allow transactions directly through the browser. Some sites offer to install your own terminal. However, such programs support transactions with a small number of cryptocurrencies. And the exchange rate that the terminals show often differs significantly from the real ones.

It is highly recommended not to download and install programs from little-known exchanges. It is possible that such terminals contain viruses. Relatively recently, platforms have appeared on the Internet that not only provide access to trading on the stock exchange, but also allow you to earn money from mining. Such resources are mostly blocked on Russian territory. To register on such sites, you will need a VPN service.

It is highly recommended not to download and install programs from little-known exchanges. It is possible that such terminals contain viruses. Relatively recently, platforms have appeared on the Internet that not only provide access to trading on the stock exchange, but also allow you to earn money from mining. Such resources are mostly blocked on Russian territory. To register on such sites, you will need a VPN service.

When choosing a cryptocurrency exchange, you should also focus on the following aspects:

- types of supported cryptocurrencies;

- availability of the ability to withdraw earnings in rubles;

- presence/absence of hidden commissions;

- whether there are delays with the withdrawal of funds (you can find out in the reviews about the exchange);

- types of supported operations.

Experienced traders register on several cryptocurrency platforms at once. This approach allows you to trade at the most favorable rate using arbitrage. The latter means simultaneous work with the same currency pairs, but on different platforms.

Recommendations for beginner traders

Beginner traders are advised to avoid large platforms or trade only well-known cryptocurrencies. Due to the large number of virtual coins, the functionality of the exchange may be incomprehensible to inexperienced users. If a novice trader plans to stick to long-term trading, then the optimal platforms in this case would be Kraken and Bithumb. It is better to trade with cryptocurrency and real money on Exmo, Livecoin or Bitfinex. A wide range of currency pairs are supported by the Bittrex, Yobit and Poloniex exchanges. The latter are better suited for experienced traders. But at the same time, these sites allow you to earn a lot of income.

Features of trading on a cryptocurrency exchange

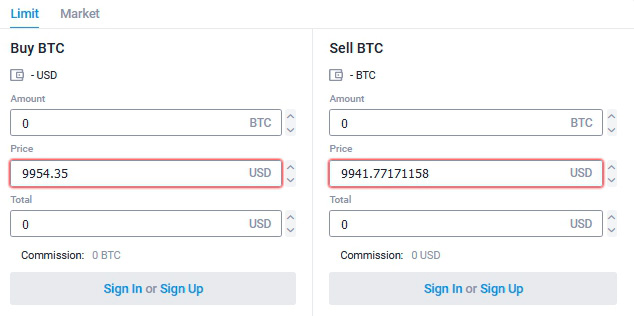

Having decided on a cryptocurrency exchange, you can start trading. To do this, you first need to top up your balance on the site and open an order. The principle of trading on a cryptocurrency exchange comes down to the following: buy cheaper, sell more expensive. Everything else is nuances, which, however, should be taken into account when trading.

Analysis Tools

The main difficulty of trading in the cryptocurrency market is that it is characterized by increased volatility. Moreover, quite often a sharp movement of the chart from the outside looks random. But in reality, such jumps are caused by the release of certain news, which take a long time to reach most traders. This is one of the main differences between cryptocurrency and stock exchanges. Therefore, when trading on such sites, it is extremely important to use analysis tools:

- Charts. They are used to analyze price changes over a certain time period. The length of the latter depends on the exchange.

- Book of orders. Here are all active buy and sell trades for the selected cryptocurrency pair. Using such a glass, you can make a forecast about how prices will change in the near future.

- Trading history. This section helps to identify the most popular cryptocurrency pairs. The prices of the most popular assets change rapidly.

It is better to analyze these parameters together. This approach will increase the chances of making a correct forecast and successfully entering the market.

Tools of the trade

Trading on a cryptocurrency exchange involves placing orders. The latter refers to a trader’s application to buy or sell a specific asset at a set price. Accordingly, cryptocurrency exchanges support two types of orders: Buy and Sell.

Some sites also provide a stop order. This option helps reduce the amount of risk traders face while trading.

Trading Rules

The general rules for trading on a cryptocurrency exchange are as follows:

- do not panic when the exchange rate goes in the opposite direction - this will bring a loss;

- keep at least half of the funds in Bitcoin, which is the basis and support of the market;

- It is better to keep part of the money in real currency, with which you can buy cheap coins in the event of a market collapse;

- Do not store large sums on the exchange.

Each trader develops the remaining rules with experience. Basically, users adhere to their own trading principles, which emerged thanks to a certain strategy.

Advantages and disadvantages of cryptocurrency platforms

Despite the fact that cryptocurrency platforms provide a real opportunity for large earnings, these resources have a number of limitations that reduce their popularity.

Lack of trading terminals

Most cryptocurrency platforms offer a standard set of tools for market analysis. Stock exchanges support terminals that speed up the trading process and have advanced functionality. In addition, all major cryptocurrency platforms conduct transactions through a browser, which in certain cases significantly slows down the work with digital assets and sometimes brings losses due to sharply changing rates.

No regulator

Stock market brokers are officially registered in the European Union, USA, Russia and other countries. That is, the activities of such companies are regulated at the state level. And in the event of bankruptcy of one of the brokers, its clients can fully or partially reimburse the funds.

Cryptocurrency exchanges cannot offer this. Moreover, such sites are periodically attacked by hackers who siphon clients’ money from their accounts. And in this case it is impossible to track the direction of the transfers (let alone return the funds). Therefore, until a regulatory body is created, traders will have to take into account these risks. On the other hand, this feature allows you to start trading on a cryptocurrency exchange immediately after registration. To protect your account from unauthorized logins, such sites recommend conducting verification and providing scans of your own documents.

High volatility

High volatility is both an advantage and a disadvantage of cryptocurrency exchanges. Sudden changes in rates can bring big profits. But if a trader does not guess the direction of movement of the price chart, he often has to wait several days for the value of the selected asset to return to its original values.

Access to trading bots

Trading bots are a software product that allows you to automate trading. This software is not capable of continuously generating income. And the most effective bots are not distributed among traders. The latter is due to the fact that if many users take possession of profitable automatic trading programs, their effectiveness will immediately disappear.

How do cryptocurrency exchanges differ from currency exchanges?

The main difference between these sites is that cryptocurrency is characterized by really high volatility. None of the existing currency or stock exchanges experience such sharp rate fluctuations. Thanks to this, traders who use the right strategy can earn millions of dollars within a few months. However, this will require not only choosing the optimal cryptocurrency platform, but also learning to analyze the behavior of other users and the market as a whole, online quotes, and operate charts.

Results

Cryptocurrency exchanges allow you to make quite large profits within a few months. This is due to the high volatility that is constantly observed on such sites. In addition, to start trading cryptocurrency, you just need to register on a suitable exchange and make a small deposit. But these sites have one significant drawback: the lack of regulation. Therefore, traders’ money is not insured against cases of hacker attacks or sudden closure of the exchange.