The VIJ Light strategy appeared by accident. Its occurrence is associated with an attempt to make certain changes to a number of rules. However, despite this, the number of adherents to this strategy has increased over time. As a result, VIJ Light went through many hours of testing and 3 reworks, each of which was designed to simplify tactics by reducing the rules and the number of indicators used. As a result, a strategy was born, the effectiveness of which has been proven by many successful transactions.

Characteristics of VIJ Light

The VIJ Light strategy has the following features:

- type of trading platform - MetaTreder4;

- trading asset - any currency pairs;

- timeframe - M1;

- expiration period - 1-5 minutes;

- the best brokers are Alpari , Quotex , PocketOption , Binarium .

The VIJ Light strategy is suitable for 24/7 binary options trading.

Composition of the strategy

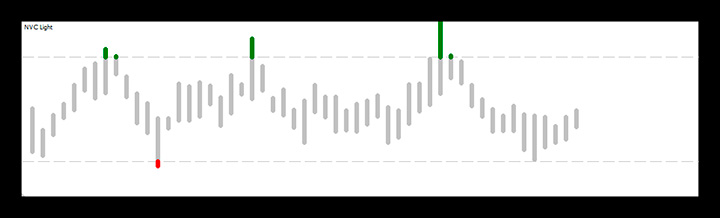

The VIJ Light strategy is based on three indicators. The latter includes the NVC Light oscillator. Traders often use this tool as part of binary options trading. This indicator draws overbought zones (shown as a green bar) and oversold zones (red).

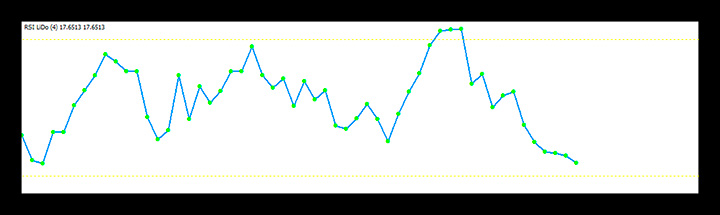

Next on the list of indicators is RSI . This tool has been slightly redesigned for the VIJ Light strategy. Therefore, in the window in which the RSI chart is displayed, yellow lines are drawn as dotted lines, showing the overbought zones (level 90) and oversold zones (level 10).

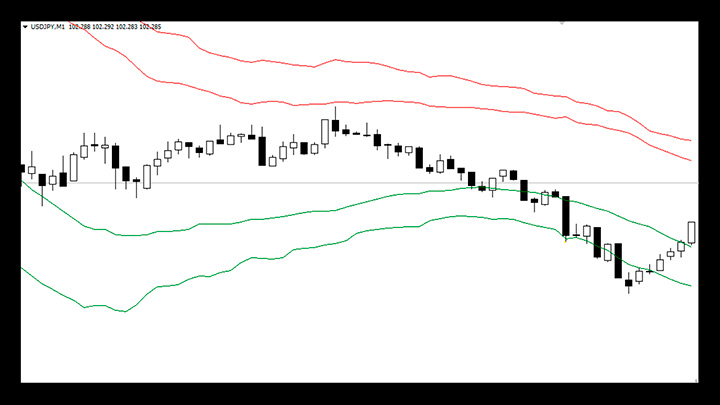

The third indicator is the MBFX channel indicator, created by a trader from Morocco for the system of the same name. Real trading practice shows that when both lines are broken, the strongest signal for opening a trade appears.

The VIJ Light strategy was originally developed for short-term binary options trading. The creator of this tactic uses a 5-minute expiration period. Other traders advise using this strategy with a shorter period in cases where a pronounced trend has formed in the market.

Conditions for purchasing Call

It is recommended to open trades to buy a Call option under the following circumstances:

- a red bar has formed on the chart according to NVC, that is, a signal to enter the market has arisen;

- the RSI curve has entered the oversold zone;

- the price chart has touched the lower line of the channel or crossed it.

If the described signals occur, the trade must be opened on the next candle.

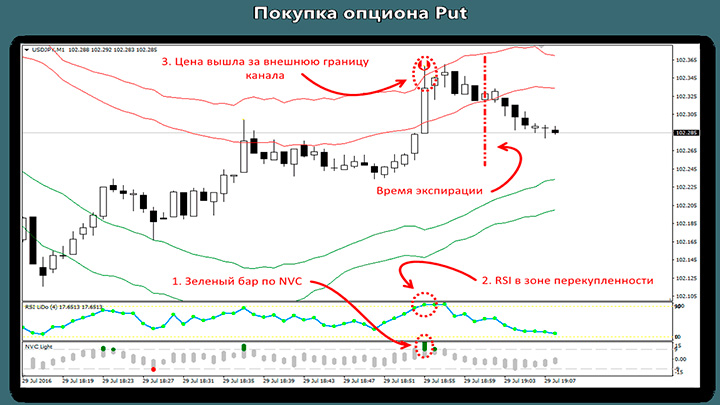

Conditions for purchasing Put

To buy a Put option, the opposite situation is necessary:

- the oscillator has formed a green bar;

- the price chart has entered the oversold zone according to RSI;

- the chart has touched or gone beyond the uppermost line of the MBFX channel.

A deal to buy a Put option should be opened using a similar algorithm.

Cascade signals

The developer of the VIJ Light strategy notes that some indicators (in particular, VITO3) often give false signals. That is, a green or red bar may appear on the chart, indicating a good time to enter the market. However, it disappears almost immediately. Therefore, it is recommended to open a trade after the candle closes.

In addition, sometimes an effect called a “cascade of signals” occurs. This situation is characterized by the appearance of signals on each opening candle. Moreover, each appearance of such bars (green or red) in this case can lead to unprofitable transactions. To avoid this, it is recommended to always wait for a new candle to open. If another signal does not appear along with it, then you can open a deal. In cases where the situation does not change, you should wait for a new candle.

Examples of strategy application

One of the features of the VIJ Light strategy is that even if all three indicators are triggered, unsuccessful transactions are possible. This is shown in the figure below. The vertical lines on this chart show the moment when two signals were triggered, which indicate a price reversal against the trend. In this case, it is recommended to set the expiration time to 5 minutes.

The second entry signal turned out to be false. As the figure shows, the price chart went in a different direction.

The second example, taken from trading the USD/JPY currency pair, demonstrates the strategy’s almost perfect performance. In this case, the price chart only slightly leaves the MBFX channel and returns.

Conclusion

The VIJ Light strategy is convenient because it can be used as a template. This binary options trading tactic is suitable for beginners or traders who work with short-term assets. The main disadvantage of the strategy is that you need to constantly monitor the movement of the chart so as not to miss the moment to open a deal.

Download the VIJ Light strategy template and indicators

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also:

Online signals for binary options

To leave a comment, you must register or log in to your account.