At first glance, currency pair quotes change chaotically. Although, upon closer study of such fluctuations, the cyclical nature of this process becomes noticeable. Moving Average, a binary options market tool in the form of an indicator, allows you to verify this. When constructing it, prices at the moment of closing candles are taken into account, and average values are taken into account.

The presence of the mentioned cyclicality makes it possible to achieve profitable transactions. One approach is to turn to fractals. Let's consider how this is implemented in practice through the use of the mentioned indicator in relation to binary options.

Initial parameters of trading based on fractals

As for the platform, there is only one limitation - it requires support for the indicators analyzed below. It is possible to use MetaTrader 4 as an auxiliary platform. The remaining parameters are as follows:

- currency pairs – only cross rates are excluded;

- timeframe – M15;

- expiration time – 30 minutes;

- trading period – sessions of America and Europe within the time range from 10.00 to 20.00;

- type of trading – down and up contracts (Call/Put);

- preferred brokers – Alpari , Quotex , PocketOption , Binarium .

Recommendations regarding when trading can lead to negative trades:

- news release with an important mark on the economic calendar;

- before the start of the European session;

- later than 21.00 Moscow time.

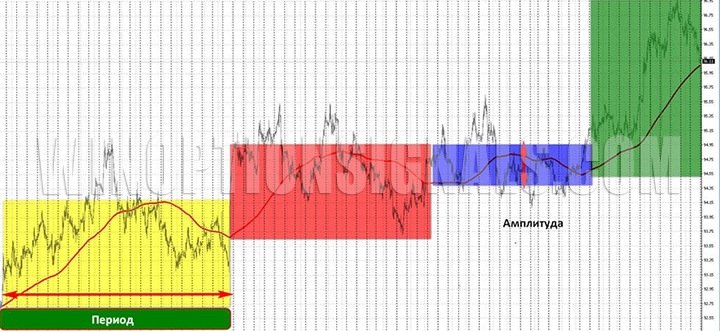

By taking into account cyclicality, it is possible to achieve reliable forecasting of future fluctuations. But at the same time, it is necessary to take into account 2 characteristics of quote waves: amplitude, periodicity.

The profitability of transactions directly depends on how stable these characteristics are. The trader must correctly identify the appropriate parameters used to describe the current cyclicality. If everything is taken into account, then the applied strategy for binary options leads to the formation of appropriate warnings that contribute to the profitability of transactions:

- a signal is given to buy “at the bottom”;

- the continuation of the trend or its completion is determined, which serves as a signal to sell.

Indicator curves and graphical analysis are based on calculations made by referring to past quotes. This is due to the fact that the future is viewed from the perspective of history repeating itself with a slight error. Understanding this leads to practical break-even transactions.

Modern trading is an appeal to the following approaches to the trading system:

- Coefficients defined as adaptive, the use of which allows you to determine how price and time are related to each other on a chart without a linear relationship.

- Neural networks that help find unique price patterns in the past for successful forecasting in the future.

What is meant by fractals

By definition, fractals mean objects with a structure filled with self-similar copies. This makes it possible to say that dividing such an object into parts leads to the formation of elements that have an exact copy of the structure that is inherent in the original object.

As an example, consider corals. Their geometric structure is identical regardless of the size of such a formation: an atoll or a small fragment of a similar island.

This property was noticed by the mathematician Benoit Mandelbrot, which made him the founder of fractal geometry. He identified a geometric figure - a fractal, characterized by the following features:

- uniqueness of lines - the possibility of similarity with multifaceted figures currently known is excluded;

- self-similarity – unity of parts and the whole in terms of structure;

- metric dimension.

The last feature is rules that describe the structure in an exhaustive amount of information. To clarify this process, let’s consider fluctuations in stock exchange quotes in relation to the foreign exchange, stock and commodity markets.

The first to transfer the laws of self-similarity to the mentioned markets was American financier Ralph Elliott. His conclusion is that future movement, regardless of the direction of the trend, forms 5 waves, which does not correlate with a specific timeframe size. As a result, Elliott's theory , implying the presence of five-wave fractals, became famous. The American financier described all permissible changes in the quotes of any assets based on the use of 8 models.

Bill Williams theory

Another theorist of fractals within the framework of trading strategies is Bill Williams. In this case, the structure of oscillations was described from the position of wave theory.

Another theorist of fractals within the framework of trading strategies is Bill Williams. In this case, the structure of oscillations was described from the position of wave theory.

At one time, Williams said that the tools used to forecast the market, which should be understood as relevant news and indicators, had exhausted their capabilities. In his opinion, price changes occur chaotically. In this regard, its ordering is possible only if the analyzed structure is divided into 3–5 candles. This will allow you to determine the direction of trends due to the fractals of such candles.

The trading community was hostile to the rejection of fundamental theory and technical analysis. It was considered that there was an obvious attempt to hide the elementary highs and lows of 3–5 candles under the geometry of fractals.

The situation is controversial, but a large number of trading platforms used today include the Fractals indicator from Williams. MetaTrader is no exception in this case.

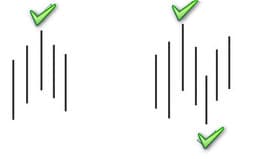

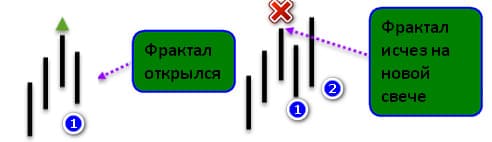

The above image shows the fractal icon according to the symmetric extremum rule. Icons (arrows) indicating a fractal appear on candles with highs and lows that occur in a certain sequence. The opening of a fractal on the previous candle occurs when 3 conditions are met:

- Such a candle shows a high or low in comparison with two similar price representations that preceded it.

- The candles in question correspond to an up or down fractal. In the first case, a consistent increase in the minimums is implied, and in the second, a decrease in the maximums.

- The closing price of the candle does not reach the high of the previous one, which forms an up symbol, or overcomes it – a down symbol. The law of symmetry applies. The signal appears on the candle that is the first from the fractal. It is possible to redraw this signal.

Application of fractals in practice in binary options

In binary options you can make money if you make a correct forecast of the price direction in a given period of time.

Bill Williams' theory allows for the formation of fractals with a limit on the number of candles. Their sum allows you to determine the duration of holding the position.

To implement the fractal strategy in binary options, we will need:

- Find the Fractals indicator in the trading terminal. We use the indicator when concluding transactions following a trend.

- Select the type of binary options – “Higher/Lower”.

- Open trades after 1-2 candles, which corresponds to the display of the icon. The movement of the candles corresponds to the opposite sign of the indicator.

The described actions are an implementation of the Williams theory (the fractal is followed by correctional candles) in binary options. For more successful trading, moving averages are added to the trading system, the formation of which takes three maximums and minimums. As a result, it is possible to determine the so-called sufficiency of the rollback after the fractal is opened. The choice of time frame is 15 minutes, which is enough in the short term to gain profit.

Trading based on fractals

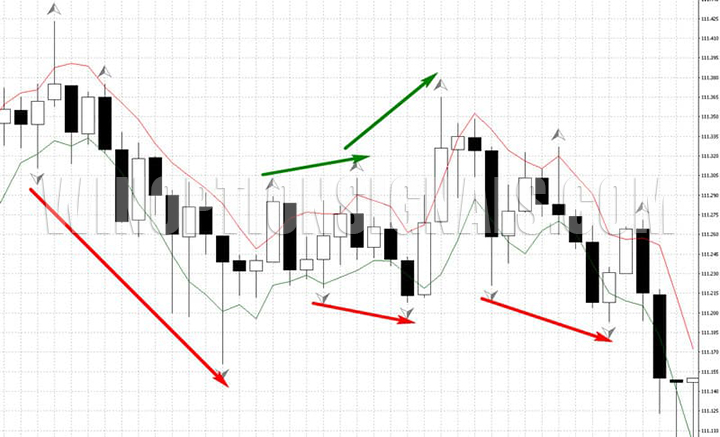

When you open a fractal, a corresponding mark appears. This point must be constantly monitored. If it happens, you should pay attention to where the previous mark is located. Choosing a specific option might look like this:

- The current signal occupies a higher position - we buy the “Call” option, provided that the price approaches the moving average based on the lows.

- The fractal opens below the previous icon with the price reaching the upper moving average – the “Put” option.

Rules for opening transactions using the Fractals strategy for binary options

As we wrote above, in the case of binary options you should adhere to certain rules.

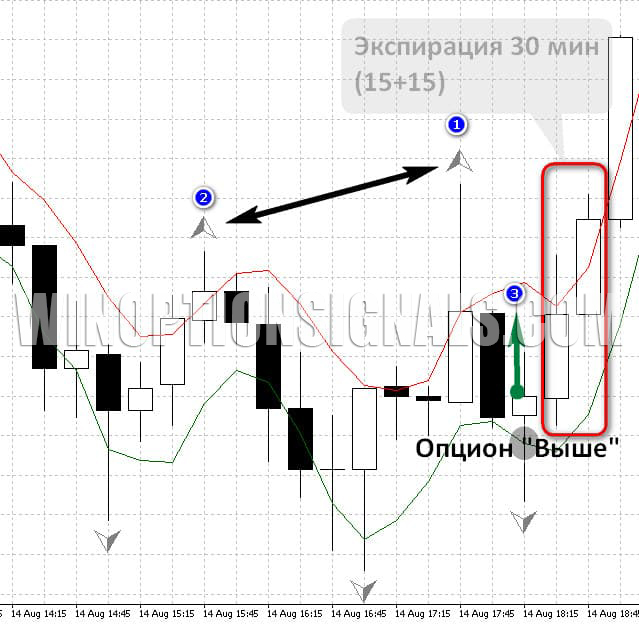

Option “Higher” (Call):

- the fractal opens above the previous mark;

- the candle formed after the signal one crosses the moving average based on the lows;

- The contract expires in 30 minutes.

Option “Below” (Put):

- the fractal opens below the previous mark;

- the candle formed following the signal candle touches the moving average based on the highs.

Conclusion

Many traders try to avoid turning to fractals, which is associated with redrawing of signals. The appearance of a new extreme on the chart may cause the indicator to change its signal. In this regard, it is necessary to take a time lag of 2 candles from the moment the fractal opens. In this case, proof of correction is required to guarantee the stability of the locally formed minimum and maximum.

These are the only shortcomings of the trading system. Otherwise, there are only advantages in terms of reliability. This state of affairs is due to the use of trend continuation signals and a possible price reversal when a correction occurs. In the latter case, the reason is the price falling to extreme values, reaching local support/resistance levels .

We recommend testing all new strategies and indicators for binary options without the risk of losing your main deposit. A good option would be to try them out using risk-free day trading on the financial market from Grand Capital .

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.