The Aroon indicator can be found in the trading platforms of many brokerage companies today, including the Quotex broker , although the indicator itself is new and has not yet gained the same popularity as other common indicators for binary options . The Maroon strategy allows you to get information about the direction of the trend, the state of the flat and the points of reversal of the asset price.

You can trade binary options exclusively using Aroon, but to generate more effective signals, it is recommended to use it with the MA (Moving Average) indicator . As a result, you can trade without using the MetaTrader 4 terminal .

How the Aroon Indicator Works

The indicator in question is still unusual for many traders, as many are accustomed to using standard oscillators like Stochastic Oscillator or RSI in trading. But if you look at Aroon in more detail, you will understand that it is necessary to determine the market movement and calculate the pressure of sales and purchases, which can be determined by the high and low values of the indicator. Its creator was technical analyst and author of books Tushar Chand, who is known for many developments for the futures and stock markets.

Aroon is an oscillator of two lines that are always in different directions and move in the range from "0" to "100". The calculation is based on the principle of taking into account bars after reaching the minimum or maximum price values. After the bar reaches the minimum or maximum, the indicator reaches the values "0" or "100":

Price movements in different markets can be both strong and weak, regardless of the time frame, so due to rapid price changes, the indicator may not reach its maximum or minimum (values of "0" or "100"), creating troughs and peaks in any places.

Installing Indicators on the Quotex Platform

To successfully apply the Maroon strategy on the Quotex broker platform, you need to add the necessary indicators to the chart, which can be found on the corresponding panel:

There is no need to make any changes to the Aroon settings. It is recommended to leave the parameter "25" unchanged:

In the Moving Average indicator, you should set the parameter to “30”, and then change the type of moving average to EMA:

Trading Rules for Maroon Strategy

Trading according to the strategy under consideration is not complicated and it is necessary to pay attention to signals from both indicators. First, let's consider signals from the Aroon indicator.

Since Aroon is an oscillator consisting of two directed lines, you will need to track the intersections of these lines: if the green line passes through the red one from bottom to top, you need to buy a Call option, and if the opposite is true, you need to buy a Put option:

After the signals from the Aroon indicator have been received, it is worth monitoring the EMA indicator readings, and if the asset price is below the indicator line, you need to buy Put, and if above it - Call.

It is also worth considering that the Maroon strategy demonstrates the highest quality results on the trend, since a large number of false signals are created in the flat. For this reason, it is necessary to understand the process of determining the trend and trading on it before using this strategy with a broker from Quotex.

Buying Options at Quotex

Taking into account everything discussed above, the following algorithm will be used for trading:

- The Aroon indicator lines must cross from bottom to top or from top to bottom;

- The price position must be above or below the EMA line;

- You can use timeframes M1 and M5, and the expiration will be 5 candles.

Let's look at an example of buying a Call option in Quotex:

The price was in an uptrend and above the EMA line. Then the Aroon indicator lines crossed, and there was an opportunity to buy a Call option with an expiration of 5 candles (5 minutes).

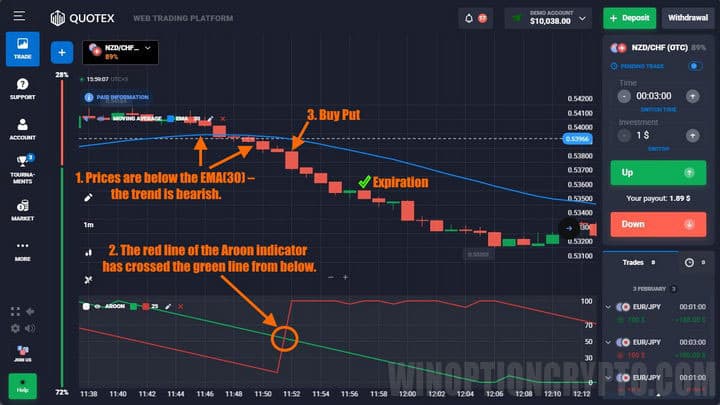

Let's look at an example of buying a Put option in Quotex:

In this case, the Aroon lines crossed first, and then the price closed below the EMA. The Put option is bought with a similar expiration of 5 candles.

It is worth remembering that signals for this strategy can also be unprofitable, and in order to reduce risks when trading, we recommend using a promo code to cancel a losing trade in Quotex , which will allow you to get the loss back to your account in full.

Let's Sum It Up

The Marron strategy has several advantages over similar strategies:

- Simple and easy to use;

- It can be used by novice traders too;

- You can apply the strategy on the Quotex broker platform, since all the necessary indicators are already implemented on it.

In addition, the indicators from the Maroon strategy are extremely easy to read, and if desired, you can adjust the sensitivity of the indicators at your discretion by changing their values.

At the same time, it is necessary to remember the basic rules and be sure to test the strategy on a demo account , working through all possible cases and errors in order to reduce the risk of losing money, after which you can try to start trading on a real account.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto, where we will definitely analyze all your questions on video.

Find the best bonuses, promo codes, and contests for Quotex in our social networks: Telegram Group | Facebook Group.

To leave a comment, you must register or log in to your account.