Binary options traders are always most interested in those trading strategies that not only give the desired result, but also allow them to achieve this result with maximum efficiency. Any online trading strategy is, first of all, a tool for making profit from exchange rate fluctuations. An online trading strategy should help the trader make the right decisions on how to act in a given market situation in order to “work out” this situation with a profitable outcome. Moreover, it is important for any trader that the profitable outcome from the practical application of the strategy takes place in reality as often as possible.

As experience has shown, Getsuga Tensho is the very strategy for binary options that largely satisfies all the requirements discussed above - effectiveness, efficiency, methodicality, profitability, high frequency of achieving the desired result. This online trading strategy for binary options is of Japanese origin, as its name clearly indicates. On the one hand, Getsuga Tensho is fundamentally no different from any other strategy based on the use of technical analysis indicators. On the other hand, in the process of using Getsuga Tensho for trading binary options, it becomes obvious that its “highlight”, which allows you to regularly receive speculative profits, is precisely the fact that all the indicators with which this strategy operates are ideally combined, forming exactly that effective symbiosis, which a well-designed online trading strategy aimed at financial success should have.

Characteristics of the Getsuga Tensho strategy

- Platform : MetaTrader 4

- Currency pairs : volatile

- Timeframe : 5 minutes

- Expiration time : from 30 minutes to an hour

- Trading time: European and American sessions

- Recommended brokers: Quotex , PocketOption , Alpari, Binarium .

Getsuga Tensho is implemented through the MetaTrader4 terminal program. This terminal program is perhaps the most famous platform for online trading on Forex today, which contains excellent functionality necessary for the development and use of various kinds of automation tools for speculative online trading.

It is believed that the Getsuga Tensho strategy is ideal for trading the most dynamic currency pairs, the markets of which are traditionally characterized by a fairly high degree of volatility, that is, the most intense exchange rate fluctuations with high frequency.

For Getsuga Tensho, you should choose a time frame of 5 minutes. It is this time frame, according to the creators of this strategy, that best allows an online trader to use the profitable potential of short-term fluctuations in the target market, that is, the market for a specific currency pair characterized by a high degree of volatility.

The expiration period for a binary option transaction made using the Getsuga Tensho strategy should be considered in the range of 30-60 minutes.

The preferred time period for making transactions using the Getsuga Tensho strategy is the time of the European and American Forex sessions. It is these Forex sessions that are known to be characterized by the highest level of business activity, liquidity and volatility of trading, which creates the best preconditions for making a profit from using the Getsuga Tensho strategy.

Getsuga Tensho: general description of trading strategy

An important advantage of using technical analysis in financial markets is precisely that this approach to analysis makes it possible to best identify the trend in the exchange rate dynamics of the instrument of interest to the trader. Unfortunately, fundamental analysis cannot boast of such accuracy, since it only covers and describes the general sentiments of the target market. The competent and methodical use of indicators, usually used as part of technical analysis, allows us to describe with pinpoint accuracy the movement observed in the target market and evaluate it from the point of view of the prospects for further dynamics. It should be noted that this is exactly the approach that is implemented by the trader through the use of the Getsuga Tensho strategy. Of course, Getsuga Tensho, like any other strategy for binary options, can lead to unprofitable results on online transactions. Meanwhile, as practice shows, the proportion of profitable trades resulting from the use of Getsuga Tensho is much higher than the proportion of losing trades from the use of the same strategy.

The Getsuga Tensho strategy itself has the unique ability to automatically filter possible transactions that an online trader should no longer make. This is especially true in those obvious situations where the trend observed throughout the day begins to show signs of obvious “exhaustion.” Getsuga Tensho clearly guides the trader to purchase options in the direction of a confident trend movement, eliminating those options that could force the trader to leave the trend path.

Getsuga Tensho: indicators used by the strategy

Getsuga Tensho operates with the following indicators:

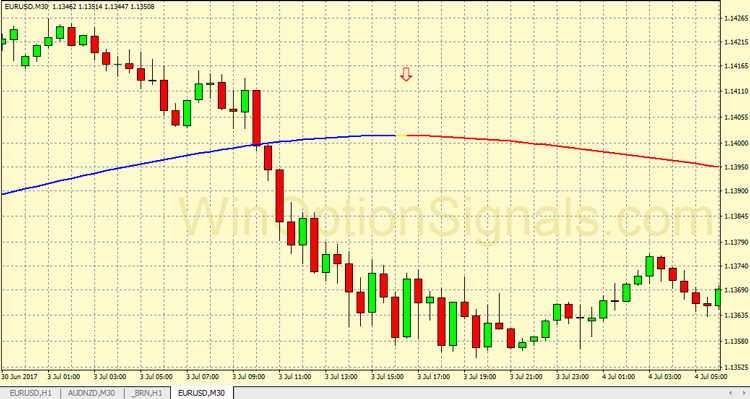

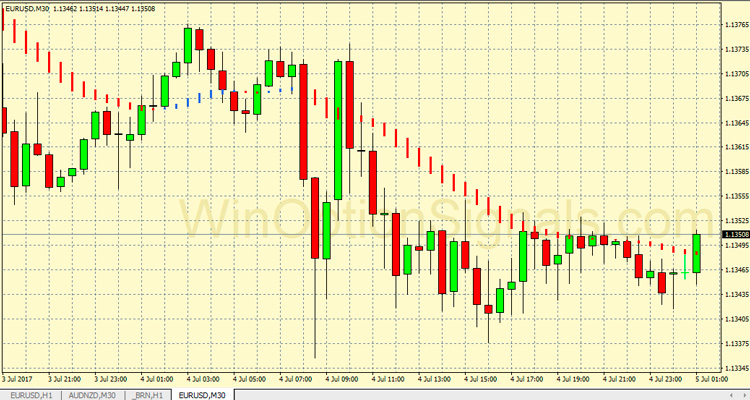

- XPMA indicator (triple moving average of exponential type);

– HAMA indicator (a hybrid version of the well-known HEIKEN ASHI indicator with the addition of additional moving averages);

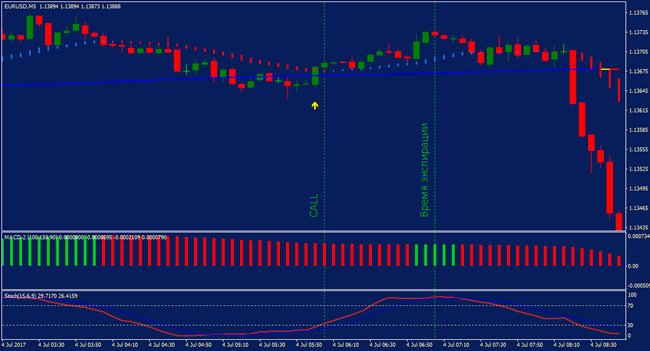

– MACD 2_1 indicator (a two-color indicator, which is an analogue of the well-known MACD indicator, which received the most successful execution in MetaTrader4);

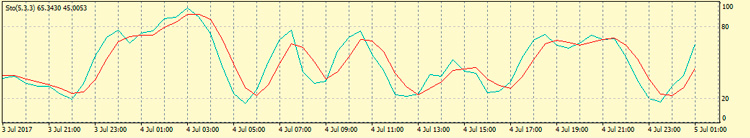

– Stoch indicator (this is the familiar Stochastic indicator, which has standard parameters “15”, “6”, “9”);

– a separate indicator responsible for generating signals according to the Getsuga Tensho strategy (this indicator gives a signal about the possibility of entering the market through a yellow arrow pointing in the direction appropriate to the signal).

The XPMA indicator signals directly about the vector of the current trend, which is the main one for the target market. The red line of the indicator indicates the possibility of opening a CALL. The blue line of the indicator indicates the possibility of opening PUT.

The HAMA indicator informs the binary options trader about the beginning and end of corrective movements in the target market. If, for example, there is an upward trend in the market, then the trader should wait for the moment when HAMA changes its color according to the following algorithm: blue - red - blue. This will be a signal of completion of the correction, which will indicate a favorable moment to enter the market during an uptrend.

The MACD 2_1 indicator is designed to warn the trader against trading in a sluggish market (that is, “in a flat”), since Getsuga Tensho is a strategy for following the current trend. For a CALL trade, the MACD 2_1 indicator should have a value greater than 0. For a PUT trade, the MACD 2_1 indicator should have a value below 0. If the indicator value is 0, then the target market is most likely in a flat state.

The Stoch indicator produces the following typical signals:

– a CALL trade should be opened in an “oversold” situation;

– a PUT trade should be opened in an “overbought” situation.

Getsuga Tensho: how to trade according to strategy

A buy deal (CALL option) is opened by a trader in the following situation:

- the XPMA indicator turned blue;

- the HAMA indicator demonstrates the change of colors in the sequence: blue – red – blue;

- the MACD 2_1 indicator shows a value greater than 0, its bar has a characteristic green color;

- The Stoch indicator is oversold.

A sell transaction (PUT option) is opened by a trader in the following situation:

- the XPMA indicator turned red;

- the HAMA indicator demonstrates the change of colors in the sequence: red – blue – red;

- the MACD 2_1 indicator shows a value below 0, its bar has a characteristic red color;

- The Stoch indicator is overbought.

Conclusion

This strategy was created thanks to numerous observations of the chart. The author of the strategy was guided by such concepts as a trend, the following rollback (correction) and continuation of the trend. Like any other strategy, it will give some false signals, but a significant part of them can be eliminated by trading at the right time, with the right currency pairs in the absence of important economic news.

We do not recommend starting trading with new strategies immediately on a real account; be sure to try it on a demo account.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

Download Getsuga Tensho strategy files

To leave a comment, you must register or log in to your account.