The strategy for the Quotex broker called Everest includes two popular and effective indicators – Envelopes and Stochastic Oscillator , which allow you to determine the highest and lowest prices for buying binary options .

The advantage of this strategy is that these instruments are available on the Kvotex trading platform and you can trade on it without the help of the MetaTrader 4 terminal . It also has very simple rules and is suitable for beginners in trading.

Before you start buying options, don't forget that you can reduce trading risks using the Quotex Loss Cancel Promo Code . This will always allow you to cancel any $10 loss trade.

Description and Configuration of Indicators on the Quotex Platform

The Envelopes indicator, also called "envelopes", is based on moving averages that form a channel reminiscent of another channel indicator - Keltner Channels . But it works on a different principle, and one of the "movings" is shifted down, and the second - up. As a result, the higher the market volatility , the more the averages shift:

The Stochastic indicator is more popular and is an oscillator that compares the current price with the price range for a specified period of time. In simple terms, it shows overbought and oversold zones:

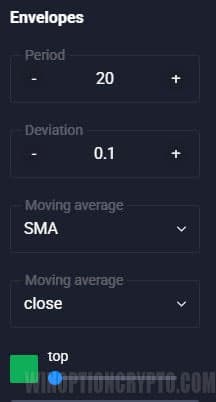

Before adding these technical analysis tools to the chart, you need to change their settings. Envelopes in this strategy is used with the following parameters:

- Period: "20";

- Deviation: "0.1".

The remaining parameters remain unchanged:

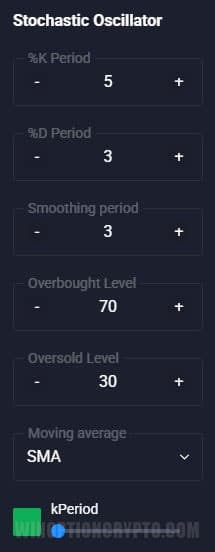

Stochastic Oscillator should be added with the following parameters:

- %K Period: "5";

- %D Period: "3";

- Smoothing period: «3».

The remaining parameters remain unchanged:

Trading Rules and Deals in Quotex

It is worth noting right away that the best results for the Everest strategy can be seen when trading with the trend , but this is not a mandatory condition.

Call options are purchased when:

- Stochastic is below level "30" and its lines are starting to intersect and head upwards.

- The price is below the Envelopes indicator.

Put options are purchased when:

- Stochastic is above the 70 level and its lines are starting to cross and head downwards.

- The price is above the Envelopes indicator.

The timeframe that should be used is 5 minutes, although other timeframes are not prohibited. The expiration should be used in three candles.

Buying Call Options

In the following situation, we have a Stochastic Oscillator that was below the "30" level and was oversold. The price was also below the envelopes. Based on this, we could try to buy a Call option with an expiration of 15 minutes (three candles):

Buying Put Options

This situation is the opposite and Stochastic is above the overbought level, and the price is above the envelopes, so it was possible to buy the Put option with an expiration of 15 minutes (three candles):

Conclusion

As a result, you can see that this strategy for the binary options broker Quotex "Everest" is really easy to understand and use, as it contains only a few conditions for making transactions. But do not forget that any strategy must be tested on a demo account , and also adhere to the rules of money management and risk management.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely analyze all your questions on video.

Find the best bonuses, promo codes, and contests for Quotex in our social networks: Telegram Group | Facebook Group.

To leave a comment, you must register or log in to your account.