Today in the world of crypto trading there are many Forex brokers and binary options brokers that provide the opportunity to trade on absolutely any markets and exchanges, and the eToro broker is no exception.

With the help of brokers you can trade on:

- Stock markets.

- Derivatives markets.

- Cryptocurrency markets.

- Forex market.

- Binary options .

But not all brokers can be considered proven, reliable and providing quality services, since some of them are completely new companies, and they have not yet managed to earn any authority among traders. The other part of brokers are fraudulent projects and are not interested in long-term and promising cooperation. And only the remaining third of brokers can be considered truly worthy, since they do everything possible to provide quality services to their clients, and eToro can be considered one of such brokers.

Further in the article we will consider all the advantages and disadvantages of this broker, and more detailed information about it can always be found on the official eToro website:

Content:

- Brief overview and history of the eToro broker .

- Regulation of the eToro broker .

- eToro personal account .

- Verification of your account with the eToro broker .

- The process of trading through the eToro broker .

- Trading terminal of the eToro broker .

- Account types and trading options with eToro broker .

- What is eToro's CopyPortfolios service ?

- eToro broker leverage .

- Trading commissions of the eToro broker .

- Broker eToro and cryptocurrencies .

- Depositing and withdrawing funds from the eToro broker .

- Online support for eToro broker .

- eToro broker mobile app .

- Pros and cons of the eToro trading platform .

- Broker eToro reviews .

- Conclusion .

Brief overview and history of eToro broker

Many years have passed since the company was founded, and therefore we can highlight the most important points in the development of the eToro broker and its achievements:

2006 The eToro broker began providing its services, and until 2009, this platform was considered the most standard in the trading world, but did not stop developing, adding new trading tools for its clients and developing the eToro official website.

year 2009. A web-based trading terminal called WebTrader was launched, which contained various tools suitable for both new and experienced traders.

2011. A social trading platform called OpenBook has launched. As the world's first social trading platform, it allowed anyone to start copying the trades of other more successful traders. Thanks to this development, eToro received the Finovate Europe award.

year 2012. Thanks to OpenBook, eToro's popularity began to grow rapidly, and in 2012 it was a welcome decision to add US shares to the list of tradable assets. Thanks to this, all traders of the company have the opportunity to study the stock market and engage not only in trading, but also in investing, diversifying their risks and creating much more profitable and less risky trading portfolios.

year 2012. Thanks to OpenBook, eToro's popularity began to grow rapidly, and in 2012 it was a welcome decision to add US shares to the list of tradable assets. Thanks to this, all traders of the company have the opportunity to study the stock market and engage not only in trading, but also in investing, diversifying their risks and creating much more profitable and less risky trading portfolios.

year 2013. The eToro mobile application was born for both iOS and Android OS, which made it possible to trade remotely from anywhere in the world where there is an Internet connection.

2015 The development of the project continued in parallel with the growth in the number of clients wishing to use the services of the eToro broker, and therefore the new version of the platform, released in 2015, not only began to look different, but also had new features and functionality that simplified the process of standard trading and social trading. Now traders, even with small capital, had the opportunity to copy the transactions of their more successful colleagues.

2016 The CopyPortfolios service has been redesigned and improved, which allows you to engage in long-term investing. Thanks to this service, you can create a portfolio of assets that uses a specific trading strategy with machine learning technologies. The company's best traders also take part in portfolio management.

2017 Artificial intelligence is beginning to be used in strategies for investment portfolios, which makes it possible to select traders with high returns even better. Also thanks to this, it became possible not only to form your own portfolios, but also to communicate with experienced traders around the world.

As a result, we can conclude that thanks to the eToro broker, everyone can:

- Engage in trading or investing in any trading instruments (currency pairs, stocks, bonds, cryptocurrencies , commodities).

- Create an investment portfolio of any complexity.

- Copy trades of the best traders.

eToro Broker Regulation

The company has three licenses and is supervised by regulators such as:

- CySEC (Cyprus) .

- FCA (UK).

- ASIC (Australia).

Thanks to this, you don’t have to worry about the integrity of transactions and the withdrawal of profits, since these regulators take any violations very seriously and even the smallest mistake can lead to large fines.

Also, thanks to the privacy policy, traders’ data is not transferred to third parties and does not go beyond the company.

eToro personal account

The eToro personal account is very convenient and has only the functions necessary for work. To gain access to your account, you need to quickly register on the eToro official website and then log in:

Also, the eToro personal account can be translated into 21 languages, including Russian, so you can work with the platform without problems, and it will be understandable even for beginners.

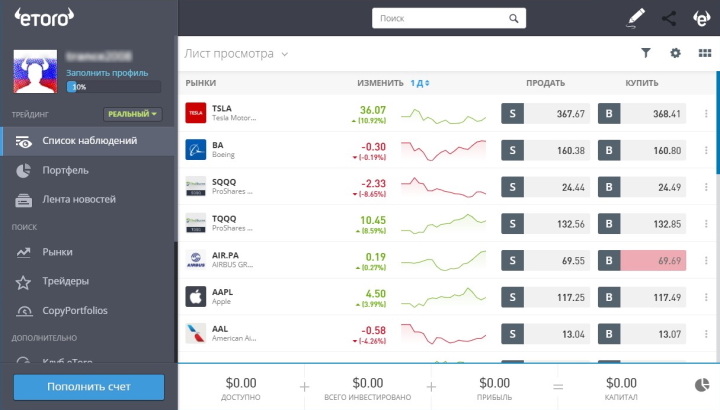

The eToro personal account can be divided into three components:

- Trading.

- Search.

- Additionally.

On the “Trading” tab you can find a watchlist that contains all the trading assets of interest, as well as your portfolio and news feed. I would especially like to note the watch lists, which allow you to monitor any markets in real time and also trade.

On the “Search” tab you can find any market or instrument you are interested in, as well as find and view the statistics of any traders and learn more about CopyPortfolios. Conveniently, you can immediately start copying traders’ transactions:

On the “Advanced” tab you can find other useful functions of the account, which include settings, deposits and withdrawals.

You can also switch to a virtual account in your eToro account and try demo trading.

Account verification with eToro broker

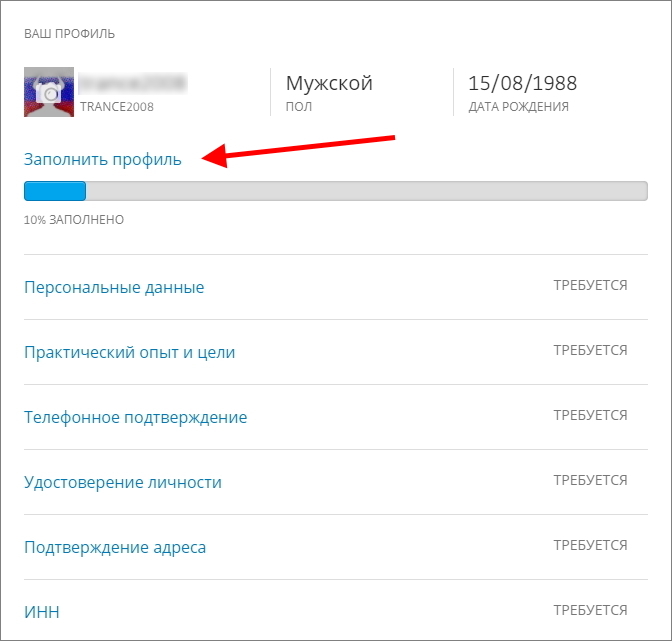

Since the broker is licensed, regulatory rules require that all clients of the company undergo verification . This approach improves security and eliminates cases of money laundering or other illegal transactions.

Also, the completed verification will provide full access to the trading platform and will remove various restrictions, one of which is the limit on trading amounts on the account, which is $2,250. Verification is also required to withdraw profits.

To pass verification, you will need to perform standard actions and send identification documents to the company managers. The fastest and easiest way is to send scans of your passport with all the necessary pages, but you can also use other documents.

To send documents, you need to go to the “Settings” section on the side panel on the eToro official website, then select the “Account” tab, where you click on the “Fill out profile” button, and after filling out, add the necessary documents:

The verification process usually takes up to 1-2 days and as soon as it is completed, the client will be notified by mail, after which they can begin to fully use the platform.

Trading process with eToro broker

Before you start trading with a given broker, it is worth understanding what types of accounts and trading conditions it provides, as well as how you can trade. Next, we will look at all the most important features in trading through the eToro broker.

eToro broker trading terminal

Any trading starts from the terminal and the most familiar and popular terminal is MetaTrader 4 , but trading through the eToro broker is carried out through its own web terminal, which does not require installation or downloading.

Information about trading assets can be seen in the “Watch List” or “Markets” sections. This information includes:

- Asset name.

- Mini chart.

- Percentage of growth or decline.

- Price.

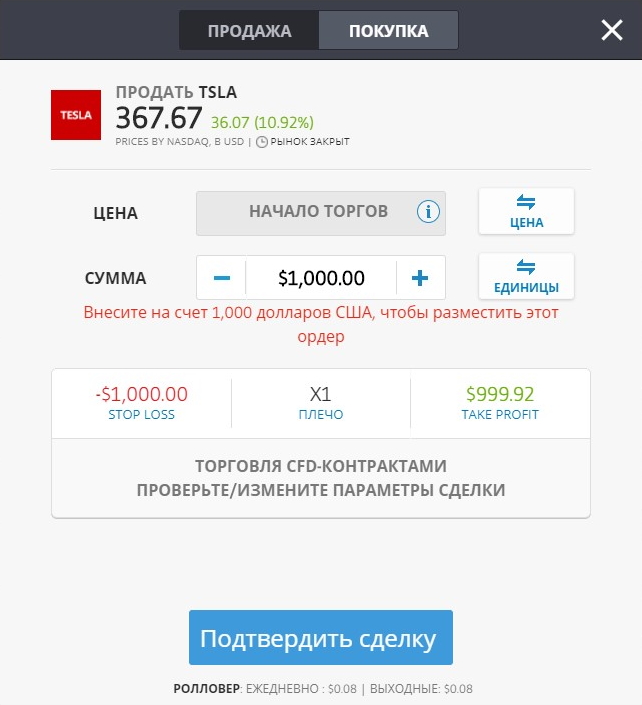

You can open trades both from the “Watch List” and from the “Markets” tab. To do this, you need to select the desired instrument, then press the “B” (Buy) or “S” (Sell) button:

After which a window for making transactions will open with detailed information and the ability to place the desired order:

The eToro web terminal also allows you to analyze charts, from where you can also make trades. To open a chart, click on the mini-graph of the desired instrument, after which a window with the chart will open:

On the chart itself you can:

- Choose the type of candles.

- Open several charts in one window (up to 6 charts).

- Select the desired time frame.

- Conduct analysis using graphical tools.

- Conduct analysis using indicators .

- Make transactions.

- Change visual design and other settings.

Account Types and Trading Methods with eToro Broker

The eToro broker has only one type of account for any operations, and then the trader himself chooses how he wants to manage his funds. It could be:

- Regular trading according to your trading strategy .

- Investing in one or more assets.

- Creating an investment portfolio with many different instruments.

- Copying transactions of successful traders.

- Investing in ready-made portfolios of successful traders.

With independent trading, investing and copying ordinary transactions, everything is more or less clear, since these are standard types of trading and you can make transactions yourself according to your strategy or select a trader with good profitability statistics both in terms of time and account amount, and then just start copy his transactions. But when it comes to investing in portfolios, it can be confusing for some.

What is eToro's CopyPortfolios service?

It is possible to invest in portfolios with the eToro broker thanks to the CopyPortfolios service, which is located on the eToro official website:

Using this service, a trader invests available funds into already formed profitable portfolios, which can contain a huge variety of different assets from different sectors and areas of the economy. Most often used in portfolios:

- Shares of American companies.

- ETF funds .

- Commodity assets (metals, oil, etc.).

- Indexes.

- Currencies.

It is worth noting that this method of investing is as conservative as possible and does not imply large profits in a short time, so the average return on such portfolios can be about 15-25% per year.

An example of such an investment portfolio managed by the eToro committee can be considered BigTech, which includes shares of American giant companies such as Google, Apple, Amazon, and so on.

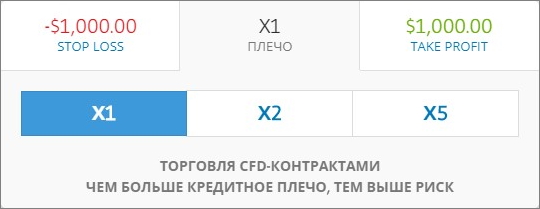

eToro Broker Leverage

We can talk for a long time about the benefits and harms of leverage with Forex brokers, and everything depends on the trader and his trading style, as well as on psychological preparation .

The eToro broker provides leverage of up to 1:400, but to obtain this leverage, you must become a professional trader by applying. After filling out the application, you need to wait for approval from the company, after which you can use high leverage.

The following leverages are available to all other traders:

- Currency pairs – 1:30.

- Cross-courses – 1:20.

- Goods and raw materials – 1:10.

- CFD on shares – 1:5.

- Cryptocurrencies – 1:2.

More detailed information about leverage and conditions for increasing it can be found on the official eToro website.

eToro broker trading commissions

The income of all brokers almost always consists of commissions and fees.

When trading any assets through the eToro broker, the trader pays a commission in the form of a spread, which depends on the instrument, and in the case of ETFs and shares, when rolling positions overnight, an additional 6.4% + one-month LIBOR rate of 2.9% is charged

Also, if there is any amount on the trading account, but trading has not been carried out for a year, an additional $5 will be charged.

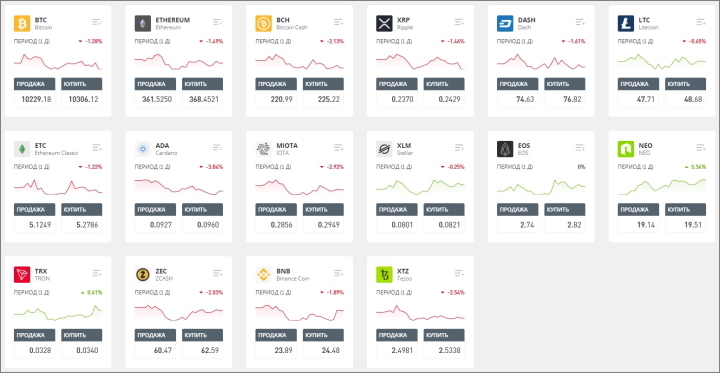

Broker eToro and cryptocurrencies

As mentioned earlier, you can also trade cryptocurrencies with the eToro broker, of which there are currently 16 types.

You can find eToro cryptocurrencies in the “Markets” section and on the “Cryptocurrencies” tab:

The process of trading cryptocurrencies on eToro is exactly the same as with other assets, and if you wish, you can immediately buy any coin or open a chart and conduct an analysis.

But it is worth noting that in this case the trader does not receive real cryptocurrency on eToro and trades only on the price difference (CFD). It is also important to know that cryptocurrency trading in eToro is not very convenient for short-term trading, since coins have a high spread.

Depositing and withdrawing funds from eToro broker

Funding your eToro trading account is easy and fast thanks to its simple interface. Since the company is foreign, it is possible to open and fund trading accounts only in US dollars, and it is worth noting that the minimum deposit is $200.

Also, methods such as QIWI, WebMoney or Yandex Money are not available for replenishment, but it is possible to replenish from a card, PayPal, Skrill, Neteller or bank transfer:

Funds are credited automatically and therefore instantly, unless there are obstacles from the payment system. The broker does not charge any commission when replenishing your account.

You can also use a card, PayPal or bank transfer to withdraw funds, and the minimum withdrawal amount is $30. But it is worth noting that you can withdraw profits only to the same details from which the deposit was made.

Withdrawal time takes 1-2 business days for a card or PayPal and up to 8 business days for a bank transfer. The application can also be canceled and the funds returned to the trading account, but only if the application status is not designated as “In Process”. Otherwise, all you have to do is wait for funds using your details.

There is also a small commission for withdrawal:

- From $30 to $200 – $5.

- From $200 to $500 – $10.

- From $500 – $25.

As soon as the funds are sent, the client will receive a notification by email with all the details of the transaction.

Online support for eToro broker

The broker's support works around the clock, five days a week except weekends, so you can always get an answer to your questions.

You can also contact the company’s managers by email or through social networks (Twitter or Instagram).

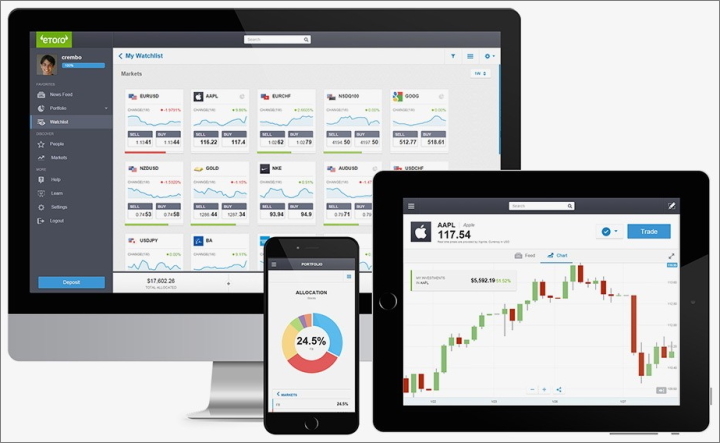

eToro broker mobile app

As mentioned earlier, you can also trade through the eToro application, which contains all the necessary functionality of a web trader.

The eToro application is available for users of Android OS and iOS and its functionality is not inferior to the web terminal, since it allows you to trade, communicate with other traders, track and copy transactions:

Download the eToro app from official sites:

Pros and cons of the eToro trading platform

This platform has enormous functionality and capabilities compared to other platforms, but of course, like everything else, it has its pros and cons.

The poles include:

- The broker has three licenses from leading regulators.

- Working as a broker for more than 13 years.

- Support for multiple languages.

- Various options for trading (independent trading, copying transactions, investing and creating a portfolio, investing in already created portfolios).

- A variety of trading assets, including ETFs, stocks, currencies, cryptocurrencies.

- Own mobile application.

The disadvantages include:

- Mandatory verification.

- Availability of only dollar trading accounts.

- Commissions for withdrawing funds and when transferring positions overnight.

- A small number of ways to deposit and withdraw funds.

- Bad conditions for scalpers, since trading is tailored for investors and long-term traders.

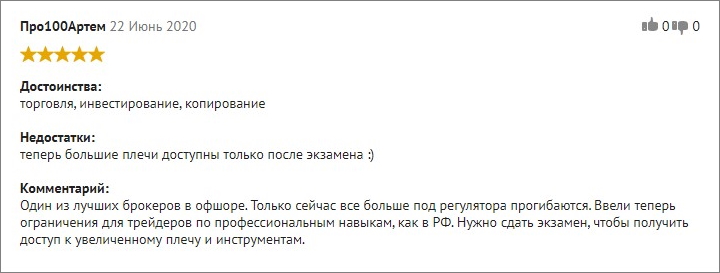

Broker eToro reviews

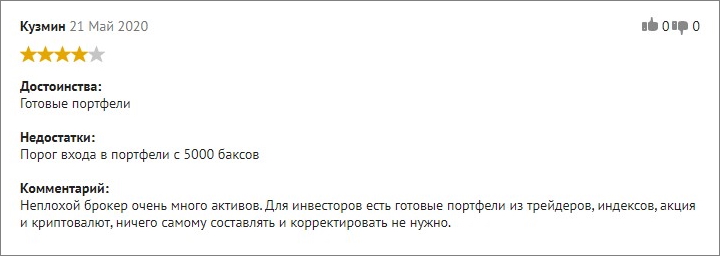

You can find many reviews about eToro online, both positive and negative. On the positive side, many traders talk about a variety of trading assets and ready-made investment portfolios, as evidenced by this review:

The same can be learned from this eToro review:

If we talk about negative eToro reviews, then most often traders complain about high commissions when withdrawing funds and slippage that occurs from time to time, which is not very convenient when trading. But if you compare all the reviews about eToro and discard custom comments, there will be more positive reviews.

Conclusion

eToro can rightfully be called one of the best platforms offering social trading in all its forms, since almost every trader or investor is likely to be satisfied with this broker. It is also very convenient that all the broker’s functionality is available on the eToro official website without the need to install additional software.

If we talk about trading conditions through the eToro broker, then we can note low leverage, which is more of a plus than a minus, since initially it allows you to tune in to low-risk trading, regardless of style, but if desired, each trader can still get high leverage, by submitting an application and passing a proficiency assessment test.

The only traders for whom this broker will not be suitable are scalpers, since there are absolutely no conditions for high-frequency trading and transactions take more than 1-5 seconds, which is critical for fast transactions.

To leave a comment, you must register or log in to your account.