The choice of strategies for trading binary options is huge, but most of them involve the use of the MetaTrader 4 terminal. In conditions where analysis is carried out on one platform, and trading on another, this can reduce the efficiency of trading. Meanwhile, there are a number of effective strategies for trading which a set of technical indicators available from the Quotex broker is sufficient. One of these strategies is Awesome MACD.

This strategy for the Quotex broker is based on the use of three effective indicators:

- Awesome Oscillator;

- MACD;

- Fractals.

The versatility of this strategy allows it to be used when making transactions with any financial assets traded with the broker Kvotex. Moreover, by strictly following the trading rules and analyzing the indicator readings in their entirety, it is possible to minimize risks, which in the long term will help increase profits.

Adding Indicators to Quotex

To add indicators to the Kvotex platform, in the web terminal, click on the indicator panel icon:

Then select the indicators needed for the Awesome MACD strategy. But before adding them to the chart, it is worth noting that each of them has its own operating principle and after selecting it, you will need to change the initial settings of the MACD and Awesome Oscillator indicators. The fractals work based on the use of a certain number of Japanese candlesticks, so its settings cannot be changed.

Initially, you should place the MACD indicator on the chart in the terminal, the task of which is to help determine in which direction the price is moving. It should be clarified that usually in MACD they pay attention to the histogram overcoming the zero line, but in this strategy you need to track the green and red signal lines. The columns themselves can be used to determine the trend, and the intersection of the histogram columns with the zero level upwards indicates an upward trend, and if the histogram is below the zero level, the trend is going down.

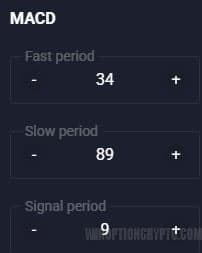

MACD values to set: fast period – “34”, slow period – “89”, signal period – “9”:

The second thing to add is the AO indicator, its standard values are “5” and “34”:

There is no need to change the settings, as the preset parameters give good results.

This indicator (AO) is used in the Awesome MACD strategy to determine the moment to buy options, however, to get accurate signals, you should use a number of patterns that relate specifically to the AO indicator:

- Crossing the zero (average) line;

- "Saucer".

With the first pattern, everything is very clear - this is the intersection of the Awesome Oscillator columns with the zero level.

The Saucer pattern is more complex. It is formed by three columns on the histogram, and for Call options it looks like this:

And for Put options it's like this:

The images clearly show that the column marked with the number "1" is higher than the column "2", and the highest one is the column "3", it signals the purchase of an option. When such a combination is formed, you need to enter into a transaction.

Call and Put options for the Saucer pattern are purchased depending on the position of the AO indicator relative to the "0" line. A Call purchase is made if the signal bars are above the line, and a Put purchase is made if they are below the line.

Lastly, you need to install Fractals, with the help of which you can track the price going beyond the range, which is also a signal to buy an option, but they should be used only after the formation of patterns on AO.

The Fractals indicator is displayed as arrows above/below the candles. It does not require any settings, so it is enough to simply place fractals on the chart.

Examples of Trading with Quotex Using the Awesome MACD Strategy

Financial transactions on Quotex according to the specified strategy occur after all indicators simultaneously give the necessary signals, and for Call options it is necessary that:

- MACD bars were above the green and red lines.

- AO has formed a Saucer pattern above the zero line, or its bars have crossed the zero line upwards.

- The asset price has broken through the previous fractal upwards.

For Put options it is necessary that:

- MACD bars were below the green and red lines.

- AO formed a Saucer pattern below the zero line, or for its bars to cross the zero line downwards.

- The asset price has broken through the previous fractal downwards.

The Awesome MACD strategy is effective when working on any timeframe, but the expiration should not exceed 3 candles.

It should be noted that the technical combination "Saucer" of the Awesome Oscillator indicator is best used only by experienced stock market players, since it is formed quite often, but is not true in all cases. Therefore, novice traders should focus only on the intersection of the middle line ("0").

Entering a trade with a purchase of a Call option looks like this:

As you can see, when the indicators cross “0”, you need to wait until the border of the last fractal that was before the crossing is broken.

Buying Put options is similar, but the rules are reversed:

Please note that sometimes the price can cross fractals ahead of time and this means that it is not necessary to wait for the next fractal, but you can buy an option if other signals indicate this.

Don't forget that if you have suffered a loss on the signals of the Awesome MACD strategy, you can always use the promo code to cancel a losing trade in Quotex for $10.

Conclusion

The Awesome MACD strategy is notable not only because it can be used in the Quotex broker terminal. This strategy is basically universal and has simple trading rules, so it can be used by novice traders when making transactions with binary options.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto, where we will definitely analyze all your questions on video.

To leave a comment, you must register or log in to your account.