Of course, the short expiration period of options allows you to get a possible profit much faster, which seems very tempting for novice traders. However, experienced stock market players prefer to use medium-term and long-term strategies when trading binary options . This option allows you to reduce risks with significant price fluctuations in the range (market "noise").

The choice of turbo options for beginners to trade through the broker Quotex is also due to the fact that such contracts seem more understandable and do not require long analysis, whereas when opening medium-term transactions, quick analysis is not enough. Meanwhile, there is an easy-to-learn strategy that is often used by experienced traders. In addition, all the necessary indicators for binary options used in this system are available by default on the broker Quotex platform.

Features of the Stochastic Average Strategy for Quotex

To trade using the specified strategy, you need to install 3 indicators:

- Moving Average . Moving Average is a smooth line on the chart and is used mainly to understand the direction of the trend . The location of Japanese candlesticks above the SMA line indicates an upward (bullish) trend. When the candlesticks are below the line, the trend is bearish (i.e. downward);

- Bollinger Bands. This indicator is displayed as three smooth lines. It can be used to determine not only the trend direction, but also the boundaries of the market price range (price channel). Bollinger Bands is used to calculate the moment of buying a binary option. The entry into the transaction should be made immediately after the price bounces off the upper or lower boundary of the range;

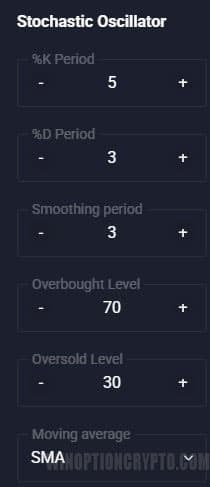

- Stochastic Oscillator . Also a popular indicator that shows overbought/oversold asset. Used in the Stochastic Average strategy for additional confirmation of the signal received from Bollinger Bands.

Installing and Configuring Indicators in Quotex

To make binary options trades on Quotex using this strategy, you need to add the following indicators to the chart with certain settings:

- Simple Moving Average: period "150":

- Bollinger Bands: period "20", deviation "2":

- Stochastic Oscillator: period%k – “5”, period%d – “3”, deviation – “3”, levels – “70” and “30”, method – SMA:

The recommended timeframe for trading using the Stochastic Average strategy is H1, the chart is “Japanese candlesticks”, the expiration is 4 candles.

Trading Rules for Stochastic Average Strategy for Quotex Broker

There should be no major questions when trading on Quotex when choosing this strategy if you follow three basic rules.

A deal with the purchase of a Call option should be opened when the price bounces off the lower Bollinger line, if at the same time the Moving Average indicates a bullish trend (i.e. the line is below the candles), and the Stochastic signal line has left the oversold zone, i.e. is above the “30” level:

Put options should be bought in the opposite situation. Such binary options transactions are made during a downward trend, indicated by the SMA line, while the Stochastic Oscillator line should leave the overbought zone (that is, should be below the "70" level), and the price should rebound from the upper border of the Bollinger bands:

The expiration for each trade should be at least 2 hours, but as mentioned above, it is better to use 4 hours (4 candles on the H1 chart).

Also, don't forget that risks in trading can be reduced using the promo code for canceling a losing trade from Quotex . This will allow you to always cancel any losing trade of $10.

Recommendations When Using This Strategy

In order to make a profit by trading on the Stochastic Average strategy at the binary options broker Kvotex, you should use assets with high volatility, for which many contracts are opened. It is not recommended to make a deal during a flat, when the direction of the price movement is not clearly expressed (sideways trend).

It is also worth paying special attention to the position of the broken line of Stochastic and you should open an order only when it has left the overbought/oversold zone.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely analyze all your questions on video.

To leave a comment, you must register or log in to your account.