Speculators use technical analysis approaches to find optimal entry points into the market. However, this approach does not provide effective signals with 100% probability. In particular, the effectiveness is reduced due to the fact that they react to changes in the market with a slight delay. In this regard, users simultaneously use an extended toolkit for binary options.

Some of the correct methods for making deals on buying digital contracts include combining three popular indicators: SMA (simple ma) , RSI (relative strength index) and MACD (moving average convergence and divergence).

Before you start buying options, don't forget that you can reduce trading risks by using the Quotex Loss Cancel Promo Code. This will always allow you to cancel any $10 loss trade.

Features of the Trading Methodology for Quotex

For work it is recommended to use three tools with default settings:

- SMA 10;

- Relative Strength Index 14;

- MACD 12, 26, 9.

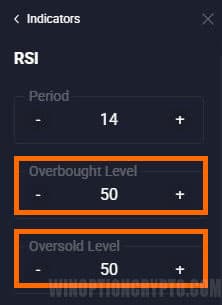

You will need to change the zones in RSI, where you set the value to 50:

Unlike many other strategies for Quotex, this approach is based on the RSI indicator. That is, other tools give signals that confirm or refute the main one. Trading within this method is conducted according to the readings of the relative strength index: the trader needs to track the moment when it crosses the middle line.

With the help of SMA, you can see whether the average rate is rising or falling over a given time interval. And thanks to MACD, you can find the optimal moment to place an order, as well as identify "noise" and false indications from other instruments used in trading.

To conduct trading operations, it is recommended to simultaneously use all three trader "assistants" with the settings set by the platform by default.

Conditions for Purchasing Call

Trading on Kvotex comes down to determining the moment when all three indicators used reach certain values. It is recommended to buy Call contracts if:

- graphical display of Relative Strenth Index crosses level 50;

- the price chart is located above the 10 moving average level;

- MACD charts intersect each other below the zero level.

If all the above conditions are met, you need to open a position to buy a Call option on the next candle:

When to Buy a Put Option

Buying digital Put contracts is recommended in the opposite situation. Such operations should be carried out when the MACD shows an intersection, and the RSI chart goes down from top to bottom, crossing the 50 border. In addition, the price of the selected asset should be below the moving average of 10. Under such conditions, users need to place orders after the following candlestick pattern has formed:

Results

The given method is distinguished by its increased efficiency. This is explained by the fact that each of the used capabilities of the Kvotex platform gives strong signals. However, this trading format introduces certain limitations: the described entry situations rarely occur on the market. Therefore, users rarely make transactions.

It is important to note that the RSI must cross the 50 level, and the MACDI lines must cross each other. You cannot open trades if the charts are close to the specified limits. It is important that there is an intersection. But if all three conditions are met, you can open a position: with a high degree of probability, such an operation will be profitable. At the same time, to avoid losses, we recommend testing this strategy for Quotex on a demo account before entering the real market.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto, where we will definitely analyze all your questions on video.

Find the best bonuses, promo codes, and contests for Quotex in our social networks: Telegram Group | Facebook Group.

To leave a comment, you must register or log in to your account.