This article will be devoted to one very interesting strategy for binary options, which will allow you to increase the percentage of profitable trades to 80%. In this case, we will not have to use indicators at all. We will only need the well-known Absorption Model with minor modifications. In most cases, the most valuable things can be found in the smallest details.

Characteristics of the Nitro Booster trading strategy

- Trading platform: everything.

- Trading instrument: currency pairs.

- Working TF: 5 minutes.

- Expiration: 2-3 candles.

- The most optimal trading period: European stock exchange opening hours .

- Recommended brokers for work: Alpari , Quotex , PocketOption , Binarium .

The essence of the Nitro Booster strategy

This system is based on the Absorption Model. In a number of sources it is called the Outer Bar. It is also worth mentioning that a modified version of this pattern is used to carry out trading operations using Nitro Booster.

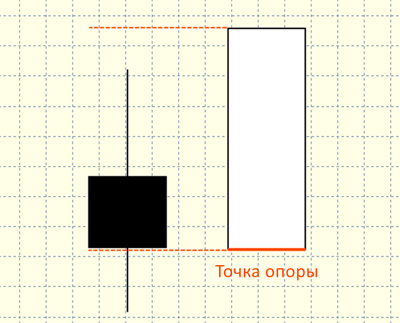

In the classic version, the Absorption Model is a certain combination of two candles. The maximum and minimum price levels of the outer candle (the second one) overlap the same values of the previous one. It is this aspect that is the essence of “absorption”.

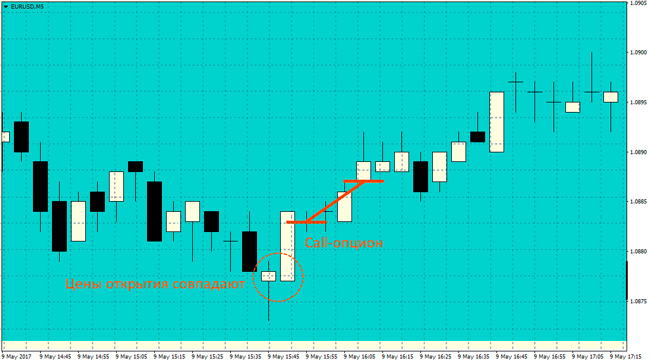

The rules of the strategy in question say: the body of a candle absorbs the body of another candle located in front of it. The body of the first candle should be much smaller than its shadow. Candles that do not have bodies also fall under the conditions of the strategy. The rules that apply to the second candle are completely opposite. The body should be very large compared to the shadows. Shadows may be completely absent. This rule is especially relevant for the reference point.

|

|

If no shadow forms near the opening price, this is a sign of significant price momentum. The initial price level of the outside bar must be at the level of the body of the previous candle or its price lows/highs.

This pattern is accompanied by strong momentum, which is short-term. That is why it is suggested to choose an expiration time of about 2-3 candles. This nuance also distinguishes the strategy in question from the well-known Price Action , where trading is carried out over longer periods.

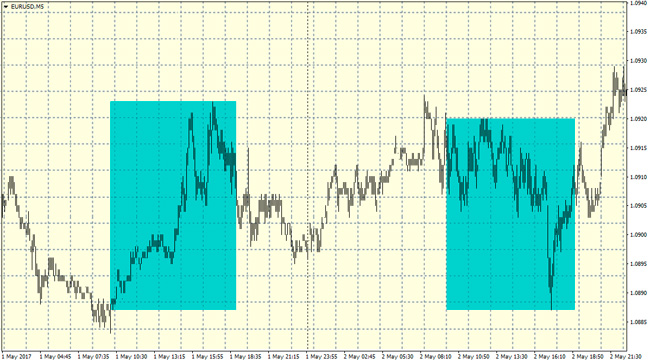

Another important condition for the strategy is the presence of volatility. It is not recommended to carry out trading operations during a lull in the market. The same reason is also the rationale behind the recommendation to use only major currency pairs as trading instruments, since they are more liquid. Most currency pairs perform well during the European session, but some can be traded during the American session.

Rules for making transactions

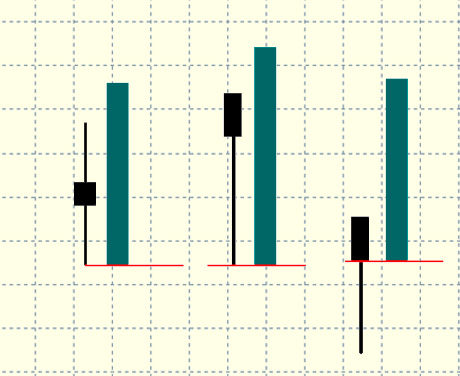

CALL :

- The first candle has a small body relative to the size of the shadow.

- The next candle is rising. Her body overlaps that of the first.

- The opening of the second candle is at the level with the low of the first candle or with its body.

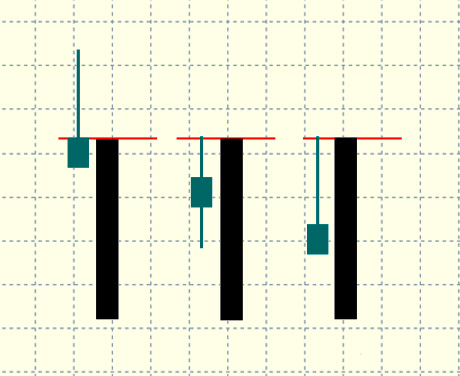

PUT :

- The initial candle of the pattern has a short body, but a long shadow compared to the body.

- The second candle is downward. Her body should completely overlap the first one.

- The opening price of the subsequent candle must be the same as the high or closing price of the previous candle.

If one of the indicated patterns is formed on the chart, you can enter the market in the corresponding direction. Recommended option expiration is 10-15 minutes (2-3 candles, respectively). This parameter depends on the volatility of the asset at the time the option is purchased. When volatility is low, it is advisable to take an option with a longer expiration date.

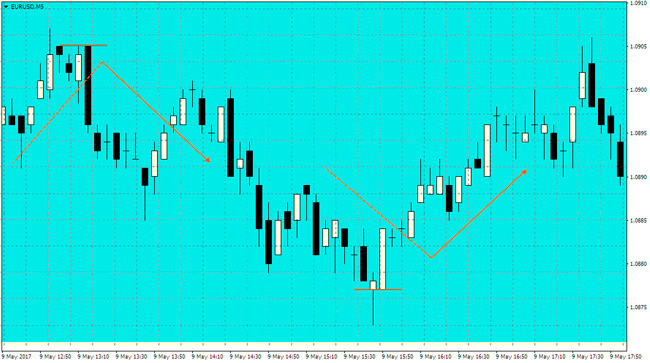

Examples of work using the Nitro Booster strategy

To determine the time of active trading, it is recommended to use the trading sessions indicator. If you plan to trade the EURUSD currency pair, then it is best to do this during the London session (10-19 hours Moscow time).

The first thing a trader should do is to find a candlestick on the chart with a small body and a relatively large shadow. Dojis as well as pin bars also fall under this category. The next candle formed should have a large body, with which it will overlap the short body of the bar located in front of it. The chart may show equality in opening prices, which is a fairly strong signal for a reversal. At the opening of the third candle, an option is purchased.

Conclusion

It may immediately seem that this strategy is very simple, but in fact it is based on certain psychological motives, which were described in some books that reveal the essence of trading. If you manage to interpret them correctly, then with a high degree of probability you will be able to predict the behavior of traders only based on the information provided by the market. In other words, the trader acts as a translator from the language of quotes to market price movements.

We recommend testing all new strategies and indicators for binary options without the risk of losing your main deposit. A good option would be to try them out using risk-free day trading on the financial market from Grand Capital.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.