To make money by trading binary options, you need to guess in which direction the price will move. The forecast must be based on reliable guidelines. One of them is the behavior of other investors.

The Antigravity binary options strategy is based on the trading methodology using Price Action .

Features of the Antigravity strategy

"Antigravity" is suitable for any currency pairs.

Recommended broker: Quotex , PocketOption , Alpari, Binarium .

Recommended timeframe: H1-H4.

Expiration time: depends on a number of conditions.

Trading session: any.

Since the contract expiration time is set based on the market situation, the analysis is performed on a chart with a time frame that is two orders of magnitude lower. Let us consider in more detail the procedure for applying the strategy on the interval H1.

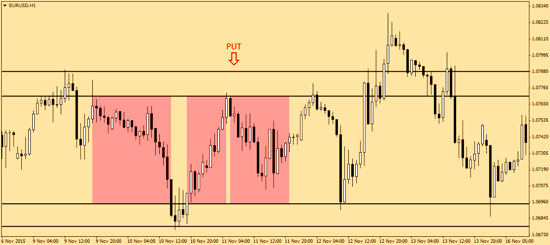

The further stage of preparation for trading involves marking on the chart support and resistance levels passing along the bodies of the candles and their shadows. In this way, a certain channel is formed. This is necessary to identify overbought and oversold zones. We will place a bet as soon as the price reaches the specified lines. These levels are visible especially clearly on short time intervals, for example, M5.

An important parameter of the trading strategy is Wave. This is the number of candles needed to move from one zone to another.

In the example we are considering, the price needed 20 candles to overcome the “path” from the resistance line to support, and 10 candles on the opposite “road”.

Wave is the average value, it is calculated like this: (20+10):2=15. Expiration time should be within 70-120% of Wave. In our case, this is 10-18 candles.

Before and after the release of important news, strong movements are likely in the market. The rest of the time there are practically no sharp fluctuations, since there is no special rush among traders to open transactions.

Wave should be recalculated after some time to update the data.

So, the trader’s procedure is:

- drawing support/resistance levels;

- calculation of the Wave parameter;

- determination of option expiration time (70-120% of Wave).

If we see that the quotes have broken through a key level, and presumably the resistance is now support, we count the number of candles before the decline to the new support level. In the chart below, such a section was 38 bars. Wave will be equal to 19 (38:2). Expiration time is from 13 to 23 candles. After the price reaches the support level, we buy an option to increase.

Bets are made both when crossing the first line and the second. In order not to miss a good chance, it is recommended to enter the market twice: when reaching each of the lines. Risks should be distributed equally between both bets.

Conclusion

A simple trading strategy “Antigravity” allows you to find good entry points. It has a sufficient percentage of profitable trades - more than 60%. Using this system will increase the efficiency of your trading in a calm market. It is suitable for any currency pairs and has proven itself well in long-term trading on “average” timeframes.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.