The Quotex broker platform offers wide opportunities for using new strategies due to a significant expansion of the list of indicators for binary options. Now there is no need to go to other terminals for technical analysis. In particular, a successful strategy for binary options can be the simultaneous use of two indicators - "Relative Strength Index" and "Bollinger Bands".

This strategy is suitable even for beginner traders, as its rules are simple and clear. In addition, it can be applied to all currency pairs, as well as when trading other assets on the Quotex platform.

Also, do not forget that the Quotex broker offers all traders promo codes and bonuses, which allows you to maximize profits from trading binary options.

Adding and Configuring Indicators on the Quotex Platform

First, let's briefly tell you what each indicator of the Relative BB strategy is.

Bollinger Bands show the boundaries of the price channel, within which the asset is located almost all the trading time. A breakout can occur at the moment of impulse, which does not happen very often (approximately in one case out of five). During flat periods, the price moves in a certain range and practically does not go beyond the channel. Therefore, you can safely trade inside, buying Put options when the price is at the upper limit, and Call options when the price approaches the lower limit. Bollinger Bands are simultaneously used as a trend indicator and as an indicator of the right moment to buy options:

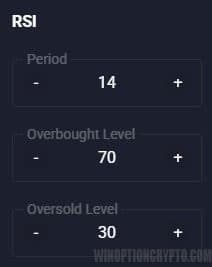

The Relative Strength Index (RSI) indicator reflects the relative strength of the trend and the probability of a price reversal in the opposite direction. By its nature, this indicator is an oscillator, i.e. it fluctuates in a certain channel between the minimum (0) and maximum (100) values. If the indicator line is below "30", it means that the asset is oversold. If the line rises above "70", the asset is overbought. Going beyond these limits may mean a change in trend:

It should be noted that each of the indicators is effective in itself and has long been used by traders around the world. There are many strategies based only on Bollinger Bands or exclusively on the Relative Strength Index. Another important point is that when focusing on these indicators, you need to trade according to the trend. In this case, the probability of receiving income from trading binary options increases dramatically.

To start using indicators on the Quotex platform, click on the indicator icon at the bottom of the chart and select the necessary tools in the window that opens:

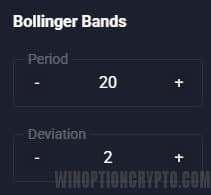

After adding RSI and Bollinger Bands, in the latter you need to change the values of “Period” and “Deviation”, setting them to “20” and “2” respectively:

It is not necessary to change the preset values of the Relative Strength Index indicator:

Trading with Relative BB Strategy in Quotex

After adding indicators, you can start trading by following simple rules:

Buying binary options Call occurs if:

- The asset price fell to the lower border of the Bollinger Bands.

- The RSI line was in the oversold zone (that is, below the “30” mark), and from there it breaks upwards.

Buying binary options Put occurs if:

- The asset price rose to the upper border of the Bollinger Bands.

- The RSI line was in the overbought zone (that is, above the “70” mark), and from there it breaks downwards.

It should be borne in mind that the RSI line will often be near the “30” or “70” marks, which can also be used as a buy signal, but for greater reliability, you should enter the market when the indicator values are below or above the specified levels.

The expiration period in the trading strategy "Bollinger Bands + RSI" is 5 candles.

Below you can see an example of a favorable situation for buying a Call option. It is clear that the price was at the lower border of the Bollinger Bands several times, and the RSI line dropped below the value of "30" and began to rise up, and despite the fact that the first transaction would have brought a loss, the second would have closed with a profit:

To buy a Put option, the opposite conditions are required. In this situation, the price has risen to the upper boundary of the Bollinger Bands, and the RSI indicator has crossed the overbought level in the opposite direction:

Conclusion

Thus, it is clear that trading on standard indicators can be profitable, provided that the rules are strictly followed. However, before starting trading on a real account, you should learn on a practically identical demo account , the only difference of which is that trading is conducted with virtual money.

Also, you should never forget the golden rules of risk management and money management when trading any assets with the Quotex broker. Following these principles will help you save and increase your investments. We wish you profitable trading!

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto, where we will definitely answer all your questions on video.

Find the best bonuses, promo codes, and contests for Quotex in our social networks: Telegram Group | Facebook Group.

To leave a comment, you must register or log in to your account.