The Nexo exchange wallet is one of the most reliable and profitable places where users are invited to deposit money or receive a loan secured by cryptocurrency. Moreover, the service is ready to lend even very large sums. And the interest on deposits reaches 12% per annum even in stable coins, while an additional 5% can be obtained when interest is calculated in Nexo tokens.

Attention, when registering on the nexo website, the activation email may end up in spam or not arrive at all, add [email protected] to your contact list

Content:

- Nexo development history;

- How to register on the Nexo platform;

- Nexo platform interface;

- How to use Nexo: basic functions;

- Replenishment of balance;

- The procedure for obtaining a loan;

- How to earn passive income;

- Advantages and disadvantages of Nexo;

- Nexo reviews.

Nexo Development History

The prototype of Nexo was the Credissimo resource. This company, created by two entrepreneurs in 2007, was aimed at those people who needed to quickly get a loan. That's why Credissimo has specialized in issuing online loans from the first day of operation.

Three years after its formation, the company's owners automated the lending process. The created algorithm independently processed each incoming application and made a decision. This approach helped speed up loan disbursement. Thanks to the new algorithm, Credissimo began to credit clients with money at any time of the day.

After three years, the company created its own application for mobile devices, while simultaneously optimizing the official website for smartphones. This allowed Credissimo to increase the number of applications processed to one million per year.

The following year, the company went public, issuing about 2.5 million of its shares. After another year, the developers improved the algorithm that made the decision to issue a loan. And in 2016, the creators of Credissimo for the first time added the function of repaying debt using Bitcoin .

The Nexo platform was officially registered in 2018. From the first day of its existence, this platform specialized in issuing loans secured by cryptocurrency.

After more than ten years, Credissimo and Nexo have processed over a billion applications. To date, the platform has appeared in many countries around the world, including the CIS.

How to register on the Nexo platform

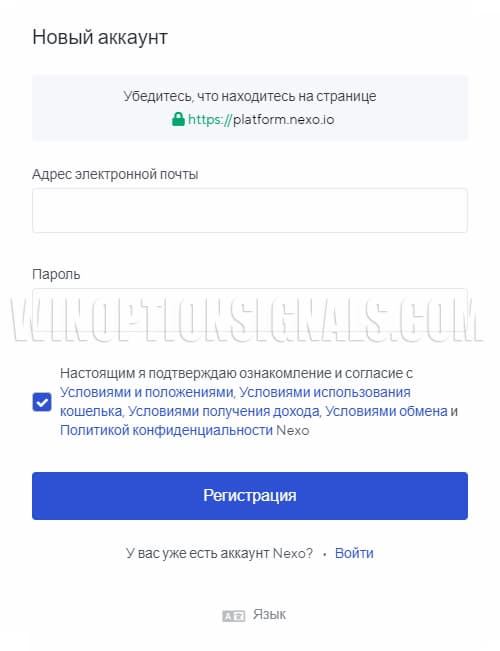

Loans are issued only to registered users. To open a new account on Nexo, you just need to go through the standard procedure:

- Go to the official website.

- Click on the create a new account button.

- Enter your email and password.

- Confirm your account registration by clicking on the link that will be sent to your email (if the email does not arrive, you need to add [email protected] to your address book).

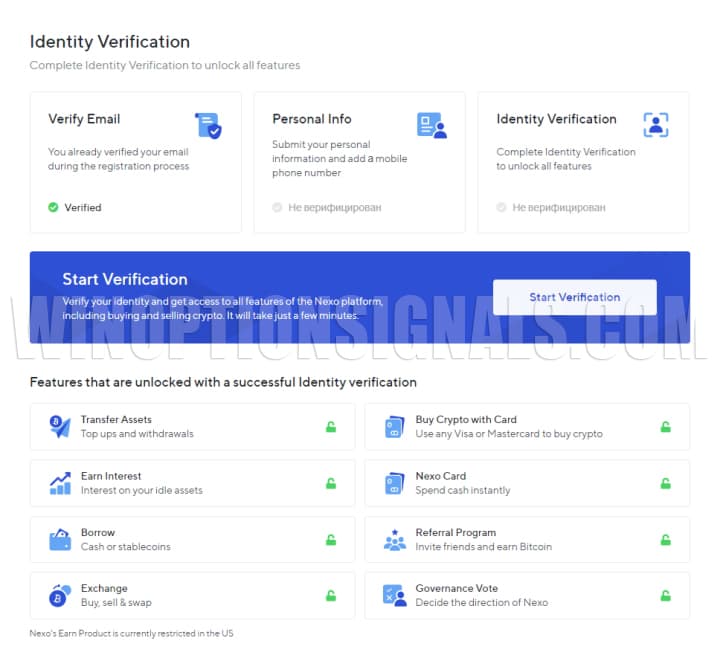

But in order to unlock all the functionality of the site, the user needs to undergo identity verification. Without fulfilling this requirement, it is impossible to even top up the balance in your personal account. Therefore, after registering a new account, you will have to perform the following steps:

- Confirm your registration by following the link in the email . We have already talked about this above, but we repeat it because without this point you will not be able to enter your personal account, and this is the first stage of verification.

- Fill in personal information about yourself . After logging into your personal account, go to your profile and click on the “Start Verification” button. A page will open where you will need to fill out all the fields, including first name, last name, residential address and telephone number. Indicate only real data, as they will need to be confirmed later.

- Confirm your identity . After entering your data, you will need to send identification documents, and the best option would be a foreign passport.

Once verification is completed, you will be able to use the full functionality of the platform, which includes:

- Replenishment and withdrawal of funds.

- Earnings.

- Applying for a loan.

- Cryptocurrency exchange.

- Buying cryptocurrencies using credit cards.

- Registration of a plastic card from Nexo.

- Access to the referral program.

- The right to participate in votes relating to the future of the company.

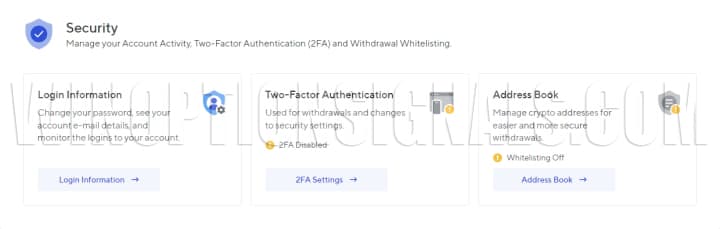

Be sure to pay attention to two-factor authentication, since if you fund your account and use the Nexo platform, you need to protect your money as much as possible. To enable authentication, you need to:

- Install Google Authenticator on your mobile device. This application automatically and randomly generates passwords that will be used to log into the site, replenish your account and withdraw funds.

- Click on the profile icon and go to the “Security” section.

- Click on the two-factor authentication icon located at the bottom of the page.

- Go to Google Authenticator and add a new profile by clicking on the corresponding icon. You can speed up this process by using the QR code scanning option.

- Enter the one-time password in the appropriate field.

Using two-factor authentication provides a high level of account protection from hacking. This is explained by the fact that for all actions (login to your personal account, withdrawal of funds) a password is required, which is always generated randomly.

Nexo platform interface

The platform developers have created a simple and intuitive interface, so users can immediately start applying for loans without wasting time searching for the necessary buttons and sections. After verification, you can use your personal account, which contains the main functions of Nexo.

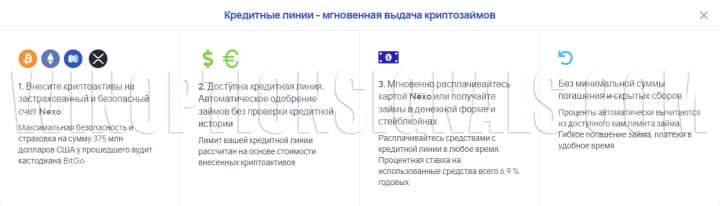

The main advantages of the platform are described at the top of the screen:

- All money that users send to Nexo is insured for up to $375 million. That is, even if force majeure occurs, the service will definitely return customer funds.

- Quickly obtain credit security without checking your credit history.

- When you sign up for a Nexo card, you can instantly pay and borrow in fiat money or stablecoins.

- No restrictions or hidden fees and automatic interest debiting.

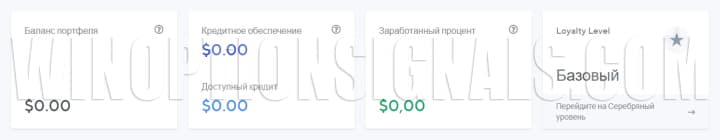

Below are three financial blocks plus a block with the loyalty level. Financial blocks include:

- Portfolio balance . This block shows the total balance, including cryptocurrencies, fiat money and stablecoins.

- Credit collateral and credit limit . Shows what kind of loan you can get. It is based on the cryptocurrency you hold in your Nexo wallet.

- Interest earned . The block shows the total income, which is calculated in real time.

- Loyalty block . Initially, each user receives a basic level of loyalty, but if you increase it, you can receive various lucrative bonuses.

Below on the main page you can find three blocks for:

- Getting a loan.

- Loan repayment.

- Buying, selling and exchanging cryptocurrencies.

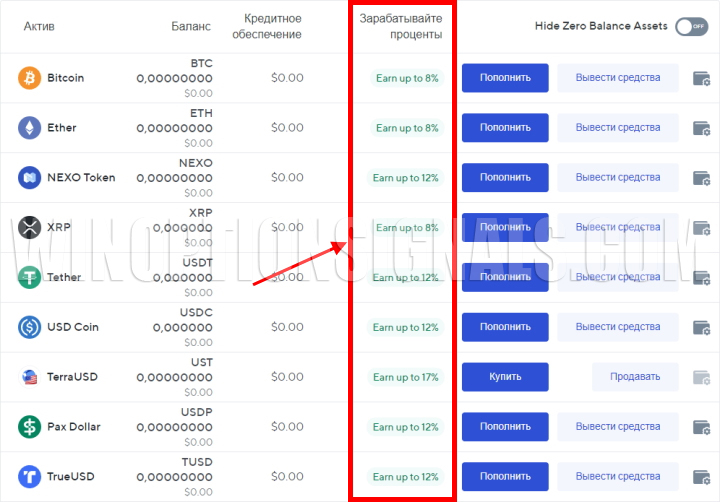

Next is a section that lists all supported cryptocurrencies, including:

- Bitcoin;

- Ethereum ;

- BNB (Binance);

- Litecoin ;

- Ripple ;

- TRON;

- Stellar;

- Bitcoin Cash;

- NEXO Token and others.

Users can also top up their balance using one of five stablecoins: USDT, TUSD, DAI, PAX or USDC. For the convenience of clients, Nexo developers have introduced the ability to make transfers in euros.

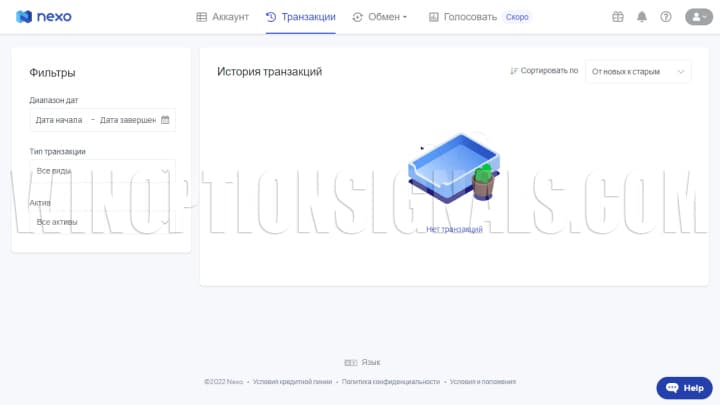

To view the history of all transactions, you can go to the “Transactions” section located at the top of the site. Here are all transfers: incoming and outgoing:

You can read the notifications that the site sends out by clicking on the bell icon, which is also located at the top of the site. Nearby there is a question mark, when clicked, additional sections of the platform are revealed. Through this menu you can contact the user support center or find out information about Nexo (in the form of text or an explanatory video). Also, by clicking on the question mark, sections with the advantages of the area, a calculator, a credit card and loan conditions open.

How to use Nexo: basic features

Despite the fact that the platform has advanced functionality, Nexo clients carry out mainly three operations: replenish their balance, apply for a loan and buy coins to receive passive income. Each operation has certain nuances, but thanks to the convenient and extremely simplified interface, users usually do not have problems with performing all procedures.

Top up your balance

To top up your balance on Nexo, all you need is:

- Open the list with supported cryptocurrencies, select the appropriate one and click on “Top up”.

- Send the required number of coins to the wallet that the site will automatically generate.

The speed at which funds are credited depends on the type of network selected. In particular, it can take up to a day to transfer bitcoins. XPR or TRON are credited almost immediately.

The Nexo platform did not introduce restrictions on transfers in cryptocurrencies that can be transferred to the balance. But the credit limit depends on the amount. That is, when determining the loan size, the platform takes into account only the volume of coins transferred to the balance sheet. Stablecoins are credited to the account using a similar algorithm.

Procedure for obtaining a loan

After replenishing the balance in cryptocurrency, the platform automatically determines the amount of funds that users can take out as a loan. This amount is indicated in dollars. The credit amount is 40% of the volume of coins deposited into the account.

After the platform determines the amount of funds that can be borrowed, Nexo customers just need to withdraw funds by going to the loan collateral section. It is allowed to transfer borrowed money to:

- dollars;

- Euro;

- stablecoins.

The loan is issued subject to full repayment within a year. However, Nexo will automatically extend this period without requiring a partial refund. However, you cannot withdraw cryptocurrencies until they are fully repaid.

The standard loan rate is 11.9%. If you pay off debt using Nexo coins, then this figure decreases to 5.9%. In some cases, the site may change the lending terms and issue a loan at 16% (8% respectively when using Nexo coins). It depends on the:

- general market situation;

- loan amount;

- volume of introduced cryptocurrency.

Data on lending conditions is constantly updated and is publicly available. As stated, Nexo does not use hidden fees.

The loan is credited to your account within 1-2 days. But due to the fact that some processes do not depend on the site, Nexo reserves the right to transfer borrowed funds within five days. But if the loan is issued in internal stablecoins, then the coins are credited almost immediately.

The conditions for issuing loans on Nexo differ from traditional ones. Customers do not have to transfer a certain amount into the account every month, as required by banks. To secure a loan, users credit cryptocurrency to their balance. You can repay the debt either with several transfers or with one.

How to earn passive income

Nexo developers are ready to share part of the income with users if they replenish their balance in euros or cryptocurrencies. This is explained by the fact that the platform owners, when lending to clients, risk their own money. To reduce the likelihood of losses associated with non-repayment, developers are ready to give part of their earnings to those users whose money is also issued in the form of a loan. Such funds are subsequently returned to clients with a certain percentage.

You can receive additional income immediately after depositing funds into the exchange wallet. Now the profit of clients whose money is managed by the site is 8%-12% per annum. Other cryptocurrency platforms offer similar conditions, but the Nexo exchange provides clients with greater income. In particular, Binance offers 2-6% per annum, while on NEXO you can get 8% for a regular deposit, 12% for earning profits in nexo tokens and another 5% for depositing into fixed accounts (with a time limit on withdrawals)

Advantages and disadvantages of Nexo

Among the advantages of Nexo, users highlight the following:

- a convenient interface that allows you to immediately find the sections you need;

- support for popular cryptocoins that clients leave as collateral for a loan;

- attractive lending conditions (40% of the cryptocurrency amount, automatic extension of the repayment period, no need to deposit money monthly to repay the debt);

- the opportunity to receive passive income is available;

- a high-quality security system that minimizes the likelihood of money theft (without verification, most functions are closed and restrictions on operations are introduced);

- the money is insured for $375 million;

- cryptocurrency is stored in “cold” wallets, which are very difficult to hack.

Nexo is a centralized service that is regularly audited by third parties, which proves the reliability of the platform.

However, like other similar platforms, this one is not without a number of disadvantages:

- two-factor authentication, without which it is impossible to carry out a number of operations, does not always work correctly;

- to reduce the credit rate, you need to purchase an internal coin, which is not always convenient for clients;

- To gain access to all features and remove restrictions, you must fully disclose the user's identity.

Nexo is a convenient platform for obtaining loans designed for cryptocurrency owners. The platform differs from its analogues in that it does not provide the anonymity to which users who resort to the services of such resources are accustomed. However, Nexo provides a high level of investment security and allows you to earn money on loans, offering more favorable conditions than competitors.

Attention, when registering on the nexo website, the activation email may end up in spam, add [email protected] to your contact list

Nexo reviews

The NEXO platform is a reliable exchange for receiving loans and opening deposits. All user funds are insured for $375 million. High interest rates on deposits allow you to receive passive income on cryptocurrencies with an interest rate significantly higher than in banks. There are practically no negative reviews about the exchange, and most of the negativity is associated only with the difficulties of newcomers on the platform, while there are no reviews that the exchange is a scam and does not withdraw clients’ money.

See also:

To leave a comment, you must register or log in to your account.