Recently, the binary options broker Pocket Option announced the release of a new feature in its platform – AI Trading. The algorithm, controlled by artificial intelligence, is designed to make basic trading decisions when you click a special button located between BUY and SELL.

Content

- Pocket Option AI-trading: How It Works?

- How Does Аrtificial Intelligence Make Trade Decisions?

- Is Pocket Option AI Trading a Scam?

- Mistakes in Using AI-trading from Pocket Option

- Conclusion

What results can be expected from AI in managing trading operations, as well as how to avoid important mistakes in using the algorithm - we tell you in the review.

Pocket Option AI-trading: How It Works?

Pocket Option has provided a tool that can independently determine the direction of the transaction and the optimal expiration time. What else is needed, it would seem?

Of course it is! An experienced binary options trader will immediately understand: we are not talking about trading on full autopilot under AI control here. In fact, the task of choosing the optimal asset for trading and all risk management remains with the person.

Since you will no longer be the one analyzing the chart, when choosing a trading instrument, you will need to trade only those assets that offer the best payouts. In the dynamic environment of the pocket Option platform, the payout percentage can change quickly, so we recommend that you pay close attention to this issue and focus on your part of the business.

There is one more nuance concerning the choice of assets for trading via AI-trading. We will tell you more about it in the corresponding section of this review material.

As for risk management, the trader must define its rules and adhere to them. The AI robot will not decrease or increase your bet, so before each trade you should set its size, and only then click the AI-trading button. Whether you bet a certain equal amount for each trade, adapt the bet according to the Martingale principles, set it as a certain percentage of the deposit, or follow some other specific risk management rules - this is your job as a co-pilot.

How Does Аrtificial Intelligence Make Trade Decisions?

Of course, we don’t know exactly the algorithms by which the Pocket Option trading robot makes decisions. It is not customary to share the source code of such developments, so we can only take into account what the company itself tells about the principles of AI Trading on its platform.

The promotional video released by Pocket Option announcing the new functionality claims that the algorithm uses the following factors to make a decision to buy or sell, as well as the expiration of the asset selected by the trader:

- market dynamics

- trading signals and strategy

- technical analysis

- other traders experience

- more than 100 additional indicators

Of course, Pocket broker clients may have suspicions: does it all sound too good to be true? Let's figure out whether such use of AI in trading is possible, at least theoretically?

Is Pocket Option AI Trading a Scam?

Artificial intelligence, aggressively conquering new territories in the field of practical application, has divided humanity into skeptics, anxious and enthusiastic. According to YouGov research, 29% of people feel curious and enthusiastic about AI, 22% are afraid and 49% describe their feelings as anxious and worried.

The introduction of AI into trading also causes a lot of controversy. And, it must be said, skepticism here is entirely justified. After all, financial markets are not a chessboard with clear rules, but rather a poker tournament where the strongest win.

But let's take a look at the tricks that Pocket Option claims its AI algorithm has up its sleeve. The broker claims that the system relies on five key factors. How realistic are these claims?

Market Dynamics Analysis

Let's say this task involves analyzing price behavior in real time - price action. Sure, AI can process mountains of data and find patterns in it. But can it outperform an experienced trader in reading market sentiment?

It's like drawing. A talented artist is more likely to create a masterpiece than AI, but a beginner may lose to the machine. In trading on financial markets, artificial intelligence can show impressive results, especially against the background of inexperienced players. But will it be able to surpass the best traders with their intuition and years of market instinct? It's unlikely.

Working with trading signals and strategies

In this aspect, there are probably the fewest questions about AI. Modern algorithms are quite capable of processing signals from a broker at lightning speed and integrating them into a given trading strategy. Moreover, a robot can simultaneously track multiple signals on various assets, which is physically inaccessible to a person. Another question is how high-quality are the signals fed to the algorithm?

Technical analysis

Theoretically, a properly trained AI algorithm could become a true technical analysis virtuoso. It would be able to accurately determine support and resistance levels, identify trends, and recognize complex graphic patterns. And it would do this much faster than a human and simultaneously on multiple charts.

The main condition here is the quality of training. It is extremely important that the algorithms are based on time-tested methods of technical analysis, and not on dubious theories or outdated approaches. Otherwise, AI risks becoming a kind of "high-tech fortune teller" that gives beautiful but useless forecasts.

Taking into account the experience of other traders

This is the point that has the most questions. When it comes to sentiment, the intrigue arises: does Pocket Option use its internal data on traders and their trades or does it turn to external sources?

If a broker analyzes the behavior of its clients, this can provide interesting insights, but the sample will be limited. On the other hand, if AI processes data from external sources (social networks, forums, news feeds), this opens up broader opportunities for analyzing market sentiment.

The key question is: how quickly can the AI process this information? In trading, delay is expensive, and outdated sentiment data can do more harm than good. It also remains a mystery how the algorithm distinguishes real trends from information noise.

More than 100 additional indicators

At first glance, this sounds impressive. However, aren't we at risk of encountering a situation where the abundance of input data causes the system to "overheat" and produce incorrect conclusions?

In trading, as in many other areas, the rule "less is more" often works. Experienced traders usually use a limited set of proven indicators, without overloading their analysis with unnecessary information. Perhaps a more effective approach would be to teach AI to choose the most relevant indicators for each specific situation, instead of trying to take them all into account at once. It would be great if the developers of Pocket Broker did just that.

Mistakes in Using AI-trading from Pocket Option

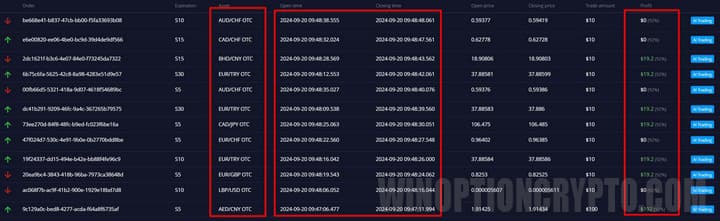

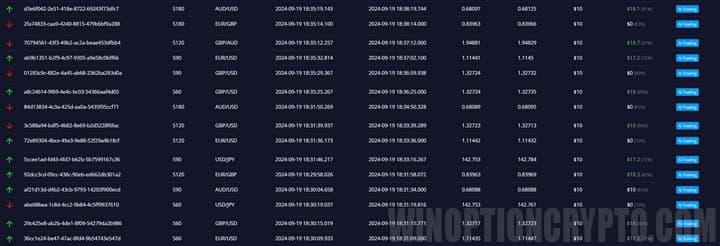

While testing the AI-trading function on the Pocket Option platform, we discovered an interesting feature: artificial intelligence and OTC assets turned out to be poorly compatible.

The thing is that the Pocket Broker AI algorithm seems to have a weakness for fast expirations. Since the minimum expiration on OTC instruments in Pocket Option can be as little as 5 seconds, here AI trading starts to behave somewhat impulsively. It opens many short-term deals, entrusting the result to market chaos and succumbing to the treachery of lower timeframes.

At the same time, on standard assets, AI shows its best side, opening deals with expiration usually in 1, 3 or 5 minutes. Therefore, if you decide to use AI-trading on Pocket Option, it is better to stay away from OTC assets.

For example, on our experimental sample of 15 trades, the AI showed a pretty good result, closing 10 of them with a profit, 1 at breakeven, and 4 with a loss.

Speaking about mistakes in using AI-trading feature on the Pocket Option platform, the most important thing is not to forget about risk management and money management. Many novice traders ignore them, while in binary options trading they are no less important than choosing a good point for making a deal, or even choosing its direction.

Conclusion

The stated capabilities of Pocket Option AI trading are truly impressive. However, as always happens with new technologies, the real effectiveness of the system can only be assessed through long-term practical use. Traders who decide to try this tool should approach it with a reasonable amount of skepticism and be sure to start with small bets, gradually increasing the risk in case of successful testing.

To leave a comment, you must register or log in to your account.