Chart analysis in binary options trading is a very important part of trading, and for convenience, most traders use candlestick charts, as this type of chart is the most popular and convenient. But there are also alternative types that can be useful in analysis and trading, and one of these is Heiken Ashi.

The advantage of using the Heiken Ashi indicator is that it smooths out price fluctuations using a special formula and thus makes the chart more orderly. With this approach, a trader can see the trend direction more accurately, and the Heiken Ashi indicator can be used on any instrument and time frame.

Setting up and operating principle of the Heiken Ashi indicator

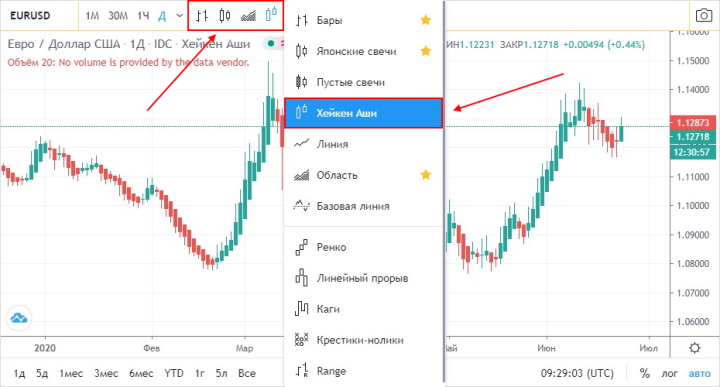

Many trading platforms have Heiken Ashi built in as a standard chart type. For example, when using a live chart on our website, this type of chart will be available without indicators and terminals:

It can also be found on other platforms, but, unfortunately, in MT4 Heiken Ashi candles can only be used using the indicator.

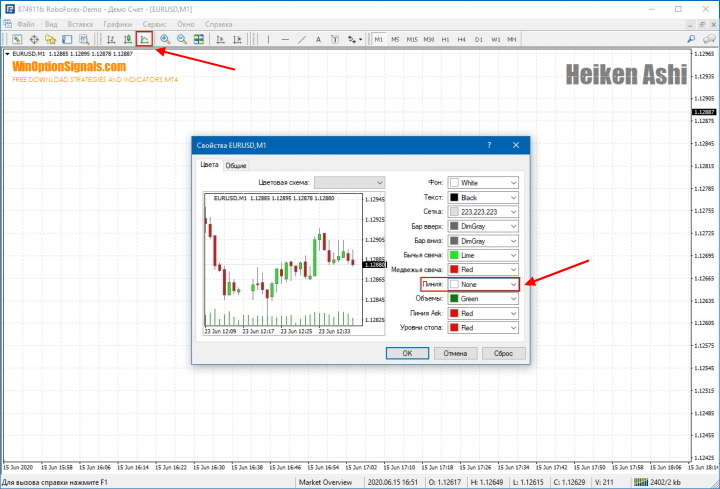

The indicator can be installed as standard in the MetaTrader 4 terminal , and then immediately placed on the chart.

Instructions for installing indicators in MetaTrader 4:

To display the indicator correctly, it will also be necessary to change the standard terminal chart to a linear one, and then make the line color transparent in the chart properties:

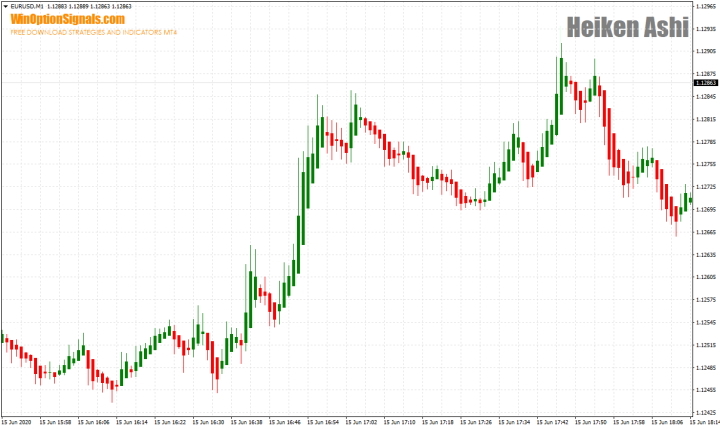

After this, you can add the Heiken Ashi indicator, change the color of the candles if you wish, and in the end you should get a chart like this:

Also, in order not to set up the chart yourself, at the end of the article you can download the Heiken Ashi indicator and a template for it.

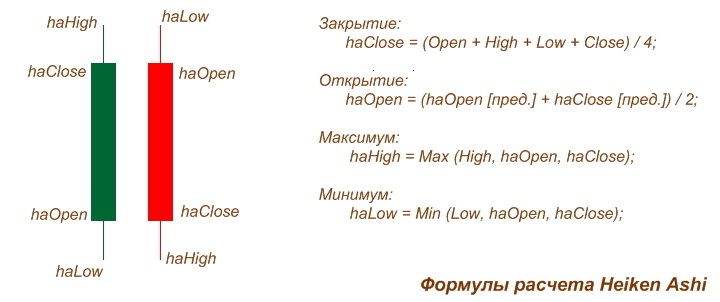

Despite the fact that standard candles and Heiken Ashi chart candles are similar in shape, they display price differently:

These types of charts differ in that standard candles display the price without any formulas, while Heiken Ashi candles, in addition to simple price display, use a special formula that corrects the visual component:

The values by which the Heiken Ashi indicator candles are calculated are dynamic, and they are taken from the current candle. Therefore, the current candle will always be calculated with a delay, since it depends on the previous candle.

But don’t think that this is only a disadvantage of the Heiken Ashi chart. This property can be successfully used on such volatile currency pairs as GBP/JPY or EUR/JPY, since most false breakouts are filtered with the help of Heiken Ashi candles.

Types of signals for trading binary options using the Heiken Ashi indicator

The Heiken Ashi chart can generate different types of signals that can be used for binary options trading. Also, using such candles, you can determine the direction of the trend and other phases of the market.

Determining the trend using the Heiken Ashi chart

Uptrend and downtrend can be easily identified using Heiken Ashi candles. At moments of growth or fall, a feature of candles is the absence of shadows on a certain side (depending on the direction):

As you can see, during an upward movement, green candles have no shadows below, and during a downward movement, most of the red candles have no shadows above.

Also a clear indicator of a trend is the opening of a new candle in the middle of the previous candle, which is especially noticeable in the upward movement in the example above.

To trade, you should focus on three candles of the same color in a row, based on the rules described above. The end of a trend can be indicated by a change in the color of the candle or a decrease in size and the appearance of a long shadow.

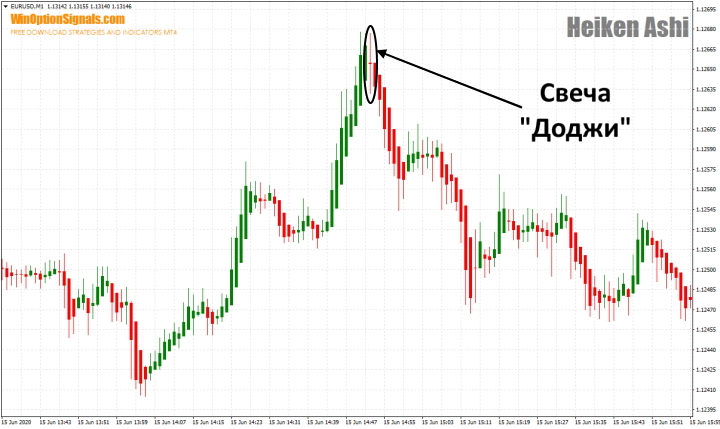

Doji candle and Heiken Ashi indicator

Another signal that can be used in trading is the Doji candle. Its distinguishing characteristics are long shadows and a short body. This candlestick pattern is borrowed from “Price Action” and is quite effective both when used on standard candles and with Heiken Ashi:

Although this formation is strong, you need to be confident in the current trend to use this type of signal.

First of all, even if a Dodji candle appears, you should not trade before a news release (all upcoming news can be found in the economic calendar ). However, if even after the news the trend is confirmed and the price goes in the direction of the Doji candle, then you can buy the corresponding option. To confirm signals, you can use a standard candlestick chart, which will act as a leading factor.

Defining a flat using Heiken Ashi

Another type of signal can be the determination of a flat using this indicator, which is suitable for binary options traders for analysis and for Forex market traders for exiting a position.

When a flat is formed in the market, Heiken Ashi candles will be very short, while shadows can be on both sides, and the color of the candles does not matter at all:

Trading strategies using Heiken Ashi in binary options

The Heiken Ashi indicator can also be used in conjunction with other indicators, which will give you an advantage and help you more accurately determine points for buying options.

You can use any time frames, since the signal formations on each chart will be the same. Expiration for buying options should be calculated based on the trading style, and therefore for scalping trades it is 3-5 candles, and for trend trades it is 5-10 candles.

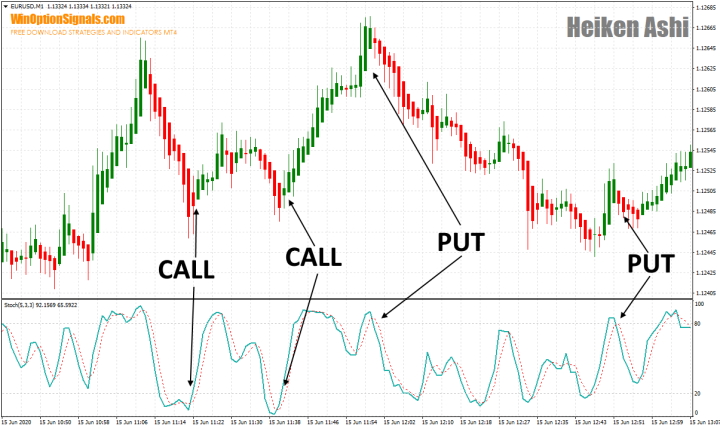

Heiken Ashi and Stochastic Oscillator Strategy

For this simple strategy, the standard settings of the Stochastic Oscillator indicator will be sufficient. The essence of the strategy comes down to trading at the moment when the oscillator leaves the overbought and oversold zone, and Heiken Ashi changes the color of the candles:

I would like to pay special attention to this signal from the oscillator:

As you can see, although Stochastic generated a signal, the Heiken Ashi candles did not confirm this and buying a Put option was extremely risky.

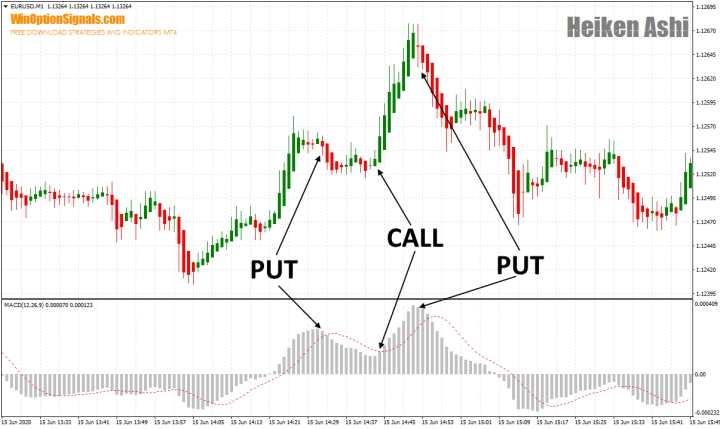

Heiken Ashi and MACD Strategy

The Heiken Ashi indicator can be successfully combined with the MACD indicator :

As you can see, the option is purchased at the moment when the Heiken Ashi changes its color and the MACD histogram bar becomes lower or higher compared to the previous bar.

It is also worth noting that for greater signal accuracy, you should buy options after two consecutive Heiken Ashi candles of the same color.

Heiken Ashi Strategy and PSAR

This strategy is suitable for more experienced traders, since it does not give clear signals and it only makes sense to trade according to the trend. Its essence comes down to finding moments when PSAR is far from the Heiken Ashi candles and at this moment you can buy an option:

Please note that you should only buy an option with an expiration of at least 10 candles. It is also necessary to understand that in real time it is much more difficult to determine the moment of the trend and that is why this strategy is not suitable for beginners.

Recommendations for beginners for trading with Heiken Ashi candles

Heiken Ashi candlesticks can be used by traders with any experience, but if we talk about beginners, then the best option is to use this indicator along with other indicators to get more accurate trading signals.

To trade with the trend, it is worth using longer expirations, such as 10 candles. Expirations of 1-3 candles are not allowed for Heiken Ashi trading, since due to their artificial nature they can bring a loss, although their color will indicate otherwise.

Also, you should not use Heiken Ashi on exotic instruments, since high volatility but low liquidity can play a cruel joke on a novice trader. It is also better to exclude gold from trading using Heiken Ashi.

Conclusion

The Heiken Ashi indicator can be successfully used in binary options trading, but it is worth remembering that before trading on a real account, you should check all versions and capabilities of Heiken Ashi candles on a demo account.

Also, do not forget that Heiken Ashi candles are artificial and long shadows that may appear on the candles do not mean that the price has reached these levels.

In addition to all of the above, for successful trading you also need to choose a trusted broker, who can be found in our rating of binary options brokers . We wish you successful trading!

Download Heiken Ashi template and indicator

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also:

How to make money on binary options

How to choose a binary options broker?

How to make money on the Internet during the crisis of 2020

To leave a comment, you must register or log in to your account.