Many traders in all corners of the planet use gold (as well as silver) as a reliable source of investment, as well as an always liquid asset to preserve and increase their capital in the long term. Inflation, economic crises, and unstable exchange rates of national currencies are the main reasons for investing in a precious metal that has not lost its value for many centuries.

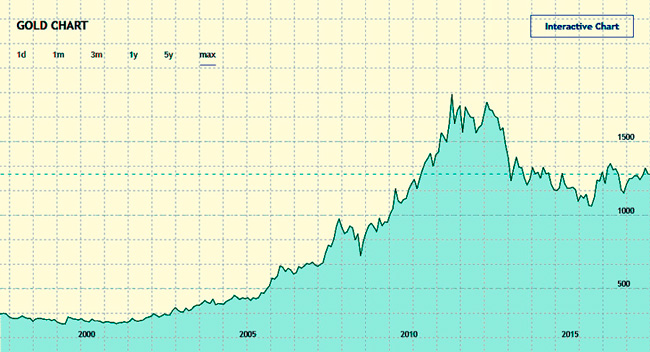

However, in the last few years, the investment attractiveness of gold has decreased significantly, since the previous level of reliability of the precious metal in the long term has been lost. For these reasons, gold has become an excellent asset for short-term speculation.

A binary option is the most convenient trading platform for making transactions in order to profit from short-term price fluctuations. Let's try to understand how to trade gold today and develop an optimal strategy that takes into account all the features of a given exchange lot.

Features of gold trading on binary options

As a rule, it is customary to price gold on exchanges in US dollars, so the trading instrument is designated XAU/USD on the market. If you look at the chronology of exchange rate changes, it will immediately become clear why investing in gold has always been an irreplaceable way to insure exchange risks. Unfortunately, the steady increase in the price of an ounce stopped in 2011. Today's rate is approximately $1300. Moreover, in previous years, the exchange price of an ounce broke through the $1,900 mark.

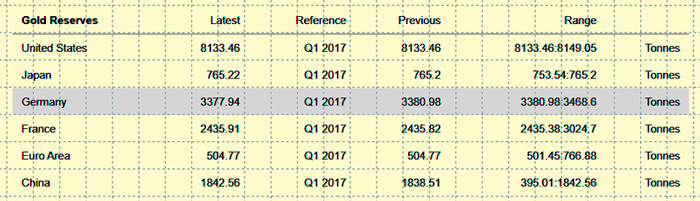

According to experts, the United States occupies a leading position in terms of gold reserves, Germany is in second place. Basically, it is for this reason that the main world and most convertible currency is the American dollar, while the euro occupies second position. However, in addition to its huge gold reserves, the United States is also home to the largest number of the world's most powerful financial corporations. It is clear that in their hands are the most powerful levers of influence not only on the price of gold, but also on the exchange rates of the national currencies of other countries.

In binary options, long-term risks mean nothing. Gold is a very volatile asset, so the expected profit and level of hedging can be calculated quite accurately. However, when trading short-term options, traders may only be interested in the current trend, and not in what maximum value the lot quote can increase.

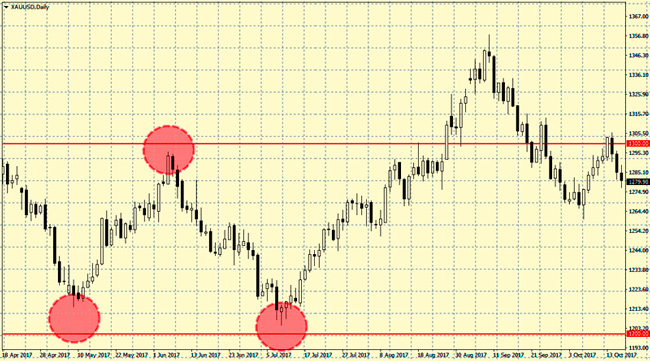

Gold lends itself very well to conventional graphical analysis. For example, bets on breaking through a round level work very well: 1300, 1400, 1500 points, etc. This method cannot be taken literally, so you can take any indicator within the framework of price correlation as the starting point, for example, starting from 50 points above and below.

Another advantage of gold and foreign exchange trading is pronounced and frequent false breakouts. For example, when we see the level of 1200 points exceeded, followed by confirmation of the candle being extinguished. We are seeing signs of the Morning Star scenario - this indicates a very likely trend reversal. This allows us to close a hopeless trade in advance and exit it either with maximum profit or with minimal losses.

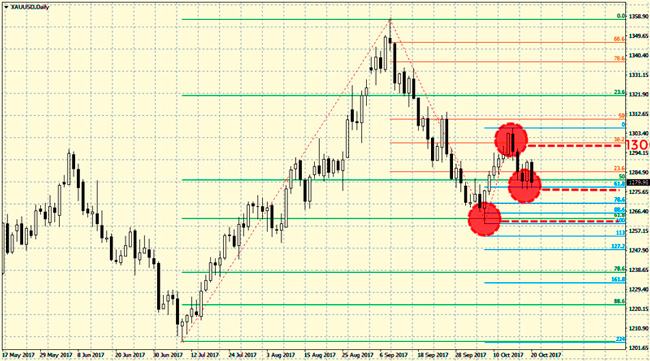

Fibonacci levels are very indicative; the correction is very often 61.8% or 38.2%. In combination with the round level strategy, the prediction accuracy increases significantly. In the example given, the correction of two wave indicators has stabilized by 60% of the previous change. The third wave on the chart broke through 1300, which again indicates the effectiveness of both strategies.

Gold trading strategy

- Platform: any

- Currency pair: XAU/USD

- Trading period: H1

- Expiration time: 1 hour

- Trade time: American session

- Trusted brokers: Quotex , PocketOption , Alpari, Binarium .

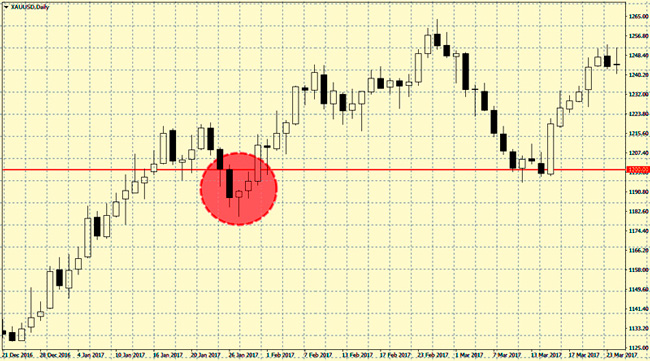

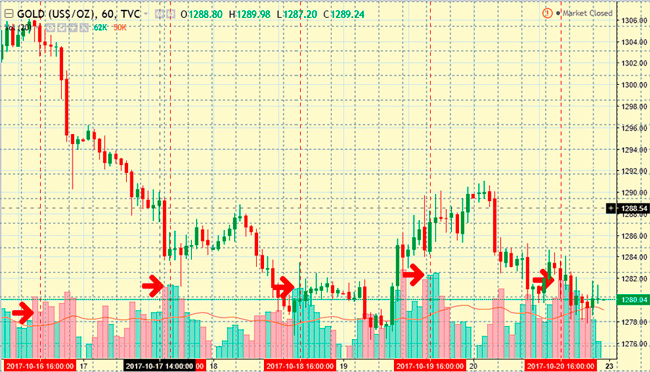

You can trade gold around the clock on any exchange in the world, but London and Zurich are considered the most popular trading centers. At 16:00 Moscow time, trading begins there - this is clearly reflected in the graph, indicating a sharp increase in transaction volumes.

So, that's the essence of the strategy. At 16:00 Moscow time, take the gold chart and observe the trend of the last hourly candle. By this time, London traders had already gone to work. The direction of the closing candle will accurately point you in the direction of a potentially profitable trade. Simply put, if you are bearish, you put. If you are playing for a raise, create a Call order with an expiration time of 1 hour.

Very important - always pay attention to how the candle looks:

- The body of the candle should be larger than its shadow.

- A bullish candle closes at the top, a bearish candle closes at the bottom. This will guarantee you sustainable success.

Equally important is the study of current news - they greatly influence the exchange rate of the US dollar, so even with any other obvious signals, a serious shift in the price of the asset can occur. If important news is discovered, it is recommended to reduce the expiration period to 30 minutes or, if there are no open positions, simply wait for a while.

Graphic examples

If the body of the candle is small and does not indicate a particular trend, trading is like running barefoot through a minefield. Simply put, if the market itself has not yet shown a specific direction, why do we need to take risks? Control the size of the candle and its shadow.

In this case, the signal candle, indicated by a vertical line, began to grow almost at the very bottom and closed near its maximum - an indicator of a pronounced upward trend. Such a candle at the opening of the London Stock Exchange is a favorable signal to start trading. A one-hour expiration almost always brings a positive result. And vice versa - a bearish downward signal candle is a good reason to go bearish.

Conclusion

Please note that gold has already lost its status as an “impregnable haven” and does not at all guarantee the safety of a capital investment. Today, precise mathematical analysis hardly fails and is the most effective tool for stock trading. This gives us a unique opportunity to profit from speculation in gold, regardless of whether its price rises or falls.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.