The foreign exchange market is characterized by constantly emerging patterns. Such patterns are not so difficult to see. Some of them disappear after some time. Others do not lose their effectiveness over a fairly long period of time. The second category includes Japanese candlestick patterns. Below you will see one of the patterns formed on the candlestick chart. It's called "Alternation". We will also explain how it can be used to make a profit when trading options.

Characteristics of the strategy

- Trading Platform: Doesn't matter.

- Tool: any.

- Timeframe: M1-H1.

- Expiration: one candle.

- Trading sessions: American or European.

- Suitable brokers: Quotex , PocketOption , Alpari, Binarium .

The essence of the rotation strategy

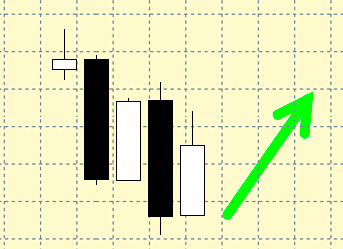

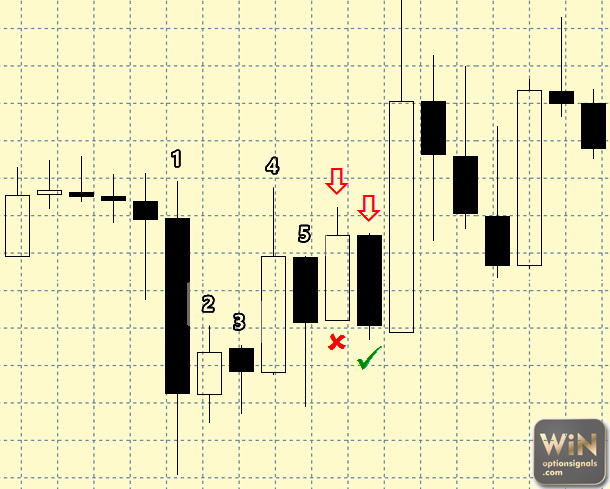

You need to pay attention to the change in the nature of the candles (bearish changes to bullish and vice versa). For some time, candles of different types may be observed, alternating with each other, but sooner or later this will end. The trader’s task is not to miss this moment and open a trade in the direction of the price movement.

You need to pay attention to the change in the nature of the candles (bearish changes to bullish and vice versa). For some time, candles of different types may be observed, alternating with each other, but sooner or later this will end. The trader’s task is not to miss this moment and open a trade in the direction of the price movement.

An important factor in this strategy is the amount of alternation within a single sequence. It is worth considering only the situation in which there are more than 5 candles in different directions. For more conservative trading, it is recommended to wait for 7 candles. In this case, the number of false signals will be minimal.

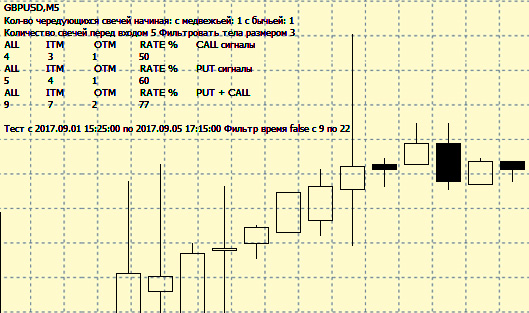

You can find an advisor on the Internet to test your strategy. It works in the MT4 trading terminal tester. The trading results are summarized in a table located at the top left of the screen. With their help, you can determine the best pair and timeframe for trading according to the strategy. The advisor does not open positions, but only shows the trading performance on the chart. The table has 3 rows in total:

- PUT.

- CALL.

- All options.

The Rate column is intended to display the percentage of profitable trades for the entire testing period.

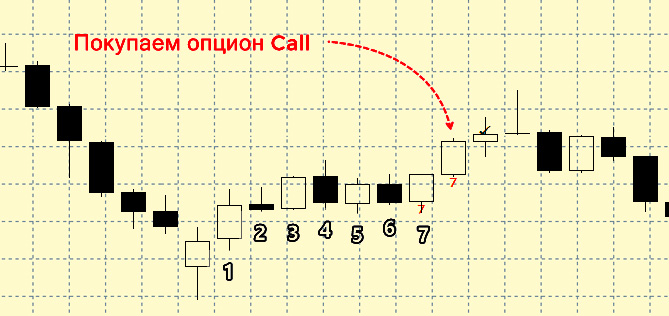

Rules for purchasing options

The main task of the trader is to identify the alternation, that is, to determine the sequence of candles of different colors following each other. The countdown starts from the first candle that forms the sequence. As soon as the fifth candle closes, we purchase an option in the same direction.

PUT:

- 5 or 7 candles alternate. The alternation begins with a bearish candle.

- As soon as it closes, we buy the PUT option.

We also pay attention to the fact that the shape of the pattern should be symmetrical, regardless of the number of candles. The alternation begins and ends with candles of the same color.

CALL:

- A sequence of 5 or 7 multi-colored candles is formed. The pattern starts with a bullish candle.

- The closing of the last candle is the moment of opening the CALL option.

The option expiration is one candle of the time frame used. When trading on an hourly chart, the expiration time will be one hour. The higher the TF, the less noise. It is quite difficult to see the color of a candle if its body is very small. For this reason, it is recommended to trade using the strategy in question only during periods of high trading activity.

Money management

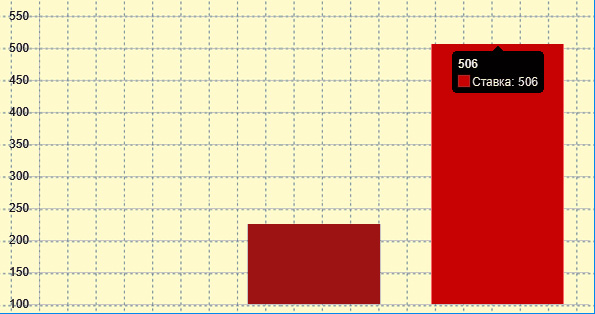

If the contract turns out to be a loser, then we will use the Martingale strategy . However, the sequence of additional transactions will be small. It is very important to correctly calculate the size of the subsequent bet. To facilitate this process, you can use the Martingale calculator .

When calculating the bet volume, 3 parameters are taken into account:

- Initial investment size.

- Profitability of the selected instrument.

- The maximum possible losing streak. We will limit it to three bets.

If the contract's profitability is 80%, then the bet size will be as follows: 100, 225, 506 units.

With this size of additional bets, we will cover losses from previous ones. After two losing knees we return to the original bet. Martingale is a rather interesting tool, but its abuse can lead to the loss of the entire deposit.

Examples of buying options using the “Alternating” strategy

Let's take the hourly chart of the EURUSD currency pair as an example. We see 5 alternating candles. The direction of the last candle tells us that we need to open a PUT option. The bet size is $100. The alternation continued. As a result, we received a loss on the purchased option. We immediately open another deal in a similar direction, but with a size of $225. The deal turned out to be profitable. As a result, we recovered our losses from the first bet and earned $100.

Conclusion

In the end, I would like to share some recommendations that may be useful to you when trading using this strategy. It is recommended to open a trade only when the size of the candle body is sufficient to determine its color. If a doja or a very small candlestick is observed on the chart, then such a pattern cannot be analyzed and should be skipped. It is recommended to refrain from trading during the Asian session. You need to use Martingale carefully, as it is a rather risky tactic. Maximum – 2 knees. With the help of subsequent profitable streaks, you will be able to recoup your losses. Follow these rules and you will be successful.

Download the advisor for testing the alternation strategy

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.