Cryptocurrencies made a real revolution in the financial sector and virtual money was able not only to penetrate the global market, but also to make changes in its work.

The term “cryptocurrency” itself has become firmly established in everyday life, and even those who do not understand the principle of its operation or the peculiarities of the development of virtual coins have heard about digital money.

What is cryptocurrency

The term “cryptocurrency” first appeared on the pages of Forbes magazine in 2011. This name hides a special type of electronic payment instrument created on the basis of a complex mathematical code. Each such currency contains special cryptographic elements that act as a digital signature and protect the asset from any outside influence, thereby minimizing the risks of hacking electronic wallets and stealing money. This principle of operation of cryptocurrencies is made possible thanks to blockchain technology.

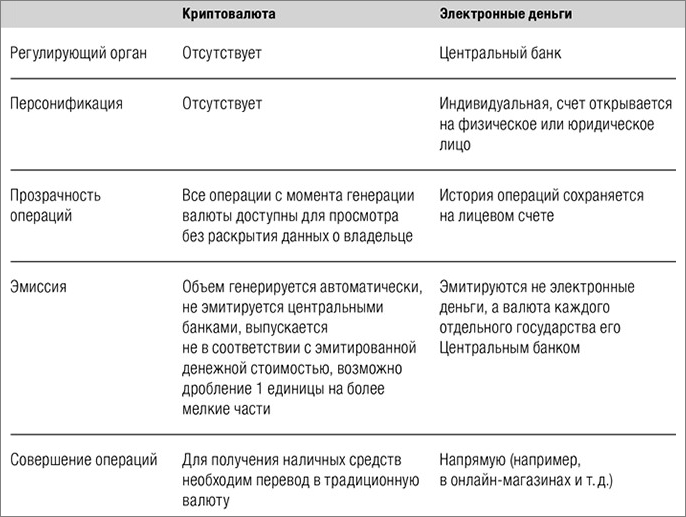

Crypto coins are not identical to real currencies (the so-called fiat) and exist exclusively in the digital world, while real money is issued in the form of coins or banknotes. Thanks to this, virtual coins also differ from fiat money in that they implement the principle of decentralization, that is, they are not issued by one body (for example, the ruble is issued by the Central Bank of Russia). The movement and transactions of cryptocurrencies are not regulated by third parties or banks, which means that financial institutions (other than through exchange trading) cannot influence the value of virtual money.

How Cryptocurrency Works

For an example that allows you to clearly show the principles of how virtual money works, you can take Bitcoin , since this coin appeared earlier than the others and still remains the most popular.

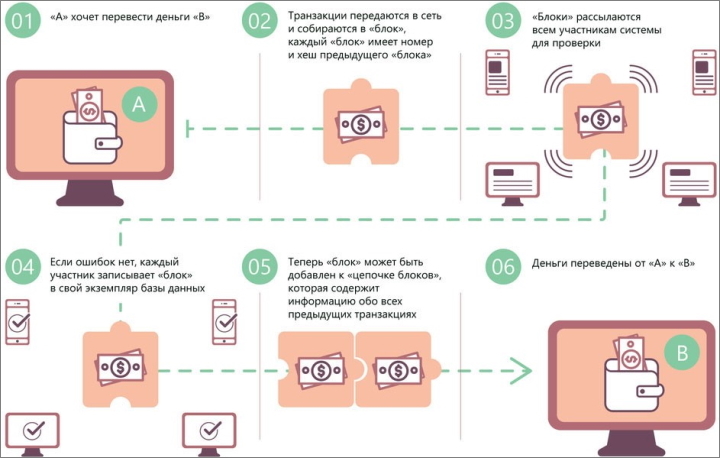

Each operation (transaction) carried out using Bitcoin is recorded in a separate block, which in turn is connected to other blocks, and together they form a sequential chain that forms a kind of register with publicly accessible data:

This system operates on the basis of complex cryptographic calculations that ensure the integrity and chronological order of blocks in the chain. Changes can be made to it only if consensus is reached between all network participants.

Each transaction or transfer of BTC from one cryptocurrency wallet to another is recorded in a separate block, which is built into the chain and remains unchanged throughout the history of the system. Thanks to this feature of the blockchain, it ensures the legitimacy of all transactions and protects the network from third-party interference (hacking, rewriting data in a block, and so on).

Bitcoin also has other operating principles:

- BTC is a decentralized asset that is not managed by a single administrator (supervisory authority or other entity);

- all information about completed transactions is stored on the computers of all network participants simultaneously;

- each block contains information about the new and all previous transactions;

- For each block found, a reward in the form of cryptocurrency is paid.

An important detail of this system is that all blocks have a special digital signature, without which they are not integrated into the chain, and to hack such a system, attackers need to gain access to more than half of the computers connected to the network, which is absolutely impossible, since it millions of computers are involved.

What are cryptocurrencies backed by?

Fiat money has long been backed by gold, but now the US dollar is the measure of its value. That is, the global financial market has centralized control, ensuring the activities of various banks and other similar institutions. Despite this, there is currently a trend towards a gradual abandonment of the dollar, facilitated by the gradual introduction of cryptocurrencies, the value of which is not determined by precious metals, the banking system or other factors. In addition, the following factors influence the value of cryptocurrencies:

- reliability of the system, which is based on blockchain technology;

- recognition of cryptocurrency as one of the means of payment;

- lack of ability to uncontrollably create new crypto coins.

Unlike the dollar and other currencies, which are printed by order of Central Banks, cryptocurrencies are mined by solving complex mathematical problems and the number of digital coins directly depends on the resources spent on their development, or, in other words, the volume of emission is determined by end users .

Cryptocurrency emission

Unlike ordinary money, the size of the emission of cryptocurrencies is artificially limited and speaking of Bitcoin, regardless of consumer requests, no more than 21 million BTC will be mined.

However, not all cryptocurrencies have such an artificial limitation, and the second most popular cryptocurrency, Ethereum, can be mined in any quantity, but even in this case certain restrictions are provided. In particular, the number of Ethereum coins produced directly depends on the total value of the network that is used to develop a given coin.

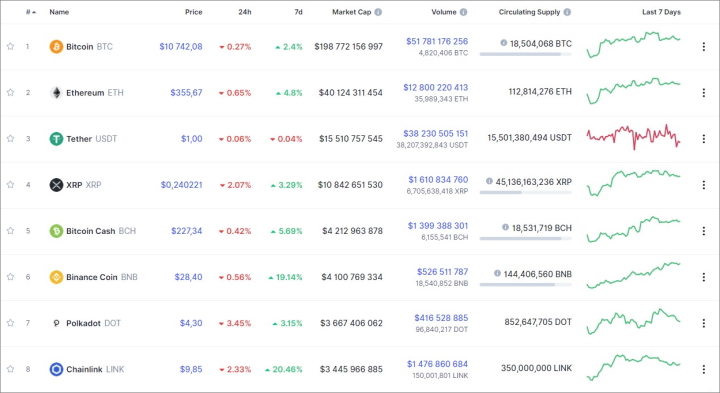

Capitalization of cryptocurrencies

Capitalization is one of the important indicators that investors focus on when making decisions. This parameter is calculated as the total value of all cryptocoins that are currently in circulation. Capitalization also shows the level of demand for digital money and reflects the nature of market development.

The cryptocurrency rate directly depends on the demand for the asset among traders. This parameter is determined by the same principles as the exchange value of the euro, dollar and other fiat money, so the rate depends on the following factors:

- news reports;

- financial policy (in this case, the creators of cryptocoins);

- rumors;

- activity of large investors;

- general behavior of market participants.

A distinctive feature of cryptocurrencies is that their rates often change rapidly, and this makes digital coins stand out against the background of fiat money, whose price remains within a certain level for many years.

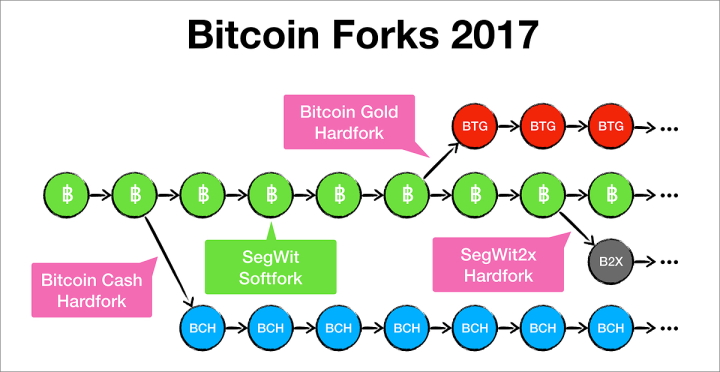

What is a fork

The essence of the concept of “fork” clearly demonstrates the operating features of blockchain technology. As stated, changes to the blockchain can be made subject to consensus among network participants, and such a process is referred to as a “fork.” That is, this concept is applied in the case when branches from the standard chain arise. For example, Bitcoin Cash was created, and this crypto coin is a fork from the Bitcoin block chain.

There are two types of forks:

- A hard fork occurs when significant changes are made to the system, or a new network is created on the basis of the previous one (an example of a hard fork is the emergence of Bitcoin Cash). Similar processes arise in the event of a large-scale conflict among users, after which a completely new blockchain is created, which does not correlate (does not interact) with the old one.

- Soft work occurs when it is necessary to make minor changes to the network. Unlike the first case, the new block chain recognizes all transactions that were recorded in the old one. This procedure is resorted to when there is a danger of centralization of the cryptocurrency or in the event of other threats arising during the development of the project.

How to buy cryptocurrency

At first, it was possible to purchase cryptocurrency only through mining. This term refers to the process of calculating complex mathematical problems on a computer, the results of which open a new block of the chain, for which miners are paid a reward in the form of cryptocurrency. And if at first it was possible to mine Bitcoin using a video card, now special devices are used for this. Therefore, an easier way to obtain cryptocurrency is to buy it on a cryptocurrency exchange .

Despite the above, cryptocurrency mining is still relatively popular, but the process has become more complicated. For the extraction of cryptocurrencies, mining pools are more often used, that is, mining is carried out using the power of many computers combined into one pool.

There is also a certain demand for cloud mining. In this case, users buy part of the capacity on the basis of which cryptocoins are mined.

How to use cryptocurrency

All cryptocurrencies are stored in electronic wallets, which are divided into several types:

- multicurrency (contain several types of currencies);

- online wallets;

- local;

- hardware.

To choose the right wallet for storing cryptocurrencies , you need to decide what the cryptocurrencies will be used for.

If you plan to purchase cryptocurrency for a large amount, then hardware wallets (cold storage) are considered the safest, since information about them is recorded on an external medium, but this storage method is not the most convenient, since each operation with digital money requires connecting an electronic wallet to network, which is inconvenient if data about it is recorded on a flash drive.

If you plan to trade cryptocurrencies frequently, then you should store your funds on the exchange, and this will be the most convenient way.

Small amounts that do not constitute the entire possible capital can be stored in hot wallets, which are provided by online services on the network.

Advantages and disadvantages of cryptocurrencies

The advantages of cryptocurrencies include the following:

The advantages of cryptocurrencies include the following:

- No restrictions on mining. That is, anyone can get crypto coins using only the power of their computer. But the volume of mining directly depends on the performance of the equipment.

- All transactions with cryptocurrencies are carried out anonymously.

- There is no central authority for control and management, making it impossible to manipulate the cryptocurrency unless a consensus is reached within the network to make specific changes.

- Absolute transparency. Users have access to information about the capitalization of crypto coins, the current rate, the size of the issue, the difficulty of mining and other data.

- High network security. Research has shown that, thanks to advanced encryption methods, cryptocurrencies are safer to store than fiat money.

- Low commissions. In some cases, transactions are made free of charge.

Despite the above, cryptocurrencies have a number of significant disadvantages:

- If you lose your wallet password, it is impossible to get your money back.

- High volatility. The cost of cryptocurrency can change within one month within the range of 100-300%.

- Vulnerability to government policy. A number of countries have already banned any transactions with cryptocurrencies, while others are taking measures aimed at establishing control by Central Banks over digital money.

- Cryptocurrency mining is becoming less profitable.

It is also necessary to take into account the direct relationship between the profitability of mining and the cryptocurrency exchange rate, and today the costs of mining crypto coins are often comparable to the costs of electricity.

How are cryptocurrencies regulated?

The concept of “cryptocurrency” and other related terms are absent in the legislation of many countries. In this regard, activities related to cryptocoins are not regulated in all countries.

In the USA, for example, an act was adopted that defines the rules for licensing transactions with cryptocurrency and other related terms, but in Russia this concept has not yet been legally enshrined. The Central Bank said in one of its letters that it is prohibited to accept cryptocurrencies as a means of payment in the country, since the main law states that the only currency that can be used in Russia is the ruble.

Conclusion

Despite great skepticism regarding cryptocurrencies, digital money is becoming increasingly popular around the world, and the capitalization of individual coins amounts to billions of dollars, but it is worth remembering that this segment of the market still remains high-risk. It is also worth noting the high volatility of prices for cryptocurrencies, due to which the price of some coins can rise and fall by hundreds of percent in a very short period of time.

See also:

- Cryptocurrency news

- Cryptocurrency analysis

- What is Ripple and why do banks like this coin so much?

- Live cryptocurrency chart

To leave a comment, you must register or log in to your account.