To find an entry point into the market, many traders, including clients of the Pocket Option broker , often use an indicator such as Stochastic. This tool is highly efficient. Those strategies that are based on Stochastic give positive results in 80-85% of cases. In this regard, the tool is quite often used in binary options trading.

Features of Stochastic

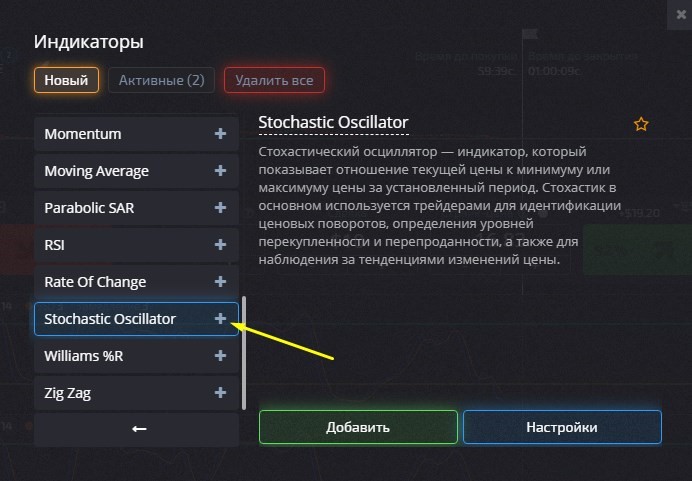

Stochastic Oscillator is included in the set of standard tools built into the Poketoption terminal.

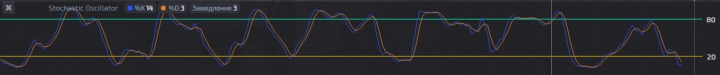

The window with the indicator is located under the price chart. It contains several horizontal levels and 2 lines, the intersection of which signals the moment to enter the market.

With the help of fast moving averages, traders can find out the current market sentiment (that is, the direction of the trend). However, this line quickly responds to price changes. A slow moving average eliminates market “noise”, giving a more accurate entry signal.

Two horizontal lines with values of 0 and 20 show the so-called oversold zone. If the Stochastic signal lines fall below the specified value, this indicates that there is an overabundance of sellers (or open transactions for the sale of a certain asset) in the market. The overbought zone is formed by two other lines with values of 80 and 100. Stochastic moving averages falling into this interval indicates for an oversupply of buyers.

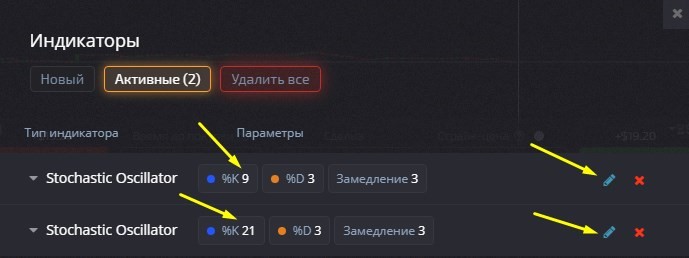

By default, trading on Pocket Option with this indicator begins with a fast line period of 14 and a slow line period of 3. The slowdown parameter is also equal to three.

If necessary, these indicators can be changed in accordance with the chosen strategy.

Basic signals

Stochastic stands out from other indicators in that it regularly provides signals about a good time to enter the market, but does not require traders to have deep knowledge of technical analysis. Trading on Pocket Option using this oscillator is carried out according to the following rules:

- Signal lines are leaving the overbought and oversold zones. As soon as the fast moving average crosses level 20 from bottom to top (the slow moving average also moves upward at this moment), a deal to buy a Call option should be opened immediately after the current candle closes. Orders for Put contracts are placed in the opposite situation. These options need to be bought if the fast line crosses the 80 level from top to bottom (the second moving average also leaves the overbought zone).

- Crossing signal lines. In this case, you need to take into account the direction of the moving averages. Contracts to buy a Call option are opened if the fast line crosses the slow line from bottom to top, Put - from top to bottom.

A number of traders use another trading tactic using Stochastic. When opening a transaction, such market participants are guided by the direction of the lines. However, this signal is considered weak and more often brings losses.

Features of the “Two Stochastics” strategy in Pocket Option

Broker Pocket Option recommends that newcomers to the binary options market start trading using this strategy. The described system is easy to use, but very effective.

Also, do not forget that you can start trading with additional funds by using promo codes for replenishing your account from the Pocket Option broker, and to improve your performance with this strategy, you can use a promo code to cancel a losing trade for $10 .

To work within this system, you will need to launch 2 Stochastic indicators, setting the fast period to 9 for one of them, the slow and slow period to 3. For the second instrument, you need to set the following parameters accordingly: 21, 9, 9.

To eliminate market noise, it is recommended to set the timeframe to 15 minutes. The expiration period of the contract for this strategy should be 45-60 minutes. Trading is carried out under the following conditions: Call contracts must be bought if the fast lines of both oscillators cross the slow ones from bottom to top at the moment when all the moving averages are located in the oversold zone.

Transactions to purchase Put options are opened in the opposite situation. All signal lines should be located in the oversold zone. You need to enter the market when the fast moving average crosses the slow one from top to bottom.

Despite the simplicity of this strategy, it is highly effective. But the success of trading in this case is determined by the condition that signals from both Stochastics are received simultaneously.

OPEN AN ACCOUNT WITH POCKET OPTION

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionSignals , where we will definitely answer all your questions in the video.

See also:

How to trade from mobile devices on the Pocket Option platform

How to participate in tournaments on the Pocket Option platform

To leave a comment, you must register or log in to your account.