This article will look at several tricky steps that will significantly improve your binary options trading results. Naturally, this will not be possible to achieve without a good trading strategy . In this case, no trick will help. If you are using a profitable trading system, then by building up positions you can use it much more effectively.

In the forecasting process, special attention is paid to probability. That is why, when discussing the profitability of a certain strategy, it is necessary to have statistics of transactions made on it. Using position scaling, you can significantly improve the performance of a trading strategy by manipulating statistics. Scaling positions can be done using several principles. However, it is worth understanding that scaling is not a unique trading system. You must have a profitable system in your arsenal. Otherwise, scaling will not give a positive result and may cause the loss of part of the deposit.

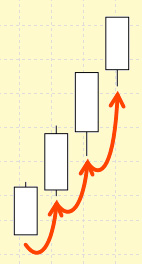

You can scale in both directions. Topping up is carried out as the market situation develops in the direction of the forecast made, thereby increasing the average price of already open transactions. You can also average positions in the loss zone, thereby creating conditions for late entry at the best price.

Each of the presented approaches is designed to increase the efficiency of the working trading system and the level of profit on it. The correct approach to using the technique will definitely give positive results.

By the way, scaling involves working specifically with positions, and not with a number of individual transactions. Buying options on a single signal should represent a single entity. To achieve this, it is necessary to select the same expiration time for all purchased options. In other words, when adding an option, care must be taken to ensure that its expiration time coincides with other contracts.

Topping up positions

This trading method is not difficult to understand. When a contract is opened, the price begins to go in the direction we need. Why not increase profits by building up your overall position? The following facts speak in favor of topping up with the trend:

This trading method is not difficult to understand. When a contract is opened, the price begins to go in the direction we need. Why not increase profits by building up your overall position? The following facts speak in favor of topping up with the trend:

- The amount you risk at the start when dividing your capital into several parts is significantly less when you start trading. If the forecast turned out to be incorrect and the price of the asset went into the unprofitable zone, then the losses will be relatively small.

- Topping up during a correction allows you to increase your final profit, since the trend has already formed and is very stable.

But scaling also has disadvantages:

- If the forecast is incorrect, the loss on the overall position can be very large compared to a single entry.

- Thoughtlessly building up positions makes the method ineffective.

Let's look at the application of the method using an example. After carrying out the analysis, you decided to buy a long-term Call option. At what point should you start topping up? Increasing a position along a trend is quite dangerous and completely unprofitable. This is best done during a corrective movement. In this matter, it is very important to correctly determine the correction.

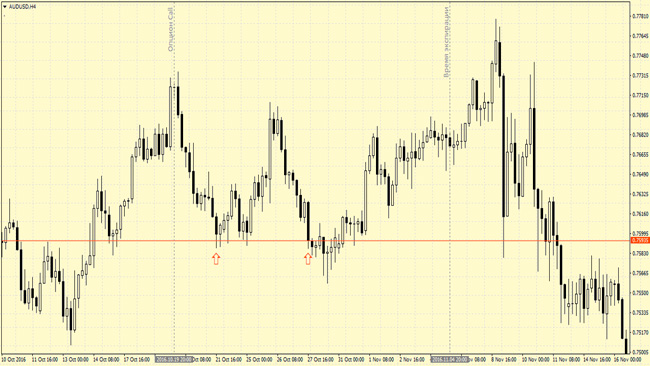

For these purposes , graphical analysis is best suited. This method has already been tested for years. The price chart itself is analyzed. The simplest figures in graphical analysis are support and resistance levels . It's quite easy to see them on a chart. It is desirable that the trading level have several confirmations at once. A level is considered strong if the price has tested it 2 or more times. That is, the graph reached a certain level and bounced away from it.

Therefore, if a Call option is purchased, then resistance levels must be plotted on the chart. When resistance is broken, this level becomes support. The ideal moment to top up is when the price returns to this level. This method allows you to identify a correction and enter the market at the best price.

When purchasing additional contracts, it is worth remembering that they must all end at the same time. This allows you to combine all purchased options into one cohesive position. But the price returning to the level and rebounding from it is not the only way to determine the moment for topping up. You can resort to using indicators or find formed graphic patterns. The essence of the method is to ensure that the trend continues.

Averaging positions

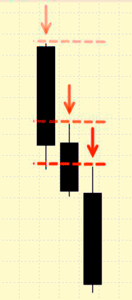

In the case described above, we considered a situation in which events developed according to the scenario we needed. The forecast began to justify itself, which resulted in price movement in the desired direction. Below we will consider a case in which an early entry was made due to a trader’s error. For example, we were unable to determine the moment of completion of the previous movement.

In the case described above, we considered a situation in which events developed according to the scenario we needed. The forecast began to justify itself, which resulted in price movement in the desired direction. Below we will consider a case in which an early entry was made due to a trader’s error. For example, we were unable to determine the moment of completion of the previous movement.

One of the most important rules of averaging says: this method can only be used if there is complete confidence in the correctness of the forecast. In other words, we must be sure that we correctly predicted the direction of price movement, but slightly missed the entry point.

If the price does not go in our direction, then there is a possibility of receiving a loss on the contract. However, dividing capital into several parts makes it possible to foresee such an outcome.

When the price rolls back, you must wait until the movement is completed to average the entry price. In some cases, the first open contract remains unprofitable, but the second one compensates for these losses and we have a plus for the sum of the two transactions.

Let's say we decided to split the position into three parts. The first option is purchased at the top and the price begins to fall. What should be done in such a situation? We need to find support levels on the chart and wait for the price to drop to them. When the price touches support, he buys another option in a similar direction with the same expiration date. And the more options we manage to buy below the forecast level, the higher the chance of making a profit. With the help of such simple manipulations, the position is averaged by opening additional options at a more favorable price.

Examples

Understanding the principles of the method should not be difficult, but in practice everything is much more complicated. Averaging and adding to a position does not imply the presence of certain rules. Your main goal is to make a profit or at least increase the likelihood of making it. You only need to top up if you are confident in your forecast. Thoughtless actions will lead to losses.

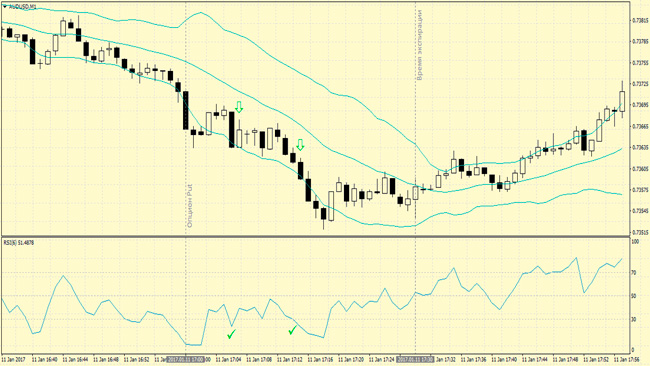

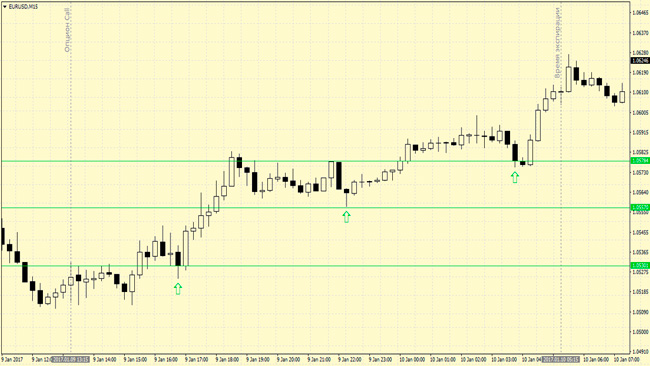

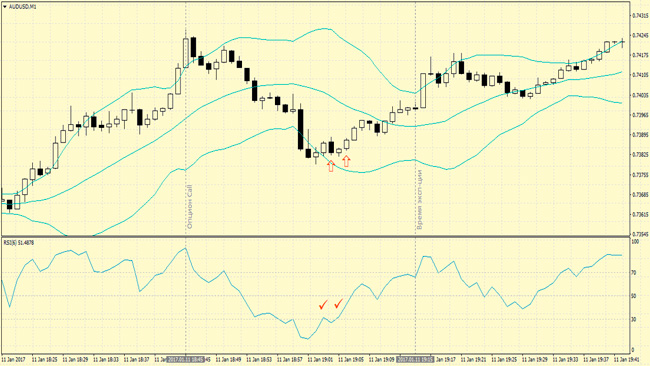

Let's consider a strategy based on the use of Bollinger Bands. The entry rules are as follows: When a candle or bar closes outside the channel, we buy an option in the direction of the breakout. We take the expiration time twice as long as the working time frame. When working on the M15 chart, expiration should be 30 minutes.

In this case, scaling will be used on the M1 chart. To determine entry points, add the RSI indicator to the chart. There are no fixed rules, so we will consider several options for the development of events.

When we bought the first option, the price went in the direction we wanted. Topping up will be done when the RSI curve enters the oversold zone. This approach is a little unconventional, but it can be justified. In our case, the price should receive a good impulse so that we can buy an additional contract in the same direction.

Now let's consider a situation where, after buying a Call option, the price began to move down. The RSI should leave the oversold zone. Only in this case do we begin to average the position by purchasing two more Call contracts. The first option brought losses, but two additional ones brought us profit on the overall position.

In some cases, the price moves very quickly in the direction of the trend, and it is extremely difficult to identify a corrective movement for topping up. Under such circumstances, you can buy a couple more contracts at the moment the RSI curve crosses the 50 level.

Conclusions

The considered option trading method is quite flexible. Entry into the market is carried out not by all means, but by a certain part of them. We can only observe the situation and, if necessary, adjust our position. Any trading system should develop in a similar way.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.