Trading binary options through the Pocket Option broker has one undeniable advantage compared to trading other financial assets: the trader always knows the size of potential profits and losses before opening a transaction. That is why so-called turbo options are popular among market participants. This contract differs from others in that the duration of its expiration period varies from several seconds to five minutes. With the right strategy for trading turbo options on Pocket Option, you can consistently receive a fairly high income.

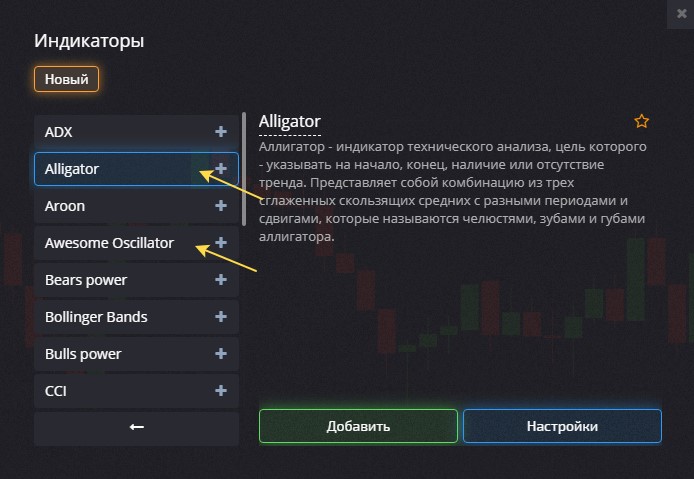

One of the successful methods of working with these contracts is to use signals that come from the Awesome Oscillator, Alligator and RSI indicators. Each of these tools is built into the trading terminal provided by Poketoption.

Setting up indicators in Pocket Option

As noted, turbo options trading is fast. Therefore, the Pocket Option broker recommends working with these instruments on small timeframes. In particular, you can trade turbo options on the one-minute Japanese candlestick chart. To set these parameters (timeframe and chart type), you need to click on the chart icon located in the main window of the Poketoption terminal and select the appropriate item.

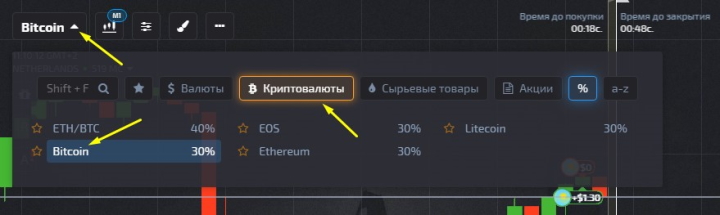

When using turbo options as a trading tool, you need to take into account that indicators produce up to 10-15 signals on them every hour. In such conditions, it is necessary to choose highly volatile assets that are frequently traded. Otherwise, there is a high probability that the indicators will constantly give false signals. In particular, such assets include the GBP/USD and EUR/USD pairs. Cryptocurrencies are also suitable for such trading.

Also, do not forget that you can start trading with additional funds by using promo codes for replenishing your account from the Pocket Option broker, and to improve your performance with this strategy, you can use a promo code to cancel a losing trade for $10 .

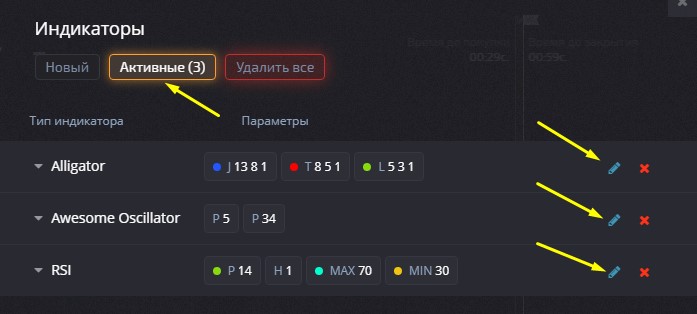

To configure indicator parameters, you need to go to the “Active” tab in the Pocket Option broker terminal and click on the pencil icon next to each instrument.

In the windows that appear, you need to set parameters that will meet the conditions of the selected trading strategy. For Alligator it is:

- default shift;

- lips - 3;

- teeth - 5;

- jaws - 13.

For RSI, you need to set the period to 14 and level 50 for overbought and oversold zones. And in the Awesome Oscillator indicator window you should set periods of 5 and 34.

Trading Rules

Despite the fact that the contract duration is minimal (which is why the number of signals increases), the three indicated indicators help to trade turbo options on Poketoption. To find a convenient moment to enter the market, you need to track when the RSI signal lines cross.

You need to place an order to buy a Call if the indicated lines cross level 50 from bottom to top. In this case, it is necessary to open a deal at the moment when the green Alligator moving average crosses the red one in a similar way, and a bar begins to form in the Awesome Oscillator indicator window above the zero limit.

Put options need to be purchased when the opposite situation occurs. That is, such transactions must be made when the RSI and Alligator lines cross in the indicated manner from top to bottom, and a new column is formed at the bottom in the Awesome Oscillator window.

As noted, the expiration period of the contract within the framework of the described strategy should be 1-2 minutes. It is recommended to place no more than 2% of the entire deposit on each transaction. Such small amounts are due to the fact that contracts are concluded frequently, which significantly increases risks.

OPEN AN ACCOUNT WITH POCKET OPTION

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also:

The best binary options broker! Who is he?

How to use social trading with the Pocket Option broker

How to participate in tournaments on the Pocket Option platform

To leave a comment, you must register or log in to your account.