Trading systems using Heiken Ashi are among the most effective not only for Forex, but also for binary options trading. They are quite simple, but at the same time profitable and effective.

The tool smoothes the graph, eliminating random movements. The indicator is convenient for users because it clearly demonstrates whether there is a strong trend in the market.

Basic Concepts

The chart of any trading asset consists of ticks. A tick is the minimum rate fluctuation; it appears after a transaction is made through the platform or as a result of a pending order being executed. The number of transactions completed in milliseconds is the number of ticks.

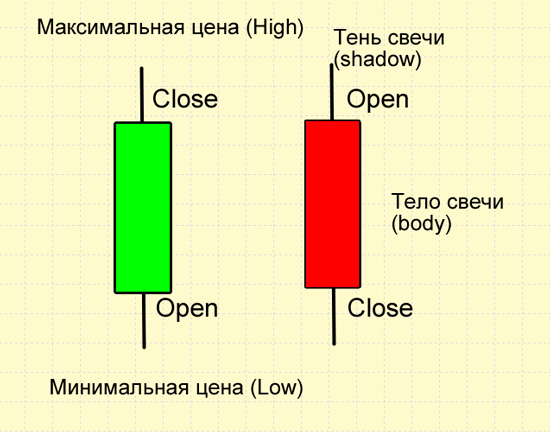

The constant flow of executed orders was divided into identical time periods - time frames and “divided” into “Japanese candles” , which are formed taking into account the opening price of each time interval. Over a fixed period of time, the body of the candle is built. Longer “tails” are extremes observed during a given interval.

Features of Heiken Ashi

The smoothed version of candles was invented in Japan. It became popular after the publication of analytical material in the publication Technical Analysis of STOCKS & COMMODITIES.

Each current indicator candle is inextricably linked with the previous one. The middle of her body is the opening price. To calculate the closing price, use the formula: the sum of the closing and opening extrema is divided by 4. High and Low are the largest and smallest parameters.

Modified candles are placed on the chart of a trading asset for greater convenience and better visual perception.

Benefits of Heiken Ashi for Binary Options

The indicator is suitable for options trading because its signals are more accurate compared to conventional candlestick analysis.

Forecasts based on emerging models are promising, but do not provide an exact time frame for the fulfillment of the “predictions.” In binary options, time is the determining factor. After the set expiration time, the trader will either make a profit or lose the bet amount, all or most of it.

Heiken Ashi candlesticks are often used in options trading due to a number of advantages. For example, they are suitable for turbo contracts with an expiration time of up to 5 minutes. The following peculiarity has been noticed: if several candles of the same color appear in succession, and after them one opposite candle appears, the next one usually continues the new trend that has begun. The forecast accuracy will be about 65%, which is quite good.

Another element of Heiken Ashi candles that deserves close attention is the “tail”. It has nothing to do with real quotes; a special approach is used when drawing it. The “tail” of the indicator candles shows the strength of the trend. If the body is small in size, and the “tail” is long, has a direction in the direction of the impulse (“bearish” - to the bottom, “bullish” - to the top), without an opposite “tail”, such a trend is really strong.

In classic binary options, income depends on the expiration time of the contract; the longer it is, the higher the percentage of income. Larger timeframes demonstrate trends that are more stable and lasting. To “catch” them, focusing on the “tails,” traders set the H1 interval. Trading assets are volatile currency pairs like EURUSD, USDJPY, etc. It is also necessary to select a trading session characterized by active trading accordingly. If, for example, the base of the pair is the dollar, it is best to trade between 11.00-21.00 Moscow time.

Having discovered a clear trend from the long “tail” and small body of the candle, we enter the market in the direction of the main trend. Optimal timeframe: M15-H1.

It is recommended to set the expiration time depending on the interval. If you are working on H1, it will be 4 candles. Those who prefer M15-M30 should set it equal to 5-6 candles.

Conclusion

Heiken Ashi is a simple and reliable indicator included in the list of standard indicators for MT4. Many strategies are based on it, including binary options.

In relation to turbo options (1-5 minutes), the best expiration time will be 1 timeframe. To increase the effectiveness of signals, it is better to trade on larger time frames; they help to “catch” a stronger and more stable trend.

When choosing an interval of M15 and higher, the quality of the signals increases, but the trader must have certain skills to recognize the presence of a trend by the shape of the Heiken Ashi candles and the size of the “tails”.

In addition to candlestick analysis, an important factor is the choice of trading session - the most active trading time for the selected instrument. And don’t forget about money management - this is a prerequisite regardless of the chosen strategy.

Despite the fact that this indicator is built into the MetaTrader 4 terminal, you can also download it on our website.

Download the Heiken Ashi indicator

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionCrypto , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.